Freehold Royalties Ltd. (Freehold or the Company) (TSX:FRU)

announces first quarter results for the period ended March 31,

2022.

Operating and Financial Highlights

| |

Three Months Ended March 31 |

Three Months Ended December 31 |

|

FINANCIAL ($ millions, except as noted) |

2022 |

|

2021 |

|

Change |

2021 |

|

Change |

|

Funds from operations |

71.9 |

|

32.4 |

|

122 |

% |

68.7 |

|

5 |

% |

| Funds from operations per

share, basic ($) (1) |

0.48 |

|

0.25 |

|

92 |

% |

0.46 |

|

4 |

% |

| Acquisitions and related

expenditures |

1.3 |

|

79.8 |

|

nm |

|

67.9 |

|

nm |

|

| Dividends paid per share ($)

(2) |

0.18 |

|

0.06 |

|

200 |

% |

0.16 |

|

13 |

% |

| Payout ratio (%) (3) |

38 |

% |

24 |

% |

14 |

% |

35 |

% |

3 |

% |

| Net debt |

62.6 |

|

64.8 |

|

(3 |

%) |

101.2 |

|

(38 |

%) |

|

OPERATING |

|

|

|

|

|

|

Total production (boe/d) (4) |

13,676 |

|

10,944 |

|

25 |

% |

14,005 |

|

(2 |

%) |

| Oil and NGL (%) |

60 |

% |

54 |

% |

6 |

% |

59 |

% |

1 |

% |

| Petroleum and natural gas

realized price ($/boe) (4) |

69.71 |

|

37.31 |

|

87 |

% |

57.44 |

|

21 |

% |

| Cash costs ($/boe) (3)

(4) |

3.70 |

|

4.37 |

|

(15 |

%) |

3.57 |

|

4 |

% |

| Netback ($/boe) (3) (4) |

66.17 |

|

32.94 |

|

101 |

% |

53.58 |

|

23 |

% |

|

ROYALTY INTEREST DRILLING (gross / net) |

|

|

|

|

|

|

Canada |

144 / 5.9 |

|

87/ 3.4 |

|

66% / 74 |

% |

149 / 5.2 |

|

(3%) / 13 |

% |

| United States |

100 / 0.4 |

|

18 / 0.1 |

|

455% / 300 |

% |

101 / 0.5 |

|

(1%) / (20 |

%) |

President’s Message

Approximately eighteen months after Freehold’s

initial expansion in the US, the Company continues to execute its

North American strategy providing shareholders a sustainable

dividend, low leverage and diversification to royalty payors

operating in core oil and gas plays throughout North America. We

achieved record level funds from operations for the quarter,

marking the second straight period reaching this achievement.

Through the efforts of our team and the expansion of our North

American portfolio, we are a bigger, better company and will

continue to showcase this moving forward.

Volumes averaged 13,676 boe/d for Q1-2022, down

slightly from the previous quarter, but up 25% from Q1-2021. Our

Canadian portfolio was impacted by cold temperatures to start 2022.

In the US, timing delays in bringing new wells on production

resulted in a decline in volumes quarter over quarter, despite

strong permitting and drilling activity.

Drilling activity levels on the Company’s

royalty lands remained robust over the quarter, both within the US

and Canada as high-quality counterparties put capital to work into

plays such as the Viking, Clearwater, Eagle Ford and Permian. As

commodity prices have increased, we have seen increased capital

directed to drilling on our royalty assets.

Typical cycle times from when a well is

permitted to when a well is placed on production in the US is

approximately nine months, as compared to approximately three

months in Canada. Accordingly, the increased development activity

over the past two quarters in our US portfolio will contribute

royalty volumes in the mid to latter part of 2022 whereas in

Canada, this activity is already contributing to our quarterly

results. The extended cycle times in the US predominantly relate to

the logistics and timing of multiple wells drilled off a central

pad site and the subsequent completions operations once the

drilling rig has moved off. As our US asset base has a greater

concentration to larger investment grade producers with

corresponding larger programs, these delays are expected.

After six consecutive quarters of increasing our

dividend, we are maintaining our monthly dividend at $0.08/share,

reflecting our long-term view of commodity pricing and what we see

as a strong suite of opportunities to enhance our royalty portfolio

with strategic acquisition work within Canada and the US. Assuming

current dividend levels for the entire quarter would have implied a

payout of approximately 50% while Freehold generated record funds

from operations. We will evaluate our monthly dividend as part of

our Q2-2022 which will be released in August 2022.

