Fairfax Financial Holdings Limited (TSX: FFH and FFH.U) announces

2024 fiscal year net earnings of $3,874.9 million ($160.56 net

earnings per diluted share after payment of preferred share

dividends) compared to fiscal year 2023 net earnings of $4,381.8

million ($173.24 net earnings per diluted share after payment of

preferred share dividends). Book value per basic share at

December 31, 2024 was $1,059.60 compared to $939.65 at

December 31, 2023 (an increase of 14.5% adjusted for the $15

per common share dividend paid in the first quarter of 2024).

"2024 produced record underwriting profit of

$1.8 billion and a consolidated combined ratio of 92.7%. Our

property and casualty insurance and reinsurance operations achieved

record adjusted operating income of $4.8 billion and operating

income of $6.5 billion including the benefit of discounting, net of

a risk adjustment on claims, reflecting strong underwriting

performance and interest and dividends, and continued favourable

results from share of profit of associates. Gross premiums written

grew by 12.6% or $3.6 billion to $32.5 billion and net premiums

written grew by 11.6%, primarily reflecting the acquisition of Gulf

Insurance in 2023, which added $2.7 billion in gross premiums

written and $1.6 billion in net premiums written. Excluding Gulf

Insurance gross premiums written were up 3.1% and net premiums

written were up 4.5%.

"Our net gains on investments of $1.1 billion

were principally comprised of net gains on common stocks of $1.9

billion, partially offset by mark to market net losses on bonds of

$0.7 billion, and our annual interest and dividend income increased

to $2.5 billion.

"Our book value per basic share included a net

loss of $477 million, or $22 per share, in comprehensive income

related to unrealized foreign currency losses net of hedges due to

the significant strengthening of the U.S. dollar against many

currencies around the world, primarily in the fourth quarter of

2024. We view these unrealized foreign currency movements as market

fluctuations similar to unrealized gains or losses on our equity

holdings.

"During the year we purchased 1,346,953

subordinate voting shares for cancellation for cash consideration

of approximately $1.6 billion, or $1,179 per share.

"We remain focused on being soundly financed and

ended 2024 in a strong financial position with $2.5 billion in

cash, marketable securities and investments in the holding company,

and an additional $2.0 billion, at fair value, of investments in

associates and consolidated non-insurance companies owned by the

holding company," said Prem Watsa, Chairman and Chief Executive

Officer.

The table below presents the sources of the

company's net earnings in a segment reporting format which the

company has consistently used as it believes it assists in

understanding Fairfax:

| |

Fourth quarter |

|

Year ended December 31, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

($ millions) |

| Gross premiums written |

7,548.7 |

|

|

6,639.3 |

|

|

32,825.4 |

|

|

29,092.5 |

|

| Net premiums written |

5,923.0 |

|

|

5,161.5 |

|

|

25,607.4 |

|

|

22,903.6 |

|

| Net insurance revenue |

6,329.3 |

|

|

5,680.9 |

|

|

24,866.4 |

|

|

21,957.4 |

|

| |

|

|

|

|

|

|

|

| Sources of net

earnings |

|

|

|

|

|

|

|

| Operating income - Property

and Casualty Insurance and Reinsurance: |

|

|

|

|

|

|

|

|

Insurance service result: |

|

|

|

|

|

|

|

|

North American Insurers |

301.2 |

|

|

265.7 |

|

|

1,101.1 |

|

|

977.1 |

|

|

Global Insurers and Reinsurers |

1,026.1 |

|

|

714.7 |

|

|

3,037.4 |

|

|

2,828.0 |

|

|

International Insurers and Reinsurers |

144.1 |

|

|

100.9 |

|

|

463.6 |

|

|

330.8 |

|

|

Insurance service result |

1,471.4 |

|

|

1,081.3 |

|

|

4,602.1 |

|

|

4,135.9 |

|

|

Other insurance operating expenses |

(292.1 |

) |

|

(246.8 |

) |

|

(1,038.1 |

) |

|

(822.1 |

) |

| |

1,179.3 |

|

|

834.5 |

|

|

3,564.0 |

|

|

3,313.8 |

|

|

Interest and dividends |

632.8 |

|

|

482.1 |

|

|

2,224.6 |

|

|

1,654.7 |

|

|

Share of profit of associates |

236.7 |

|

|

153.4 |

|

|

745.1 |

|

|

761.6 |

|

| Operating income - Property

and Casualty Insurance and Reinsurance |

2,048.8 |

|

|

1,470.0 |

|

|

6,533.7 |

|

|

5,730.1 |

|

| Operating loss - Life

insurance and Run-off |

(108.8 |

) |

|

(187.3 |

) |

|

(92.1 |

) |

|

(144.6 |

) |

| Operating income (loss) -

Non-insurance companies |

150.1 |

|

|

(40.3 |

) |

|

241.4 |

|

|

121.9 |

|

| Net finance income (expense)

from insurance contracts and reinsurance contract assets held |

203.4 |

|

|

(1,010.3 |

) |

|

(1,279.9 |

) |

|

(1,605.6 |

) |

| Net gains (losses) on

investments |

(403.2 |

) |

|

1,464.4 |

|

|

1,067.2 |

|

|

1,949.5 |

|

| Gain on sale and consolidation of

insurance subsidiaries |

— |

|

|

290.7 |

|

|

— |

|

|

549.8 |

|

| Interest expense |

(172.7 |

) |

|

(130.5 |

) |

|

(649.0 |

) |

|

(510.0 |

) |

| Corporate overhead and

other |

(40.4 |

) |

|

(153.4 |

) |

|

(182.8 |

) |

|

(182.8 |

) |

| Earnings before income

taxes |

1,677.2 |

|

|

1,703.3 |

|

|

5,638.5 |

|

|

5,908.3 |

|

| Provision for income

taxes |

(359.3 |

) |

|

(28.5 |

) |

|

(1,375.6 |

) |

|

(813.4 |

) |

| Net

earnings |

1,317.9 |

|

|

1,674.8 |

|

|

4,262.9 |

|

|

5,094.9 |

|

| |

|

|

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

|

|

Shareholders of Fairfax |

1,152.2 |

|

|

1,328.5 |

|

|

3,874.9 |

|

|

4,381.8 |

|

|

Non-controlling interests |

165.7 |

|

|

346.3 |

|

|

388.0 |

|

|

713.1 |

|

| |

1,317.9 |

|

|

1,674.8 |

|

|

4,262.9 |

|

|

5,094.9 |

|

The table below presents the insurance service

result for the property and casualty insurance and reinsurance

operations reconciled to underwriting profit, a key performance

measure used by the company and the property and casualty industry

in which it operates. The reconciling adjustments are (i) other

insurance operating expenses as presented in the consolidated

statement of earnings, (ii) the effects of discounting of losses

and ceded losses on claims recorded in the period, and (iii) the

effects of the risk adjustment and other.

