This news release contains forward-looking

information that is based upon assumptions and is subject to risks

and uncertainties as indicated in the cautionary note contained

within this news release.

DREAM INDUSTRIAL REIT (DIR.UN-TSX) (“Dream Industrial REIT”

or the “Trust”) today announced that it has waived all

conditions to acquire a portfolio of 21 buildings located in five

cities across the Midwest United States (“the Acquisition” or “the

Acquisition Portfolio”) totalling approximately 3.5 million square

feet of gross leasable area (“GLA”). The Acquisition Portfolio is

well located in the attractive U.S. logistics markets of Chicago,

Cincinnati, Columbus, Indianapolis, and Louisville. The total

purchase price for the Acquisition is approximately CAD$235 million

(US$179.1 million) and is expected to be accretive to the Trust’s

funds from operations (“FFO”) per unit on a stabilized basis. The

Acquisition is scheduled to close by the end of the first quarter

of 2019.

Acquisition Portfolio

Highlights

- Sizeable portfolio totaling 3.5 million square feet of GLA adds

immediate scale in core logistics markets in the Midwest U.S.

- Each city within the portfolio is supported by large commercial

airports, intermodal transport hubs and is accessible to over 50%

of the U.S. population within a one-day drive.

- Strong economic fundamentals supporting industrial real estate

(e-commerce and logistics) with the average vacancy across all

markets at 5.4%, and unemployment rates in each market below

4%.

- The portfolio includes an attractive mix of single-tenant

assets and multi-tenant facilities that service a broad range of

tenant uses and sizes from small bay to large distribution

facilities.

- The portfolio is comprised of functional distribution

facilities that are well-located, highly reusable and cater to a

wide range of users.

- Purchase price of US$179.1 million represents a going-in

capitalization rate (“cap rate”) of 6.0%, US$51 per square foot

(below estimated replacement cost of US$71 per square foot), with

3.0% average annual rent escalators built into the leases.

- Near-term growth opportunity with a recent vacancy of

approximately 300,000 square feet in a high-quality, well-located

facility in Louisville. Following lease-up, we expect the cap rate

to increase to approximately 6.5%.

“Consistent with our communicated strategy, the

Acquisition adds highly functional assets in key industrial markets

that offer attractive yields with strong growth potential, while

improving the overall quality of the Trust’s portfolio,” said Brian

Pauls, Chief Executive Officer of Dream Industrial REIT. “With a

total GLA of 3.5 million square feet, the Acquisition Portfolio

enables us to establish a meaningful footprint in attractive

logistics markets in the U.S. and also add scale in our existing

markets. Moreover, the Acquisition further highlights the Trust’s

ability to work alongside the PAULS U.S. platform and successfully

source attractive investment opportunities in our core markets at

below replacement cost. Less than two years after announcing

our U.S. expansion, we have successfully acquired 7 million square

feet of GLA and the U.S. now represents our initial target of

approximately 20% of our gross asset value. Looking forward, we

will continue to add portfolio scale with a primary focus on our

target Canadian markets, including Ontario and Quebec.”

Acquired Properties and Market

Overview1

The Acquisition Portfolio is comprised of 21

high quality and functional industrial properties (totalling

approximately 3.5 million square feet of GLA) that further expands

the Trust’s presence in the United States. The portfolio includes

both single and multi-tenant buildings that are well located in

strong U.S. logistics hubs. The properties are strategically

situated in each of their respective markets, located in close

proximity to major U.S. cities with excellent access to interstate

highways and transportation nodes. The tenant base has invested

significant capital in their respective properties and consists of

an attractive mix of large and medium sized enterprises that span

across multiple industries. The portfolio is currently 91%

occupied, and excluding approximately 300,000 square feet recently

vacated in the Louisville property, portfolio occupancy is 99.6%

with a weighted average lease term of 4.1 years. With Louisville

just having recorded its second strongest quarter in market

history, with 2 million square feet of net absorption, the recent

vacancy at this property provides an opportunity to enhance the

Trust’s yield through aggressive lease up.

