Dream Industrial Real Estate Investment Trust Announces Offering of C$200 Million Senior Unsecured Debentures, Series F

17 Mars 2023 - 3:41AM

Business Wire

This press release constitutes a “designated

news release” for the purposes of Dream Industrial REIT’s

prospectus supplement dated November 30, 2021 to its short form

base shelf prospectus dated November 26, 2021.

NOT FOR DISTRIBUTION IN THE UNITED STATES OR

DISSEMINATION THROUGH U.S. NEWS OR WIRE SERVICES

Dream Industrial REIT (TSX: DIR.UN) (the “Trust” or “Dream

Industrial REIT”) announced today that it has priced a private

placement of senior unsecured debentures (the "Offering")

consisting of C$200 million aggregate principal amount of 5.383%

Senior Unsecured Debentures, Series F maturing on March 22, 2028

(the "Series F Debentures").

The Series F Debentures are being offered on an agency basis by

a syndicate of agents led by TD Securities Inc., Scotia Capital

Inc., RBC Dominion Securities Inc., CIBC World Markets Inc., and

National Bank Financial Inc., and including BMO Nesbitt Burns Inc.,

Desjardins Securities Inc. and iA Private Wealth Inc. The Series F

Debentures are being offered on a private placement basis in each

of the provinces of Canada in reliance upon exemptions from the

prospectus requirements under applicable securities

legislation.

The Series F Debentures will be issued at a price equal to

$1,000 per $1,000 principal amount and bear interest at a rate of

5.383% per annum and will mature on March 22, 2028. Interest is

payable on the Series F Debentures on March 22 and September 22 of

each year commencing on September 22, 2023. The Series F Debentures

will be direct senior unsecured obligations of the Trust and will

rank equally and ratably with all other unsecured and

unsubordinated indebtedness of the Trust, except to the extent

prescribed by law. The closing of the Offering is expected to take

place on March 22, 2023.

The Series F Debentures are expected to be rated BBB with a

Stable Trend by DBRS Limited. The Trust intends to use the net

proceeds from the Offering to repay existing indebtedness and for

general trust purposes.

The Series F Debentures have not been and will not be qualified

for sale to the public under applicable securities laws in Canada

and, accordingly, any offer or sale of the Series F Debentures in

Canada will be made on a basis which is exempt from the prospectus

requirements of such securities laws. The Series F Debentures will

not be listed on any stock exchange and there will be no market for

such securities. The Series F Debentures have not been, and will

not be, registered under the United States Securities Act of 1933,

as amended, or any state securities laws and may not be offered or

sold in the United States and may not be offered or sold to other

persons who are not residents of a province of Canada.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

Series F Debentures in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

About Dream Industrial Real Estate Investment Trust

Dream Industrial REIT is an unincorporated, open-ended real

estate investment trust. As at December 31, 2022, Dream Industrial

REIT owns, manages and operates a portfolio of 257 industrial

assets totaling approximately 47.3

million square feet of gross leasable area in key markets across

Canada, Europe, and the U.S. Dream Industrial REIT’s goal is to

deliver strong total returns to its unitholders through secure cash

flows underpinned by its high-quality portfolio and an investment

grade balance sheet as well as driving growth in its net asset

value and cash flow per unit. For more information, please visit

www.dreamindustrialreit.ca.

Forward Looking Information

This press release may contain forward-looking information

within the meaning of applicable securities legislation.

Forward-looking information generally can be identified by the use

of forward-looking terminology such as “outlook”, “objective”,

“may”, “will”, “expect”, “intend”, “estimate”, “anticipate”,

“believe”, “should”, “plans”, or “continue”, or similar expressions

suggesting future outcomes or events. Some of the specific

forward-looking information in this press release may include,

among other things, statements regarding the intended use of

proceeds of the Offering, the expected rating of the Series F

Debentures, the anticipated closing date of the Offering and the

terms of the Series F Debentures. Forward-looking information is

based on a number of assumptions and is subject to a number of

risks and uncertainties, many of which are beyond the Trust’s

control, which could cause actual results to differ materially from

those that are disclosed in or implied by such forward-looking

information. These risks and uncertainties include, but are not

limited to, general and local economic and business conditions;

employment levels; mortgage and interest rates; regulations;

uncertainties around the timing and amount of future financings;

uncertainties surrounding the COVID-19 pandemic; geopolitical

events, including disputes between nations, war and international

sanctions; the financial condition of tenants; leasing risks,

including those associated with the ability to lease vacant space;

rental rates and the strength of rental rate growth on future

leasing; and interest and currency rate fluctuations. The Trust’s

objectives and forward-looking statements are based on certain

assumptions, including that the general economy remains stable,

interest rates remain stable, conditions within the real estate

market remain consistent, rising replacement costs in the Trust’s

operating markets remain steady, competition for acquisitions

remains consistent with the current climate and that the capital

markets continue to provide access to equity and/or debt. All

forward-looking information in this press release speaks as of the

date of this press release. The Trust does not undertake to update

any such forward-looking information whether as a result of new

information, future events or otherwise except as required by law.

Additional information about these assumptions and risks and

uncertainties is contained in the Trust’s filings with securities

regulators, including its latest annual information form and

MD&A. These filings are also available at the Trust’s website

at www.dreamindustrialreit.ca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230316005753/en/

Dream Industrial REIT

Brian Pauls Chief Executive Officer (416) 365-2365

bpauls@dream.ca

Lenis Quan Chief Financial Officer (416) 365-2353

lquan@dream.ca

Alexander Sannikov Chief Operating Officer (416) 365-4106

asannikov@dream.ca

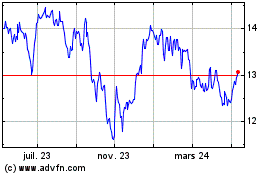

Dream Industrial Real Es... (TSX:DIR.UN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

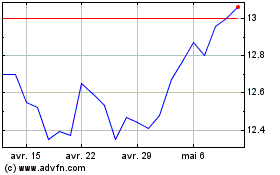

Dream Industrial Real Es... (TSX:DIR.UN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025