Dream Industrial REIT Announces $250 Million Equity Offering, and Provides Update on 5 Million Square Feet of Acquisitions Across Canada and Europe

13 Octobre 2021 - 10:32PM

Dream Industrial REIT (DIR.UN-TSX) or (the “Trust” or the “REIT” or

“we”) today announced the launch of a $250 million equity offering

and an update on its robust pace of capital deployment.

ACQUISITION UPDATE

The Trust continues to execute on its strategy

to grow and upgrade portfolio quality in its target markets. Below,

the Trust has provided an update on its acquisition activity since

Q2-2021.

- Completed the

acquisition of seven assets totalling approximately 1.4 million

square feet for a total purchase price of over $202 million,

equating to a weighted average capitalization rate (“cap rate”) of

approximately 4.7%;

- Waived all

conditions on four assets totalling approximately 1.1 million

square feet for a total purchase price of over $209 million,

equating to a weighted average cap rate of approximately 4.6%;

- The Trust is

also in exclusive negotiations on seven assets totalling

approximately 2.6 million square feet for a total purchase price of

approximately $420 million.

“Our acquisition pipeline remains robust, and we

have completed or secured over $700 million of acquisitions in

addition to approximately $100 million of acquisitions announced

along with our Q2-2021 results. These acquisitions are consistent

with our strategy of adding high-quality logistics assets in

markets with significant barriers to entry that offer strong

organic growth potential over the long term,” said Brian Pauls,

Chief Executive Officer of Dream Industrial REIT. “Our

on-the-ground local acquisition teams allow us to consistently

access a deep pool of investment opportunities, through both

marketed and off-market deals at attractive economics to the REIT.

We are poised to complete over $3 billion of acquisitions since we

announced our European expansion at the beginning of 2020,

significantly enhancing our portfolio quality, diversification,

growth potential, and balance sheet flexibility. With a

high-quality $5 billion global industrial portfolio and an

investment grade balance sheet with access to financing at

attractive rates, we are well-positioned to continue to create long

term sustainable value for our unitholders.”

Completed acquisitions

- A 360,000 square

foot modern logistics facility located in the Tilburg Region, one

of the top logistics nodes in the Netherlands, for a purchase price

of €37 million ($55 million). Fully refurbished and expanded in the

past year, the asset has a clear ceiling height of over 35 feet

across nearly two-thirds of its footprint. The property is 100%

leased to a logistics company for a 15-year term with the rental

rate on the lease fully indexed to CPI.

- A 124,000 square

foot asset located in the Greater Montreal Area for a purchase

price of $26 million. Completely renovated in the early 2010s, this

single-tenant asset is 100% occupied with a weighted average lease

term (“WALT”) of approximately six years and in-place rents

approximately 10% below current market rent, providing an

attractive balance between stability and cash flow growth. The

asset is LEED Gold certified and features geothermal heating,

energy efficient lighting and skylights for additional natural

light.

- A 118,000 square

foot urban logistics asset in the Eindhoven Region, Netherlands for

€14 million ($21 million). Substantially renovated in 2013/2014,

the building has a clear ceiling height of 31 feet and is 100%

occupied by a tenant in the Food and Beverage industry. The asset

includes a rooftop solar array as well as full LED lighting.

- The Trust also

closed on four assets across Canada, Germany, and the Netherlands

for a total purchase price of $100 million, which added

approximately 770,000 square feet of high-quality logistics assets

to the Trust’s portfolio. These acquisitions were previously

announced in the "Business Update" section of the Trust’s Q2-2021

report.

Recently waived

acquisitions

- In the

Netherlands, the Trust waived all conditions on a 600,000 square

foot urban logistics and high tech industrial campus located in the

heart of the Randstad region, known as Technology Park Ypenburg

(“TPY”), for €100 million ($144 million). TPY is well located at

the junction of the A4, A12, and A13 motorways in a densely

populated part of The Hague, where land is scarce and vacancy rates

are amongst the lowest in the Netherlands. The complex is

well-connected with extensive public transport connections,

including a tram station with direct service to The Hague’s central

train station. The asset is 100% occupied by tenants primarily in

the technology and life sciences sector with a WALT of seven

years.The going-in yield on the transaction is approximately 4.5%

with significant upside from growing rents, which are below market

and fully indexed to CPI, and additional density on the site. There

are two pre-leased expansions for 65,000 square feet currently

underway, the costs of which are included in the purchase price.

