Entrée Resources Ltd. (TSX:ETG; OTCQB:ERLFF – the

“

Company” or “

Entrée”) is pleased

to provide additional diamond drill hole results from the 2022 and

2023 drilling programs over the Hugo North Extension

(“

HNE”) deposit on the Entrée/Oyu Tolgoi JV

Property (the “

JV Property”) in Mongolia. All

drill results from the 2022 program are now reported. A portion of

the analytical results from the 2023 drilling program, and all of

the results from the 2024 drilling program are still pending and

will be reported as soon as they become available from the

Company’s joint venture partner Oyu Tolgoi LLC

(“

OTLLC”).

The Company is also pleased to report that

underground development work on OTLLC’s Oyu Tolgoi mining licence

continues to advance and that Shafts 3 and 4 have now reached their

final depths of 1,130 metres (“m”) and 1,176 m,

respectively, with final commissioning expected in H2 2024. Initial

underground development work on the JV Property remains on schedule

to start in Q4 2024.

The Company has also received analytical results

from diamond drilling at the Railway and Ulaan Khud regional

exploration targets, with both targets returning anomalous

results.

DRILL HOLE HIGHLIGHTS

HNE Surface Drill Holes

- EGD 161: 398 m

grading 2.07% copper equivalent*

(“CuEq”), including 214 m grading 2.79%

CuEq.

- EGD 173: 400 m

grading 1.41% CuEq, including 80 m grading

2.61% CuEq.

HNE Underground Drill Holes

- UGD 579: 124 m

grading 3.67% CuEq, including 78 m grading

5.43% CuEq.

- UGD 713: 114 m

grading 3.67% CuEq, including 86 m grading

4.61% CuEq.

- UGD 735: 574.3 m

grading 1.89% CuEq, including 234 m grading

3.73% CuEq.

- UGD 753: 364.8 m

grading 2.50% CuEq, including 222 m grading

3.30% CuEq.

*Copper equivalent is defined below Table 2,

where full details on the drill hole assay intervals are also

found.

Stephen Scott, Entrée’s President and CEO said,

“I am very pleased to see more exceptional drilling results from

the HNE deposit including some holes which end in potentially ore

grade mineralization below the currently proposed bottom limits of

the Oyu Tolgoi Lift 2 Panel 1 block cave. It is also encouraging

that most of the geotechnical holes drilled east of, and outside of

the Lift 2 cave shape are continually mineralized with copper

grades. These results confirm HNE is a world class deposit capable

of supporting mining from the JV Property for several future

generations. It is truly an exciting time for Entrée with first

underground development on the JV Property scheduled to start later

this year. Initial work will be on necessary infrastructure outside

of the ore footprint with mining expected to commence

thereafter.

We are also encouraged by some of the

early-stage drill results at the Ulaan Khud and Railway regional

targets, where drill holes have intercepted several intervals of

anomalous copper and gold values, at relatively shallow

depths.”

2022 and 2023 HNE DRILLING RESULTS

The Company has now received all analytical

results from the 2022 HNE drilling program on the JV Property and

partial drill results from the 2023 program. Both the 2022 and 2023

HNE drilling programs include surface drill holes that were drilled

entirely on the JV Property and underground drill holes that were

collared on the Oyu Tolgoi mining licence and drilled onto the JV

Property.

Recently received drilling results include three

holes collared from surface (EGD161, EGD173 and EGD177A), each

crossing through more than 1,300 m of barren, sedimentary and

volcanic tuff units before intersecting the porphyry deposit and

crossing between 175 m and 400 m of significant copper and gold

mineralization. The mineralization persists until the end of each

drill hole, at depths ranging between 50 m and 190 m below the base

of the potential Lift 2 Panel 1 block cave and remains open at

depth.

Recently received significant mineralized

intervals from the 2022 and 2023 HNE drilling programs are

summarized in Tables 1 and 2, and are shown on Figures 1 and 2.

OTLLC has informed Entrée that seven of the 2022 underground drill

holes (UGD578, UGD585, UGD650, UGD650B, UGD730, UGD731 and UGD731A)

that were noted by Entrée on February 28, 2024 as having pending

analytical results will not be assayed since they were used purely

for geotechnical and metallurgical purposes. In addition, five

previously reported underground drill hole intervals have been

adjusted by OTLLC due to a data clipping issue at the JV Property

boundary. As a result, the drilled lengths of these intercepts on

the JV Property have been slightly increased by approximately 8 m

to 28 m (Table 2).

Details of the 2023 HNE drilling program are

summarized further below and Tables 3 and 4 include the drill hole

collar and downhole information. Details for the 2022 HNE drilling

were previously provided by the Company on February 28, 2024.