Subsequent to quarter end, Freehold entered into

a definitive agreement to acquire mineral title and overriding

royalty interests in the core Midland basin of the Permian for

US$15.5 million, that will be funded through available credit

capacity. We believe investing in high quality acquisitions

provides the best opportunity to maximize value for our

shareholders.

2021 was an exciting year for Freehold and we

feel we have continued that momentum into 2022. Through our

efforts, we have strengthened Freehold’s asset base, balance sheet

and the long-term sustainability of our business. Enhanced business

strength within the portfolio provides significant optionality for

Freehold to: (i) continue our measured pace of dividend growth

toward a 60% payout ratio; (ii) continue our disciplined

acquisition work to grow our Company across North America, and

(iii) reduce Company net debt.

Dividend Announcement

Freehold’s Board of Directors (the Board)

announced that it has declared a monthly dividend of $0.08 per

common share to be paid on June 15, 2022, to shareholders of record

on May 31, 2022. The dividend announced today strikes a balance

between commodity price volatility, managing our financial

leverage, and portfolio reinvestment.

Post Quarter US Acquisition

In May 2022, Freehold entered into a definitive

agreement to acquire mineral title and overriding royalty interests

across approximately 1,100 net royalty acres (220,000 gross acres)

in core Midland basin of the Permian for US$15.5 million, before

customary adjustments. 2023 production volumes associated with the

transaction are forecast to average approximately 130 boe/d.

Closing of the transaction is anticipated for late Q2-2022. This

acquisition adds to Freehold’s established position in the Midland

basin, adding additional top tier acreage in one of North America’s

premier basins.

First Quarter Highlights

- Record level

total funds from operations in Q1-2022 of $71.9 million

($0.48/share) was partially used to pay down $41.0 million of

long-term debt.

- Freehold’s

production averaged 13,676 boe/d in Q1-2022, an increase of 25%

over Q1-2021 and a slight decrease of 2% over Q4-2021.

- Canadian oil and

gas royalty volumes declined 1% in Q1-2022 relative to Q4-2021,

averaging 9,793 boe/d. This decline was mainly due to extreme cold

temperatures impacting January and February volumes, with March

volumes showing recovery.

- US oil and gas royalty production

averaged 3,883 boe/d in Q1-2022, down from 4,075 boe/d in Q4-2021.

US volumes were impacted by the timing of bringing new wells

onstream in addition to certain wells being shut-in for offsetting

drilling and completion operations.

- Freehold

achieved a 132% increase in gross wells drilled on our royalty

lands in Q1-2022 versus Q1-2021. In total, Freehold had 244 gross

(6.3 net) wells drilled in Q1-2022, slightly down on a gross basis

versus Q4-2021 but up on a net basis. For Q1-2022 there were an

average of nine rigs drilling on our Canadian lands and 17 rigs

drilling on Freehold’s US lands.

- Recorded a

netback (1) of $66.17/boe in Q1-2022, up 23% over Q4-2021. Over the

past successive quarters, the higher netbacks represent a continued

structural change in Freehold’s business brought on by an

increasing share of revenue from our US assets which receive

premium pricing versus our Canadian assets.

- Net debt (1) of

$62.6 million at Q1-2022, represents 0.3 times trailing funds from

operations.

(1) See Non-GAAP Financial Ratios and Other Financial

Measure

Drilling and Leasing Activity

In total, 244 gross wells were drilled on

Freehold’s royalty lands in Q1-2022, a 132% increase versus the

same period in 2021. Significantly increased drilling activity

reflects the strong upward movement in oil prices resulting in

increased capital spending by our royalty payors in addition to an

increase in our royalty lands available to drill associated with

our 2021 US and Canadian royalty transactions.

Of the total wells drilled in Q1-2022,

approximately 36% of gross wells on Freehold royalty lands targeted

prospects in Texas, 30% in Alberta, and 27% in Saskatchewan with

the balance spread across other regions. More broadly, 59% of all

wells drilled targeted Canadian prospects with the remainder

targeting Freehold’s US acreage.

