Dominion Lending Centres Inc. Receives Shareholder Approval for Acquisition of Preferred Shares and Related Transactions

04 Décembre 2024 - 12:14AM

Dominion Lending Centres Inc. (TSX: DLCG) ("DLCG" or the

"Corporation") is pleased to announce the following results from

its special meeting (the "Meeting") of holders (the "Shareholders")

of Class A common shares ("Common Shares") held earlier today:

- In respect of an

ordinary resolution (the "Acquisition Resolution"), as more

particularly set out in the management information circular dated

October 25, 2024 (the "Information Circular"), approving the

proposed acquisition (the "Proposed Acquisition") of all of the

issued and outstanding non voting Series 1 Class B preferred shares

of the Corporation (the "Series 1 Preferred Shares") from KayMaur

Holdings Ltd. ("KayMaur") (or, in substitution of KayMaur, one or

more companies controlled by Gary Mauris or Chris Kayat) and from

certain other holders of Series 1 Preferred Shares in exchange for,

in aggregate, 30,500,000 Common Shares and a cash payment of

$15,000,000, pursuant to a purchase agreement dated October 2,

2024, subject to and conditional on approval of the Stated Capital

Resolution (as defined below):

- 99.99% of the

votes cast at the Meeting were in favour of the Acquisition

Resolution;

- 99.99% of the

votes cast at the Meeting were in favour of the Acquisition

Resolution, after excluding votes attached to Common Shares that

are beneficially owned or over which control or direction is

exercised by Gary Mauris, Chris Kayat and/or their associates and

affiliates (each as defined in the TSX Company Manual), including

KayMaur; and

- 99.99% of the

votes cast at the Meeting were in favour of the Acquisition

Resolution, after excluding votes required to be excluded for

majority of the minority approval for the purposes of Multilateral

Instrument 61-101 – Protection of Minority Security Holders in

Special Transactions;

- 99.99% of the votes cast at the

Meeting were in favour of a special resolution, as more

particularly set out in the Information Circular, authorizing and

approving the addition to the stated capital account of the

Corporation maintained in respect of the Series 1 Preferred Shares

an aggregate amount of $15,000,000, without any payment being made,

to take effect prior to the implementation of the Proposed

Acquisition, subject to and conditional on approval of the

Acquisition Resolution; and

- 99.99% of the votes cast at the

Meeting were in favour of a special resolution, as more

particularly set out in the Information Circular, authorizing an

amendment to the Corporation's articles of amalgamation to cancel

the Class B preferred shares of the Corporation as a class and the

Series 1 Preferred Shares as a series of shares in the capital of

the Corporation authorized for issuance, subject to and conditional

on approval of the Acquisition Resolution and implementation of the

Proposed Acquisition.

As a result, all resolutions were passed by the

requisite majorities. Shareholders holding an aggregate of

39,179,225 Common Shares (being 81.24% of the total issued and

outstanding Common Shares) were represented either in person or by

proxy at the Meeting.

In the event that all necessary approvals are

received, the Corporation anticipates completing the transactions

on or about December 17, 2024.

About Dominion Lending Centres

Inc.

Dominion Lending Centres Inc. is Canada's

leading network of mortgage professionals. DLCG operates through

Dominion Lending Centres Inc. and its three main subsidiaries, MCC

Mortgage Centre Canada Inc., MA Mortgage Architects Inc. and Newton

Connectivity Systems Inc., and has operations across Canada. DLCG's

extensive network includes over 8,500 agents and over 500

locations. Headquartered in British Columbia, DLCG was founded in

2006 by Gary Mauris and Chris Kayat.

DLCG can be found on X (Twitter), Facebook and

Instagram and LinkedIn @DLCGmortgage and on the web at

www.dlcg.ca.

Contact information for the Corporation is as

follows:

|

Eddy CocciolloPresident647-403-7320eddy@dlc.ca |

James BellEVP, Corporate and Chief Legal

Officer403-560-0821jbell@dlcg.ca |

|

|

|

Forward Looking Statements

This news release contains "forward-looking

statements" and "forward-looking information" within the meaning of

Canadian securities laws, including statements relating to the

Proposed Acquisition, including DLCG's expectations regarding the

expected timing of closing of the Proposed Acquisition. All

information that is not clearly historical in nature may constitute

forward-looking statements. In some cases, forward-looking

statements may be identified by the use of terms such as

"forecast", "projected", "assumption" and other similar expressions

or future or conditional terms such as "anticipate", "believe",

"could", "estimate", "expect", "intend", "may", "plan", "predict",

"project", "will", "would", and "should".

Forward-looking statements contained in this

news release are based on certain factors and assumptions made by

management of DLCG based on their current expectations, estimates,

projections, assumptions and beliefs regarding their business and

DLCG does not provide any assurance that actual results will meet

management's expectations. While management considers these

assumptions to be reasonable based on information currently

available to them, they may prove to be incorrect. Such

forward-looking statements are not guarantees of future events or

performance and by their nature involve known and unknown risks,

uncertainties and other factors, including those risks described in

the Information Circular and DLCG's annual information form dated

March 19, 2024 (both of which are filed under DLCG's SEDAR+ profile

on www.sedarplus.ca), that may cause the actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Although DLCG has attempted to

identify important factors that could cause actual actions, events

or results to differ materially from those described in

forward-looking statements, other factors may cause actions, events

or results to be different than anticipated, estimated or intended.

There can be no assurance that such statements will prove to be

accurate as actual results and future events could vary or differ

materially from those anticipated in such forward-looking

statements. Accordingly, readers should not place undue reliance on

forward-looking information. DLCG does not undertake to update any

forward-looking information, whether as a result of new information

or future events or otherwise, except as may be required by

applicable securities laws.

NEITHER THE TSX EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY

OF THIS RELEASE.

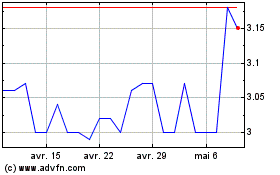

Dominion Lending Centres (TSX:DLCG)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Dominion Lending Centres (TSX:DLCG)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025