TERREBONNE, QC, June 15, 2011 /CNW/ -- FINANCIAL HIGHLIGHTS FOR THE

FIRST QUARTER ENDED APRIL 30, 2011 The results are disclosed in

accordance with the new International Financial Reporting Standards

("IFRS"). -- Revenues amounted to $13.2 million compared with $13.6

million for the same quarter of fiscal 2011. -- The Corporation

closed the quarter with a net income of $1.1 million or $0.03 per

share (basic and diluted), compared with a net income of $2.0

million or $0.06 per share (basic and diluted) in the same period

of fiscal 2011. -- As at April 30, 2011, ADF's posted a cash

surplus of more than $17 million over its total debt of,

representing a significant increase of 35% compared with January

31, 2011. -- Operating cash flows improved considerably, compared

with the quarter ended on April 30, 2010, reaching $5.0 million

during the first quarter of fiscal 2012. TERREBONNE, QC, June 15,

2011 /CNW Telbec/ - For the three-month period ended April 30,

2011, ADF GROUP INC. ("ADF" or the "Corporation") (TSX: DRX)

revenues were comparable to those for the same period of the

previous year, and even posted a slight increase notwithstanding

the increase in relative value of more than 5% of the Canadian

dollar against the U.S. dollar between the two reporting periods.