Table 1: Surface Drill Results from 2022/2023 Drilling

at HNE Deposit1

|

2022 Drilling |

|

|

|

|

|

|

|

|

Drill Hole |

From (m) |

To (m) |

Length2 (m) |

Gold (ppm) |

Copper (%) |

Silver (ppm) |

CuEq3(%) |

| EGD161 |

1,352 |

1,750 |

398 |

0.684 |

1.67 |

4.78 |

2.07 |

|

including |

1,476 |

1,690 |

214 |

0.924 |

2.25 |

6.14 |

2.79 |

| EGD173 |

1,400 |

1,800 |

400 |

0.402 |

1.17 |

3.27 |

1.41 |

|

including |

1,526 |

1,606 |

80 |

1.015 |

2.03 |

5.29 |

2.61 |

|

2023 Drilling |

|

|

|

|

|

|

|

|

EGD177A |

1,474.8 |

1,650.3 |

175.5 |

0.324 |

1.53 |

3.61 |

1.73 |

|

including |

1,500 |

1,650.3 |

150.3 |

0.364 |

1.71 |

4.02 |

1.93 |

| 1. Refer to Notes below Table

2. |

| |

|

|

|

|

|

|

|

Table 2: Underground Drill Results from 2022/2023

Drilling at HNE Deposit1

|

2022 Drilling |

|

|

|

|

|

|

|

|

Drill Hole |

From (m) |

To (m) |

Length2(m) |

Gold (ppm) |

Copper (%) |

Silver (ppm) |

CuEq3(%) |

|

UGD 456 |

324 |

408.4 |

84.4 |

0.124 |

0.68 |

1.83 |

0.76 |

|

including |

344 |

385.7 |

41.7 |

0.202 |

1.04 |

2.08 |

1.16 |

|

UGD576A |

170 |

386 |

216 |

0.602 |

2.37 |

6.45 |

2.75 |

|

UGD579 |

94 |

218 |

124 |

1.996 |

2.57 |

6.29 |

3.67 |

|

including |

140 |

218 |

78 |

3.142 |

3.70 |

9.17 |

5.43 |

|

UGD582A4 |

117.2 |

396 |

278.8 |

0.022 |

0.62 |

1.42 |

0.64 |

|

UGD583A4 |

156 |

458 |

302 |

0.666 |

2.21 |

5.09 |

2.61 |

|

including |

223 |

324 |

101 |

0.931 |

3.33 |

7.18 |

3.88 |

|

UGD584A4 |

148 |

375 |

227 |

0.024 |

0.62 |

1.93 |

0.65 |

|

UGD5864 |

96 |

300 |

204 |

0.850 |

2.58 |

5.59 |

3.07 |

|

including |

144 |

288 |

144 |

1.067 |

3.50 |

7.21 |

4.12 |

|

UGD587 |

94 |

131.9 |

37.9 |

0.135 |

0.87 |

1.73 |

0.96 |

|

UGD587A |

104 |

174 |

70 |

0.066 |

0.73 |

1.45 |

0.77 |

|

UGD587B |

147 |

296.9 |

149.9 |

0.195 |

1.15 |

3.04 |

1.28 |

|

UGD5904 |

256 |

264 |

8 |

2.078 |

3.69 |

7.47 |

4.85 |

|

UGD713 |

118 |

232 |

114 |

1.691 |

2.73 |

5.93 |

3.67 |

|

including |

144 |

230 |

86 |

2.218 |

3.38 |

7.36 |

4.61 |

|

UGD734 |

76 |

343.3 |

267.3 |

0.069 |

0.63 |

1.43 |

0.68 |

|

2023 Drilling |

|

|

|

|

|

|

|

|

UGD735 |

49.7 |

624 |

574.3 |

0.566 |

1.55 |

4.11 |

1.89 |

|

including |

390 |

624 |

234 |

1.340 |

2.95 |

7.96 |

3.73 |

|

UGD736 |

56 |

416.2 |

360.2 |

0.020 |

0.56 |

1.29 |

0.59 |

|

UGD736A |

374.4 |

408 |

33.6 |

0.033 |

0.65 |

1.41 |

0.68 |

|

UGD737 |

128 |

417 |

289 |

0.034 |

0.61 |

1.27 |

0.64 |

|

UGD738 |

60 |

698.5 |

638.5 |

0.189 |

0.93 |

2.34 |

1.05 |

|

including |

448 |

698 |

250 |

0.451 |

1.57 |

4.54 |

1.84 |

|

UGD752 |

366 |

515.6 |

149.6 |

0.255 |

1.27 |

3.19 |

1.44 |

|

UGD753 |

364 |

728.8 |

364.8 |

0.425 |

2.23 |

5.91 |

2.50 |

|

including |

364 |

586 |

222 |

0.600 |

2.92 |

7.88 |

3.30 |

|

UGD791 |

354 |

454 |

100 |

0.703 |

1.42 |

4.27 |

1.83 |

|

UGD792 |

106 |

497 |

391 |

0.120 |

0.78 |

1.94 |

0.86 |

|

UGD793 |

320 |

346 |

26 |

0.630 |

0.63 |

1.85 |

0.98 |

|

UGD794 |

70 |

485 |

415 |

0.070 |

0.73 |

1.73 |

0.78 |

|

UGD794A |

542.2 |

561 |

18.8 |

0.382 |

1.30 |

3.32 |

1.53 |

|

UGD803 |

298 |

344 |

46 |

1.968 |

1.56 |

5.66 |

2.64 |

- All of the

analytical results shown above are length weighted averages and are

only for the portions of the drill holes on the JV Property.

- Lengths reported

are drilled lengths. Approximate true widths are variable depending

on the orientation of the drill hole. Several of the holes are

geotechnical holes drilled subparallel to the trend of the

