Dream Industrial REIT (TSX: DIR.UN) (“Dream Industrial”,

“DIR”, the “REIT” or the “Trust”) today announced an

update on its robust pace of capital deployment, progress on its

development pipeline, and the launch of a $175 million equity

offering.

“Over the past four years, we have identified

several priorities to transform Dream Industrial into a high

quality, geographically diverse entity. We have acquired $1.3

billion of assets in Europe, Ontario, Quebec and the U.S., divested

assets in Atlantic Canada and have initiated a large-scale

development program. NAV growth over this time period has been 34%

and the REIT has significantly reduced its leverage and balance

sheet risk. Our portfolio is now more modern and logistics

oriented, with buildings that are on average 25% larger and leased

to tenants that are 75% larger, with over 40% of our base rent

coming from tenants occupying spaces larger than 100,000 square

feet,” said Brian Pauls, Chief Executive Officer of Dream

Industrial REIT. “With our seasoned platform in North America and

Europe and our strong balance sheet, the REIT is very well

positioned to capitalize on the momentum and strong industrial

fundamentals in a post pandemic environment. Our current

acquisition and development pipeline is exceptionally strong and

presents a unique opportunity to drive further improvements in

quality and value for the REIT and our investors over the long

term.”

ACQUISITION UPDATE

In 2021, the Trust has completed or waived

conditions on 13 acquisitions valued at $329 million in Canada, the

U.S. and Europe. These include $138 million of acquisitions

announced with our Q4 2020 results and $191 million of new

acquisitions, which include:

- A 366,000 square

foot Class A distribution and warehousing asset in the Greater

Montreal Area (“GMA”) for $62 million. Built in 2003, the building

was expanded by 138,000 square feet of 32 feet clear warehouse

space in 2020. The property is fully occupied by tenants primarily

in the Logistics and Healthcare industries. With the average

in-place rent 10% below the current market rent and with a weighted

average remaining lease term of 3.5 years, the Trust expects to

generate significant rental rate growth as leases roll;

- A brand-new

mid-bay logistics facility in Arnhem, Netherlands for €21 million

($31 million). The property spans 159,000 square feet with a clear

ceiling height of 48 feet. The asset is well-located, having access

to major Dutch and German markets and is fully occupied by a

logistics tenant with 10 years remaining on the fully-indexed

lease; and

- Five assets

closed for $51 million and three assets where all conditions have

been waived for $47 million in Ontario, Quebec and Europe, which

added 671,000 square feet to the portfolio, and enabled the Trust

to execute on its clustering strategy within its existing

markets.

These 2021 acquisitions add 1.9 million square

feet of high quality, well-located and functional logistics space

to the Trust’s portfolio. Built on average in the mid-2000s, these

assets are above the average quality of the Trust’s portfolio, with

an average clear ceiling height of 30 feet.

The Trust is also currently under contract or in

exclusive negotiations on approximately $160 million of assets in

the Trust’s target markets of Ontario in Canada, Midwestern U.S.,

as well as Germany and Netherlands in Europe. These acquisitions

are expected to close in the next 45-60 days, subject to completion

of due diligence.

The Trust’s acquisition pipeline remains strong

with over $300 million of acquisitions being currently underwritten

across North America and Europe.

DEVELOPMENT UPDATE

The Trust continues to focus on building and

executing on a development pipeline across its three operating

regions. The Trust is in the final pre-development stages on

projects totaling approximately one million square feet in 2021.

The Trust has provided some highlights on its near-term development

activities below:

- The Trust

expects to commence construction of a 460,000 square foot Class A

distribution facility on its 24.5 acre site in North Las Vegas in

Q2 2021. The Trust estimates that the yield on cost on this

development will exceed 6%;

- At the Trust’s

recently acquired 527,000 square foot property in the GMA, the

Trust intends to expand the property by 220,000 square feet. The

intensification is expected to occur over two phases, and the Trust

expects to commence construction of Phase 1 in April 2021. The

Trust continues to advance Phase 2 of the project with construction

anticipated to start in Q3 2021. The Trust expects to achieve a

yield on construction costs of over 6.5% on this project;

- The Trust has

entered into construction agreements to expand its current 110,000

square foot asset located in the Greater Toronto Area by an

additional 43,000 square feet. The Trust intends to commence

construction in Q3 2021 and expects to achieve a yield on

construction costs of approximately 8%; and

- In Germany, the

Trust intends to add over 200,000 square feet of gross leasable

area to its recently acquired property in Dresden. The Trust

expects to be in a position to commence construction in Q4 2021,

with an estimated yield on construction costs of over 6%.

