Clairvest Realizes 12.3x on Its Investment in Arrowhead Environmental Partners

03 Août 2023 - 11:05PM

Clairvest Group Inc. (TSX: CVG) (“CVG”), today announced that it, a

partnership managed by it, Clairvest Equity Partners VI (“CEP VI”,

collectively “Clairvest”) and the equity holders of Arrowhead

Environmental Partners (“Arrowhead” or the “Company”) have sold

their interests in Arrowhead to Waste Connections, Inc.

Arrowhead is a non-hazardous solid waste

management company that provides waste-by-rail disposal services to

several major U.S. markets. The Company owns and leases unique and

well-placed disposal infrastructure assets to provide

cost-effective waste-by-rail disposal solutions to solid waste

management companies in markets with tightening disposal

capacity.

In June 2020, Clairvest invested in Arrowhead

and partnered with three experienced waste management executives -

William Gay, James Francesco and Robert Berns - to help grow and

build the Company into a unique and valuable enterprise providing a

compelling solution for disposal-constrained markets. Over the

three-year investment period, the Company invested heavily in its

transportation and disposal infrastructure, grew revenue by

approximately 15x, and became a strategically significant waste

management industry player.

Upon closing, CVG’s portion of sale proceeds was

approximately US$36 million. On a constant currency basis, the sale

proceeds for CVG represent a multiple of capital invested of 12.3x

and an IRR of 128%.

“In 2020, we made a strategic and well-reasoned

decision to invest in an earlier staged company and it played out

well. The outstanding result is primarily due to our management

partners who leveraged their significant industry and waste-by-rail

experience to execute the Company’s strategy we all agreed on three

years ago. We are thrilled to have been a part of Arrowhead’s

success and look forward to seeing the continued growth trajectory

of the business,” said Michael Castellarin, Managing Director at

Clairvest.

“One of the reasons we chose to partner with

Clairvest in 2020 was their positive track record of success

backing owner-operators in the environmental services industry. Our

vision was to capitalize on the macro trends of declining disposal

capacity and rising transportation and disposal costs in the

Northeast and create a novel disposal solution for customers in the

region, which we have successfully accomplished. The Clairvest team

provided active support to our management team and was a valuable

sounding board when evaluating strategic decisions. We sincerely

appreciate their support over the past few years,” said William

Gay, Co-Founder & CEO of Arrowhead.

“As an entrepreneur for most of my career, my

experience told me it was vital to be extremely confident in and

comfortable with the people we chose to partner with, not just the

private equity firm itself. The team at Clairvest always acted with

integrity and did what they said they would do. They earned my

respect early on and I trust and truly appreciate them as

partners,” added James Francesco, Co-Founder & COO of

Arrowhead.

Vedder Price acted as legal advisor to

Arrowhead.

About ClairvestClairvest’s

mission is to partner with entrepreneurs to help them build

strategically significant businesses. Founded in 1987 by a group of

successful Canadian entrepreneurs, Clairvest is a top performing

private equity management firm with CAD $4.3 billion of capital

under management. Clairvest invests its own capital and that of

third parties through the Clairvest Equity Partners limited

partnerships in owner-led businesses. Under the current management

team, Clairvest has initiated investments in 63 different platform

companies and generated top quartile performance over an extended

period.

Contact InformationStephanie

LoDirector of Investor Relations and MarketingClairvest Group

Inc.Tel: (416) 925-9270stephaniel@clairvest.com

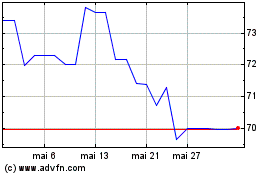

Clairvest (TSX:CVG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

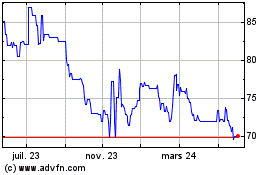

Clairvest (TSX:CVG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024