ADF Group Inc announces the renewal of a normal course issuer bid on the Corporation subordinate voting shares

02 Octobre 2011 - 4:33PM

PR Newswire (Canada)

TERREBONNE, QC, Oct. 3, 2011 /CNW Telbec/ - ADF Group Inc ("ADF" or

the "Corporation") announces that it has obtained the approval of

its Board of Directors and the Toronto Stock Exchange to renew its

normal course issuer bid. Thus, from October 6, 2011 to October 5,

2012, ADF will be authorized to repurchase for cancellation, up to

1,773,241 subordinate voting shares. These shares will be

repurchased from time to time when deemed appropriate by the

Corporation, considering current economic conditions, its

liquidities and the advancement of its development project in

Western Canada. These 1,773,241 shares represent approximately 10%

of the subordinate voting shares held by the public. At the close

of business on September 20, 2011, the number of subordinate voting

shares outstanding totalled 18,448,805, of which 17,732,413 shares

or 96.1% thereof were held by the public. ADF's management and

Board of Directors believe that the price of the subordinate voting

shares sometimes does not reflect the intrinsic value of the

Corporation and that, consequently, this repurchase of the

subordinate voting shares would be a judicious use of ADF's funds.

The repurchase of the subordinate voting shares will be carried out

by ADF on the open market through the Toronto Stock Exchange in

compliance with its requirements, which currently limit the

repurchase to 4,845 shares per day, or 25% of the number of

subordinate voting shares traded daily, on average, over the last

six months, with the exception of block trades. The price that ADF

will pay for the subordinate voting shares that it will acquire

will be the market price of those shares at their acquisition date.

All the shares repurchased under the normal course issuer bid will

be cancelled. The repurchase of shares will be made at ADF's

discretion. ADF, over the last twelve months, has repurchased no

subordinate voting share. As a reminder, the Corporation had under

two previous normal course issuer bids which ended on April 16,

2010 and April 18, 2011, repurchased 1,850,000 and 1,940,000

subordinate voting shares respectively, for cancellation. These

repurchases were carried out through the Toronto Stock Exchange at

a weighted average price of $2.45 and $1.93 per share. To the

knowledge of ADF, no director or executive officer of the

Corporation has the intent to sell shares for the duration of the

offer. About ADF Group Inc. ADF Group Inc. is a North American

leader in the design and engineering of connections, fabrication

and installation of complex steel structures, heavy steel

built-ups, as well as miscellaneous and architectural metals for

the non-residential construction industry. ADF is one of the few

players in the industry capable of handling highly technically

complex mega projects on fast-track schedules in the commercial,

institutional, industrial and public sectors. Forward-Looking

Information This press release contains forward-looking statements

reflecting ADF objectives and expectations. These statements are

identified by the use of verbs such as "expect" as well as by the

use of future or conditional tenses. By their very nature these

types of statements involve risks and uncertainty. Consequently,

reality may differ from ADF's expectations. ADF GROUP INC. CONTACT:

Source: ADF Group Inc.Contact: Jean-François Boursier, CA, Chief

Financial OfficerTelephone: (450) 965-1911 / 1 (800) 263-7560Web

Site: www.adfgroup.com

Copyright

ADF (TSX:DRX)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

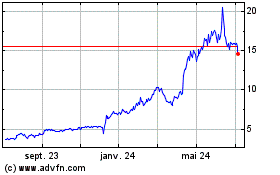

ADF (TSX:DRX)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024