Overall, the construction costs on the

aforementioned projects are expected to amount to approximately $90

million. The Trust has access to an extensive development and

redevelopment pipeline beyond these projects which it expects to

access over time.

“We look forward to commencing a structured

development program and adding brand-new, high quality properties

to the portfolio as a complement to our acquisition strategy,” said

Alexander Sannikov, Chief Operating Officer of Dream Industrial. “A

significant component of our development program is expected to

focus on leveraging the REIT’s predominantly urban portfolio in

North America and Europe, where we have a unique opportunity to add

highly sought after industrial product in infill locations with

steep barriers to entry and rising land costs. Paired with

opportunistic greenfield development, we expect this strategy to

result in meaningful NAV and FFO per unit accretion over time.”

FINANCING UPDATE

The Trust continues to focus on increasing

financial flexibility. On April 1, 2021, the Trust repaid upon

maturity, a US$22 million loan secured by a U.S. property. On a pro

forma basis, taking into consideration the repayment of this

mortgage and closing of assets that are currently firm, under

contract, or in exclusive negotiations, the Trust’s unencumbered

asset pool is expected to total $2.3 billion, representing over 60%

of the Trust’s total investment properties value. In just over 90

days, the Trust has deployed nearly $450 million of capital towards

acquisitions and repayment of secured debt, with an additional $300

million of capital earmarked for acquisitions that are firm, under

contract, or in exclusive negotiations, as well as planned

development costs. In addition, the pipeline of investment

opportunities continues to be active and the pace of capital

deployment is expected to remain robust.

The Trust today announced that it has entered

into an agreement to sell, on a bought deal basis, 12,920,000

units of the Trust (“Units”) at a price of $13.55 per Unit to a

syndicate of underwriters led by TD Securities Inc. (the

“Underwriters”) for total gross proceeds of approximately $175

million (the “Offering”). In addition, the Trust has granted the

Underwriters an over-allotment option to purchase up to an

additional 1,938,000 Units, exercisable in whole or in part,

for a period of 30 days following closing of the Offering. If the

over-allotment option is exercised in full, the gross proceeds of

the Offering will total approximately $201 million. Closing of the

Offering is subject to certain customary conditions, including the

approval of the Toronto Stock Exchange. The Offering is expected to

close on or about April 26, 2021.

The Trust intends to use the net proceeds from

the Offering, together with cash on hand: (i) to fund acquisition

and development opportunities, (ii) to repay indebtedness, and

(iii) for general trust purposes.

“This equity offering allows us to continue to

execute on our strategy to grow and upgrade portfolio quality,”

said Lenis Quan, Chief Financial Officer of Dream Industrial. “Net

proceeds from the offering are expected to be utilized towards $160

million of acquisitions that are under contract or in exclusivity

as well as to fund development costs, and we will gain balance

sheet capacity to deploy an additional $300 million, while keeping

leverage in our targeted mid-to-high 30% range.”

The Units will be offered by way of a shelf

prospectus supplement to the Trust's base shelf prospectus dated

October 11, 2019, to be filed on or about April 19, 2021 with the

securities commissions and other similar regulatory authorities in

each of the provinces of Canada.

This news release does not constitute an offer

to sell securities, nor is it a solicitation of an offer to buy

securities, in any jurisdiction in which such offer or solicitation

is unlawful. This news release is not an offer of securities for

sale in the United States (“U.S.”). The securities being offered

have not been and will not be registered under the U.S. Securities

Act of 1933, as amended, and accordingly are not being offered for

sale and may not be offered, sold or delivered, directly or

indirectly within the U.S., its possessions and other areas subject

to its jurisdiction or to, or for the account or for the benefit of

a U.S. person, except pursuant to an exemption from the

registration requirements of that Act.

About Dream Industrial Real Estate

Investment Trust

Dream Industrial REIT is an unincorporated,

open-ended real estate investment trust. As at March 31, 2021, the

Trust owns and operates a portfolio of 186 assets (280 industrial

buildings) comprising approximately 28.9 million square feet of

gross leasable area in key markets across North America and a

growing presence in strong European industrial markets. The Trust’s

objective is to continue to grow and upgrade the quality of its

portfolio and to provide attractive overall returns to its

unitholders. For more information, please visit

www.dreamindustrialreit.ca.

