TERREBONNE, QC, April 12, 2012 /CNW Telbec/ - ADF Group Inc. ("ADF"

or the "Corporation") recorded revenues of $48.4 million for the

2012 fiscal year compared with $55.3 million the previous fiscal

year. This decrease reflects the economic conditions prevailing in

the Corporation's markets. In addition, during the fourth quarter

ended January 31, 2012, the Corporation recorded a backcharge from

its client relating to a project at the World Trade Center in New

York. U.S.A., which reduced the revenues previously recognized by

about $3.5 million, thereby reducing the gross margin by the same

amount. The gross margin in dollar value declined during the 2012

fiscal year compared with the 2011 fiscal year, which is in line

with the revenue decrease. As a percentage of revenues, the gross

margin decreased from 25.6% during the fiscal year ended January

31, 2011 to 19.2% in fiscal 2012. This decrease is also explained

by the new contracts awarded during the 2012 fiscal year, which

generate lower profit margins than those posted by ADF in previous

years. Net income for the fiscal year ended January 31, 2012,

amounted to $1.8 million or $0.06 basic per share ($0.05

diluted per share), compared with a net income of $5.4 million

or $0.16 per share (basic and diluted) in 2011. In addition to the

factors previously mentioned, this decline reflects the foreign

exchange variations, which generated a lesser gain during the 2012

fiscal year than in 2011 year, whereas the profit mix generated

mostly by the Corporation's U.S. subsidiaries, was subject to a

higher tax rate than in recent years. As at January 31, 2012, the

Corporation had $24.5 million in liquidities (consisting of cash,

cash equivalents and short-term investments), up by 14% from the

previous year, exceeding ADF Group's total debt by $18.3 million.

Cash flows provided by operations allowed to further improve the

financial position of the Corporation, which, as at January 31,

2012, had $42.6 million in working capital, up by 15.9% compared

with 2011. Outlook During the 2012 fiscal year, ADF Group obtained

various mandates in Canada. Although carrying lower profit margins

than the major projects executed in previous years, these new

contracts enabled the Corporation to increase its fabrication

capacity utilization rate and make use of its qualified labour

force. ADF Group's order backlog was valued at $48 million as

at January 31, 2012. "We will be active on the Canadian market

where the short-term outlook is brighter than in the United States.

We are primarily targeting industrial facilities in Western Canada,

and public infrastructures in Ontario and Quebec. To this end, we

have recently invested in the acquisition of specialized equipment

to enhance our competitiveness in the construction and

rehabilitation of bridges" said Mr. Jean Paschini, Chairman of the

Board and Chief Executive Officer. Management foresees that the

launch of new major projects in the commercial and industrial

sectors in the United States will continue to incur some delays in

the short-term. Prospects for the U.S. public infrastructures

market are more encouraging. In fact, the current state of public

infrastructures will require important investments in the near

future. "In light of this opportunity, we are analyzing the

possibilities to set up a fabrication plant in the United States,

which would give us access to this market, and provide us with a

greater market access south of the border. Over the medium and long

term, the American market will remain ADF's target market" added

Mr. Paschini. "We are confident as we look to ADF Group's future,

considering the Corporation's healthy financial position, its

leading expertise and the quality of its assets" concluded Mr.

Paschini. Dividend The Corporation's Board of Directors approved a

semi-annual dividend payment. Consequently, ADF Group announces the

payment of a semi-annual dividend of $0.01 per share, payable on

May 17, 2012 to shareholders of record as at April 30, 2012. Annual

Meeting of Shareholders ADF Group Inc. Annual Meeting of

Shareholders will be held on: Date: Wednesday, June 13, 2012 Time:

11:00 a.m. Place: Hilton Montreal-Laval Hotel Laval, Quebec

Financial results for the first quarter ending April 30, 2012, will

also be disclosed at the Corporation's shareholders' meeting. ABOUT

ADF GROUP INC. | ADF Group Inc. is a North American leader in the

design and engineering of connections, fabrication and installation

of complex steel structures, heavy steel built-ups, as well as

miscellaneous and architectural metals for the nonresidential

construction industry. ADF is one of the few players in the

industry capable of handling highly technically complex mega

projects on fast-track schedules in the commercial, institutional,

industrial and public sectors. FORWARD-LOOKING INFORMATION | This

press release contains forward-looking statements reflecting ADF

objectives and expectations. These statements are identified by the

use of verbs such as "expect" as well as by the use of future or

conditional tenses. By their very nature these types of statements

involve risks and uncertainty. Consequently, reality may differ

from ADF's expectations. NON-IFRS MEASURES | EBITDA is not a

performance measure recognized by IFRS standards, and is not likely

to be comparable to similar measures presented by other issuers.

Management, as well as investors, consider this to be useful

information to assist them in assessing the Corporation's

profitability and ability to generate funds to finance its

operations. All amounts are in Canadian dollars, unless otherwise

indicated.