Revenues thus amounted to $13.2 million for the first quarter

of the current fiscal year, compared with $13.6 million for

the same quarter of last year. The gross margin as a percentage of

revenues stood at 24%, versus the high of 29% achieved in the first

quarter of the previous year. This change is primarily explained by

the fact that the supply of steel accounted for a larger proportion

of the revenue mix this year. However, it should be noted that the

gross margin achieved during the first quarter of the 2012 fiscal

year corresponds to the average margin posted by ADF over the last

eight quarters. Income before interest, income taxes, depreciation

and amortization (or EBITDA) amounted to $2.1 million,

compared with $3.2 million the previous year. Net income

totalled $1.1 million or $0.03 per share, compared with a net

income of $2.0 million or $0.06 per share in the same period

last year. Notwithstanding the reversal of provisions and a gain on

disposal of property, plant and equipment recognized in the first

quarter of fiscal 2011, the results for the first quarter ended

April 30, 2011 would have been similar to those for the

corresponding period a year ago. In addition, a lesser exchange

gain than in the previous year and a slightly higher tax rate, have

also reduced the first quarter's net income. ADF closed the first

quarter of the 2012 fiscal year with working capital of $38.4

million, of which $29.4 million in short-term available liquidities

(cash, cash equivalents and short-term investments), provided

notably by the cash flows from operating activities of $5.0

million. Consequently as at April 30, 2011, ADF Group's short-term

available liquidities exceeded its total interest-bearing debt by

$17.3 million. Jean Paschini, Chairman of the Board and Chief

Executive Officer indicated that "these results reflect the added

value of our contracts in progress, our rigorous operating

practices and the positive impact of our recent investments on the

overall efficiency of our fabrication activities. They also reflect

efficient cost control and a profit margin that remains above the

industry average." Implementation of a Dividend Policy As announced

in April 2011, the Corporation's Board of Directors approved the

payment of a semi-annual dividend policy. Consequently, on May 16,

2011, ADF Group paid a first semi-annual dividend of $0.01 per

share to shareholders of record as at April 29, 2011. Order Backlog

As at April 30, 2011, the Corporation's order backlog stood at

$62 million, extending over an execution period of

12 months. However, the order backlog at that date does not

reflect all the revenues likely to be recognized in upcoming

quarters as it only includes a portion of the contractual changes

requested by clients over the past months in connection with its

current mandates. Outlook In regard to business development, the

Corporation expects Western Canada to offer the greatest

opportunities within the short term, considering the increase in

bidding activity it is currently witnessing in this region. It is

therefore carrying on its plans to establish its local presence

through a joint venture with a Manitoba-based partner. The goal of

the new entity will be to build and operate an ultramodern

fabrication plant that will enable the Corporation to serve all of

Western Canada, in particular the energy and potash sectors and the

public infrastructures segment, where significant investments are

expected in the coming years. Furthermore, it will provide ADF with

greater access to the large American Midwest market. Over the

longer term, the regions in the Eastern and Midwest U.S., and

especially New York City, remain natural and high-potential markets

for ADF Group, where it is strongly positioned and enjoys an

excellent reputation. Based on its current order backlog and

considering its development targets as well as a certain stability

of the Canadian dollar, management expects ADF Group's revenues

within the next few quarters to be comparable to, or up slightly

over previous quarters. "Today, with an enhanced fabrication

capacity, very healthy financial position and development projects

well on their way, ADF Group is embarking on a new profitable

growth phase, having all the resources in hand to achieve a solid

performance once the economy is back on track" concluded Mr. Jean

Paschini. Annual Meeting of Shareholders ADF Group's Annual Meeting

of Shareholders will take place this morning, June 15, 2011 at

11:00 am at the Omni Mount-Royal Hotel in Montreal. About ADF Group

Inc. ADF Group Inc. is a North American leader in the design and

engineering of connections, fabrication and installation of complex

steel structures, heavy steel built-ups, as well as in

miscellaneous and architectural metals for the non-residential

construction industry. ADF is one of the few players in the

industry capable of handling highly technically complex mega

projects on fast-track schedules in the commercial, institutional,

industrial and public sectors. Forward-Looking Information This

press release contains forward-looking statements reflecting ADF

objectives and expectations. These statements are identified by the

use of verbs such as "expect" as well as by the use of future or

conditional tenses. By their very nature these types of statements

involve risks and uncertainty. Consequently, reality may differ

from ADF's expectations. Transition to International Financial

Reporting Standards (IFRS) All financial information, including

comparative figures pertaining to ADF Group's 2011 results, has

been prepared in accordance with International Financial Reporting

Standards (IFRS). In previous periods, the Corporation prepared its

consolidated financial statements and interim financial statements

in accordance with Canadian generally accepted accounting

principles ("Previous GAAP"), in effect prior to February 1, 2011.

Comparative figures presented pertaining to ADF's results have been

restated to be in accordance with IFRS. A reconciliation of net

income, gross margin and EBITDA reported under the previous GAAP

and the IFRS is provided in the table below: 2011 Fiscal Year

Annual Q4 Q3 Q2 Q1 12 months 3 months 3 months 3 months 3 months

ended ended ended ended ended 2011.01.31 2011.01.31 2010.10.31

2010.07.31 2010.04.30 (In thousands of $) $ $ $ $ $ Net Income

Previous GAAP 3,743 1,037 630 878 1,198 Impact of IFRS standards,

after income taxes - Exchange differences on translation of the

foreign operations 1,623 639 308 (70) 746 - Share-based 4 (28) 31

44 compensation 51 - Amortization of property, plant and equipment

and intangible assets (26) (6) (7) (6) (7) 1,648 637 273 (45) 783

IFRS 5,391 1,674 903 833 1,981 Gross Margin Previous GAAP 17,072

5,146 3,495 3,850 4,581 Impact of IFRS standards : -

Reclassification of amortization of property, plant and equipment

and intangible assets (2,936) (735) (739) (782) (680) IFRS 14,136

4,411 2,756 3,068 3,901 Gross Margin (as a % of revenues) Previous

GAAP 31% 34% 26% 30% 34% IFRS 26% 29% 20% 24% 29% EBITDA Previous

GAAP 10,871 3,122 2,069 2,525 3,155 Impact of IFRS standards : -

Share-based 4 (28) 31 44 compensation 51 IFRS 10,922 3,126 2,041

2,556 3,199 Non-IFRS Measures EBITDA is not a performance measure

recognized by IFRS standards, and is not likely to be comparable to

similar measures presented by other issuers. Management, as well as

investors, consider this to be useful information to assist them in

assessing the Corporation's profitability and ability to generate

funds to finance its operations. All amounts are in Canadian

dollars, unless otherwise indicated.

____________________________________________________________________

| CONFERENCE CALL WITH INVESTORS | | | |To discuss ADF Group's

results for the first quarter ended April 30,| | 2011, | |

Wednesday, June 15, 2011 at 09:30 a.m. (Montreal time) | | | |To

participate in the conference call, please dial 1-800-731-5319 a |

| few minutes before the start of the call. | | | | For those

unable to participate, a taped rebroadcast will be | | available

from June 15, 2011 at 12:30 p.m. | |until midnight June 21, 2011,

by dialing 1-877-289-8525; access code| | 4445591#. | | | | The

conference call (audio) will also be available at | |

www.adfgroup.com | | | | Members of the media are invited to listen

in. |

|____________________________________________________________________|

CONSOLIDATED STATEMENTS OF INCOME (Unaudited) 3-Month Periods Ended

April 30, 2011 2010 (In thousands of $, except per-share amounts) $

$ Revenues 13,229 13,641 Cost of goods sold 10,123 9,740 Gross

margin 3,106 3,901 Selling and administrative expenses 1,892 1,478

Financial revenues (95) (22) Finance charges 60 72 Foreign exchange

gain (755) (1,167) 1,102 361 Income before income tax expense 2,004

3,540 Income tax expense 923 1,559 Net income for the period 1,081

1,981 Earnings per share Basic per share 0.03 0.06 Diluted per

share 0.03 0.06 Average number of outstanding shares (in thousands)