Canada

Through Q1-2022, Freehold has seen consistent

drilling activity in plays including the Viking, Mississippian,

Clearwater, Deep Basin and Cardium. We are also seeing a strong

increase in drilling in plays including the Shaunavon and East

Shale Duvernay. Approximately 83% of wells drilled on Freehold’s

Canadian lands were on gross overriding royalty (GORR) prospects

with the remaining 17% targeting mineral title prospects.

As producers balance sheets are improved and

their funds from operations become more robust, we are seeing an

increase in drilling activities more broadly throughout our

Canadian royalty portfolio. In total, we had 144 gross locations

drilled compared to 87 gross locations in Canada during the same

period in 2021.

During Q1-2022, Freehold generated $0.6 million

in bonus and rental consideration by entering into 32 distinct

leasing arrangements with 11 different counterparties.

US

In the US, activity levels on Freehold’s royalty

lands were generally in line with expectations with the focus on

light oil prospects targeting the Permian and Eagle Ford basins. We

continue to see development backstopped by a strong group of

disciplined investment grade public companies along with an active

group of private companies.

Although US net wells are lower than in Canada,

US wells are significantly more prolific as first year production

contributes approximately ten times that of an average Canadian

well in our portfolio. We also note that we are seeing upwards of

six to twelve months from initial license to first production

within our US royalty assets (compared to three to four months in

Canada, on average). Overall, 100 gross wells were drilled on our

US royalty lands during Q1-2022, which compares to 18 gross wells

during the same period in 2021, the increase largely due to more

royalty lands available to drill associated with our 2021 US

royalty property transactions.

In Q1-2022, Freehold executed its first US

mineral lease adding $0.3 million of lease bonus consideration with

active dialogue with a number of private operators.

Royalty Interest Drilling

|

|

Three Months Ended March 31 |

|

|

2022 |

2021 |

|

|

Gross |

Net (1) |

Gross |

Net (1) |

| Canada |

144 |

5.9 |

87 |

3.4 |

|

United States |

100 |

0.4 |

18 |

0.1 |

|

Total |

244 |

6.3 |

105 |

3.5 |

(1) Equivalent net wells are the aggregate of the numbers

obtained by multiplying each gross well by our royalty interest

percentage

2022

Guidance

The following table summarizes our key

assumptions for 2022, which remains unchanged.

| |

|

Guidance Date |

|

2022 Average |

|

May 10, 2022 |

| Average

production (boe/d) (1) |

|

13,750-14,750 |

| Funds from

operations (mm) |

|

$230-$250 |

| West Texas

Intermediate crude oil (US$/bbl) |

|

$75.00 |

| Edmonton Light

Sweet crude oil (Cdn$/bbl) |

|

$88.00 |

| AECO natural gas

(Cdn$/Mcf) |

|

$4.00 |

| NYMEX natural gas

(US$/Mcf) |

|

$4.00 |

| Exchange rate

(US$/Cdn$) |

|

|

0.80 |

(1) 2022 production is expected to consist of 8% heavy oil, 41%

light and medium oil, 11% NGL’s and 40% natural gas

Annual Meeting

Freehold’s annual meeting of Shareholders will

be conducted in person and via live audio webcast at

https://video.isilive.ca/rife/2022-05-10/ commencing at 4:00 PM

(MST) on Tuesday May 10, 2022. Further details are available on our

website at

www.freeholdroyalties.com/investors/events-presentations.

Conference Call Details

A conference call to discuss financial and

operational results for the period ended March 31, 2022, will be

held for the investment community on Wednesday May 11, 2022,

beginning at 7:00 AM MST (9:00 AM EST). To participate in the

conference call, approximately 10 minutes prior to the conference

call, please dial 1-800-898-3989 (toll-free in North America)

participant passcode is 6797277#.