porphyry. Other holes were drilled across the trend of the porphyry

at varying orientations with estimated true widths ranging between

approximately 20% and 70% of the drilled lengths.

- CuEq is calculated

by the formula CuEq = Cu + ((Au * 35.7175) + (Ag * 0.5773)) /

67.9023, taking into account differentials between metallurgical

performance and price for copper, gold and silver. Metal prices

used are US$3.08/lb copper, US$1,292.00/oz gold, and US$19.00/oz

silver. Metallurgical recoveries used are 82% for copper, 73% for

gold and 78% for silver.

- Drill hole

intervals previously reported on February 28, 2024 were adjusted

due to a data clipping issue by OTLLC at the Shivee Tolgoi mining

licence boundary. As a result, the lengths of the drill hole

intervals on the JV Property have been slightly increased.

Figure 1: Plan View of 2022 and 2023 Drilling at the HNE

Deposit

Figure 2: 3D Image of 2022 and 2023 Drilling at the HNE

Deposit

UNDERGROUND DEVELOPMENT

UPDATE

The Company is pleased to report that

underground development work on OTLLC’s Oyu Tolgoi mining licence

continues to advance and that Shafts 3 and 4 have now reached their

final depths of 1,130 m and 1,176 m, respectively, with final

commissioning expected in H2 2024. Completion of these shafts is

significant since they are a key piece of the infrastructure and

are required to provide ventilation to support production from

Panels 1 and 2 during ramp up. The HNE deposit is located in the

northern portion of Panel 1.

OTLLC continues to advise the Company that Lift

1 Panel 1 underground infrastructure development work on the JV

Property is scheduled to commence in Q4 2024. Development work will

start in the southwest corner of the HNE deposit on the Shivee

Tolgoi mining licence and establish the initial Panel 1 western ore

handling truck chute, including extraction level tipple

development, the truck chute chamber on the haulage level, and the

supporting ventilation loop with the return air level. OTLLC has

planned approximately 212 equivalent metres

(“eqm”) of development on the JV Property in 2024.

This includes 15 eqm on the extraction level, 117 eqm on the

haulage level, and 181 eqm on the return air level. OTLLC has

advised the Company all 2024 development materials will be waste

which will be stockpiled separately and sampled in accordance with

OTLLC’s standard sampling protocols and procedures.

2023 DRILLING INFORMATION

Underground and surface drilling at HNE was

carried out by OTLLC from December 30, 2022, to December 21, 2023,

during which time seven surface holes totalling 8,063.9 m and 25

underground holes totalling 7,307.8 m were drilled on the JV

Property.

The 2023 underground holes were all collared

from existing infrastructure on the Oyu Tolgoi mining licence and

crossed onto the Entrée/OTLLC JV Property. Several of the holes

were drilled as “daughter holes” (wedges) from a “parent hole” at

varying distances along the hole. Underground holes were designed

to achieve multiple objectives; as in-fill holes within the

mineralized footprint of Lift 2 to support the next mineral

resource estimate update; for geotechnical purposes with many holes

drilled subparallel to, but outside of the mineralized footprint;

and for metallurgical purposes.

Five of the seven 2023 surface holes were

collared east of HNE and drilled steeply, either towards the

northwest targeting Lift 2, or the area to the east of Lift 2 for

geotechnical purposes. Two additional surface holes were also

geotechnical holes collared west of the HNE footprint and drilled

steeply towards the southeast or southwest, outside of the

mineralized footprint. Except for daughter hole EGD177A, all

analytical results from the surface holes are still pending.

