Clairvest Reports Fiscal 2025 First Quarter Results

13 Août 2024 - 11:00PM

Clairvest Group Inc. (TSX: CVG) today reported results for the

fiscal 2025 first quarter ended June 30, 2024 and events which

occurred subsequent to quarter end. (All figures are in Canadian

dollars unless otherwise stated)

Highlights

- June 30, 2024 book value was

$1,186.2 million or $81.02 per share compared with $1,176.3 million

or $80.16 per share as at March 31, 2024

- Net income for the quarter ended

June 30, 2024 was $23.9 million or $1.63 per share

- Clairvest and Clairvest Equity

Partners VI (“CEP VI”) made two platform investments during the

quarter to complete the CEP VI Fund investment program and

Clairvest commenced the CEP VII investment program

- Clairvest and Clairvest Equity

Partners V (“CEP V”) completed the sale of Durante Rentals

- Subsequent to quarter end,

Clairvest, CEP V and CEP VI completed the sale of FSB

Technology

- Subsequent to quarter end,

Clairvest and CEP V completed the sale of Winters Bros. Waste

Systems of Long Island

- Subsequent to quarter end,

Clairvest paid $0.8016 in dividends

Clairvest’s book value was $1,186.2 million or

$81.02 per share as at June 30, 2024, compared with $1,176.3

million or $80.16 per share as at March 31, 2024. For the quarter

ended June 30, 2024, Clairvest recorded net income of $23.9

million, or $1.63 per share, which was primarily driven by a net

increase in the valuation of Clairvest’s private equity investment

portfolio. Also during the quarter, Clairvest purchased and

cancelled 32,050 common shares at an average price of $70.92/share,

or a total cost of $2.3 million, which added $0.03 per share to the

book value.

As described in the Clairvest fiscal 2024 fourth

quarter and year end press release, Clairvest and CEP VI completed

two platform investments during the quarter, completing the CEP VI

Fund investment program with a total of fourteen investments. With

the completion of the CEP VI investment program, Clairvest

commenced the CEP VII investment program which has total committed

capital of US$1.2 billion, US$902 million of which is third party

capital.

During the quarter, Clairvest and CEP V sold

their interest in Durante Rentals at a loss, with proceeds equating

to 0.7x what was invested, which was at a small premium to the

carrying value at March 31, 2024. Clairvest received US$8 million

of sale proceeds.

In July 2024, Clairvest exited FSB Technology

and did not receive any proceeds. FSB Technology was previously

written off entirely in 2023.

Also in July 2024, Clairvest, CEP V and the

Winters family sold Winters Bros. Waste Systems of Long Island

(“Winters Bros. Long Island”) to Waste Management. Proceeds on the

sale generated a 6.8x return on invested capital, or US$57 million

for Clairvest. As at June 30, 2024, Clairvest’s investment in

Winters Bros. Long Island was carried at the exit value. In

addition, we anticipate additional proceeds could be generated on

the sale of other assets not acquired by Waste Management which

could raise the multiple of money realized to over 7x.

“The successful Winters Bros. result is a

testament to the business that the Winters Family has built over

the past nine years where they grew it into an industry leader on

Long Island. We are proud to have been their partner in 3 different

waste management investments and hope we can partner with them

again,” said Ken Rotman, CEO of Clairvest. “At the same time, we

pride ourselves on honestly assessing each situation and taking

appropriate action, even when unpleasant. Cleaning up the portfolio

enables us to focus on our core mission of building assets of

strategic significance, which is critical to our ongoing success.

While we still have more issues to address, putting the Durante and

FSB Technology investments behind us is a step in the right

direction. These realized losses, the first in some time, represent

catalysts to reassess our process and internalize some lessons

learned. Our track record includes 45 exits which generated an

aggregate return of 3.8x invested capital; it includes many

terrific wins but also 9 losses, of which these are two.”