____________________________________________________________________

| CONFERENCE CALL WITH INVESTORS | |to discuss ADF Group's results

for the fiscal year ended January 31,| | 2012 | | | | Thursday

April 12, 2012 at 10:00 a.m. (Montreal Time) | | | |To participate

in the conference call, please dial 1-888-231-8191 a | | few

minutes before the start of the call. | | | | For those unable to

participate, a taped rebroadcast will be | | available from | |

April 12, 2012 at 1:00 p.m. until midnight April 19, 2012, | | by

dialing 1-855-859-2056; access code 66290573 | | | | The conference

call (audio) will also be available at | | www.adfgroup.com | |

Members of the media are invited to listen in. |

|____________________________________________________________________|

CONSOLIDATED STATEMENTS OF INCOME Fiscal Years Ended January 31,

2012 2011 (In thousands of Canadian dollars and in dollars per

share) $ $ Revenues 48,431 55,268 Cost of goods sold 39,128 41,132

Gross Margin 9,303 14,136 Selling and administrative expenses 6,690

6,598 Financial revenue (345) (293) Financial expenses 233 392

Foreign exchange gain (1,043) (2,486) 5,535 4,211 Income before

income tax expense 3,768 9,925 Income tax expense 1,956 4,534 Net

income for the year 1,812 5,391 Earnings per share Basic per share

0.06 0.16 Diluted per share 0.05 0.16 Average number of outstanding

shares (in thousands) 32,771 33,642 Average number of outstanding

diluted shares (in thousands) 33,309 34,301 CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME Fiscal Years Ended January 31, 2012 2011

(In thousands of Canadian dollars) $ $ Net income for the year

1,812 5,391 Other comprehensive income: Exchange differences on

translation of foreign operations (a) (53) (1,621) Changes in value

of available-for-sale financial assets (b) (56) — (109) (1,621)

Comprehensive income for the year 1,703 3,770 (a) Net of hedging

activities and of $24,000 in related income taxes for the fiscal

year ended January 31, 2012 (nil for the fiscal year ended January

31, 2011). (b) Net of $9,000 in related income taxes. CONSOLIDATED

STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY Accumulated Other

Capital Contributed Comprehensive Retained Stock Surplus Income

Income Total (In thousands of Canadian dollars) $ $ $ $ $ Balance,

February 1, 2010 75,436 3,659 144 13,348 92,587 Net income for the

year — — — 5,391 5,391 Other comprehensive income — — (1,621) —

(1,621) Comprehensive income for the year — — (1,621) 5,391 3,770

Share-based compensation — 237 — — 237 Options exercised 277 (101)

— — 176 Subordinate voting share redemption (5,681) 1,945 — —

(3,736) Balance, January 31, 2011 70,032 5,740 (1,477) 18,739

93,034 Accumulated Other Capital Contributed Comprehensive Retained

Stock Surplus Income Income Total (In thousands of Canadian

dollars) $ $ $ $ $ Balance, February 1, 2011 70,032 5,740 (1,477)

18,739 93,034 Net income for the year — — — 1,812 1,812 Other

comprehensive income — — (109) — (109) Comprehensive income for the

year — — (109) 1,812 1,703 Share-based compensation — 107 — — 107

Options exercised 20 (7) — — 13 Subordinate voting share redemption

(966) 528 — — (438) Dividends — — — (656) (656) Balance, January

31, 2012 69,086 6,368 (1,586) 19,895 93,763 CONSOLIDATED STATEMENTS

OF FINANCIAL POSITION As at January 31, 2012 January 31, 2011

February 1, 2010 (In thousands of Canadian dollars) $ $ $ ASSETS

Current assets Cash and cash equivalents 18,976 18,677 5,770

Short-term investments 5,562 2,787 11,652 Accounts receivable

14,189 22,215 13,421 Holdbacks on contracts 5,082 167 2,692 Work in

progress 5,263 403 1,574 Inventories 3,613 3,865 3,093 Income tax

assets — — 442 Prepaid expenses and other current assets 782 985

2,299 Derivative financial instruments — 741 832 Total current

assets 53,467 49,840 41,775 Non-current assets Holdbacks on

contracts — 3,562 1,297 Property, plant and equipment 45,089 46,871

47,438 Intangible assets 2,618 2,601 2,590 Other non-current assets

2,796 2,852 2,312 Deferred income tax assets 4,549 6,960 11,569

Total assets 108,519 112,686 106,981 LIABILITIES Current

liabilities Accounts payable and other current liabilities 5,551

5,365 5,649 Income tax liabilities 77 159 — Deferred revenues 2,618

4,994 1,274 Derivative financial instruments 75 45 — Current

portion of long-term debt 2,526 2,513 2,422 Total current

liabilities 10,847 13,076 9,345 Non-current liabilities Long-term

debt 3,676 6,151 4,645 Deferred income tax liabilities 233 425 404

Total liabilities 14,756 19,652 14,394 SHAREHOLDERS' EQUITY

Retained income 19,895 18,739 13,348 Accumulated other

comprehensive income (1,586) (1,477) 144 18,309 17,262 13,492

Capital stock 69,086 70,032 75,436 Contributed surplus 6,368 5,740

3,659 Total shareholders' equity 93,763 93,034 92,587 Total

liabilities and shareholders' equity 108,519 112,686 106,981

CONSOLIDATED STATEMENTS OF CASH FLOWS Fiscal Years Ended January

31, 2012 2011 (In thousands of Canadian dollars) $ $ OPERATING

ACTIVITIES Net income for the year 1,812 5,391 Non-cash items:

Amortization of property, plant and equipment 3,063 3,045

Amortization of intangible assets 356 339 Loss (gain) on disposal

of property, plant and equipment 8 (52) Unrealized loss on

derivative financial instruments 771 136 Non-cash exchange gain

(63) (600) Share-based compensation 107 237 Income tax expense

1,956 4,534 Financial revenue (345) (293) Financial expenses 233

392 Net income adjusted for non-cash items 7,898 13,129 Changes in

non-cash working capital items (1) 243 (4,324) Income tax expense

paid (15) (393) Cash flows from (used in) operating activities

8,126 8,412 INVESTING ACTIVITIES (Acquisition) disposal of

short-term investments (2,807) 8,596 Net acquisition of property,

plant and equipment (1,230) (2,302) Acquisition of intangible

assets (373) (350) Reduction in other non-current assets (9) (4)

Interest received 380 629 Cash flows from (used in) investing

activities (4,039) 6,569 FINANCING ACTIVITIES Issuance of long-term

debt — 4,370 Repayment of long-term debt (2,491) (2,333) Issuance

of subordinate voting shares 13 176 Redemption of subordinate

voting shares (438) (3,736) Dividends paid (656) — Interest paid on

the interest rate swap (33) (35) Interest paid (199) (290) Cash

flows from (used in) financing activities (3,804) (1,848) Impact of

fluctuations in foreign exchange rate on cash 16 (226) Net increase

in cash and cash equivalents 299 12,907 Cash and cash equivalents,

beginning of year 18,677 5,770 Cash and cash equivalents, end of

year(2) 18,976 18,677 Non-cash financing and investing activities

were as follows: Obligation under a capital lease 37 134 Property,

plant and equipment given in exchange for new property, plant and

equipment 56 139 (1) Details on the components of the "Changes

in non-cash working capital items": Fiscal Years Ended January 31,

2012 2011 (In thousands of Canadian dollars) $ $ Accounts

receivable 7,825 (10,236) Holdbacks on contracts (1,324) 23 Income

tax 144 476 Work in progress (4,764) 1,114 Inventories 252 (772)

Prepaid expenses and other current assets 203 774 Accounts payable

and other current liabilities 240 1,295 Deferred revenues (2,333)

3,002 Changes in non-cash working capital items 243 (4,324)

(2) For the purpose of the consolidated statements of cash

flows, cash and cash equivalents are disclosed as follows: As at

January 31, 2012 January 31, 2011 February 1, 2010 (In thousands of

Canadian dollars) $ $ $ Cash 18,976 15,918 5,770 Cash equivalents -

term deposits — 2,759 — 18,976 18,677 5,770 SEGMENTED INFORMATION

The Corporation operates in the non-residential construction

sector, primarily in the United States and Canada. Its operations

include the connections design and engineering, fabrication and

installation of complex steel structures, heavy steel built-ups, as

well as miscellaneous and architectural metalwork. Fiscal years

ended January 31, 2012 2011 (In thousands of Canadian dollars) $ $

Revenues Canada 6,371 698 United States 42,060 54,570 48,431 55,268

As at January 31, 2012 January 31, 2011 February 1, 2010 (In

thousands of Canadian dollars) $ $ $ Property, Plant and Equipment

Canada 44,410 46,767 47,293 United States 679 104 145 45,089 46,871

47,438 All intangible assets and investment tax credits included in

"Other non-current assets" at February 1, 2010, January 31, 2011

and January 31, 2012, originated from Canada. During the fiscal

year ended January 31, 2012, one client accounted for 83% of the

Corporation's revenues (one client accounted for 90% of the

revenues during the fiscal year ended January 31, 2011), and was

therefore the only one that accounted for more than 10% of

revenues. ADF GROUP INC. CONTACT: Source:ADF Group

Inc.Contact:Jean Paschini, Chairman of the Board of Directors and

Chief ExecutiveOfficerJean-Francois Boursier, CA, Chief Financial

OfficerTelephone: (450) 965-1911 / 1 (800) 263-7560Web Site:

www.adfgroup.com

Copyright

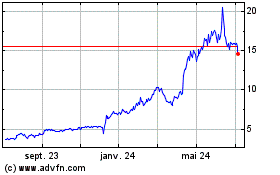

ADF (TSX:DRX)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

ADF (TSX:DRX)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024