Although no new holes have been drilled north of the current Lift 2

block cave shape, many holes, especially the surface holes, were

drilled upwards of 190 m below the base of Lift 2 and remained in

significant copper and gold mineralization providing continuity for

deeper, potential future lifts.

Holes drilled into the mineralized porphyry

intersected predominantly phyllic and potassic altered quartz

monzodiorite, cut by occasional intervals of unmineralized

biotite-granodiorite dikes (generally less than 10 m in drilled

width). Total sulphide content is variable but averages around 5%

and comprised of a mix of chalcopyrite, bornite and pyrite hosted

in quartz stockworks and disseminated form. Some of the

highest-grade individual assays (grading around 5% to 10% CuEq) are

often hosted within hydrothermal breccias, containing up to 10%

disseminated and coarse bornite and chalcopyrite.

Drill holes outside of the HNE mineralized

footprint generally crossed an interbedded sequence of ignimbrite

and augite basalt with varying amounts of advanced argillic and

phyllic alteration. Mineralization is variable, but consists of

about 3% sulphides, comprised of a mix of pyrite and

chalcopyrite.

Drill hole sample lengths generally averaged 2.0

m. Tables 3 and 4 summarize the drill hole details and Figures

1 and 2 shows the locations of the 2023 HNE drill holes and assay

intervals discussed in this press release.

Table 3: HNE 2023 Surface

Drilling

|

Drill Hole |

UTM EAST |

UTM NORTH |

Elevation (masl) |

Length (m) |

Length on JV (m) |

Azimuth (degrees) |

Dip (degrees) |

Assay Status |

|

EGD174 |

652692.2 |

4768413 |

1170 |

1,800.0 |

1800.0 |

296 |

-77 |

Pending |

| EGD175 |

652641.5 |

4768349 |

1181 |

508.4 |

508.4 |

296 |

-77 |

Pending |

| EGD176 |

652656.6 |

4768377 |

1161 |

1,450.0 |

1,450.0 |

242 |

-81 |

Pending |

| EGD177 |

652618 |

4768236 |

1160 |

1,548.0 |

1,548.0 |

296 |

-80 |

Pending |

| EGD177A |

652618 |

4768236 |

1160 |

178.0 |

178.0 |

303 |

-73 |

Complete |

| EGD182 |

652137 |

4768610 |

1173 |

814.5 |

814.5 |

103 |

-83 |

Pending |

|

EGD187 |

652201.2 |

4768524 |

1175 |

1,765.0 |

1,765.0 |

243 |

-83 |

No samples collected |

|

Total Surface |

|

|

|

|

8,063.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 4: HNE 2023 Underground