Also subsequent to quarter end, Clairvest paid

an annual ordinary dividend of $0.10 per share and a special

dividend of $0.7016 per share, such that in aggregate, the

dividends represent 1% of the March 31, 2024 book value. Both

dividends were paid on July 26, 2024 to common shareholders of

record as at July 5, 2024 and are eligible dividends for Canadian

income tax purposes.

| Summary of

Financial Results – Unaudited |

|

|

|

|

|

Financial

Results(1) |

Quarter ended |

|

|

June 30 |

|

|

2024 |

2023 |

|

($000’s, except per share amounts) |

$ |

$ |

|

Net investment gain |

20,112 |

24,469 |

|

Net carried interest from Clairvest Equity Partners III and IV |

2,124 |

591 |

|

Distributions, interest income, dividends and fees |

16,703 |

11,809 |

|

Total expenses, excluding income taxes |

11,958 |

15,831 |

|

Net income and comprehensive income |

23,921 |

19,462 |

|

Basic and fully diluted net income per share |

1.63 |

1.30 |

|

Financial Position |

June 30 |

March 31, |

|

|

2024 |

2024 |

|

($000’s, except share information and per share amounts) |

$ |

$ |

|

Total assets |

1,361,010 |

1,342,139 |

|

Total cash, cash equivalents, temporary investments and restricted

cash |

282,572 |

330,193 |

|

Carried interest from Clairvest Equity Partners III and IV |

54,312 |

52,188 |

|

Corporate investments(1) |

929,377 |

870,660 |

|

Total liabilities |

174,802 |

165,842 |

|

Management participation from Clairvest Equity Partners III and

IV |

43,105 |

41,506 |

|

Book value(2) |

1,186,208 |

1,176,297 |

|

Common shares outstanding |

14,641,651 |

14,673,701 |

|

Book value per share(2) |

81.02 |

80.16 |

(1) Includes carried interest of $151,846 (March

31: $143,617) and management participation of $109,761 (March 31:

$103,740) from Clairvest Equity Partners V and VI, and $105,360

(March 31: $90,973) in cash, cash equivalents and temporary

investments held by Clairvest’s acquisition entities.(2) Book value

is a Non-IFRS measure calculated as the value of total assets less

the value of total liabilities.

Clairvest’s first quarter fiscal 2025 financial

statements and MD&A are available on the SEDAR website at

www.sedar.com and the Clairvest website at www.clairvest.com.

About Clairvest Clairvest’s

mission is to partner with entrepreneurs to help them build

strategically significant businesses. Founded in 1987 by a group of

successful Canadian entrepreneurs, Clairvest is a top performing

private equity management firm with over CAD $4.6 billion of

capital under management. Clairvest invests its own capital and

that of third parties through the Clairvest Equity Partners limited

partnerships in owner-led businesses. Under the current management

team, Clairvest has initiated investments in 66 different platform

companies and generated top quartile performance over an extended

period.

Contact InformationStephanie

LoDirector, Investor Relations and MarketingClairvest Group

Inc.Tel: (416) 925-9270Fax: (416)

925-5753stephaniel@clairvest.com

Forward-looking Statements This

news release contains forward-looking statements with respect to

Clairvest Group Inc., its subsidiaries, its CEP limited

partnerships and their investments. These statements are based on

current expectations and are subject to known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Clairvest, its subsidiaries, its CEP

limited partnerships and their investments to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. Such

factors include general and economic business conditions and

regulatory risks. Clairvest is under no obligation to update any

forward-looking statements contained herein should material facts

change due to new information, future events or otherwise.

www.clairvest.com

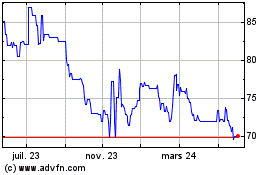

Clairvest (TSX:CVG)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

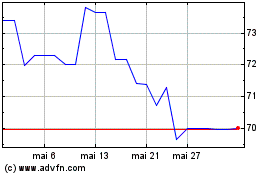

Clairvest (TSX:CVG)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024