Cenovus closes acquisition of Toledo Refinery

28 Février 2023 - 10:00PM

Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) has closed on the

transaction to purchase bp’s 50% interest in the bp-Husky Toledo

Refinery in Ohio, effective today. Cenovus already owned 50% of the

facility, and now owns 100% and assumes operatorship. Total

consideration for the sale is approximately US$370 million after

closing adjustments, including working capital. Cenovus and bp will

also enter into a multi-year product supply agreement.

The Toledo Refinery has 160,000 barrels per day (bbls/d) of

throughput capacity, including about 90,000 bbls/d of heavy oil

capacity, and increases Cenovus’s total downstream refining

capacity to about 740,000 bbls/d. Cenovus expects the refinery will

ramp to full rates by mid-second quarter.

Advisory Forward-looking

Information This news release contains certain

forward‐looking statements and forward‐looking information

(collectively referred to as “forward‐looking information”) within

the meaning of applicable securities legislation about Cenovus’s

current expectations, estimates and projections about the future of

the company, based on certain assumptions made in light of the

company’s experiences and perceptions of historical trends.

Although Cenovus believes that the expectations represented by such

forward‐looking information are reasonable, there can be no

assurance that such expectations will prove to be correct.

Forward-looking information in this document is related to the

Toledo Refinery ramping up to full rates of production, the

addition of throughput capacity from the acquisition and entering

into a multi-year product supply agreement with bp.

Developing forward‐looking information involves reliance on a

number of assumptions and consideration of certain risks and

uncertainties, some of which are specific to Cenovus and others

that apply to the industry generally. The factors or assumptions on

which the forward‐looking information in this news release are

based include, but are not limited to: commodity prices, inflation

and supply chain constraints; Cenovus’s ability to deliver safe and

reliable operations and demonstrate strong governance; and the

assumptions inherent in Cenovus’s 2023 Guidance available

on cenovus.com.

The risk factors and uncertainties that could cause actual

results to differ materially from the forward‐looking information

in this news release include, but are not limited to: the accuracy

of estimates regarding commodity prices, inflation, operating and

capital costs, and currency and interest rates; risks inherent in

the operation of Cenovus’s business; and risks associated with

climate change and Cenovus’s assumptions relating thereto and other

risks identified under “Risk Management and Risk Factors” and

“Advisory” in Cenovus’s Management’s Discussion and Analysis

(MD&A) for the year ended December 31, 2022.

Except as required by applicable securities laws, Cenovus

disclaims any intention or obligation to publicly update or revise

any forward‐looking statements, whether as a result of new

information, future events or otherwise. Readers are cautioned that

the foregoing lists are not exhaustive and are made as at the date

hereof. Events or circumstances could cause actual results to

differ materially from those estimated or projected and expressed

in, or implied by, the forward‐looking information. For additional

information regarding Cenovus’s material risk factors, the

assumptions made, and risks and uncertainties which could cause

actual results to differ from the anticipated results, refer to

“Risk Management and Risk Factors” and “Advisory” in Cenovus’s

MD&A for the period ended December 31, 2022, and to the

risk factors, assumptions and uncertainties described in other

documents Cenovus files from time to time with securities

regulatory authorities in Canada (available on SEDAR

at sedar.com, on EDGAR at sec.gov and Cenovus’s

website at cenovus.com).

Cenovus Energy Inc.

Cenovus Energy Inc. is an integrated energy company with oil and

natural gas production operations in Canada and the Asia Pacific

region, and upgrading, refining and marketing operations in Canada

and the United States. The company is focused on managing its

assets in a safe, innovative and cost-efficient manner, integrating

environmental, social and governance considerations into its

business plans. Cenovus common shares and warrants are listed on

the Toronto and New York stock exchanges, and the company’s

preferred shares are listed on the Toronto Stock Exchange. For more

information, visit cenovus.com.

Find Cenovus on Facebook, Twitter, LinkedIn, YouTube and

Instagram.

Cenovus contacts:

|

Investors |

Media |

| Investor Relations general

line403-766-7711 |

Media Relations general

line403-766-7751 |

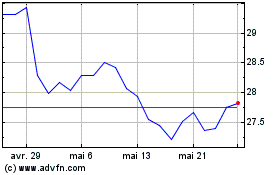

Cenovus Energy (TSX:CVE)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Cenovus Energy (TSX:CVE)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025