Stem, Inc. To Acquire Also Energy Holdings, Inc.

16 Décembre 2021 - 1:51PM

Clairvest Group Inc. (TSX: CVG) (“CVG”), today announced that it, a

partnership managed by it, Clairvest Equity Partners V (“CEP V”,

collectively “Clairvest”), and the other shareholders of Also

Energy Holdings Inc. (“AlsoEnergy” or the “Company”) have entered

into an agreement to sell their interests in AlsoEnergy to Stem,

Inc. (NYSE: STEM) (“Stem”). The proposed transaction is expected to

close in Q1 2022 after satisfaction of customary closing

conditions, including notification requirements under applicable

U.S. antitrust laws.

AlsoEnergy is a leading provider of solar

monitoring software, integrated controls, and edge solutions to

Distributed Generation and Utility customers across the U.S. Since

Clairvest partnered with the two co-founders, Robert Schaefer and

Holden Caine, in August 2017, AlsoEnergy executed a successful

growth plan through acquiring & integrating three highly

strategic companies, building a global footprint, and broadening

its service offerings through innovation. Clairvest and the other

shareholders will take a portion of their consideration in shares

of Stem.

“We are very excited about AlsoEnergy’s new

chapter with Stem, given their market position in the rapidly

growing storage and digitization sectors,” said Robert Schaefer,

Co-founder & CEO of AlsoEnergy. “With respect to our

partnership with Clairvest, Ken Rotman, Angus Cole, and the

Clairvest team provided unparalleled support to our company over

the years and were true partners. Together, we navigated through

opportunities and challenges collaboratively and achieved this

fantastic outcome.”

“We are extremely pleased with the growth and

evolution of AlsoEnergy over our investment period. AlsoEnergy grew

to market leadership in the C&I segment and successfully

entered the utility-scale segment to become the largest solar

monitoring software company. This success was fueled by a

passionate management team with a clear entrepreneurial vision,”

remarked Angus Cole who leads Clairvest’s energy transition

practice.

Ken Rotman, CEO & Managing Director of

Clairvest commented that, “Our partnership with AlsoEnergy is an

excellent example of Clairvest’s domain-focused approach to

investing and emphasizes our mission to help build strategically

significant businesses with our entrepreneur partners. It is our

view that Stem and AlsoEnergy have a strategic fit that will enable

both companies to accelerate their growth.”

The transaction will be funded by a combination

of cash and common shares of Stem, providing potential further

upside to Clairvest and other AlsoEnergy shareholders. Should the

transaction close on anticipated terms, Clairvest will realize

total sale proceeds of approximately US$350 million (CVG’s portion

being US$108 million).

The sale is expected to have a positive impact

on Clairvest’s book value per share of approximately $5 over the

carrying value as at September 30, 2021, assuming the transaction

closes on anticipated terms and not including any changes, positive

or negative, to the carrying value of Clairvest’s other

investments.

While all parties involved have a strong desire

to complete the sale, there can be no guarantee that the

transaction will be completed, or if it is completed, that it will

close within the anticipated time period.

William Blair acted as financial advisor to

AlsoEnergy in this transaction. Goodmans LLP acted as legal advisor

to AlsoEnergy.

About ClairvestClairvest’s

mission is to partner with entrepreneurs to help them build

strategically significant businesses. Founded in 1987 by a group of

successful Canadian entrepreneurs, Clairvest is a top performing

private equity management firm with over CAD $2.5 billion of

capital under management. Clairvest invests its own capital and

that of third parties through the Clairvest Equity Partners limited

partnerships in owner-led businesses. Under the current management

team, Clairvest has initiated investments in 57 different platform

companies and generated top quartile performance over an extended

period.

About AlsoEnergyAlsoEnergy

provides complete advanced solutions for control, monitoring, and

management of solar PV and solar plus storage assets. This includes

integrated software and hardware systems for DAS, SCADA, and power

plant control, along with services covering the project lifecycle

from system design and engineering through installation,

commissioning, and support. AlsoEnergy provides technology

solutions for more than 30GW of production in over 50 countries

worldwide, providing regional expertise in all world markets using

sales and service offices in Germany, Japan, and India along with

US headquarters. For more information, visit:

www.alsoenergy.com.

Forward-looking StatementsThis

news release contains forward-looking statements with respect to

Clairvest Group Inc., its subsidiaries, its CEP limited

partnerships and their investments. These statements are based on

current expectations and are subject to known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Clairvest, its subsidiaries, its CEP

limited partnerships and their investments to be materially

different from any future results, performance or achievements

expressed or implied in such forward-looking statements. Such

factors include regulatory risks which could impact completion of

the AlsoEnergy sale transaction. Clairvest is under no obligation

to update any forward-looking statements contained herein should

material facts change due to new information, future events or

otherwise.

Contact InformationStephanie

LoManager, Investor Relations and MarketingClairvest Group Inc.Tel:

(416) 925-9270stephaniel@clairvest.com

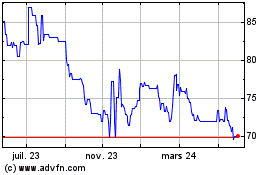

Clairvest (TSX:CVG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

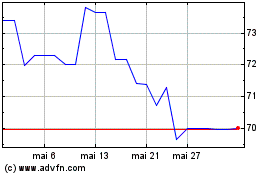

Clairvest (TSX:CVG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024