Select Quarterly Information

|

|

|

2022 |

|

|

2021 |

|

|

2020 |

|

|

Financial ($000s, except as noted) |

Q1 |

Q4 |

Q3 |

Q2 |

Q1 |

Q4 |

Q3 |

Q2 |

|

Royalty and other revenue |

|

87,605 |

|

|

75,202 |

|

|

51,423 |

|

|

45,353 |

|

|

37,014 |

|

|

25,882 |

|

|

23,156 |

|

|

14,847 |

|

|

Net Income (loss) |

|

38,395 |

|

|

31,178 |

|

|

22,726 |

|

|

12,545 |

|

|

5,635 |

|

|

373 |

|

|

139 |

|

|

(5,421 |

) |

|

Per share, basic ($) (1) |

$ |

0.25 |

|

$ |

0.21 |

|

$ |

0.17 |

|

$ |

0.10 |

|

$ |

0.04 |

|

$ |

- |

|

$ |

- |

|

$ |

(0.05 |

) |

|

Cash flows from operations |

|

69,300 |

|

|

59,700 |

|

|

43,911 |

|

|

33,420 |

|

|

24,990 |

|

|

20,610 |

|

|

1,130 |

|

|

13,144 |

|

|

Funds from operations |

|

71,893 |

|

|

68,773 |

|

|

48,247 |

|

|

40,208 |

|

|

32,421 |

|

|

22,129 |

|

|

19,893 |

|

|

10,622 |

|

|

Per share, basic ($) (1) |

$ |

0.48 |

|

$ |

0.46 |

|

$ |

0.36 |

|

$ |

0.31 |

|

$ |

0.25 |

|

$ |

0.19 |

|

$ |

0.17 |

|

$ |

0.09 |

|

|

Acquisitions and related expenditures |

|

1,294 |

|

|

67,906 |

|

|

228,382 |

|

|

930 |

|

|

79,782 |

|

|

222 |

|

|

485 |

|

|

981 |

|

|

Dividends paid |

|

27,112 |

|

|

24,094 |

|

|

17,095 |

|

|

13,147 |

|

|

7,633 |

|

|

5,342 |

|

|

5,342 |

|

|

9,790 |

|

|

Per share ($) (2) |

$ |

0.18 |

|

$ |

0.16 |

|

$ |

0.13 |

|

$ |

0.10 |

|

$ |

0.06 |

|

$ |

0.045 |

|

$ |

0.045 |

|

$ |

0.0825 |

|

|

Dividends declared |

|

30,124 |

|

|

25,598 |

|

|

19,364 |

|

|

14,464 |

|

|

9,201 |

|

|

5,938 |

|

|

5,342 |

|

|

5,341 |

|

|

Per share ($) (2) |

$ |

0.20 |

|

$ |

0.17 |

|

$ |

0.14 |

|

$ |

0.11 |

|

$ |

0.07 |

|

$ |

0.05 |

|

$ |

0.045 |

|

$ |

0.045 |

|

|

Payout ratio (%) (3) |

|

38 |

% |

|

35 |

% |

|

35 |

% |

|

33 |

% |

|

24 |

% |

|

24 |

% |

|

27 |

% |

|

92 |

% |

|

Long term debt |

|

105,000 |

|

|

146,000 |

|

|

126,000 |

|

|

78,000 |

|

|

96,000 |

|

|

93,000 |

|

|

107,000 |

|

|

102,000 |

|

|

Net debt |

|

62,578 |

|

|

101,229 |

|

|

75,278 |

|

|

40,751 |

|

|

64,797 |

|

|

65,765 |

|

|

81,678 |

|

|

96,071 |

|

|

Shares outstanding, period end (000s) |

|

150,626 |

|

|

150,612 |

|

|

150,585 |

|

|

131,490 |

|

|

131,463 |

|

|

118,788 |

|

|

118,746 |

|

|

118,705 |

|

|

Average shares outstanding (000s) (1) |

|

150,612 |

|

|

150,585 |

|

|

132,941 |

|

|

131,463 |

|

|

130,874 |

|

|

118,747 |

|

|

118,706 |

|

|

118,664 |

|

|

Operating |

|

|

|

|

|

|

|

|

|

Light and medium oil (bbl/d) |

|

5,305 |

|

|

5,401 |

|

|

4,038 |

|

|

4,102 |

|

|

3,811 |

|

|

3,239 |

|

|

3,384 |

|

|

3,314 |

|

|

Heavy oil (bbl/d) |

|

1,139 |

|

|

1,254 |

|

|

1,236 |

|

|

1,199 |

|

|

1,045 |

|

|

1,173 |

|

|

791 |

|

|

920 |

|

|

NGL (bbl/d) |

|

1,757 |

|

|

1,564 |

|

|

1,125 |

|

|

1,107 |

|

|

1,065 |

|

|

824 |

|

|

859 |

|

|

788 |

|

|

Total liquids (bbl/d) |

|

8,201 |

|

|

8,219 |

|

|

6,399 |

|

|

6,408 |

|

|

5,921 |

|

|

5,236 |

|

|

5,034 |

|

|

5,022 |

|

|

Natural gas (Mcf/d) |

