This press release constitutes a

“designated news release” for the purposes of Dream

Industrial REIT’s prospectus supplement dated February 26, 2021 to

its short form base shelf prospectus dated October 11, 2019

This press release contains forward-looking

information that is based upon assumptions and is subject to risks

and uncertainties as indicated in the cautionary note contained

within this press release.

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE

SERVICES OR DISSEMINATION IN THE UNITED STATES

Dream Industrial REIT (TSX: DIR.UN) (“Dream Industrial”,

“DIR”, or the “Trust”) today announced that it has closed on

the previously announced acquisition of shares of a corporation

that owns a portfolio of 31 institutional quality, logistics

properties across Europe (the “Acquisition”). The purchase price

for the Acquisition was approximately $850 million, excluding

customary closing adjustments. The total value of the real estate

in connection with the Acquisition is approximately €880 million or

$1.3 billion which implies a going in capitalization rate in the

low 4% range, inclusive of excess land.

The portfolio is 100% leased, has an average construction date

in the mid-2000s and an average clear height of 34.5 feet. This

fully indexed portfolio has a weighted average lease term of 5.3

years. A majority of the properties have strong income growth

potential with in-place rents estimated to be on average 10% below

market. Those properties with longer term leases have stable

tenants with strong covenants, including multi-national

corporations and investment grade credits. Food distribution and

third-party logistics tenants represent 50% of the portfolio by net

rent.

“This transaction allows us to gain significant scale in strong

European industrial markets and accelerate our long-term capital

allocation targets in the region. Since announcing our European

expansion in early 2020, we have amassed one of the largest

publicly traded European logistics portfolios globally, and are

well positioned for strong organic growth, which should drive solid

FFO and net asset value per unit growth for our unitholders,” said

Brian Pauls, Chief Executive Officer of Dream Industrial REIT.

“Following this transaction, Dream Industrial will own a $5 billion

portfolio of high-quality, well-diversified assets located in some

of the most sought-after logistics markets in the world.”

This transaction provides a unique and transformational

opportunity to accelerate Dream Industrial’s European expansion

strategy. It significantly enhances quality and scale in top

European industrial markets and establishes a comprehensive

pan-European real estate platform, including in-house development

capabilities. Following the transaction, Dream Industrial’s gross

asset value increases to $5 billion and Europe will account for

approximately 37% of total assets from approximately 14% as at

March 31, 2021, which is consistent with its strategy of growing in

markets that have significant barriers to entry and provide strong

organic growth potential. With the larger asset base and enhanced

platform, the Trust has the opportunity to pursue investment and

asset management opportunities that are of higher quality and

deliver higher returns.

Pro forma Combined Portfolio

Portfolio Metrics

As at March 31, 2021,

Adjusted1

Acquisition Portfolio

Pro Forma2

Number of properties

286

31

317

Investment properties fair value (millions

of dollars)

3,673

1,305

4,977

Gross leasable area (thousands of square

feet)

29,541

8,903

38,446

Number of tenants

1,128

33

1,161

Average tenant size (thousands of square

feet)

26

270

33

Occupancy rate (including committed

occupancy)

96.9%

100.0%

97.6%

Average remaining lease term (years)

4.2

5.3

4.5

Average clear height (feet)

25.5

34.5

27.6

Development pipeline (millions of square

feet)

~2.0

1.1

>3.0

“Our significant expertise in sourcing and executing on

investment opportunities in Europe, along with our strong balance

sheet and access to capital allowed us to successfully execute on

this rare opportunity to acquire high-quality properties in top

European industrial markets at scale,” said Alex Sannikov, Chief

Operating Officer of Dream Industrial REIT. “The

institutional-grade quality of the assets and strong organic growth

potential driven by contractual rental escalators, significant

upside over current in-place rents, and over 1 million square feet

of development opportunities, will allow us to deliver strong FFO

and net asset value per unit growth for our unitholders, while

enhancing the overall quality and stability of our portfolio and

the business.”

The purchase price of the Acquisition was approximately $850

million, excluding customary closing adjustments. The Acquisition

was financed by net proceeds from the $287.5 million subscription

receipts offering completed on May 31, 2021, a portion of net

proceeds from the $800 million unsecured debenture offering

completed on June 17, 2021, as well as cash on hand.