Drilling

|

Drill Hole |

UTM EAST |

UTM NORTH |

Elevation (masl) |

Length (m) |

Length on JV (m) |

Azimuth (degrees) |

Dip (degrees) |

Assay Status |

|

UGD732 |

651639.3 |

4767963 |

-128.1 |

600 |

430.2 |

37 |

2 |

No samples collected |

| UGD733 |

651639.5 |

4767962 |

-128.1 |

700 |

511.6 |

46 |

-1 |

No samples collected |

| UGD735 |

652236.6 |

4768068 |

-74.7 |

707.8 |

663.1 |

10 |

-24 |

Complete |

| UGD736 |

652237.2 |

4768067 |

-74.7 |

416.2 |

368.5 |

16 |

-26 |

Complete |

| UGD736A* |

652237.2 |

4768067 |

-74.7 |

408 |

35.1 |

16 |

-26 |

Complete |

| UGD737 |

652235.1 |

4768066 |

-76.3 |

417 |

329.4 |

20 |

-68 |

Complete |

| UGD738 |

652234.4 |

4768064 |

-75.1 |

698.5 |

640.2 |

22 |

-36 |

Complete |

| UGD752 |

652060.9 |

4767907 |

-80.8 |

515.6 |

150.5 |

349 |

-49 |

Complete |

| UGD753 |

651639.4 |

4767961 |

-128.1 |

728.8 |

365.6 |

65 |

-25 |

Complete |

| UGD757A* |

651969 |

4767860 |

-180.6 |

516.3 |

132.1 |

41 |

-35 |

Pending |

| UGD791 |

652060.4 |

4767906 |

-80.8 |

650 |

296.3 |

330 |

-53 |

Complete |

| UGD792 |

652234.1 |

4768068 |

-76.3 |

497 |

392.8 |

340 |

-66 |

Complete |

| UGD793 |

652235 |

4768066 |

-76.2 |

346.2 |

264.5 |

23 |

-60 |

Pending |

| UGD794 |

652235.2 |

4768066 |

-76.2 |

569.6 |

505.6 |

18 |

-46 |

Complete |

| UGD794A* |

652235.2 |

4768066 |

-76.2 |

561 |

18.8 |

18 |

-46 |

Complete |

| UGD803 |

651966.1 |

4767860 |

-180.6 |

378 |

80.9 |

344 |

-31 |

Complete |

| UGD805B* |

651967.5 |

4767860 |

-180.6 |

473 |

184.5 |

20 |

-26 |

Pending |

| UGD807A* |

652234.5 |

4768067 |

-76.3 |

191.7 |

136.3 |

9 |

-42 |

Pending |

| UGD807B* |

652234.4 |

4768067 |

-76.2 |

226.7 |

171.4 |

8 |

-42 |

Pending |

| UGD807C* |

652234.5 |

4768067 |

-76.3 |

661.6 |

456.5 |

9 |

-42 |

Pending |

| UGD808 |

652235.7 |

4768067 |

-76.3 |

671.6 |

615.5 |

23 |

-36 |

Pending |

| UGD812 |

652059.4 |

4767907 |

-80.8 |

447 |

53.3 |

309 |

-45 |

Pending |

| UGD813 |

652060.2 |

4767907 |

-80.8 |

507 |

130.6 |

325 |

-53 |

Pending |

| UGD814 |

652060.5 |

4767908 |

-80.8 |

435 |

147.1 |

337 |

-43 |

Pending |

|

UGD815 |

652061.5 |

4767908 |

-80.7 |

522 |

227.3 |

356 |

-47 |

Pending |

|

Total Underground |

|

|

|

|

7,307.8 |

|

|

|

|

TOTAL ALL DRILLING |

|

|

|

|

16,844.3 |

|

|

|

* Holes drilled as “daughter” holes (wedges)

from a “parent” drill hole; Coordinates are WGS UTM Zone 48N, Local

OT GRID system.

2024 HNE DRILLING UPDATE

OTLLC is continuing to drill at HNE throughout

2024 and as of late April have reported the completion of one

surface diamond drill hole, with 3 more planned and 13 underground

diamond drill holes with 12 additional holes planned. In addition,

5 diamond drill holes are planned for Heruga, which will be the

first holes drilled at the deposit since 2012. Once the complete

database is received and reviewed by the Company the 2024 drill

results will be released. It is the Company’s understanding that

similar to the 2022 and 2023 drilling programs, all of the 2024

drill holes will be drilled within the current mineralized

footprint or within the hanging and/or footwall rocks, with the

objective to update the HNE mineral resource estimate and to

conduct geological and geotechnical characterization.

2023 REGIONAL PROSPECTS DRILLING UPDATE

Regional exploration continued during 2023 with

IP/resistivity, 3D modelling, and diamond drilling focused at the

Railway and Ulaan Khud prospects. Other prospects, inducing

Airstrip, Ductile Shear, East Bumbat Ulaan, Castle Rock, Southeast

IP and West Mag had 3D modeling and data integration completed over

them. Seven diamond drill holes were completed at the Ulaan Khud

and Railway Prospects, totaling 5,143.5 m, as shown on Table 5 with

anomalous assay results reported on Table 6.

Table 5: 2023 Entrée/Oyu Tolgoi JV

Regional Drilling

|

Target |

Drill Hole |

UTM EAST |

UTM NORTH |

Elevation (masl) |

Length (m) |

Azimuth (degrees) |

Dip (degrees) |

| Ulaan

Khud |

EGD178 |

655466 |

4774995 |

1170 |

700.2 |

269 |

-61 |

| |

EGD180 |

655051 |

4775198 |

1165 |

800 |

90 |

-70 |

| |

EGD181 |

655471 |

4775199 |

1178 |

552.9 |

270 |

-65 |

| |

EGD183 |

654793 |

4775196 |

1166 |

827 |

90 |

-65 |

| |

SUBTOTAL |

|

|

|

2,880.1 |

|

|

|

Railway |

EJD0094 |

642000 |

4755500 |

1203 |

1,300 |

82 |

-75 |

| |

EJD0095 |

641700 |

4754850 |

1205 |

263.4 |

90 |

-70 |

| |

EJD0096 |

641711 |

4755380 |

1208 |

700 |

88 |

-80 |

| |

SUBTOTAL |

|

|

|

2,263.4 |

|

|

|

|

Total Drilling |

|

|

|

5,143.5 |

|

|

Coordinates are WGS UTM Zone 48N, Local OT GRID system.

