Clairvest Announces New Normal Course Issuer Bid

03 Mars 2022 - 11:22PM

Clairvest Group Inc. (TSX: CVG) today announced that the Toronto

Stock Exchange has accepted a notice filed by Clairvest of its

intention to make a new normal course issuer bid (“NCIB”).

Clairvest’s current NCIB expires on March 7, 2022. The notice

provides that the Corporation may, during the 12-month period

commencing March 8, 2022 and ending March 7, 2023, purchase on The

Toronto Stock Exchange up to 761,551 common shares in total, being

approximately 5% of the outstanding common shares. The average

daily trading volume for the six months ending February 28, 2022

was 256 common shares. Daily purchases will be limited to 1,000

common shares, other than block purchase exceptions. Any shares

purchased will be cancelled. The price which the Corporation will

pay for any such shares will be the market price at the time of

acquisition. The actual number of common shares which may be

purchased and the timing of any such purchases will be determined

by the Corporation. In total 3,631,532 common shares at a cost of

approximately $ 40.9 million have been purchased under previous

normal course issuer bids. The Corporation purchased 6,200 common

shares on the Toronto Stock Exchange, out of an approved maximum

repurchase amount of 760,749 under its current bid within the last

twelve months at a weighted average price of $61.48 per share.

There were 15,231,012 common shares of the Corporation outstanding

on February 28, 2022.

The Corporation believes, depending upon future

price movements and other factors, that its outstanding common

shares may represent an attractive investment and a desirable use

of a portion of its available funds.

Clairvest also announced today that, in

connection with its NCIB, Clairvest has renewed its automatic share

purchase plan (the “ASPP”) with a designated broker to allow for

the purchase of its common shares under the NCIB, once effective,

at times when Clairvest normally would not be active in the market

due to applicable regulatory restrictions or internal trading

black-out periods. Before the commencement of any internal trading

black-out period, Clairvest may, but is not required to, instruct

its designated broker to make purchases of Clairvest’s common

shares under the NCIB during the ensuing black-out period in

accordance with the terms of the ASPP. Such purchases will be

determined by the broker in its sole discretion based on parameters

established by Clairvest prior to commencement of the applicable

black-out period in accordance with the terms of the ASPP and

applicable TSX rules. Outside of these black-out periods, common

shares will be purchasable by Clairvest at its discretion under its

NCIB, once effective.

The ASPP will commence on the effective date of

the NCIB and will terminate on the earliest of the date on which:

(a) the maximum annual purchase limit under the NCIB has been

reached; (b) the NCIB expires; or (c) Clairvest terminates the ASPP

in accordance with its terms. The ASPP constitutes an “automatic

securities purchase plan” under applicable Canadian securities

laws.

About Clairvest

Clairvest’s mission is to partner with

entrepreneurs to help them build strategically significant

businesses. Founded in 1987 by a group of successful Canadian

entrepreneurs, Clairvest is a top performing private equity

management firm with over CAD $2.6 billion of capital under

management. Clairvest invests its own capital and that of third

parties through the Clairvest Equity Partners limited partnerships

in owner-led businesses. Under the current management team,

Clairvest has initiated investments in 57 different platform

companies and generated top quartile performance over an extended

period.

For further information, please

contact:

Stephanie Lo Manager, Investor Relations and

Marketing Clairvest Group

Inc. Tel: (416)

925-9270 stephaniel@clairvest.com

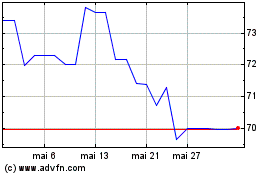

Clairvest (TSX:CVG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

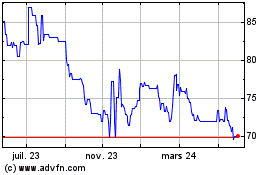

Clairvest (TSX:CVG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024