FINANCIAL HIGHLIGHTS: All results are disclosed in accordance with

International Financial Reporting Standards ("IFRS"). - Revenues

amounted to $11.2 million, an 18% decrease compared with those for

the same quarter of the previous fiscal year. - ADF Group closed

the third quarter with net earnings of $0.4 million or $0.01 per

share (basic and diluted). - Because of its profitability, the

Corporation recorded an increase in the surplus of available

short-term liquidities over total debt, which now stands at $18.6

million. TERREBONNE, QC, Dec. 8, 2011 /CNW Telbec/ - ADF GROUP

INC. ("ADF" or the "Corporation") closed the third quarter of the

2012 fiscal year with revenues of $11.2 million, compared with

$13.7 million for the same quarter last year. Besides the weak

economy, this decline is attributable for the most part to a

different mix of revenues billed, notably in terms of fabrication

hours and the supply of raw material and other. The gross profit

margin as a percentage of revenues declined from 20% in the third

quarter of fiscal 2011 to 15% in the third quarter of fiscal 2012.

This decline is explained by the start of fabrication on new

lower-margin contracts consistent with its action plan implemented

at the beginning of the current fiscal year, the short-term

objective of which being to increase the order backlog. To a

certain extent, the gross margin was also affected by the

recognition of a portion of the costs associated with contractual

changes and adjustments in connection with mandates in progress,

whereas the related revenues should be recognized at a later date.

The revenues and profits derives from these contractual changes

should be recognized in the coming months. For the third quarter

ended October 31, 2011, the Corporation posted net earnings of $0.4

million or $0.01 per share (basic and diluted), compared with $0.9

million or $0.03 per share (basic and diluted) for the third

quarter of the previous year. For the nine-month period ended

October 31, 2011, ADF Group recorded year-to-date revenues of $37.6

million, compared with $40.3 million for the same period of fiscal

2011. Additionally to the reasons previously outlined, this decline

is also attributable to the 5% increase in the Canadian dollar in

relation to the U.S. dollars between the two reporting periods.

However, the gross margin only slightly decreased, from 24% of

revenues to 21% of revenues. For the nine-month period, net

earnings totalled $2.3 million or $0.07 per share (basic and

diluted), compared with $3.7 million or $0.11 per share (basic

and diluted) for the same period last year. In addition to the

factors listed above, this decline is partly attributable to the

non-recurrence of certain favourable items recognized a year ago,

and the realization of lower foreign exchange gains than last year.

The Corporation's operating activities provided cash flows of $7.9

million during the first nine months of the current fiscal year,

compared with $6.6 million for the same period last year. Cash

flows from operating activities contributed to further strengthen

the financial health of the Corporation which, as of October 31,

2011, had working capital of $43.2 million, including short-term

available liquidities (cash, cash equivalents and short-term

investments) of $25.4 million. Therefore, available liquidities

exceeded ADF Group's total debt by $18.6 million. Major Events

Since October 31, 2011 Over the last few weeks, ADF Group and the

various parties involved in the World Trade Center ("WTC")

projects, in New York, U.S.A., have reached an agreement to

expedite the contractual changes review process and the collection

of debts. The Corporation had previously availed itself of measures

available under the different contracts. In addition, the

Corporation is announcing the postponement of its development

project in Western Canada after ADF's minimum requirements were

refused by the both provincial and municipal bodies. It must be

noted that ADF Group Inc. was actively negotiating for the past 18

months with the Province of Manitoba and the City of Winnipeg to

purchase an industrial lot in order to build a new fabrication

plant of 9,290 m(2 )(100,000 ft(2)). This acquisition was

conditional to the conclusion of a due diligence, including notably

an environmental remediation, satisfactory to ADF Group Inc. and

its partner. Consistent with its responsible management, the

Corporation decided to end these negotiations and analyze other

options to increase its coverage of the Western Canada markets.