Table 6: JV Property Regional Targets – 2023 Anomalous

Drill Results1

|

Drill Hole |

From (m) |

To (m) |

Length1 (m) |

Gold (ppm) |

Copper (%) |

Silver (ppm) |

CuEq2 (%) |

|

Ulaan Khud |

|

|

|

|

|

|

|

|

EGD178 |

592 |

646 |

54 |

0.023 |

0.16 |

2.08 |

0.19 |

|

EGD180 |

130 |

174 |

44 |

0.069 |

0.14 |

0.57 |

0.18 |

|

and |

236 |

348 |

112 |

0.122 |

0.36 |

1.22 |

0.43 |

|

and |

488 |

526 |

38 |

0.017 |

0.12 |

1.20 |

0.14 |

|

EGD181 |

388.45 |

404 |

15.55 |

0.024 |

0.20 |

2.61 |

0.24 |

|

EGD183 |

572 |

625.7 |

53.7 |

0.062 |

0.21 |

1.61 |

0.26 |

|

and |

690 |

712 |

22 |

0.020 |

0.23 |

1.04 |

0.25 |

|

and |

727.87 |

775 |

47.13 |

0.032 |

0.21 |

1.45 |

0.24 |

|

Railway |

|

|

|

|

|

|

|

| EJD0095 |

83.15 |

114 |

30.85 |

0.171 |

0.19 |

1.13 |

0.28 |

|

and |

142 |

188 |

46 |

0.054 |

0.17 |

0.87 |

0.20 |

|

and |

250 |

263.4 |

13.4 |

0.116 |

0.15 |

0.83 |

0.21 |

- All of the

analytical results shown above are length weighted averages.

- Lengths reported

are drilled lengths. Insufficient drilling has been done to

determine the orientation of mineralized zones.

- CuEq is

calculated by the formula CuEq = Cu + ((Au * 35.7175) + (Ag *

0.5773)) / 67.9023, taking into account differentials between

metallurgical performance and price for copper, gold and silver.

Metal prices used are US$3.08/lb copper, US$1,292.00/oz gold, and

US$19.00/oz silver. Metallurgical recoveries used are 82% for

copper, 73% for gold and 78% for silver.

The drill results at Ulaan Khud are encouraging

as all three holes intersected the target quartz monzodiorite host

unit and each returned anomalous gold and copper results, with some

intervals at relatively shallow depths. OTLLC is planning to review

these results and undertake additional drilling during 2024.

One of the Railway prospect drill holes

(EJD0095) returned several intervals of anomalous copper and gold

results over moderate drill lengths at relatively shallow depths.

This hole is the furthest south of the three that OTLLC drilled

during 2023 and the target of augite basalt coinciding with Zeuss

IP anomaly remains open at depth. OTLLC will review the results

before they plan any follow-on work at Railway.

During 2024, OTLLC will complete additional

exploration on the JV Property, including 4 diamond drill holes at

Bumbat Ulaan; gravity and CSAMT geophysical surveys, followed by 2

diamond drill holes at Heruga West and South; one deep diamond

drill hole at Ulaan Khud; soil sampling at Airstrip; and gravity

and CSAMT geophysical surveys followed by one deep drill hole to

the north of Hugo North Extension.

SAMPLE PREPARATION AND ANALYSES, QAQC AND QUALIFIED

PERSON

All drill core from the 2022 and 2023 HNE

drilling programs and the regional drilling programs was

geologically and geotechnically logged at site by OTLLC. Surface

drill holes were generally collared with PQ diameter core (123 mm)

and reduced to HQ (96 mm) and occasionally NQ (76 mm) core

diameters at depth. Underground holes were collared using HQ

diameter and occasionally reduced to NQ at depth. Core from HNE and

regional drilling was saw-cut on site before being bagged and

shipped to the laboratory for analyses. A few core samples from HNE

were shipped to SGS Laboratory (“SGS”) in

Ulaanbaatar, Mongolia for sample preparation and analysis. Most

core samples from HNE and all regional drilling samples were

shipped to ALS (“ALS”) in Ulaanbaatar, Mongolia

for sample preparation with pulp samples sent to ALS in Perth,

Australia for geochemical analysis. Both SGS and ALS are

independent of OTLLC, Rio Tinto and Entrée. At SGS the samples were

crushed to <2mm and pulverized to 75μm, then analysed for gold

by 30-gram fire assay with an AAS finish, and for copper, silver

and molybdenum, along with 8 additional elements by 4-acid

digestion ICP-OES and ICP-MS multi-element analysis. Additional

analysis was done for carbon/sulphur by Leco furnace and fluorine

by specific ion electrode. At ALS the samples were crushed to

<2mm and pulverized to 75μm then analysed for gold and multiple

elements with an ICP-MS method. Gold was further analysed for gold

by 30 g fire assay with an ICP finish.

OTLLC follows a rigorous quality

assurance/quality control (QAQC) program for the sampling programs

that includes the regular insertion of standards, blanks and

duplicates into the sample stream. The QP is not aware of any

drilling, sampling, recovery, or other factors that could

materially affect the accuracy or reliability of the data referred

to in this disclosure.