1Certain statistical information in this section

has been taken from the following sources: United States Bureau of

Labor Statistics – September 2018 report; CBRE Chicago

Industrial Snapshot Q3-2018; CBRE Columbus Industrial Snapshot

Q3-2018; CBRE Indianapolis Industrial Snapshot Q3-2018; CBRE

Louisville Industrial Snapshot Q3-2018; and CBRE Cincinnati

Industrial Snapshot Q3-2018.

Chicago, Illinois

The Chicago industrial market experienced its

33rd consecutive quarter of positive net absorption in Q3-2018 and

market vacancy is now at 3.5%. Demand for mid-to-large bay space is

strong with over 80 tenants looking for at least 50,000 square feet

of space, for a cumulative total of 21.1 million square feet. The

development pipeline represents less than 1% of market inventory

despite 12.5 million square feet of new supply under construction.

The Acquisition Portfolio consists of four assets totalling 1.3

million square feet, located primarily in the O’Hare and Lake

County sub-markets. The vacancy rate across the respective

sub-markets averages 2.3%.

Columbus, Ohio

Located within 500 miles of approximately 50% of

the combined population in the U.S. and Canada, Columbus serves as

a major logistics hub with more than 4,400 warehouse/distribution

facilities and employing 83,000 people. The Acquisition Portfolio

includes 12 buildings totalling 1.2 million square feet in

Columbus. The majority, or 11 assets, are located in the West

submarket, with a low vacancy rate of 1.7%. The remaining building

is strategically located in the Northeast submarket close to major

population centres. This is the tightest submarket in the city,

with a vacancy rate of only 0.8%. These assets complement the

Trust’s two existing assets in Columbus, adding scale and bringing

the Trust’s total Columbus portfolio to 2 million square feet.

Indianapolis, Indiana

With seven Fortune 1000 companies headquartered

in Indianapolis, the city has the eighth lowest unemployment rate

amongst the 40 largest metro areas in the U.S. Indianapolis

experienced 3.3 million square feet of positive net absorption

during Q3-2018, the 32nd consecutive quarter with positive net

absorption. Vacancy is currently at 4.5%, a post-recession low. The

Acquisition Portfolio includes two large-bay single tenant

buildings that are located in Indianapolis, totaling 632,000 square

feet. The assets are well-located with access to major

transportation corridors and skilled labour.

Cincinnati, Ohio

Cincinnati has one of the tightest market-wide

vacancy rates in the U.S., which includes absorption of a

significant amount of recent industrial construction deliveries.

Net absorption in Q3-2018 totalled 1.1 million square feet with

vacancy at 3.2% as of Q3-2018. The Acquisition Portfolio consists

of two multi-tenant buildings totalling 140,000 square feet located

adjacent to the Cincinnati Airport and in the preferred Northern

Kentucky submarket which has excellent highway access and is

located minutes away from Amazon Prime and DHL Supercargo Hubs.

Louisville, Kentucky

Industrial fundamentals in Louisville are strong

with Q3-2018 marking the second highest quarterly net absorption (2

million square feet) in the history of the market, just behind

Q2-2018 of 2.6 million square feet. Vacancy in the market is 6.0%,

down 200 bps year-over-year. The Acquisition Portfolio includes one

303,000 square foot property in Louisville which has immediate

highway access and visibility along I-65. This 28 foot clear

high-quality distribution and warehousing facility is the newest

property in the portfolio.

Pro Forma Portfolio

Upon completion of the Acquisition, the Trust‘s

portfolio will comprise 244 properties (including the previously

announced acquisition of a property located in Montreal which

closed in October 2018) with a total GLA of 23.7 million square

feet and a pro forma gross asset value of $2.3 billion.

Approximately 7 million square feet or $0.5 billion (22%) of

the pro forma portfolio will be located in the United States. The

following chart illustrates the Trust’s geographic exposure based

on gross asset value on a pro forma basis following the completion

of the Acquisition.