| |

Fourth quarter |

|

Year ended December 31, |

|

Property and Casualty Insurance and

Reinsurance |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

($ millions) |

| Insurance service

result |

1,471.4 |

|

|

1,081.3 |

|

|

4,602.1 |

|

|

4,135.9 |

|

|

Other insurance operating expenses |

(292.1 |

) |

|

(246.8 |

) |

|

(1,038.1 |

) |

|

(822.1 |

) |

|

Discounting of losses and ceded losses on claims recorded in the

period |

(399.6 |

) |

|

(393.7 |

) |

|

(1,667.5 |

) |

|

(1,813.6 |

) |

|

Changes in the risk adjustment and other |

(121.4 |

) |

|

138.5 |

|

|

(105.1 |

) |

|

22.0 |

|

| Underwriting

profit |

658.3 |

|

|

579.3 |

|

|

1,791.4 |

|

|

1,522.2 |

|

| Interest and dividends |

632.8 |

|

|

482.1 |

|

|

2,224.6 |

|

|

1,654.7 |

|

| Share of profit of

associates |

236.7 |

|

|

153.4 |

|

|

745.1 |

|

|

761.6 |

|

| Adjusted operating

income |

1,527.8 |

|

|

1,214.8 |

|

|

4,761.1 |

|

|

3,938.5 |

|

Highlights for fiscal year 2024 (with

comparisons to fiscal year 2023 except as otherwise noted, and

excluding the effects of IFRS 17 when discussing the combined ratio

and adjusted operating income) include the following:

- Net premiums written by the

property and casualty insurance and reinsurance operations

increased by 11.6% to a record $25.3 billion from $22.7 billion,

while gross premiums written increased by 12.6%, primarily

reflecting the consolidation of Gulf Insurance on December 26, 2023

which contributed $1.6 billion to net premiums written and $2.7

billion to gross premiums written in 2024, and continued growth

across most operating companies.

- The consolidated undiscounted

combined ratio of the property and casualty insurance and

reinsurance operations improved to 92.7%, producing a record

underwriting profit of $1,791.4 million, while absorbing higher

catastrophe losses of $1,099.3 million (representing 4.5

combined ratio points), compared to an undiscounted combined ratio

of 93.2% and an underwriting profit of $1,522.2 million in 2023.

The increase in underwriting profitability reflected growth in

business volumes and higher net favourable prior year reserve

development, with a benefit of $593.6 million or 2.4 combined ratio

points (2023 - $309.6 million or 1.4 combined ratio points).

- Adjusted operating income (which

excludes the benefit of discounting, net of a risk adjustment on

claims) of the property and casualty insurance and reinsurance

operations increased by 20.9% to a record $4,761.1 million from

$3,938.5 million, reflecting the best year in the company's history

for both underwriting profit and interest and dividends, and

continued strong results from share of profit of associates.

- The consolidated statement of

earnings included a net loss of $529.9 million (2023 – a net

benefit of $496.0 million) reflecting the effects of increases in

discount rates during the year, which was comprised of net losses

on bonds of $731.3 million, partially offset by a net benefit on

insurance contracts and reinsurance contracts held of $201.4

million. Of the $529.9 million net loss in 2024, $437.7 million was

incurred in the fourth quarter (2023 – a net benefit of $326.7

million).

- Float of the property and casualty

insurance and reinsurance operations increased by 5.9% to $35.4

billion at December 31, 2024 from $33.4 billion at

December 31, 2023.

- Operating loss of the Life

insurance and Run-off operations was $92.1 million compared to an

operating loss of $144.6 million in 2023, principally reflecting

lower net adverse prior year reserve development at Run-off of

$221.1 million in 2024 (2023 - $259.4 million) on an undiscounted

basis, primarily related to latent hazard claims, construction

defects and workers' compensation.

- Consolidated interest and dividends

increased significantly from $1,896.2 million to a record $2,511.9

million (comprised of interest and dividends of $2,224.6 million

(2023 - $1,654.7 million) earned by the investment portfolios of

the property and casualty insurance and reinsurance operations,

with the remainder earned by life insurance and run-off,

non-insurance companies and corporate and other). At

December 31, 2024 the company's insurance and reinsurance

companies held portfolio investments of $62.9 billion (excluding

Fairfax India's portfolio of $1.9 billion), of which $7.6 billion

was in cash and short term investments representing 12.1% of those

portfolio investments.

- Consolidated share of profit of

associates of $956.3 million (comprised of $745.1 million earned in

the property and casualty insurance and reinsurance operations

investment portfolio, with the remainder earned in life insurance

and run-off, non-insurance companies and corporate and other),

principally reflected share of profit of $515.0 million from

Eurobank, $212.6 million from Poseidon (formerly Atlas) and $57.0

million from Peak Achievement (principally reflecting its sale of

Rawlings Sporting Goods), partially offset by share of loss of

$72.7 million from Sanmar Chemicals Group.

- Net gains on investments of

$1,067.2 million (net losses on investments of $403.2 million in

the fourth quarter) consisted of the following:

| |

Fourth quarter of 2024 |

| |

($ millions) |

| |

Realized gains (losses) |

|

Unrealized gains (losses) |

|

Net gains (losses) |

| Net gains (losses) on: |

|

|

|

|

|

|

Equity exposures |

858.9 |

|

|

24.7 |

|

|

883.6 |

|

|

Bonds |

(142.3 |

) |

|

(908.0 |

) |

|

(1,050.3 |

) |

|

Other |

293.6 |

|

|

(530.1 |

) |

|

(236.5 |

) |

| |

1,010.2 |

|

|

(1,413.4 |

) |

|

(403.2 |

) |

| |

|

|

|

|

|

| |

Year ended December 31, 2024 |

| |

($ millions) |

| |

Realized gains (losses) |

|

Unrealized gains (losses) |

|

Net gains (losses) |

| Net gains (losses) on: |

|

|

|

|

|

|

Equity exposures |

1,508.8 |

|

|

350.2 |

|

|

1,859.0 |

|

|

Bonds |

(106.5 |

) |

|

(624.8 |

) |

|

(731.3 |

) |

|

Other |

148.7 |

|

|

(209.2 |

) |

|

(60.5 |

) |

| |

1,551.0 |

|

|

(483.8 |

) |

|

1,067.2 |

|

| |

|

|

|

|

|

|

|

|

- Net gains on

equity exposures of $1,859.0 million in 2024 was primarily

comprised of net gains on common stocks and equity derivatives, a

realized gain on the disposition of Stelco of $343.7 million and a

remeasurement gain on consolidation of Peak Achievement of $203.4

million.The company recorded net gains of $1,033.5 million (fourth

quarter of 2024 - $341.9 million) on equity total return swaps on

Fairfax subordinate voting shares. During the fourth quarter of

2024 the company closed out derivative contracts on 203,800 Fairfax

subordinate voting shares with an original notional amount of $68.5

million (Cdn$88.9 million). At December 31, 2024 the company

continued to hold equity total return swaps on 1,760,355 Fairfax

subordinate voting shares with an original notional amount of

$664.0 million (Cdn$846.1 million) or $377.19 (Cdn$480.62) per

share.Net losses on bonds of $731.3 million primarily reflected net

unrealized losses on U.S. treasuries and U.S. treasury bond forward

contracts, Brazilian government bonds and corporate and other

bonds, principally due to the increase in interest rates in the

fourth quarter of 2024.Net losses on other of $60.5 million

principally reflected unrealized losses of $154.3 million on the

company's holdings of Digit compulsory convertible preferred

shares, which was partially offset by dividends received in the

fourth quarter of 2024 of $112.3 million that were recorded within

interest and dividends in the consolidated statement of

earnings.