These expansion projects are expected to be finalized in 2022.The

Trust has also identified a third expansion site that could

accommodate approximately 39,000 square feet of additional density.

The Trust expects to intensify this site in the next 24 months,

with yields on cost forecast to exceed 6.5%.

- In Germany, the

Trust waived all conditions on two logistics assets totalling

380,000 square feet for €33 million ($48 million). These assets are

located in close proximity to major transportation corridors and

are being acquired below replacement cost. These assets offer the

potential to grow rental rates on lease roll-over as well as to

potentially add incremental density over time.

- In Canada, the

Trust waived all conditions on a 78,000 square foot distribution

facility in the Greater Toronto Area for $18 million. Built in the

early 2000s, the asset has a clear ceiling height of 28 feet and is

located just north of Highway 401 in Ajax, near Amazon’s new one

million square foot distribution centre that is expected to be

completed in late 2021. The Trust agreed to acquire the asset fully

vacant and shortly after the completion of the due diligence

period, leased the entire building for a 10-year term with 3.5%

annual contractual rental rate growth, resulting in an initial

yield of approximately 4.7%.

Additional acquisitions

Furthermore, the Trust has approximately $270

million of assets totalling 1.4 million square feet in Ontario

under contract and is currently in exclusive negotiations on an

additional approximately €105 million ($151 million) of assets

totalling 1.2 million square feet in Germany. These assets are

expected to close in the next 60-90 days, subject to satisfactory

due diligence. Including the acquisitions that are currently firm

and in exclusivity, the Trust expects to complete at least $2.5

billion of acquisitions in 2021, representing an over 75% increase

in the Trust’s investment properties value since the beginning of

2021.

FINANCING UPDATE

The Trust continues to focus on growing and

improving portfolio quality while maintaining a strong and flexible

balance sheet. Subsequent to Q2-2021, the Trust repaid

approximately $265 million of Canadian mortgages at an average

interest rate of 3.54%. The Trust’s debt strategy has allowed it to

reduce its average interest rate on its total debt outstanding by

approximately 250 basis points or approximately 70% over the past

12 months, from over 3.4% to 1% currently. At the same time, the

Trust’s secured debt as a proportion of total debt outstanding is

now below 40%, compared to 100% a year ago.

The Trust today announced that it has entered

into an agreement to sell, on a bought deal basis, 15,160,000

units of the Trust (“Units”) at a price of $16.50 per Unit to a

syndicate of underwriters led by TD Securities Inc. (the

“Underwriters”) for total gross proceeds of approximately $250

million (the “Offering”). In addition, the Trust has granted the

Underwriters an over-allotment option to purchase up to an

additional 2,274,000 Units, exercisable in whole or in part, for a

period of 30 days following closing of the Offering. If the

over-allotment option is exercised in full, the gross proceeds of

the Offering will total approximately $288 million. Closing of the

Offering is subject to certain customary conditions, including the

approval of the Toronto Stock Exchange. The Offering is expected to

close on or about October 22, 2021.

The Trust intends to use the net proceeds from

the Offering, together with cash on hand: (i) to fund the closing

of the aforementioned acquisitions and (ii) for general trust

purposes.

“This equity offering allows us to continue to

execute on our growth strategy while retaining ample financial

flexibility to capitalize on the deep pool of investment

opportunities available to the REIT,” said Lenis Quan, Chief

Financial Officer of Dream Industrial REIT. “We expect this

offering will allow us to execute on our near-term acquisition

pipeline, while keeping leverage in our targeted mid-to-high 30%

range.”