Non-GAAP

Measures

NAV and FFO per unit amounts are non-GAAP

measures. See “Non-GAAP Measures and Other Disclosures” in

the management’s discussion and analysis of the financial condition

and results of operations of the Trust for the year ended December

31, 2020 for more information about these measures.

Forward Looking

Information

This news release may contain forward-looking

information within the meaning of applicable securities

legislation. Forward-looking information generally can be

identified by the use of forward-looking terminology such as

“outlook”, “objective”, “may”, “will”, “expect”, “intend”,

“estimate”, “anticipate”, “believe”, “should”, “plans”, or

“continue”, or similar expressions suggesting future outcomes or

events. Some of the specific forward-looking information in this

news release may include, among other things, the details, status

and anticipated timing of closing of the acquisitions and potential

acquisitions referred to in this press release; the development and

expansion potential of our properties and the acquisition

properties; the growth of our portfolio; statements regarding our

development and acquisition pipelines, including estimated timing

for closing future acquisitions; the amount of development and

redevelopment activity we anticipate undertaking in 2021 and future

years; estimated development expenditures; our expected yield on

construction cost for developments and redevelopments; the Trust’s

expected acquisition capacity and leverage levels; our expectation

to generate rental rate growth; our expectation that our

unencumbered asset pool will total approximately $2.3 billion,

representing over 60% of our total investment properties’ value;

the expectation that our strategy will result in meaningful NAV and

FFO per unit accretion over time; the Trust’s growth outlook for

2021 and future years; the intended use of proceeds of the Offering

and the anticipated timing for the closing of the Offering. Forward

looking information is based on a number of assumptions and is

subject to a number of risks and uncertainties, many of which are

beyond Dream Industrial REIT’s control that could cause actual

results to differ materially from those that are disclosed in or

implied by such forward-looking information. These risks and

uncertainties include, but are not limited to, global and local

economic and business conditions; uncertainties surrounding the

COVID-19 pandemic; the financial condition of tenants; our ability

to refinance maturing debt; leasing risks, including those

associated with the ability to lease vacant space; interest and

currency rate fluctuations; competition; and the risk that there

may be unforeseen events that cause the Trust’s actual capital

structure, overall cost of debt and results of operations to differ

from what the Trust currently anticipates. Our objectives and

forward-looking statements are based on certain assumptions with

respect to each of our markets, including that the general economy

remains stable, the gradual recovery and growth of the general

economy continues over the remainder of 2021, interest rates remain

stable, conditions within the real estate market remain consistent,

competition for and availability of acquisitions remains consistent

with the current climate, the capital markets continue to provide

ready access to equity and/or debt, the timing and ability to sell

certain properties remains in line with the Trust’s expectations,

valuations to be realized on property sales will be in line with

current IFRS values, occupancy levels remain stable, and the

replacement of expiring tenancies will remain consistent. All

forward-looking information in this news release speaks as of the

date of this news release. Dream Industrial REIT does not undertake

to update any such forward-looking information whether as a result

of new information, future events or otherwise except as required

by law. Additional information about these assumptions and risks

and uncertainties is contained in Dream Industrial REIT’s filings

with securities regulators, including its latest annual information

form and MD&A. These filings are also available at Dream

Industrial REIT’s website at www.dreamindustrialreit.ca.

For further information, please contact:

DREAM INDUSTRIAL REAL ESTATE INVESTMENT

TRUST

|

Brian Pauls |

Lenis Quan |

Alexander Sannikov |

|

Chief Executive Officer |

Chief Financial Officer |

Chief Operating Officer |

|

(416) 365-2365 |

(416) 365-2353 |

(416) 365-4106 |

|

bpauls@dream.ca |

lquan@dream.ca |

asannikov@dream.ca |

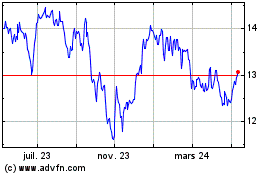

Dream Industrial Real Es... (TSX:DIR.UN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

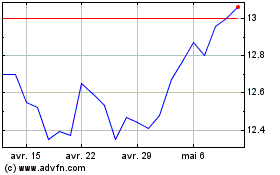

Dream Industrial Real Es... (TSX:DIR.UN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025