Outlook As at October 31, 2011, ADF Group's order backlog

stood at $49 million, the execution schedule of which should

extend until the third quarter of the Corporation's 2013 fiscal

year. "In response to a particularly challenging economic

environment in our targeted markets, especially in the United

States, we are maintaining our focus on preserving the

Corporation's operating profitability and the soundness of its

balance sheet. Our large-scale contracts currently in progress in

connection with the reconstruction of the WTC site in New York City

(U.S.A.) will remain a source of profitability for ADF Group in the

coming months," indicated Jean Paschini, Chairman of the Board and

Chief Executive Officer. In the short-term, the Corporation is

especially banking on the Canadian market, where the economic

outlook is brighter, to build its order backlog, About ADF Group

Inc. ADF Group Inc. is a North American leader in the design and

engineering of connections, fabrication and installation of complex

steel structures, heavy steel built-ups, as well as miscellaneous

and architectural metals for the non-residential construction

industry. ADF is one of the few players in the industry capable of

handling highly technically complex mega projects on fast-track

schedules in the commercial, institutional, industrial and public

sectors. Forward-Looking Information This press release contains

forward-looking statements reflecting ADF objectives and

expectations. These statements are identified by the use of verbs

such as "expect" as well as by the use of future or conditional

tenses. By their very nature these types of statements involve

risks and uncertainty. Consequently, reality may differ from ADF's

expectations. Transition to International Financial Reporting

Standards (IFRS) All financial information, including comparative

figures pertaining to ADF Group's 2011 results, has been prepared

in accordance with IFRS. In previous periods, the Corporation

prepared its consolidated financial statements and interim

financial statements in accordance with Canadian generally accepted

accounting principles ("Previous GAAP"), in effect prior to

February 1, 2011. Comparative figures presented pertaining to ADF's

results have been restated to be in accordance with IFRS. A

reconciliation of net income, gross margin and EBITDA reported

under the previous GAAP and the IFRS is provided in the table

below: 2011 FiscalYear Annual Q4 Q3 Q2 Q1 12-month period 3-month

periods ended ended 01.31.2011 01.31.2011 10.31.2010 07.31.2010

04.30.2010 (In thousands of $) $ $ $ $ $ Net Income Previous GAAP

3,743 1,037 630 878 1,198 Impact of IFRS standards, after income

taxes: - Exchange 1,623 639 308 (70) 746 differences on translation

of foreign operations - Share-based 51 4 (28) 31 44 compensation -

Amortization of property, plant and equipment and intangible assets

(26) (6) (7) (6) (7) 1,648 637 273 (45) 783 IFRS 5,391 1,674 903

833 1,981 2011 FiscalYear Annual Q4 Q3 Q2 Q1 12-month

3-monthperiods ended periodended 01.31.2011 01.31.2011 10.31.2010

07.31.2010 04.30.2010 (In thousands of $) $ $ $ $ $ Gross Margin

Previous GAAP 17,072 5,146 3,495 3,850 4,581 Impact of IFRS

standards: - Reclassification of amortization of property, plant

and equipment and intangible assets (2,936) (735) (739) (782) (680)

IFRS 14,136 4,411 2,756 3,068 3,901 Gross Margin (as a % of

revenues) Previous GAAP 31% 34% 26% 30% 34% IFRS 26% 29% 20% 24%

29% EBITDA1 Previous GAAP 10,871 3,122 2,069 2,525 3,155 Impact of

IFRS standards: - Share-based compensation 51 4 (28) 31 44 IFRS

10,922 3,126 2,041 2,556 3,199 Non-IFRS Measures EBITDA is not a

performance measure recognized by IFRS standards, and is not likely

to be comparable to similar measures presented by other issuers.

Management, as well as investors, consider this to be useful

information to assist them in assessing the Corporation's

profitability and ability to generate funds to finance its

operations. All amounts are in Canadian dollars, unless otherwise

indicated.

___________________________________________________________________

| CONFERENCE CALL WITH INVESTORS | | | | TO DISCUSS ADF GROUP'S

RESULTS | | FOR THE THIRD QUARTER ENDED OCTOBER 31, 2011 | | | |

Thursday December 8, 2011 at 2:00 p.m. (Montreal Time) | | | |To

participate in the conference call, please dial 1-800-732-1073 a| |

few minutes before the start of the call. | | | | For those unable

to participate, a taped rebroadcast will be | | available from

December 8, 2011 at 5:00 p.m. | |until midnight December 15, 2011,

by dialing 1-877-289-8525; access| | code 4491508#. | | | | The

conference call (audio) will also be available at | |

www.adfgroup.com | | | | Members of the media are invited to listen

in. |

|___________________________________________________________________|

CONSOLIDATED STATEMENTS OF INCOME (Unaudited) 3Months 9Months

Periods Ended October 31, 2011 2010 2011 2010 (In thousands of CA$,

except for per-share amounts) $ $ $ $ Revenues 11,208 13,687 37,555

40,295 Cost of goods sold 9,480 10,931 29,598 30,570 Gross margin

1,728 2,756 7,957 9,725 Selling and administrative expenses 1,567

1,565 4,906 4,463 Financial revenues (36) (79) (244) (261) Finance

charges 60 103 179 299 Foreign exchange gain (330) (822) (1,068)