The Units will be offered by way of a shelf

prospectus supplement to the Trust's base shelf prospectus dated

October 11, 2019, to be filed on or about October 15, 2021 with the

securities commissions and other similar regulatory authorities in

each of the provinces of Canada.

This news release does not constitute an offer

to sell securities, nor is it a solicitation of an offer to buy

securities, in any jurisdiction in which such offer or solicitation

is unlawful. This news release is not an offer of securities for

sale in the United States (“U.S.”). The securities being offered

have not been and will not be registered under the U.S. Securities

Act of 1933, as amended, and accordingly are not being offered for

sale and may not be offered, sold or delivered, directly or

indirectly within the U.S., its possessions and other areas subject

to its jurisdiction or to, or for the account or for the benefit of

a U.S. person, except pursuant to an exemption from the

registration requirements of that Act.

About Dream Industrial Real Estate

Investment Trust

Dream Industrial REIT is an unincorporated,

open-ended real estate investment trust. As at June 30, 2021, Dream

Industrial REIT owns and operates a global portfolio comprising

approximately 39 million square feet of gross leasable area in key

markets across North America and Europe. Dream Industrial REIT’s

objective is to continue to grow and upgrade the quality of its

portfolio and to provide attractive overall returns to its

unitholders. For more information, please visit

www.dreamindustrialreit.ca

Forward looking information

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, including statements regarding the potential upside

from growing rents; expected timing of expansion projects and

potential for densification, including expected yield on costs; the

potential to grow rental rates on lease roll-over of certain

assets; the potential to add incremental density over time with

certain assets; the Trust’s intended use of the net proceeds from

the Offering; the Trust’s ability to execute on its near-term

acquisition pipeline; the filing date of the Trust’s shelf

prospectus supplement and timing for closing of the Offering; the

effect of acquisitions on its leverage levels; the anticipated

timing of closing of the acquisitions referred to in this press

release; the expected going-in cap rate of the acquisitions; and

the Trust’s acquisition pipeline and the expected costs of such

acquisitions;. Forward-looking information is based on a number of

assumptions and is subject to a number of risks and uncertainties,

many of which are beyond Dream Industrial REIT’s control, which

could cause actual results to differ materially from those that are

disclosed in or implied by such forward-looking information. These

risks and uncertainties include, but are not limited to, general

and local economic and business conditions; employment levels;

mortgage and interest rates and regulations; the uncertainties

around the timing and amount of future financings; uncertainties

surrounding the COVID-19 pandemic; the financial condition of

tenants; leasing risks, including those associated with the ability

to lease vacant space; rental rates on future leasing; and interest

and currency rate fluctuations. The Trust’s objectives and

forward-looking statements are based on certain assumptions,

including that the general economy remains stable, interest rates

remain stable, conditions within the real estate market remain

consistent, competition for acquisitions remains consistent with

the current climate and that the capital markets continue to

provide ready access to equity and/or debt. All forward-looking

information in this press release speaks as of the date of this

press release. Dream Industrial REIT does not undertake to update

any such forward-looking information whether as a result of new

information, future events or otherwise except as required by law.

Additional information about these assumptions and risks and

uncertainties is contained in Dream Industrial REIT’s filings with

securities regulators, including its latest annual information form

and MD&A. These filings are also available at Dream Industrial

REIT’s website at www.dreamindustrialreit.ca.

For further information, please contact:

Dream Industrial Real Estate Investment

Trust

| Brian

Pauls |

Lenis

Quan |

Alexander

Sannikov |

| Chief Executive Officer |

Chief Financial Officer |

Chief Operating Officer |

| (416) 365-2365 |

(416) 365-2353 |

(416) 365-4106 |

| bpauls@dream.ca |

lquan@dream.ca |

asannikov@dream.ca |

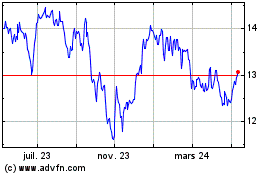

Dream Industrial Real Es... (TSX:DIR.UN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Dream Industrial Real Es... (TSX:DIR.UN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025