The scientific and technical information that

forms the basis for this press release was reviewed and approved by

Robert Cinits (P.Geo.), who is a Qualified Person

(“QP”) as defined by National Instrument 43-101.

For further information on the JV Property, see the Company’s

Technical Report, titled “Entrée/Oyu Tolgoi Joint Venture Project,

Mongolia, NI 43-101 Technical Report”, with an effective date of

October 8, 2021, available on the Company’s website at

www.EntreeResourcesLtd.com, and on SEDAR+ at www.sedarplus.ca.

ABOUT ENTRÉE RESOURCES LTD.

Entrée Resources Ltd. is a well-funded Canadian

mining company with a unique carried joint venture interest on a

significant portion of one of the world’s largest copper-gold

projects – the Oyu Tolgoi project in Mongolia. The Oyu Tolgoi

project includes two separate land holdings: the Oyu Tolgoi mining

licence, which is held by Entrée’s joint venture partner OTLLC and

the Entrée/Oyu Tolgoi JV Property, which is a partnership between

Entrée and OTLLC. Rio Tinto owns 66% of OTLLC and is the manager of

operations at Oyu Tolgoi. Entrée has a 20% or 30% carried

participating interest in the Entrée/Oyu Tolgoi JV, depending on

the depth of mineralization. Horizon Copper Corp. and Rio Tinto are

major shareholders of Entrée, beneficially holding approximately

24% and 16% of the shares of the Company, respectively. More

information about Entrée can be found at

www.EntreeResourcesLtd.com.

FURTHER INFORMATION David

JanInvestor Relations Entrée Resources Ltd. Tel: 604-687-4777 |

Toll Free: 1-866-368-7330 E-mail: djan@EntreeResourcesLtd.com

This News Release contains forward-looking

information within the meaning of applicable Canadian securities

laws with respect to corporate strategies and plans; requirements

for additional capital; uses of funds and projected expenditures;

timing and status of Lift 1 Panel 1 development work on the

Entrée/Oyu Tolgoi JV Property; timing and status of Oyu Tolgoi

underground development; potential timing and objectives of Hugo

North Extension deposit and regional exploration drilling programs;

potential timing for reporting additional analytical results from

drilling programs; the timing and progress of the commissioning of

Shafts 3 and 4 and any delays in that regard; future commodity

prices; the estimation of mineral reserves and resources; potential

size of a mineralized zone; potential expansion of mineralization;

potential discovery of new mineralized zones; potential

metallurgical recoveries and grades; plans for future exploration

and/or development programs and budgets; anticipated business

activities; and future financial performance.

In certain cases, forward-looking information

can be identified by words such as "plans", "expects" or "does not

expect", "is expected", "budgeted", "scheduled", "estimates",

"forecasts", "intends", "anticipates", or "does not anticipate" or

"believes" or variations of such words and phrases or statements

that certain actions, events or results "may", "could", "would",

"might", "will be taken", "occur" or "be achieved". While the

Company has based forward-looking information on its expectations

about future events as at the date that such information was

prepared, the information is not a guarantee of Entrée’s future

performance and is based on numerous assumptions regarding present

and future business strategies; the correct interpretation of

agreements, laws and regulations; the commencement and conclusion

of arbitration proceedings, including the potential benefits,

timing and outcome of arbitration proceedings; the potential

benefits, timing and outcome of discussions with Erdenes Oyu Tolgoi

LLC, OTLLC, and Rio Tinto; that the Company will continue to have

timely access to detailed technical, financial, and operational

information about the Entrée/Oyu Tolgoi JV Property, the Oyu Tolgoi

project, and government relations to enable the Company to properly

assess, act on, and disclose material risks and opportunities as

they arise; local and global economic conditions and the

environment in which Entrée will operate in the future, including

commodity prices, projected grades, projected dilution, anticipated

capital and operating costs, including inflationary pressures

thereon resulting in cost escalation, and anticipated future

production and cash flows; the anticipated location of certain

infrastructure and sequence of mining within and across panel

boundaries; the construction and continued development of the Oyu

Tolgoi underground mine; the status of Entrée’s relationship and

interaction with the Government of Mongolia, Erdenes Oyu Tolgoi

LLC, OTLLC, and Rio Tinto; and the Company’s ability to operate

sustainably, its community relations, and its social licence to

operate.