- The company's

fixed income portfolio is conservatively positioned with

effectively 71% of the fixed income portfolio invested in

government bonds, 19% in high quality corporate bonds, primarily

short-dated, and 10% in first mortgage loans.

- Interest expense

of $649.0 million (inclusive of $55.7 million on leases) was

primarily comprised (other than leases) of $456.6 million incurred

on borrowings by the holding company and the insurance and

reinsurance companies and $136.7 million incurred on borrowings by

the non-insurance companies (which are non-recourse to the holding

company).

- Provision for

income taxes of $1,375.6 million with an effective tax rate of

24.4% increased from $813.4 million with an effective tax rate of

13.8% in 2023, principally reflecting lower benefit from the tax

rate differential on income and losses outside Canada including the

effects of new Pillar Two global minimum taxes, lower non-taxable

investment income and changes to capital gains tax rates in India

that increased deferred income tax expense. The provision for

income taxes in 2023 also reflected a benefit for the change in tax

rate for deferred income taxes primarily related to deferred income

tax assets recognized as a result of new tax laws in Bermuda.

- On December 13,

2024 the company purchased the remaining shares of Brit from Brit's

minority shareholder, increasing the company's ownership interest

in Brit from 86.2% to 100.0%.

- During the

fourth quarter of 2024 the company completed two significant

acquisitions and commenced consolidating each entity in its

Non-insurance companies reporting segment at the respective

acquisition dates:

- On October 1,

2024 the company acquired all of the issued and outstanding common

shares of Sleep Country Canada Holdings Inc. ("Sleep Country") for

purchase consideration of $880.6 million (Cdn$1.2 billion).

Sleep Country is a specialty sleep retailer with a national retail

store network and multiple e-commerce platforms.

- On December 20,

2024 the company increased its equity interest in Peak Achievement

Athletics Inc. ("Peak Achievement") to 100.0% by acquiring the

42.6% equity interest owned by Sagard Holdings Inc. and the 14.8%

equity interest owned by other minority shareholders for purchase

consideration of $765.0 million. The company was required to

remeasure its existing equity accounted investment in Peak

Achievement to its fair value of $325.7 million upon consolidation

and recorded a pre-tax gain of $203.4 million in net gains on

investments in the consolidated statement of earnings, which

reflected Peak Achievement being now carried at approximately 8.5

times free cash flow. Peak Achievement is engaged in the design,

manufacture and distribution of performance sports equipment and

related apparel and accessories for ice hockey, roller hockey and

lacrosse, under brands such as Bauer Hockey, Cascade Lacrosse and

Maverik Lacrosse.

- These and other

smaller acquisitions resulted in an increase to goodwill and

intangible assets of $2.3 billion and to non-recourse debt of $1.2

billion during the year.

- The excess of

fair value over carrying value of investments in non-insurance

associates and market traded consolidated non-insurance

subsidiaries increased to $1,480.5 million at December 31,

2024 from $1,006.0 million at December 31, 2023, with $396.6

million of that increase related to publicly traded Eurobank. The

excess of fair value over carrying value at December 31, 2024

no longer includes an unrealized gain of $351.9 million on Stelco

as it was realized in the fourth quarter of 2024. Subsequent to

December 31, 2024, on January 23, 2025 the company sold 80.0

million shares or an approximate 2.2% equity interest in Eurobank

for gross proceeds of $190.8 million (€183.5 million, that was

received by the holding company), which decreased the company's

equity interest to 32.3% and will result in the recognition of a

realized gain of approximately $40 million in the consolidated

statement of earnings in the first quarter of 2025. The sale was a

mandatory technical adjustment to the company’s significant equity

interest in Eurobank and does not reflect in any way the company's

view on Eurobank’s valuation or long-term prospects.

- The company's

total debt to total capital ratio, excluding non-insurance

companies, increased to 24.8% at December 31, 2024 from 23.1%

at December 31, 2023, primarily reflecting increased total

debt (principally the issuance of $1.0 billion principal

amount of senior notes due 2054), partially offset by increased

common shareholders' equity.

- On November 22,

2024 the company completed an offering of aggregate Cdn$700.0

million principal amount of unsecured senior notes, comprising

Cdn$450 million of 4.73% unsecured senior notes due 2034 and

Cdn$250 million of 5.23% unsecured senior notes due 2054. A portion

of the aggregate net proceeds were used to redeem all of the

company's Series C and Series D preferred shares on December 31,

2024.

- During 2024 the

company purchased 207,974 of its subordinate voting shares for

treasury at a cost of $240.4 million and 1,346,953 subordinate

voting shares for cancellation at a cost $1,588.4 million, or

$1,179.24 per share.

- Subsequent to

December 31, 2024:

- On January 1,

2025 the company acquired a 50.0% equity interest in Blizzard

Vacatia Equity Partners LLC ("Blizzard Vacatia"). The company's

total cash investment of $835.0 million was principally comprised

of a senior secured loan, preferred shares and a mortgage-backed

loan. Blizzard Vacatia, through its subsidiaries, is engaged in the

development, sales, marketing and rental of timeshare resorts.

- During the

fourth quarter of 2024 the company entered into an agreement to

purchase an approximate 33% equity interest in Albingia SA

("Albingia") for purchase consideration of approximately $216

million (€209 million). Closing of the transaction is subject to

regulatory approvals and is expected to be in the second quarter of

2025. Albingia is a French insurance company that writes specialty

property and casualty insurance.

At December 31, 2024 there were 21,668,466

(December 31, 2023 - 23,003,248) common shares effectively

outstanding.

Consolidated balance sheet, earnings and

comprehensive income information, together with segmented premium

and combined ratio, prior year reserve development and catastrophe

loss information, follow and form part of this news release.

As previously announced, Fairfax will hold a

conference call to discuss its 2024 year-end results at 8:30 a.m.

Eastern time on Friday February 14, 2025. The call, consisting

of a presentation by the company followed by a question period, may

be accessed at 1 (800) 369-2143 (Canada or U.S.) or 1 (312)

470-0063 (International) with the passcode "FAIRFAX". A replay of

the call will be available from shortly after the termination of

the call until 5:00 p.m. Eastern time on Friday, February 28,

2025. The replay may be accessed at 1 (888) 325-4187 (Canada or

U.S.) or 1 (203) 369-3403 (International).