In connection with the Acquisition, the Trust issued $800

million aggregate principal amount of unsecured debentures (the

"Offering") which closed on June 17, 2021. The Offering consisted

of three separate tranches, including a $200 million re-opening of

the 1.662% Series A Debentures maturing in 2025, $200 million of

three month Canadian Dollar Offered Rate (“CDOR”) plus 0.35% Series

B Debentures maturing in 2024 and $400 million of 2.057% Series C

Debentures (the “Green Bonds”) maturing in 2027 (collectively the

“Debentures”). Subsequent to the completion of the Offering, the

Trust entered into cross currency interest rate swap arrangements

to swap the proceeds of the Offering to Euros that resulted in an

average all-in interest rate of only 0.35% over the approximately

5-year average term of the Debentures. The net proceeds from the

Offering were utilized to fund a portion of the purchase price of

the Acquisition and, with respect to the net proceeds from the sale

of the Green Bonds, will also be used to finance and/or refinance

eligible green projects within the meaning of the Trust’s recently

announced Green Financing Framework. The Trust may use a portion of

the net proceeds to repay existing indebtedness.

“Over the past year, we have transformed DIR to operate under a

largely unsecured financing model which has significantly increased

financial flexibility. Driven by our access to European debt, our

debt strategy has lowered our average interest rate on total debt

outstanding by approximately 200 basis points or over 50%,

accelerating the achievement of our goal set when we announced our

European expansion nearly 18 months ago,” said Lenis Quan, Chief

Financial Officer of Dream Industrial REIT. “This Acquisition also

allowed us to introduce green bonds to our capital stack as we

increasingly focus on capital allocation towards green buildings

and sustainable initiatives within our current portfolio.”

As the escrow release conditions relating to the Trust’s

subscription receipts (the “Subscription Receipts”) have been

satisfied, one unit of the Trust will be issued for each issued and

outstanding Subscription Receipt without payment of additional

consideration and the net proceeds from the sale of the

Subscription Receipts will be released from escrow. Trading in the

Subscription Receipts is expected to be halted on the Toronto Stock

Exchange this afternoon. The Trust expects that the Subscription

Receipts will be delisted from the Toronto Stock Exchange after the

close of markets today and that the units issued in exchange for

the Subscription Receipts will commence trading on the Toronto

Stock Exchange on Friday, June 25, 2021 under the symbol “DIR.UN”.

Holders of Subscription Receipts will receive units of the Trust

prior to the record date of June 30, 2021 for the Trust’s June

distribution. The June distribution will be payable on July 15,

2021 to unitholders of record as at June 30, 2021.

Update on U.S. Portfolio Strategic Partnership

The Trust is in advanced negotiations with its asset manager,

Dream Asset Management Corporation (“DAM”), and a group of

institutional investors in connection with the creation and launch

of a private U.S. industrial investment fund (the “Fund”). Under

the contemplated arrangement, the Trust will contribute its U.S.

portfolio to the Fund allowing the repatriation of over $250

million of equity at values in excess of March 31, 2021 IFRS

carrying values as well as a retained 25% interest in the Fund at

the time of closing.

The Trust intends to grow its investment in the U.S. through the

Fund and will be able to pursue higher quality acquisition and

development opportunities in strategic markets, and expects to

maintain an approximate 25% ownership interest in the Fund. It is

anticipated that DAM will be the investment manager of the Fund and

the Trust would continue to pay fees on its 25% interest under its

current asset management agreement with DAM. The Trust is expected

to become the property manager for the partnership and earn profits

from the property management platform which will enhance its

returns on equity invested in the United States going forward.