32,775 34,494 Average number of outstanding diluted shares (in

33,390 35,341 thousands) CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME (Unaudited) 3-Month Periods Ended April 30, 2011 2010 (In

thousands of $) $ $ Net income for the period 1,081 1,981 Other

comprehensive income Exchange differences on translation of foreign

(749) operations (1,495) Comprehensive income for the period (414)

1,232 CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

(Unaudited) Capital Contributed Accumulated Retained Total stock

surplus other income comprehensive income (In thousands $ $ $ $ $

of $) Balance, 75,436 3,659 144 13,348 92,587 February 1, 2010 Net

income for the period — — — 1,981 1,981 Other — — (749) — (749)

comprehensive income for the period Comprehensive — — (749) 1,981

1,232 income for the period Share-base — 56 — — 56 compensation

Options 255 (93) — — 162 exercised Subordinate (182) 32 — — (150)

voting share redemption Balance, April 75,509 3,654 (605) 15,329

93,887 30, 2010 Capital Contributed Accumulated Retained Total

stock surplus other income comprehensive income (In thousands $ $ $

$ $ of $) Balance, 70,032 5,740 (1,477) 18,739 93,034 February 1,

2011 Net income for the period — — — 1,081 1,081 Other — — (1,495)

— (1,495) comprehensive income for the period Comprehensive — —

(1,495) 1,081 (414) income for the period Share-based — 59 — — 59

compensation Dividends — — — (328) (328) Balance, April 70,032

5,799 (2,972) 19,492 92,351 30, 2011 CONSOLIDATED STATEMENTS OF

FINANCIAL POSITION (Unaudited) As at April 30, 2011 January 31,

2011 February 1, 2010 (In thousands of $) $ $ $ ASSETS Current

assets Cash and cash 19,394 18,677 5,770 equivalents Short-term

5,547 2,787 11,652 investments Accounts receivable 21,725 22,215

13,421 Income tax assets 174 — 442 Holdbacks on 1,128 167 2,692

contracts Work in progress 539 403 1,574 Inventories 3,923 3,865

3,093 Prepaid expenses and 711 985 2,299 other current assets

Derivative financial 1,088 741 832 instruments Total current assets

54,229 49,840 41,775 Non-current assets Holdbacks on 2,391 3,562

1,297 contracts Property, plant and 46,103 46,871 47,438 equipment

Intangible assets 2,600 2,601 2,590 Other non-current 2,850 2,852

2,312 assets Deferred income tax 5,661 6,960 11,569 assets Total

assets 113,834 112,686 106,981 LIABILITIES Current liabilities

Accounts payable and 5,336 5,365 5,649 other current liabilities

Income tax — 159 — liabilities Deferred revenues 7,989 4,994 1,274

Derivative financial 166 45 — instruments Current portion of 2,379

2,513 2,422 long-term debt Total current 15,870 13,076 9,345

liabilities Non-current liabilities Long-term debt 5,247 6,151

4,645 Deferred income tax 366 425 404 liabilities Total liabilities

21,483 19,652 14,394 SHAREHOLDERS' EQUITY Retained income 19,492

18,739 13,348 Accumulated other (2,972) (1,477) 144 comprehensive

income 16,520 17,262 13,492 Capital stock 70,032 70,032 75,436

Contributed surplus 5,799 5,740 3,659 Total shareholders' 92,351

93,034 92,587 equity Total liabilities and 113,834 112,686 106,981

shareholders' equity CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) 3-Month Periods Ended 2011 2010 April 30, (In thousands

of $) $ $ OPERATING ACTIVITIES Net income 1,081 1,981 Non-cash

items: Amortization of 792 692 property, plant and equipment

Amortization of 89 84 intangible assets Gain on disposal — (52) of

property, plant and equipment Unrealized gain on (226) (379)

derivative financial instruments Non-cash exchange (244) (496) gain

Share-based 59 56 compensation Income tax expense 923 1,559

Financial revenues (95) (22) Finance charges 60 72 Net income

adjusted 2,439 3,495 for non-cash items Changes in non-cash 2,961

(3,101) working capital items (1) Income tax expense (368) (191)