Fairfax Financial Holdings Limited is a holding

company which, through its subsidiaries, is primarily engaged in

property and casualty insurance and reinsurance and the associated

investment management.

| For further

information, contact: |

John

Varnell |

| |

Vice President, Corporate Development |

| |

(416) 367-4941 |

| Information

onCONSOLIDATED BALANCE SHEETSas at

December 31, 2024 and December 31, 2023(US$ millions

except per share amounts) |

|

|

|

|

| |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

| Assets |

|

|

|

|

|

|

|

|

Holding company cash and investments (including assets pledged for

derivative obligations – $193.6; December 31, 2023 – $197.7) |

|

|

2,502.7 |

|

|

|

|

1,781.6 |

|

| Insurance contract

receivables |

|

|

780.4 |

|

|

|

|

926.1 |

|

| |

|

|

|

|

|

|

|

| Portfolio investments |

|

|

|

|

|

|

|

| Subsidiary cash and short term

investments (including restricted cash and cash equivalents –

$1,240.7; December 31, 2023 – $637.0) |

|

|

7,620.5 |

|

|

|

|

7,165.6 |

|

| Bonds (cost $37,852.9; December

31, 2023 – $36,511.9) |

|

|

37,390.3 |

|

|

|

|

36,850.8 |

|

| Preferred stocks (cost $944.6;

December 31, 2023 – $898.3) |

|

|

2,365.0 |

|

|

|

|

2,447.4 |

|

| Common stocks (cost $7,116.1;

December 31, 2023 – $6,577.2) |

|

|

7,464.2 |

|

|

|

|

6,903.4 |

|

| Investments in associates (fair

value $8,144.8; December 31, 2023 – $7,553.2) |

|

|

7,153.3 |

|

|

|

|

6,607.6 |

|

| Derivatives and other invested

assets (cost $903.9; December 31, 2023 – $952.0) |

|

|

1,159.7 |

|

|

|

|

1,025.3 |

|

| Assets pledged for derivative

obligations (cost $154.8; December 31, 2023 – $137.7) |

|

|

150.8 |

|

|

|

|

139.3 |

|

| Fairfax India cash, portfolio

investments and associates (fair value $3,163.3; December 31, 2023

– $3,507.6) |

|

|

1,916.6 |

|

|

|

|

2,282.7 |

|

| |

|

|

65,220.4 |

|

|

|

|

63,422.1 |

|

| |

|

|

|

|

|

|

|

| Reinsurance contract assets

held |

|

|

10,682.6 |

|

|

|

|

10,887.7 |

|

| Deferred income tax assets |

|

|

325.0 |

|

|

|

|

301.1 |

|

| Goodwill and intangible

assets |

|

|

8,278.2 |

|

|

|

|

6,376.3 |

|

| Other assets |

|

|

8,988.0 |

|

|

|

|

8,290.2 |

|

| Total assets |

|

|

96,777.3 |

|

|

|

|

91,985.1 |

|

| |

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

| Accounts payable and accrued

liabilities |

|

|

6,078.3 |

|

|

|

|

5,487.2 |

|

| Derivative obligations |

|

|

356.9 |

|

|

|

|

444.9 |

|

| Deferred income tax

liabilities |

|

|

1,714.0 |

|

|

|

|

1,250.3 |

|

| Insurance contract payables |

|

|

923.0 |

|

|

|

|

1,206.9 |

|

| Insurance contract

liabilities |

|

|

47,602.2 |

|

|

|

|

46,171.4 |

|

| Borrowings – holding company and

insurance and reinsurance companies |

|

|

8,858.2 |

|

|

|

|

7,824.5 |

|

| Borrowings – non-insurance

companies |

|

|

2,895.5 |

|

|

|

|

1,899.0 |

|

| Total liabilities |

|

|

68,428.1 |

|

|

|

|

64,284.2 |

|

| |

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

| Common shareholders’ equity |

|

|

22,959.8 |

|

|

|

|

21,615.0 |

|

| Preferred stock |

|

|

1,108.2 |

|

|

|

|

1,335.5 |

|

| Shareholders’ equity attributable

to shareholders of Fairfax |

|

|

24,068.0 |

|

|

|

|

22,950.5 |

|

| Non-controlling interests |

|

|

4,281.2 |

|

|

|

|

4,750.4 |

|

| Total equity |

|

|

28,349.2 |

|

|

|

|

27,700.9 |

|

| |

|

|

96,777.3 |

|

|

|

|

91,985.1 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Book value per basic