About Dream Industrial Real Estate Investment Trust

Dream Industrial REIT is an unincorporated, open-ended real

estate investment trust. As at March 31, 2021, Dream Industrial

REIT owns and operates a portfolio of 186 industrial assets (280

properties) comprising approximately 28.8 million square feet of

gross leasable area in key markets across North America and a

growing presence in strong European industrial markets. Dream

Industrial REIT’s objective is to continue to grow and upgrade the

quality of its portfolio and to provide attractive overall returns

to its unitholders. For more information, please visit

www.dreamindustrialreit.ca

Forward Looking Information

This news release may contain forward-looking information within

the meaning of applicable securities legislation. Forward-looking

information generally can be identified by the use of

forward-looking terminology such as “outlook”, “objective”, “may”,

“will”, “would”, “could”, “expect”, “intend”, “estimate”,

“anticipate”, “believe”, “should”, “plans”, or “continue”, or

similar expressions suggesting future outcomes or events. Some of

the specific forward-looking information in this news release may

include, among other things, the development and expansion

potential of our properties, including the going in capitalization

rate in the low 4% range, that the assets are well located and are

well-poised for growth in FFO and NAV per unit; our ability to

capture significant upside over current in-place rents; the

expected growth of our portfolio; our combined portfolio on a pro

forma basis after giving effect to the completion of the

Acquisition; negotiations with DAM and a group of institutional

investors to partner and invest in the Trust’s United States

portfolio and the expected terms of the contemplated partnership,

including the anticipated repatriation of over $250 million of

equity at values in excess of IFRS carrying values; the growth of

our industrial platform in the United States; the pursuit of higher

quality investment and development opportunities in strategic

markets; that DAM will continue as the asset manager and that the

Trust will become the property manager for the partnership; that

the Trust believes its strategy would enhance returns on equity

invested in the United States going forward; the intended use of

proceeds from the Series C Debentures to finance and/or refinance

eligible Green projects; expansion of the Trust’s capabilities into

new markets; the opportunity for us to deliver strong growth in FFO

and net asset value per unit for our unitholders; the exchange of

the Subscription Receipts for units and the release of the net

proceeds from escrow; the halting in trading of the Subscription

Receipts and subsequent delisting; the trading of the units issued

in exchange for the Subscription Receipts; and the entitlement of

holders of Subscription Receipts to distribution equivalent

payments. Forward looking information is based on a number of

assumptions and is subject to a number of risks and uncertainties,

many of which are beyond Dream Industrial REIT’s control that could

cause actual results to differ materially from those that are

disclosed in or implied by such forward-looking information. These

risks and uncertainties include, but are not limited to, global and

local economic and business conditions; uncertainties surrounding

the COVID-19 pandemic; the financial condition of tenants; leasing

risks, including those associated with the ability to lease vacant

space; interest and currency rate fluctuations; competition; and

the risk that there may be unforeseen events that cause the Trust’s

actual capital structure, overall cost of debt and results of

operations to differ from what the Trust currently anticipates. Our

objectives and forward-looking statements are based on certain

assumptions with respect to each of our markets, including that the

general economy remains stable, the gradual recovery and growth of

the general economy continues over the remainder of 2021, interest

rates remain stable, conditions within the real estate market

remain consistent, competition for and availability of acquisitions

remains consistent with the current climate, the capital markets

continue to provide ready access to equity and/or debt, the timing

and ability to sell certain properties remains in line with the

Trust’s expectations, valuations to be realized on property sales

will be in line with current IFRS values, occupancy levels remain

stable, and the replacement of expiring tenancies will remain

consistent. All forward-looking information in this news release

speaks as of the date of this news release. Dream Industrial REIT

does not undertake to update any such forward-looking information

whether as a result of new information, future events or otherwise

except as required by law. Additional information about these

assumptions and risks and uncertainties is contained in Dream

Industrial REIT’s filings with securities regulators, including its

latest annual information form and MD&A. These filings are also

available at Dream Industrial REIT’s website at

www.dreamindustrialreit.ca.

1 Inclusive of six acquisitions that closed subsequent to March

31, 2021 2 Combined portfolio as at March 31, 2021, inclusive of

the six properties referred to in note 1 above, and giving effect

to the completion of the Acquisition

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210624005675/en/

DREAM INDUSTRIAL REAL ESTATE INVESTMENT TRUST Brian

Pauls Chief Executive Officer (416) 365-2365 bpauls@dream.ca

Lenis Quan Chief Financial Officer (416) 365-2353

lquan@dream.ca Alexander Sannikov Chief Operating Officer

(416) 365-4106 asannikov@dream.ca

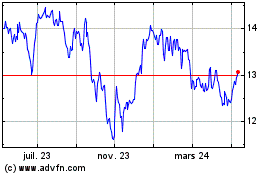

Dream Industrial Real Es... (TSX:DIR.UN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

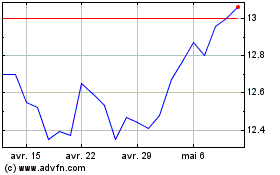

Dream Industrial Real Es... (TSX:DIR.UN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025