paid Cash flows from (used 5,032 203 in) operating activities

INVESTING ACTIVITIES Acquisition of (2,905) (131) short-term

investments Acquisition of (29) (1,649) property, plant and

equipment Acquisition of (88) (120) intangible assets Reduction in

other 1 3 non-current assets Interest received 77 94 Cash flows

from (used (2,944) (1,803) in) investing activities FINANCING

ACTIVITIES Issuance of long-term — 4,370 debt Repayment of

long-term (600) (411) debt Issuance of — 162 subordinate voting

shares Redemption of — (150) subordinate voting shares Interest

paid on the (9) — interest rate swap Interest paid (53) (61) Cash

flows from (used (662) 3,910 in) financing activities Impact of

fluctuations (709) (178) in foreign exchange rate on cash Net

increase in cash 717 2,132 and cash equivalents Cash and cash

18,677 5,770 equivalents, beginning of period Cash and cash

equivalents, end of period (2) 19,394 7,902 1. The following table

sets out in detail the components of the "Changes in non-cash

working capital items": 3-Month Periods Ended April 30, 2011 2010

(In thousands of $) $ $ Accounts receivable (749) (5,051) Holdbacks

on contracts 5 1,473 Current tax (12) 415 Work in progress (166)

(212) Inventories (58) (395) Prepaid expenses and other current

assets 273 (586) Accounts payable and other current liabilities 233

754 Deferred revenues 3,435 501 Changes in non-cash working capital

items 2,961 (3,101) Financing and investing activities without

impact on cash were nil as at April 30, 2011, and $139,000 as at

April 30, 2010, relating to the disposal of property, plant and

equipment given in exchange for new ones. 2. For the purpose of the

Consolidated Statements of Cash Flows, cash and cash equivalents

are disclosed as follows: April 30, 2011 January 31, 2011 February

1, 2010 (In thousands of $) $ $ $ Cash 19,394 15,918 5,770 Cash

equivalents - — 2,759 — term deposits 19,394 18,677 5,770 Segmented

Information The Corporation operates in the non-residential

construction sector, primarily in the United States and Canada. Its

operations include the connections design and engineering,

fabrication and installation of complex steel structures, heavy

steel built-ups, as well as miscellaneous and architectural

metalwork. 3-Month Periods 2011 2010 Ended April 30, (In thousands

of $ $ CA$) Revenues Canada 225 440 United States 13,004 13,201

13,229 13,641 As at April 30, 2011 January 31, 2011 February 1,

2010 (In thousands of $ $ $ CA$) Property, Plant and Equipment

Canada 46,010 46,767 47,293 United States 93 104 145 46,103 46,871

47,438 All intangible assets and investment tax credits included

under "Other non-current assets" at February 1, 2010, January 31,

2011 and April 30, 2011, originated from Canada. During the

three-month period ended April 30, 2011, one client accounted for

94% of the Corporation's revenues (one client accounted for 90% of

the revenues during the three-month period ended April 30, 2010),

and therefore accounted for more than 10% of revenues.

To view this news release in HTML

formatting, please use the following URL:

http://www.cnw.ca/en/releases/archive/June2011/15/c6051.html table

border="0" valign="top" tr td align="left" valign="top"

Source: /td td bADF Group Inc./b /td /tr tr td /td td

/td /tr tr td align="left" valign="top" Contact: br/

/td td bJean Paschini/b, Chairman of the Board of Directors and

Chief Executive Officerbr/ bJea/bbn-François Boursier/b, CA, Chief

Financial Officer /td /tr tr td /td td /td /tr tr td

align="left" valign="top" Telephone: /td td (450) 965-1911 /

1 (800) 263-7560 /td /tr tr td /td td /td /tr tr td

align="left" valign="top" Web Site: /td td a cr="true"

href="http://www.adfgroup.com"www.adfgroup.com/a /td /tr tr td

/td td /td /tr tr td align="left" valign="top"

Medias: br/ br/ /td td Caroline Couillardbr/ Morin Public

Relationsbr/ (514) 289-8688, ext. 233 /td /tr /table

Copyright

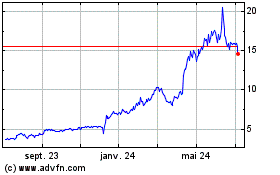

ADF (TSX:DRX)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

ADF (TSX:DRX)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024