share |

|

$ |

1,059.60 |

|

|

|

$ |

939.65 |

|

| Information

onCONSOLIDATED STATEMENTS OF EARNINGSfor the

fourth quarters and years ended December 31, 2024 and 2023(US$

millions except per share amounts) |

| |

|

Fourth quarter |

|

Year ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Insurance |

|

|

|

|

|

|

|

|

|

Insurance revenue |

|

|

7,744.2 |

|

|

|

6,901.8 |

|

|

|

31,064.1 |

|

|

|

26,934.8 |

|

|

Insurance service expenses |

|

|

(5,834.3 |

) |

|

|

(6,022.7 |

) |

|

|

(24,866.8 |

) |

|

|

(21,944.1 |

) |

|

Net insurance result |

|

|

1,909.9 |

|

|

|

879.1 |

|

|

|

6,197.3 |

|

|

|

4,990.7 |

|

|

Cost of reinsurance |

|

|

(1,414.9 |

) |

|

|

(1,220.9 |

) |

|

|

(6,197.7 |

) |

|

|

(4,977.4 |

) |

|

Recoveries of insurance service expenses |

|

|

848.0 |

|

|

|

1,258.0 |

|

|

|

4,453.2 |

|

|

|

3,943.7 |

|

|

Net reinsurance result |

|

|

(566.9 |

) |

|

|

37.1 |

|

|

|

(1,744.5 |

) |

|

|

(1,033.7 |

) |

|

Insurance service result |

|

|

1,343.0 |

|

|

|

916.2 |

|

|

|

4,452.8 |

|

|

|

3,957.0 |

|

|

Other insurance operating expenses |

|

|

(329.2 |

) |

|

|

(307.6 |

) |

|

|

(1,182.9 |

) |

|

|

(966.4 |

) |

|

Net finance income (expense) from insurance contracts |

|

|

261.0 |

|

|

|

(1,318.9 |

) |

|

|

(1,754.9 |

) |

|

|

(2,152.7 |

) |

|

Net finance income (expense) from reinsurance contract assets

held |

|

|

(57.6 |

) |

|

|

308.6 |

|

|

|

475.0 |

|

|

|

547.1 |

|

| |

|

|

1,217.2 |

|

|

|

(401.7 |

) |

|

|

1,990.0 |

|

|

|

1,385.0 |

|

| Investment

income |

|

|

|

|

|

|

|

|

|

Interest and dividends |

|

|

698.2 |

|

|

|

536.6 |

|

|

|

2,511.9 |

|

|

|

1,896.2 |

|

|

Share of profit of associates |

|

|

347.0 |

|

|

|

127.7 |

|

|

|

956.3 |

|

|

|

1,022.2 |

|

|

Net gains (losses) on investments |

|

|

(403.2 |

) |

|

|

1,464.4 |

|

|

|

1,067.2 |

|

|

|

1,949.5 |

|

| |

|

|

642.0 |

|

|

|

2,128.7 |

|

|

|

4,535.4 |

|

|

|

4,867.9 |

|

| Other revenue and

expenses |

|

|

|

|

|

|

|

|

|

Non-insurance revenue |

|

|

2,010.1 |

|

|

|

1,752.0 |

|

|

|

6,682.8 |

|

|

|

6,614.5 |

|

|

Non-insurance expenses |

|

|

(1,903.2 |

) |

|

|

(1,777.7 |

) |

|

|

(6,470.5 |

) |

|

|

(6,568.7 |

) |

|

Gain on sale and consolidation of insurance subsidiaries |

|

|

— |

|

|

|

290.7 |

|

|

|

— |

|

|

|

549.8 |

|

|

Interest expense |

|

|

(172.7 |

) |

|

|

(130.5 |

) |

|

|

(649.0 |

) |

|

|

(510.0 |

) |

|

Corporate and other expenses |

|

|

(116.2 |

) |

|

|

(158.2 |

) |

|

|

(450.2 |

) |

|

|

(430.2 |

) |

| |

|

|

(182.0 |

) |

|

|

(23.7 |

) |

|

|

(886.9 |

) |

|

|

(344.6 |

) |

| Earnings before income

taxes |

|

|

1,677.2 |

|

|

|

1,703.3 |

|

|

|

5,638.5 |

|

|

|

5,908.3 |

|

| Provision for income taxes |

|

|

(359.3 |

) |

|

|

(28.5 |

) |

|

|

(1,375.6 |

) |

|

|

(813.4 |

) |

| Net

earnings |

|

|

1,317.9 |

|

|

|

1,674.8 |

|

|

|

4,262.9 |

|

|

|

5,094.9 |

|

| |

|

|

|

|

|

|

|

|

| Attributable

to: |

|

|

|

|

|

|

|

|

| Shareholders of Fairfax |

|

|

1,152.2 |

|

|

|

1,328.5 |

|

|

|

3,874.9 |

|

|

|

4,381.8 |

|

| Non-controlling interests |

|

|

165.7 |

|

|

|

346.3 |

|

|

|

388.0 |

|

|

|

713.1 |

|

| |

|

|

1,317.9 |

|

|

|

1,674.8 |

|

|

|

4,262.9 |

|

|

|

5,094.9 |

|

| |

|

|

|

|

|

|

|

|

| Net earnings per

share |

|

$ |

54.46 |

|

|

$ |

57.02 |

|

|

$ |

173.41 |

|

|

$ |

186.87 |

|

| Net earnings per diluted

share |

|

$ |

50.42 |

|

|

$ |

52.87 |

|

|

$ |

160.56 |

|

|

$ |

173.24 |

|

| Cash dividends paid per

share |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

15.00 |

|

|

$ |

10.00 |

|

| Shares outstanding

(000) (weighted average) |

|

|

21,928 |

|

|

|

23,076 |

|

|

|

22,373 |

|

|

|

23,183 |

|

| Information

onCONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOMEfor the fourth quarters and years ended

December 31, 2024 and 2023(US$ millions) |

| |

|

Fourth quarter |

|

Year ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

| Net

earnings |

|

1,317.9 |

|

|

1,674.8 |

|

|

4,262.9 |

|

|

5,094.9 |

|

| |

|

|

|

|

|

|

|

|

| Other comprehensive

income (loss),net of income taxes |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Items that may be subsequently reclassified to net

earnings |

|

|

|

|

|

|

|

|

|

Net unrealized foreign currency translation gains (losses) on

foreign subsidiaries |

|

(500.4 |

) |

|

123.0 |

|

|

(652.5 |

) |

|

(39.6 |

) |

|

Gains (losses) on hedge of net investment in Canadian

subsidiaries |

|

123.3 |

|

|

(52.1 |

) |

|

173.9 |

|

|

(56.6 |

) |

|

Gains (losses) on hedge of net investment in European

operations |

|

60.0 |

|

|

(34.2 |

) |

|

51.5 |

|

|

(27.8 |

) |

|

Share of other comprehensive income (loss) of associates, excluding

net losses on defined benefit plans |

|

(202.4 |

) |

|

97.3 |

|

|

(135.3 |

) |

|

30.5 |

|

|

Other |

|

(1.1 |

) |

|

(7.2 |

) |

|

(6.3 |

) |

|

0.3 |

|

| |

|

(520.6 |

) |

|

126.8 |

|

|

(568.7 |

) |

|

(93.2 |

) |

|

Net unrealized foreign currency translation losses on foreign

subsidiaries reclassified to net earnings |

|

— |

|

|

— |

|

|

— |

|

|

1.9 |

|

|

Net unrealized foreign currency translation losses on associates

reclassified to net earnings |

|

6.3 |

|

|

19.8 |

|

|

6.5 |

|

|

18.2 |

|

| |

|

(514.3 |

) |

|

146.6 |

|

|

(562.2 |

) |

|

(73.1 |

) |

|

Items that will not be subsequently reclassified to net

earnings |

|

|

|

|

|

|

|

|

|

Net gains (losses) on defined benefit plans |

|

17.0 |

|

|

(46.8 |

) |

|

44.3 |

|

|

(32.9 |

) |

|

Share of net losses on defined benefit plans of associates |

|

(0.5 |

) |

|

(1.1 |

) |

|

(1.6 |

) |

|

(5.1 |

) |

|

Other |

|

9.6 |

|

|

7.2 |

|

|

21.1 |

|

|

28.2 |

|

| |

|

26.1 |

|

|

(40.7 |

) |

|

63.8 |

|

|

(9.8 |

) |

| |

|

|

|

|

|

|

|

|

| Other comprehensive

income (loss),net of income taxes |

|

(488.2 |

) |

|

105.9 |

|

|

(498.4 |

) |

|

(82.9 |

) |

| Comprehensive

income |

|

829.7 |

|

|

1,780.7 |

|

|

3,764.5 |

|

|

5,012.0 |

|

| |

|

|

|

|

|

|

|

|

| Attributable

to: |

|

|

|

|

|

|

|

|

| Shareholders of Fairfax |

|

724.4 |

|

|

1,436.3 |

|

|

3,455.3 |

|

|

4,353.4 |

|

| Non-controlling interests |

|

105.3 |

|

|

344.4 |

|

|

309.2 |

|

|

658.6 |

|

| |

|

829.7 |

|

|

1,780.7 |

|

|

3,764.5 |

|

|

5,012.0 |

|

SEGMENTED INFORMATION(US$ millions)

Third party gross premiums written, net premiums

written and combined ratios (on an undiscounted and discounted

basis) for the property and casualty insurance and reinsurance

operations (which excludes Life insurance and Run-off) in the

fourth quarters and full years ended December 31, 2024 and

2023 were as follows:

| Gross

Premiums Written |

|

Fourth quarter |

|

Year ended December 31, |

|

% change year-over-year |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Fourth quarter |