Acquisition Financing

Equity Offering

The Trust has entered into an agreement to sell,

on a bought deal basis, 12,000,000 units of the Trust

(“Units”) at a price of $10.45 per Unit to a syndicate of

underwriters led by TD Securities Inc. (the “Underwriters”) for

total gross proceeds of $125 million (the “Offering”). In addition,

the Trust has granted the underwriters an over-allotment option to

purchase up to an additional 1,800,000 Units, exercisable in

whole or in part, for a period of 30 days following closing of the

Offering. If the over-allotment option is exercised in full, the

gross proceeds of the Offering will total $144 million.

Closing of the Offering is subject to certain customary conditions,

including the approval of the Toronto Stock Exchange. The

Offering is expected to close on or about February 13, 2019.

The Trust intends to use the net proceeds from

the Offering to partially fund the purchase price of the

Acquisition and for general Trust purposes. The balance of

the purchase price for the Acquisition will be funded from the

Trust’s working capital and drawings on the Trust’s revolving

credit facility.

The Units will be offered by way of a shelf

prospectus supplement, to the Trust's base shelf prospectus dated

September 15, 2017, to be filed on or about February 6, 2019 with

the securities commissions and other similar regulatory authorities

in each of the provinces of Canada.

Amended revolving credit facility

The Trust announced today that it has also

received lender approval to amend its existing revolving credit

facility, increasing the borrowing capacity from $125 million to

$150 million, with amounts available to be drawn in Canadian and/or

U.S. dollars. The amendment is subject to customary closing

conditions.

“The announced transactions allow us to acquire

attractive assets that meet our investment criteria while reducing

our leverage and increasing our financial flexibility,” said Lenis

Quan, Chief Financial Officer of Dream Industrial REIT. “We remain

focused on driving organic growth and improving the quality of our

portfolio. For our 2019 renewals contracted to date, we have

achieved rental spreads of 9.5% and 11.5% in Ontario and Quebec,

respectively. We plan to accelerate our capital recycling program

in 2019 and are well-positioned with sufficient liquidity to grow

our portfolio primarily in Canada by acquiring or developing best

in class industrial assets that have strong income growth

potential.”

About Dream Industrial REIT

Dream Industrial REIT is an unincorporated,

open-ended real estate investment trust. Dream Industrial REIT owns

and operates a portfolio of 223 geographically diversified light

industrial properties comprising approximately 20.2 million square

feet of gross leasable area located primarily in key markets across

Canada with a growing presence in the United States. Its objective

is to build upon and grow its portfolio and to provide stable and

sustainable cash distributions to its unitholders. For more

information, please visit www.dreamindustrialreit.ca.

Non-GAAP Measures

The Trust’s consolidated financial statements

are prepared in accordance with International Financial Reporting

Standards (“IFRS”). In this press release, the Trust discloses and

discusses certain non-GAAP financial measures, including FFO per

unit. These non-GAAP measures are not defined by IFRS, do not have

a standardized meaning and may not be comparable with similar

measures presented by other income trusts. The Trust has presented

such non-GAAP measures as Management believes they are relevant

measures of the Trust’s underlying operating and financial

performance. Non-GAAP measures should not be considered as to

alternatives net income, net rental income, cash flows generated

from (utilized in) operating activities, cash and cash equivalents,

total assets, non-current debt, total equity, or comparable metrics

determined in accordance with IFRS as indicators of the Trust’s

performance, liquidity, cash flow, and profitability. For a full

description of these measures and, where applicable, a

reconciliation to the most directly comparable measure calculated

in accordance with IFRS, please refer to the “Non-GAAP Measures and

Other Disclosures” in Dream Industrial REIT’s MD&A for the

three and nine months ended September 30, 2018.