(1,817) 1,261 767 3,773 2,684 Income before income tax expense 467

1,989 4,184 7,041 Income tax expense 64 1,086 1,926 3,324 Net

income for the period 403 903 2,258 3,717 Earnings per share Basic

and diluted per share 0,01 0,03 0,07 0,11 Average number of

outstanding shares (in thousands) 32,792 32,997 32,785 33,936

Average number of outstanding diluted shares (in thousands) 33,259

33,598 33,347 34,631 CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME (Unaudited) 3 Months 9Months Periods Ended October 31, 2011

2010 2011 2010 (In thousands of CA$) $ $ $ $ Net income for the

period 403 903 2,258 3,717 Other comprehensive income Exchange

differences on translation of foreign operations, net of hedging

activities and related income taxes of $31 1,106 (310) (160) (983)

Comprehensive income for theperiod 1,509 593 2,098 2,734

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

(Unaudited) Accumulated other Capital Contributed comprehensive

Retained stock surplus income income Total (In thousands of CA$) $

$ $ $ $ Balance, February 1, 2010 75,436 3,659 144 13,348 92,587

Net income for the period ― ― ― 3,717 3,717 Other comprehensive

income for the period ― ― (983) ― (983) Comprehensive income for

the period ― ― (983) 3,717 2,734 Share-base compensation ― 172 ― ―

172 Options exercised 260 (92) ― ― 168 Subordinate voting share

redemption (5,681) 1,945 ― ― (3,736) Balance, October 31, 2010

70,015 5,684 (839) 17,065 91,925 Accumulated other Capital

Contributed comprehensive Retained stock surplus income income

Total (In thousands of CA$) $ $ $ $ $ Balance, February 1,2011

70,032 5,740 (1,477) 18,739 93,034 Net income for the period ― ― ―

2,258 2,258 Other comprehensive income for the period ― ― (160) ―

(160) Comprehensive income for the period ― ― (160) 2,258 2,098

Share-base compensation ― 92 ― ― 92 Options exercised 20 (7) ― ― 13

Dividends ― ― ― (656) (656) Balance, October 31, 2011 70,052 5,825

(1,637) 20,341 94,581 CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Unaudited) ASAT October 31,2011 January 31, 2011 (In thousands of

CA$) $ $ ASSETS Current assets Cash and cash equivalents 19,832

18,677 Short-term investments 5,558 2,787 Accounts receivable

21,885 22,215 Holdbacks on contracts 4,946 167 Work in progress

1,241 403 Inventories 3,668 3,865 Prepaid expenses and other

current assets 1,313 985 Derivative financial instruments 47 741

Total current assets 58,490 49,840 Non-current assets Holdbacks on

contracts ― 3,562 Property, plant and equipment 45,774 46,871

Intangible assets 2,581 2,601 Other non-current assets 2,866 2,852

Deferred income tax assets 4,790 6,960 Total assets 114,501 112,686

LIABILITIES Current liabilities Accounts payable and other current

liabilities 8,051 5,365 Income tax liabilities 98 159 Deferred

revenues 4,582 4,994 Derivative financial instruments 98 45 Current

portion of long-term debt 2,511 2,513 Total current liabilities

15,340 13,076 Non-current liabilities Long-term debt 4,294 6,151

Deferred income tax liabilities 286 425 Total liabilities 19,920

19,652 SHAREHOLDERS'EQUITY Retained income 20,341 18,739

Accumulated other comprehensive income (1,637) (1,477) 18,704

17,262 Capital stock 70,052 70,032 Contributed surplus 5,825 5,740

Total shareholders' equity 94,581 93,034 Total liabilities and

shareholders' equity 114,501 112,686 CONSOLIDATED STATEMENTS OF

CASH FLOWS (Unaudited) 3Months 9Months Periods Ended October 31,

2011 2010 2011 2010 (In thousands of CA$) $ $ $ $ OPERATING

ACTIVITIES Net income 403 903 2,258 3,717 Non-cash items:

Amortization of property, plant and equipment 758 764 2,312 2,283

Amortization of intangible assets 90 86 268 251 Gain (loss) on

disposal of property, plant and equipment 10 ― 10 (52) Unrealized

gain (loss) on derivative financial instruments 116 (127) 747 195

Non-cash exchange loss (gain) 882 (57) 482 (415) Share-based

compensation 21 59 92 172 Income tax expense 64 1,086 1,926 3,324

Financial revenues (36) (79) (244) (261) Finance charges 60 103 179

299 Net income adjusted for non-cash items 2,368 2,738 8,030 9,513

Changes in non-cash working capital items 1 (3,569) 4,092 62

(2,483) Income tax expense received (paid) ― (202) (174) (393) Cash

flows from (used in) operating activities (1,201) 6,628 7,918 6,637

INVESTING ACTIVITIES Disposal (acquisition) of short-term

investments 22 (50) (2,906) 3,884 Acquisition of property, plant

and equipment (495) (111) (1,133) (2,264) Acquisition of intangible

assets (85) (60) (248) (260) Reduction in other non-current assets

(16) (10) (15) (6) Interest received 22 66 232 224 Cash flows from

(used in) investing activities (552) (165) (4,070) 1,578 FINANCING

ACTIVITIES Issuance of long-term debt ― ― ― 4,370 Repayment of

long-term debt (610) (625) (1,829) (1,692) Issuance of subordinate

voting shares ― 4 13 168 Redemption of subordinate voting shares ―

(950) ― (3,736) Dividends paid (328) ― (656) ― Interest paid on the

interest rate swap (9) (24) (26) (24) Interest paid (49) (74) (151)

(195) Cash flows from (used in) financing activities (996) (1,669)

(2,649) (1,109) Impact of fluctuations in foreign exchange rate on

cash 378 (42) (44) (164) Net (decrease) increase in cash and cash

equivalents (2,371) 4,752 1,155 6,942 Cash and cash equivalents,

beginning of period 22,203 7,960 18,677 5,770 Cash and cash

equivalents, end of period 19,832 12,712 19,832 12,712 1. The

following table sets out in detail the components of the "Changes

in non-cash working capital items": 3Months 9Months Periods ended

October 31, 2011 2010 2011 2010 (In thousands of CA$) $ $ $ $

Accounts receivable (7,822) 1,373 (469) (9,725) Holdbacks on

contracts (384) (889) (1,415) 285 Income tax (130) 90 (2) 424 Work

in progress 195 417 (881) 1,092 Inventories 110 105 197 (481)

Prepaid expenses and other current assets (15) (655) (331) (1,130)

Accounts payable and other current liabilities 1,917 (962) 3,184

890 Deferred revenues 2,560 4,613 (221) 6,162 Changes in non-cash

working capital items (3,569) 4,092 62 (2,483) Financing and

investing activities without impact on cash were as follows:

3Months 9Months Periods ended October 31, 2011 2010 2011 2010 (In

thousands of CA$) $ $ $ $ Disposal of property, plant and equipment

in exchange for new ones 39 ― 39 139 Capital-lease 37 ― 37 ―

Changes in non-cash working capital items 76 ― 76 139 For the

purpose of the Consolidated Statements of Cash Flows, cash and cash

equivalents are disclosed as follows: As at October31, 2011 January

31, 2011 (In thousands of CA$) $ $ Cash 19,832 15,918 Cash

equivalents - term deposits ― 2,759 19,832 18,677 Segmented

Information The Corporation operates in the non-residential

construction sector, primarily in the United States and Canada. Its

operations include the connections design and engineering,

fabrication and installation of complex steel structures, heavy

steel built-ups, as well as miscellaneous and architectural

metalwork. 3Months 9Months Periods ended October 31, 2011 2010 2011

2010 (In thousands of CA$) $ $ $ $ Revenues Canada 2,360 4 2,835

567 United States 8,848 13,683 34,720 39,728 11,208 13,687 37,555

40,295 As at October31, 2011 January 31, 2011 (In thousands of CA$)

$ $ Property, Plantand Equipment Canada 45,092 46,767 United States

682 104 45,774 46,871 All intangible assets and investment tax

credits included under "Other non-current assets" at, January 31,

2011 and October 31, 2011, originated from Canada. During the

nine-month period ended October 31, 2011, one client accounted for

89% of the Corporation's revenues (one client accounted for 89% of

the revenues during the nine-month period ended October 31, 2010),

and therefore accounted for more than 10% of revenues.

ADF GROUP INC. CONTACT: Source: ADF Group

Inc.Contact: Jean Paschini, Chairman of the Board of Directors

andChief Executive OfficerJean-François Boursier, CA, Chief

Financial OfficerTelephone: (450) 965-1911 / 1 (800) 263-7560Web

Site: www.adfgroup.com

Copyright

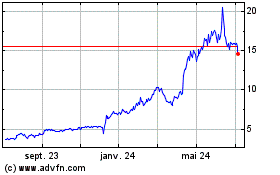

ADF (TSX:DRX)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

ADF (TSX:DRX)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024