|

|

Full year |

|

|

Northbridge |

|

613.6 |

|

623.7 |

|

2,511.4 |

|

2,442.2 |

|

(1.6 |

)% |

|

2.8 |

% |

|

Crum & Forster |

|

1,282.6 |

|

1,296.1 |

|

5,625.9 |

|

5,217.5 |

|

(1.0 |

)% |

|

7.8 |

% |

|

Zenith National |

|

154.6 |

|

149.1 |

|

729.6 |

|

738.3 |

|

3.7 |

% |

|

(1.2 |

)% |

| North

American Insurers |

|

2,050.8 |

|

2,068.9 |

|

8,866.9 |

|

8,398.0 |

|

(0.9 |

)% |

|

5.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Allied World |

|

1,452.4 |

|

1,461.5 |

|

7,149.8 |

|

6,840.5 |

|

(0.6 |

)% |

|

4.5 |

% |

|

Odyssey Group |

|

1,562.1 |

|

1,314.6 |

|

6,245.5 |

|

6,332.6 |

|

18.8 |

% |

|

(1.4 |

)% |

|

Brit(1) |

|

915.9 |

|

799.3 |

|

3,759.7 |

|

3,731.7 |

|

14.6 |

% |

|

0.8 |

% |

| Global

Insurers and Reinsurers |

|

3,930.4 |

|

3,575.4 |

|

17,155.0 |

|

16,904.8 |

|

9.9 |

% |

|

1.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

International Insurers and Reinsurers(2) |

|

1,458.7 |

|

934.8 |

|

6,505.5 |

|

3,587.3 |

|

56.0 |

% |

|

81.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Property

and casualty insurance and reinsurance(2) |

|

7,439.9 |

|

6,579.1 |

|

32,527.4 |

|

28,890.1 |

|

13.1 |

% |

|

12.6 |

% |

| Net Premiums

Written |

|

Fourth quarter |

|

Year ended December 31, |

|

% change year-over-year |

| |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Fourth quarter |

|

|

Full year |

|

|

Northbridge |

|

552.5 |

|

557.0 |

|

2,226.3 |

|

2,145.4 |

|

(0.8 |

)% |

|

3.8 |

% |

|

Crum & Forster |

|

944.1 |

|

937.3 |

|

4,233.7 |

|

3,902.3 |

|

0.7 |

% |

|

8.5 |

% |

|

Zenith National |

|

158.7 |

|

153.5 |

|

741.6 |

|

755.1 |

|

3.4 |

% |

|

(1.8 |

)% |

| North American

Insurers |

|

1,655.3 |

|

1,647.8 |

|

7,201.6 |

|

6,802.8 |

|

0.5 |

% |

|

5.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Allied World |

|

929.3 |

|

960.8 |

|

5,049.1 |

|

4,839.5 |

|

(3.3 |

)% |

|

4.3 |

% |

|

Odyssey Group |

|

1,460.2 |

|

1,162.5 |

|

5,895.0 |

|

5,740.6 |

|

25.6 |

% |

|

2.7 |

% |

|

Brit(1) |

|

787.7 |

|

686.7 |

|

3,156.8 |

|

2,982.7 |

|

14.7 |

% |

|

5.8 |

% |

| Global Insurers and

Reinsurers |

|

3,177.2 |

|

2,810.0 |

|

14,100.9 |

|

13,562.8 |

|

13.1 |

% |

|

4.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| International Insurers

and Reinsurers(2) |

|

991.8 |

|

645.9 |

|

4,033.1 |

|

2,329.8 |

|

53.6 |

% |

|

73.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Property and casualty

insurance and reinsurance(2) |

|

5,824.3 |

|

5,103.7 |

|

25,335.6 |

|

22,695.4 |

|

14.1 |

% |

|

11.6 |

% |

| Combined

Ratios |

|

Undiscounted |

|

Discounted |

| |

|

Fourth quarter |

|

Year ended December 31, |

|

Fourth quarter |

|

Year ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Northbridge |

|

83.3 |

% |

|

91.5 |

% |

|

89.3 |

% |

|

91.1 |

% |

|

81.7 |

% |

|

82.2 |

% |

|

82.2 |

% |

|

80.8 |

% |

|

Crum & Forster |

|

92.6 |

% |

|

95.9 |

% |

|

95.0 |

% |

|

97.7 |

% |

|

82.6 |

% |

|

87.0 |

% |

|

85.9 |

% |

|

88.2 |

% |

|

Zenith National |

|

101.8 |

% |

|

87.0 |

% |

|

99.1 |

% |

|

93.8 |

% |

|

98.4 |

% |

|

82.9 |

% |

|

90.8 |

% |

|

85.6 |

% |

| North American

Insurers |

|

90.8 |

% |

|

93.6 |

% |

|

93.7 |

% |

|

95.2 |

% |

|

83.9 |

% |

|

85.2 |

% |

|

85.3 |

% |

|

85.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allied World |

|

83.4 |

% |

|

86.1 |

% |

|

89.1 |

% |

|

89.5 |

% |

|

72.7 |

% |

|

74.1 |

% |

|

77.5 |

% |

|

74.1 |

% |

|

Odyssey Group |

|

85.3 |

% |

|

88.1 |

% |

|

91.2 |

% |

|

93.4 |

% |

|

58.4 |

% |

|

79.8 |

% |

|

76.2 |

% |

|

81.7 |

% |

|

Brit(1) |

|

97.2 |

% |

|

88.3 |

% |

|

93.6 |

% |

|

91.9 |

% |

|

81.9 |

% |

|

80.0 |

% |

|

75.6 |

% |

|

76.6 |

% |

| Global Insurers and

Reinsurers |

|

87.3 |

% |

|

87.5 |

% |

|

91.0 |

% |

|

91.7 |

% |

|

69.7 |

% |

|

77.6 |

% |

|

76.6 |

% |

|

77.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| International Insurers

and Reinsurers |

|

95.5 |

% |

|

93.4 |

% |

|

97.3 |

% |

|

95.9 |

% |

|

85.9 |

% |

|

84.6 |

% |

|

89.1 |

% |

|

85.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property and casualty

insurance and reinsurance |

|

89.5 |

% |

|

89.9 |

% |

|

92.7 |

% |

|

93.2 |

% |

|

76.6 |

% |

|

80.8 |

% |

|

81.4 |

% |

|

81.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Excluding Ki Insurance,

gross premiums written increased by 17.4% and 3.7% in the fourth

quarter and full year of 2024 and net premiums written increased by

14.0% and 4.7% in the fourth quarter and full year of 2024.

Excluding Ki Insurance, the undiscounted combined ratios were 94.2%

and 92.2% in the fourth quarter and full year of 2024 and 88.4% and

91.7% in the fourth quarter and full year of 2023 (discounted

combined ratios of 80.0% and 73.3% in the fourth quarter and full

year of 2024 and 79.4% and 75.2% in the fourth quarter and full

year of 2023).(2) Excluding Gulf Insurance's gross

premiums written of $492.5 million and $2,736.3 million in the

fourth quarter and full year of 2024 and net premiums written of

$335.4 million and $1,613.7 million in the fourth quarter and full

year of 2024, gross premiums written in the International Insurers

and Reinsurers reporting segment increased by 3.4% and 5.1% in the

fourth quarter and full year of 2024 and net premiums written

increased by 1.6% and 3.8% in the fourth quarter and full year of

2024, while gross premiums written for the property and casualty

insurance and reinsurance operations increased by 5.6% and 3.1% in

the fourth quarter and full year of 2024 and net premiums written

increased by 7.5% and 4.5% in the fourth quarter and full year of

2024.