Forward looking information

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, including statements regarding our objectives and

strategies and our expectations of cash flows from the Acquisition

Portfolio, anticipated timing of closing of the Acquisition and the

Offering, the Trust’s intentions for financing the Acquisition, the

expected going in capitalization rate of the Acquisition Portfolio,

expected GLA, gross asset value and geographic exposure of the

Trust after giving effect to the completion of the Acquisition, the

anticipated amendment to the Trust’s credit facility, the Trust’s

asset recycling opportunities and potential acquisition or

development opportunities. Forward-looking information is based on

a number of assumptions and is subject to a number of risks and

uncertainties, many of which are beyond Dream Industrial REIT’s

control, which could cause actual results to differ materially from

those that are disclosed in or implied by such forward-looking

information. These risks and uncertainties include, but are not

limited to, general and local economic and business conditions; the

financial condition of tenants; our ability to refinance maturing

debt; leasing risks, including those associated with the ability to

lease vacant space; and interest and currency rate fluctuations;

and, with respect to the Acquisition referred to in this news

release, the risk of failure to satisfy or waive any customary

conditions to the closing of the acquisition or to realize the

expected benefits from the Acquisitions, as well as the risk that

the properties that may be acquired may not perform as anticipated.

Our objectives and forward-looking statements are based on certain

assumptions, including that the general economy remains stable,

interest rates remain stable, conditions within the real estate

market remain consistent, competition for acquisitions remains

consistent with the current climate, that the capital markets

continue to provide ready access to equity and/or debt and that the

terms and conditions on which the Acquisition is completed will be

as currently contemplated.. All forward-looking information in this

press release speaks as of the date of this press release. Dream

Industrial REIT does not undertake to update any such

forward-looking information whether as a result of new information,

future events or otherwise except as required by law. Additional

information about these assumptions and risks and uncertainties is

contained in Dream Industrial REIT’s filings with securities

regulators, including its latest annual information form and

MD&A. These filings are also available at Dream Industrial

REIT’s website at www.dreamindustrialreit.ca.

For further information, please contact:

Dream Industrial REIT

| Brian

Pauls |

|

Lenis

Quan |

|

President and Chief Executive Officer |

|

Chief

Financial Officer |

| (416)

365-2365 |

|

(416)

365-2353 |

|

bpauls@dream.ca |

|

lquan@dream.ca |

Photos accompanying this announcement are available at

http://www.globenewswire.com/NewsRoom/AttachmentNg/62b19235-942e-4da1-ae32-04819e53efaf

http://www.globenewswire.com/NewsRoom/AttachmentNg/a105b35e-9740-4acc-a1fd-2da9e247bc20

http://www.globenewswire.com/NewsRoom/AttachmentNg/4172a167-9a5b-44ce-9a8f-ae4b511e0738

http://www.globenewswire.com/NewsRoom/AttachmentNg/5e96f5ad-4546-466c-bb2a-ec2d54862125

http://www.globenewswire.com/NewsRoom/AttachmentNg/03bd7c24-c22e-475c-a883-f037aee8292d

http://www.globenewswire.com/NewsRoom/AttachmentNg/d41250db-e3f3-4cb5-96f9-48bb49345902

http://www.globenewswire.com/NewsRoom/AttachmentNg/e454083d-9d22-4b78-8e78-52e6bae09bf8

http://www.globenewswire.com/NewsRoom/AttachmentNg/114c43e0-a6a0-40ef-886f-cc26462386c8

http://www.globenewswire.com/NewsRoom/AttachmentNg/4ad79a12-4fa2-4627-bbe2-44c0f82eef1d

http://www.globenewswire.com/NewsRoom/AttachmentNg/be3dd443-f1db-4338-b649-97f49b01a13b

http://www.globenewswire.com/NewsRoom/AttachmentNg/3d11ff55-b964-4bd7-85e7-5589b798f57d

http://www.globenewswire.com/NewsRoom/AttachmentNg/6a27522c-e7d7-4513-82b3-46fff026f66b

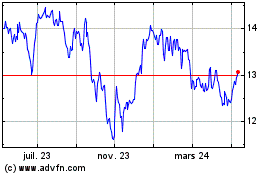

Dream Industrial Real Es... (TSX:DIR.UN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

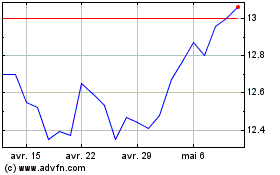

Dream Industrial Real Es... (TSX:DIR.UN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025