With respect to the construction and continued

development of the Oyu Tolgoi underground mine, important risks,

uncertainties and factors which could cause actual results to

differ materially from future results expressed or implied by such

forward-looking information include, amongst others, the nature of

the ongoing relationship and interaction between OTLLC, Rio Tinto,

Erdenes Oyu Tolgoi LLC and the Government of Mongolia with respect

to the continued operation and development of Oyu Tolgoi along with

the implementation of Resolution 103; the continuation of

undercutting in accordance with the mine plans and designs in the

current Oyu Tolgoi Feasibility Study; the amount of any future

funding gap to complete the Oyu Tolgoi project and the availability

and amount of potential sources of additional funding; the timing

and cost of the construction and expansion of mining and processing

facilities; inflationary pressures on prices for critical supplies

for Oyu Tolgoi including fuel, power explosives and grinding media

resulting in cost escalation; the ability of OTLLC or the

Government of Mongolia to deliver a domestic power source for Oyu

Tolgoi (or the availability of financing for OTLLC or the

Government of Mongolia to construct such a source) within the

required contractual timeframe; sources of interim power; OTLLC’s

ability to operate sustainably, its community relations, and its

social licence to operate in Mongolia; the impact of changes in,

changes in interpretation to or changes in enforcement of, laws,

regulations and government practises in Mongolia; delays, and the

costs which would result from delays, in the development of the

underground mine; the anticipated location of certain

infrastructure and sequence of mining within and across panel

boundaries; international conflicts such as the ongoing

Russia-Ukraine conflict; projected commodity prices and their

market demand; and production estimates and the anticipated yearly

production of copper, gold and silver at the Oyu Tolgoi underground

mine.

Other risks, uncertainties and factors which

could cause actual results, performance or achievements of Entrée

to differ materially from future results, performance or

achievements expressed or implied by forward-looking information

include, amongst others, unanticipated costs, expenses or

liabilities; discrepancies between actual and estimated production,

mineral reserves and resources and metallurgical recoveries;

development plans for processing resources; matters relating to

proposed exploration or expansion; mining operational and

development risks, including geotechnical risks and ground

conditions; regulatory restrictions (including environmental

regulatory restrictions and liability); risks related to

international operations, including legal and political risk in

Mongolia; risks related to the potential impact of global or

national health concerns; risks associated with changes in the

attitudes of governments to foreign investment; risks associated

with the conduct of joint ventures, including the ability to access

detailed technical, financial and operational information; risks

related to the Company’s significant shareholders, and whether they

will exercise their rights or act in a manner that is consistent

with the best interests of the Company and its other shareholders;

inability to upgrade Inferred mineral resources to Indicated or

Measured mineral resources; inability to convert mineral resources

to mineral reserves; conclusions of economic evaluations;

fluctuations in commodity prices and demand; changing foreign

exchange rates; the speculative nature of mineral exploration; the

global economic climate; dilution; share price volatility;

activities, actions or assessments by Rio Tinto or OTLLC and by

government stakeholders or authorities including Erdenes Oyu Tolgoi

LLC and the Government of Mongolia; the availability of funding on

reasonable terms; the impact of changes in interpretation to or

changes in enforcement of laws, regulations and government

practices, including laws, regulations and government practices

with respect to mining, foreign investment, royalties and taxation;

the terms and timing of obtaining necessary environmental and other

government approvals, consents and permits; the availability and

cost of necessary items such as water, skilled labour,

transportation and appropriate smelting and refining arrangements;

unanticipated reclamation expenses; changes to assumptions as to

the availability of electrical power, and the power rates used in

operating cost estimates and financial analyses; changes to

assumptions as to salvage values; ability to maintain the social

licence to operate; accidents, labour disputes and other risks of

the mining industry; global climate change; global conflicts; title

disputes; limitations on insurance coverage; competition; loss of

key employees; cyber security incidents; misjudgements in the

course of preparing forward-looking information; and those factors

discussed in the Company’s most recently filed MD&A and in the

Company’s Annual Information Form for the financial year ended

December 31, 2023, dated March 8, 2024 filed with the Canadian

Securities Administrators and available at www.sedarplus.ca.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking information,

there may be other factors that cause actions, events or results

not to be as anticipated, estimated or intended. There can be no

assurance that forward-looking information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information. Accordingly,

readers should not place undue reliance on forward-looking

information. The Company is under no obligation to update or alter

any forward-looking information except as required under applicable

securities laws.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d1ccbf7d-6921-4cb1-a464-24f670deefe7

https://www.globenewswire.com/NewsRoom/AttachmentNg/03ceaaee-73fc-40ee-8d16-3227de9ca13b

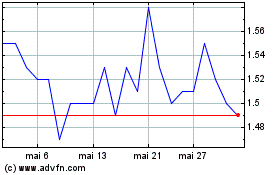

Entree Resources (TSX:ETG)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Entree Resources (TSX:ETG)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025