Prior year reserve development and current

period catastrophe losses, both on undiscounted basis, of the

property and casualty insurance and reinsurance operations (which

excludes Life insurance and Run-off) in the fourth quarters and

full years ended December 31, 2024 and 2023 were as

follows:

Net (Favourable) Adverse Prior Year Reserve

Development

| |

Fourth quarter |

|

Year ended December 31, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Northbridge |

(33.5 |

) |

|

(29.0 |

) |

|

(58.1 |

) |

|

(75.9 |

) |

|

Crum & Forster |

(0.2 |

) |

|

(0.1 |

) |

|

(0.8 |

) |

|

(0.5 |

) |

|

Zenith National |

(13.2 |

) |

|

(19.7 |

) |

|

(42.1 |

) |

|

(50.8 |

) |

| North American

Insurers |

(46.9 |

) |

|

(48.8 |

) |

|

(101.0 |

) |

|

(127.2 |

) |

| |

|

|

|

|

|

|

|

|

Allied World |

(20.9 |

) |

|

1.4 |

|

|

(22.2 |

) |

|

— |

|

|

Odyssey Group |

(156.4 |

) |

|

(86.1 |

) |

|

(207.4 |

) |

|

(78.6 |

) |

|

Brit |

(16.2 |

) |

|

(2.8 |

) |

|

(27.8 |

) |

|

(3.0 |

) |

| Global Insurers and

Reinsurers |

(193.5 |

) |

|

(87.5 |

) |

|

(257.4 |

) |

|

(81.6 |

) |

| |

|

|

|

|

|

|

|

| International Insurers

and Reinsurers |

(61.0 |

) |

|

(15.4 |

) |

|

(235.2 |

) |

|

(100.8 |

) |

| |

|

|

|

|

|

|

|

| Property and casualty

insurance and reinsurance |

(301.4 |

) |

|

(151.7 |

) |

|

(593.6 |

) |

|

(309.6 |

) |

Current Period Catastrophe

Losses

| |

|

Fourth quarter |

|

|

Year ended December 31, |

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| |

Losses(1) |

|

Combinedratio

impact(2) |

|

Losses(1) |

|

Combinedratio impact(2) |

|

Losses(1) |

|

Combinedratio

impact(2) |

|

Losses(1) |

|

Combinedratio impact(2) |

|

Hurricane Milton |

|

235.3 |

|

|

3.8 |

|

|

|

— |

|

|

— |

|

|

|

235.3 |

|

|

1.0 |

|

|

|

— |

|

|

— |

|

|

Hurricane Helene |

|

68.9 |

|

|

1.1 |

|

|

|

— |

|

|

— |

|

|

|

174.0 |

|

|

0.7 |

|

|

|

— |

|

|

— |

|

|

Canadian events(3) |

|

10.0 |

|

|

0.2 |

|

|

|

— |

|

|

— |

|

|

|

142.1 |

|

|

0.6 |

|

|

|

— |

|

|

— |

|

|

Dubai floods |

|

17.8 |

|

|

0.3 |

|

|

|

— |

|

|

— |

|

|

|

89.1 |

|

|

0.4 |

|

|

|

— |

|

|

— |

|

|

Hawaii wildfires |

|

— |

|

|

— |

|

|

|

3.3 |

|

|

0.1 |

|

|

|

— |

|

|

— |

|

|

|

183.6 |

|

|

0.8 |

|

|

Turkey earthquake |

|

— |

|

|

— |

|

|

|

1.2 |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

113.0 |

|

|

0.5 |

|

|

Italy hailstorms |

|

— |

|

|

— |

|

|

|

30.8 |

|

|

0.5 |

|

|

|

— |

|

|

— |

|

|

|

47.2 |

|

|

0.2 |

|

|

Other |

|

67.2 |

|

|

1.0 |

|

|

|

146.6 |

|

|

2.6 |

|

|

|

458.8 |

|

|

1.8 |

|

|

|

553.5 |

|

|

2.5 |

|

| Total catastrophe losses |

|

399.2 |

|

|

6.4 |

|

|

|

181.9 |

|

|

3.2 |

|

|

|

1,099.3 |

|

|

4.5 |

|

|

|

897.3 |

|

|

4.0 |

|

(1) Net of reinstatement

premiums.(2) Expressed in combined ratio

points.(3) Comprised of the Calgary hailstorm,

flooding in Ontario and Quebec and the Jasper wildfire.

Certain statements contained herein may

constitute forward-looking statements and are made pursuant to the

"safe harbour" provisions of the United States Private Securities

Litigation Reform Act of 1995 and any applicable Canadian

securities regulations. Such forward-looking statements are subject

to known and unknown risks, uncertainties and other factors which

may cause the actual results, performance or achievements of

Fairfax to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Such factors include, but are not

limited to: our ability to complete acquisitions and other

strategic transactions on the terms and timeframes contemplated,

and to achieve the anticipated benefits therefrom; a reduction in

net earnings if our loss reserves are insufficient; underwriting

losses on the risks we insure that are higher than expected; the

occurrence of catastrophic events with a frequency or severity

exceeding our estimates; changes in market variables, including

unfavourable changes in interest rates, foreign exchange rates,

equity prices and credit spreads, which could negatively affect our

operating results and investment portfolio; the cycles of the

insurance market and general economic conditions, which can

substantially influence our and our competitors’ premium rates and

capacity to write new business; insufficient reserves for asbestos,

environmental and other latent claims; exposure to credit risk in

the event our reinsurers fail to make payments to us under our

reinsurance arrangements; exposure to credit risk in the event our

insureds, insurance producers or reinsurance intermediaries fail to

remit premiums that are owed to us or failure by our insureds to

reimburse us for deductibles that are paid by us on their behalf;

our inability to maintain our long term debt ratings, the inability

of our subsidiaries to maintain financial or claims paying ability

ratings and the impact of a downgrade of such ratings on derivative

transactions that we or our subsidiaries have entered into; risks

associated with implementing our business strategies; the timing of

claims payments being sooner or the receipt of reinsurance

recoverables being later than anticipated by us; risks associated

with any use we may make of derivative instruments; the failure of

any hedging methods we may employ to achieve their desired risk

management objective; a decrease in the level of demand for

insurance or reinsurance products, or increased competition in the

insurance industry; the impact of emerging claim and coverage

issues or the failure of any of the loss limitation methods we

employ; our inability to access cash of our subsidiaries; an

increase in the amount of capital that we and our subsidiaries are

required to maintain and our inability to obtain required levels of

capital on favourable terms, if at all; the loss of key employees;

our inability to obtain reinsurance coverage in sufficient amounts,

at reasonable prices or on terms that adequately protect us; the

passage of legislation subjecting our businesses to additional

adverse requirements, supervision or regulation, including

additional tax regulation, in the United States, Bermuda, Canada or

other jurisdictions in which we operate; risks associated with

applicable laws and regulations relating to sanctions and corrupt

practices in foreign jurisdictions in which we operate; risks

associated with government investigations of, and litigation and

negative publicity related to, insurance industry practice or any

other conduct; risks associated with political and other

developments in foreign jurisdictions in which we operate; risks

associated with legal or regulatory proceedings or significant

litigation; failures or security breaches of our computer and data

processing systems; the influence exercisable by our significant

shareholder; adverse fluctuations in foreign currency exchange

rates; our dependence on independent brokers over whom we exercise

little control; operational, financial reporting and other risks

associated with IFRS 17; financial reporting risks relating to

deferred taxes associated with amendments to IAS 12; impairment of

the carrying value of our goodwill, indefinite-lived intangible

assets or investments in associates; our failure to realize

deferred income tax assets; technological or other change which

adversely impacts demand, or the premiums payable, for the

insurance coverages we offer; disruptions of our information

technology systems; assessments and shared market mechanisms which

may adversely affect our insurance subsidiaries; and risks

associated with the conflicts in Ukraine and Israel and the

development of other geopolitical events and economic disruptions

worldwide. Additional risks and uncertainties are described in our

most recently issued Annual Report, which is available at

www.fairfax.ca, and in our Base Shelf Prospectus (under "Risk

Factors") filed with the securities regulatory authorities in

Canada, which is available on SEDAR+ at www.sedarplus.ca. Fairfax

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable

securities law.

GLOSSARY OF NON-GAAP AND OTHER FINANCIAL

MEASURESManagement analyzes and assesses the underlying

insurance and reinsurance operations, and the financial position of

the consolidated company, through various measures and ratios.

Certain of the measures and ratios provided in this news release,

which have been used consistently and disclosed regularly in the

company's Annual Reports and interim financial reporting, do not

have a prescribed meaning under IFRS Accounting Standards and may

not be comparable to similar measures presented by other companies.

Those measures and ratios are described below.

Underwriting profit (loss) – A

measure of underwriting activity calculated as insurance service

result with the effects of discounting for net claims incurred in

the current period and changes in the risk adjustment and other

excluded, and other insurance operating expenses deducted, as shown

in the table on page 2 of this news release.

Operating income (loss) – This

measure is used by the company as a pre-tax performance measure of

operations that excludes net finance income (expense) from

insurance contracts and reinsurance contract assets held, net gains

(losses) on investments, interest expense and corporate overhead

and other, and that includes interest and dividends and share of

profit (loss) of associates, which the company consider to be more

predictable sources of investment income. Operating income (loss)

includes the insurance service result and other insurance operating

expenses of the insurance and reinsurance operations and the

revenue and expenses of the non-insurance companies. A

reconciliation of operating income (loss) to earnings before income

taxes, the most directly comparable IFRS measure, is presented in

the table on page 2 of this news release.

Adjusted operating income

(loss) – Calculated as the sum of underwriting profit

(loss), interest and dividends and share of profit of associates,

this measure is used in a similar manner to operating income

(loss).

Gross premiums written – An

indicator of the volume of new business generated, it represents

the total premiums on policies issued by the company during a

specified period, irrespective of the portion ceded or earned.

Net premiums written – A

measure of the new business volume and insurance risk that the

company has chosen to retain from new business generated, it

represents gross premiums written less amounts ceded to

reinsurers.

Undiscounted combined ratio – A

traditional performance measure of underwriting results of property

and casualty companies, it is calculated by the company as

underwriting expense (comprised of losses on claims, commissions

and other underwriting expenses) expressed as a percentage of net

premiums earned. Net premiums earned is calculated as insurance

revenue less cost of reinsurance, adjusted for net commission

expense on assumed business and other. Underwriting expense is

calculated as insurance service expenses less recoveries of

insurance service expenses and other insurance operating expenses,

adjusted for the effects of discounting, risk adjustment and other.

The combined ratio is used by the company for comparisons to

historical underwriting results, to the underwriting results of

competitors and to the broader property and casualty industry, as

well as for evaluating the performance of individual operating

companies. The company may also refer to combined ratio

points, which expresses, on an undiscounted basis, a loss

that is a component of losses on claims, net, such as a catastrophe

loss or prior year reserve development, as a percentage of net

premiums earned during the same period.

Discounted combined ratio – A

performance measure of underwriting results under IFRS 17, it is

calculated by the company as insurance service expenses less

recoveries of insurance service expenses, expressed as a percentage

of net insurance revenue. Net insurance revenue is calculated as

insurance revenue less cost of reinsurance, both as presented in

the company's consolidated statements of earnings.

Float – In the insurance

industry the funds available for investment that arise as an

insurance or reinsurance operation receives premiums in advance of

the payment of claims is referred to as float. The company

calculates its float as the sum of its insurance contract

liabilities and insurance contract payables, less the sum of its

reinsurance contract assets held and insurance contract

receivables, adjusted to remove the effects of discounting and risk

adjustment from insurance contract liabilities and reinsurance

contract assets held.

Book value per basic share –

The company considers book value per basic share a key performance

measure as one of the company’s stated objectives is to build long

term shareholder value by compounding book value per basic share by

15% annually over the long term. This measure is calculated by the

company as common shareholders' equity divided by the number of

common shares effectively outstanding. Increase or decrease

in book value per basic share adjusted for the $15.00 per common

share dividend is calculated in the same manner except

that it assumes the annual $15.00 per common share dividend paid in

the first quarter of 2024 was not paid and book value per basic

share at the end of the current reporting period would be higher as

a result.

Total debt to total capital ratio,

excluding non-insurance companies – The company uses this

ratio to assess the amount of leverage employed in its operations.

As the borrowings of the non-insurance companies are non-recourse

to the Fairfax holding company, this ratio excludes the borrowings

and non-controlling interests of the non-insurance companies in

calculating total debt and total capital, respectively.

| |

December 31, 2024 |

|

December 31, 2023 |

| |

As presented in information on the consolidated balance

sheet |

|

|

Adjust for consolidatednon-insurance

companies |

|

Excluding consolidatednon-insurance

companies |

|

|

As presented in information on the consolidated balance sheet |

|

|

Adjust for consolidatednon-insurance companies |

|

Excluding consolidatednon-insurance companies |

|

|

Total debt |

11,753.7 |

|

|

2,895.5 |

|

8,858.2 |

|

|

9,723.5 |

|

|

1,899.0 |

|

7,824.5 |

|

| Total equity |

28,349.2 |

|

|

1,541.0 |

|

26,808.2 |

|

|

27,700.9 |

|

|

1,634.6 |

|

26,066.3 |

|

| Total capital |

40,102.9 |

|

|

|

|

35,666.4 |

|

|

37,424.4 |

|

|

|

|

33,890.8 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total debt to total capital

ratio |

29.3 |

% |

|

|

|

24.8 |

% |

|

26.0 |

% |

|

|

|

23.1 |

% |

Excess (deficiency) of fair value over

carrying value – These pre-tax amounts, while not included

in the calculation of book value per basic share, are regularly

reviewed by management as an indicator of investment performance

for the company's non-insurance associates and market traded

consolidated non-insurance subsidiaries that are considered to be

portfolio investments, which are Fairfax India, Thomas Cook India,

Dexterra Group, Boat Rocker and Farmers Edge (privatized in

2024).

In the determination of this non-GAAP

performance measure the fair value and carrying value of

non-insurance associates at December 31, 2024 were $7,394.9

and $6,615.9 (December 31, 2023 - $6,825.9 and $6,221.7),

which are the IFRS fair values and carrying values included in the

company's information on consolidated balance sheets as at

December 31, 2024 and December 31, 2023. Excluded from

this performance measure are (i) insurance and reinsurance

associates and (ii) associates held by market traded consolidated

non-insurance companies that are already included in the carrying

values of those companies.

The fair values of market traded consolidated

non-insurance companies are calculated as the company's pro rata

ownership share of each subsidiary's market capitalization as

determined by traded share prices at the financial statement date.

The carrying value of each subsidiary represents Fairfax's share of

that subsidiary's net assets, calculated as the subsidiary's total

assets less total liabilities and non-controlling interests. All

balances used in the calculation of carrying value are those

included in the company's information on consolidated balance

sheets as at December 31, 2024 and December 31, 2023.

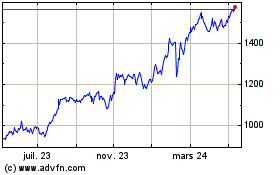

Fairfax Financial (TSX:FFH)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Fairfax Financial (TSX:FFH)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025