|

32,845 |

|

|

34,700 |

|

|

29,203 |

|

|

28,376 |

|

|

30,132 |

|

|

26,671 |

|

|

24,656 |

|

|

25,576 |

|

|

Total production (boe/d) (4) |

|

13,676 |

|

|

14,005 |

|

|

11,265 |

|

|

11,137 |

|

|

10,944 |

|

|

9,681 |

|

|

9,143 |

|

|

9,285 |

|

|

Oil and NGL (%) |

|

60 |

% |

|

59 |

% |

|

57 |

% |

|

58 |

% |

|

54 |

% |

|

54 |

% |

|

55 |

% |

|

54 |

% |

|

Petroleum and natural gas realized price ($/boe) (4) |

|

69.71 |

|

|

57.44 |

|

|

49.17 |

|

|

44.21 |

|

|

37.31 |

|

|

28.16 |

|

|

26.95 |

|

|

17.06 |

|

|

Cash costs ($/boe) (3)(4) |

|

3.70 |

|

|

3.57 |

|

|

2.49 |

|

|

4.48 |

|

|

4.37 |

|

|

4.03 |

|

|

3.70 |

|

|

4.79 |

|

|

Netback ($/boe) (3)(4) |

|

66.17 |

|

|

53.58 |

|

|

46.60 |

|

|

39.83 |

|

|

32.94 |

|

|

24.85 |

|

|

23.79 |

|

|

12.68 |

|

|

Benchmark Prices |

|

|

|

|

|

|

|

|

|

West Texas Intermediate crude oil (US$/bbl) |

|

94.29 |

|

|

77.19 |

|

|

70.55 |

|

|

66.07 |

|

|

57.81 |

|

|

42.47 |

|

|

40.91 |

|

|

27.81 |

|

|

Exchange rate (Cdn$/US$) |

|

0.79 |

|

|

0.79 |

|

|

0.79 |

|

|

0.81 |

|

|

0.79 |

|

|

0.77 |

|

|

0.75 |

|

|

0.72 |

|

|

Edmonton Light Sweet crude oil (Cdn$/bbl) |

|

115.67 |

|

|

93.28 |

|

|

83.77 |

|

|

77.12 |

|

|

66.76 |

|

|

50.45 |

|

|

49.81 |

|

|

29.79 |

|

|

Western Canadian Select crude oil (Cdn$/bbl) |

|

101.02 |

|

|

78.71 |

|

|

71.79 |

|

|

66.90 |

|

|

57.55 |

|

|

43.56 |

|

|

42.55 |

|

|

22.37 |

|

|

Nymex natural gas (US$/mcf) |

|

4.64 |

|

|

4.75 |

|

|

4.35 |

|

|

2.95 |

|

|

3.50 |

|

|

2.26 |

|

|

2.00 |

|

|

1.70 |

|

|

AECO 7A Monthly Index (Cdn$/Mcf) |

|

4.58 |

|

|

4.93 |

|

|

3.36 |

|

|

2.80 |

|

|

2.92 |

|

|

2.76 |

|

|

2.14 |

|

|

1.85 |

|

(1) Weighted average number of shares

outstanding during the period, basic(2) Based on the number of

shares issued and outstanding at each record date(3) See Non-GAAP

Financial Ratios and Other Financial Measure(4) See Conversion of

Natural Gas to Barrels of Oil Equivalent (boe)

Forward-Looking Statements

This news release offers our assessment of

Freehold’s future plans and operations as of May 10, 2022 and

contains forward-looking statements that we believe allow readers

to better understand our business and prospects. These

forward-looking statements include our expectations for the

following:

- 2022 forecast

production (including commodity weightings) and funds from

operations;

- the expectation

that enhanced business strength within Freehold's portfolio

provides significant optionality for Freehold to: (i) continue our

measured pace of dividend growth toward a 60% payout ratio; (ii)

continue our disciplined acquisition work to grow our company

across North America, and (iii) reduce Company net debt to zero (in

the absence of further acquisition work)

- Freehold's

belief that the quality of both its Canadian and US portfolios is

expected to drive strong third-party production additions

throughout 2022; and

- the expectation

that the acquisition of additional U.S royalty production and

royalty lands in late 2021 will further diversify and enhance

Freehold’s asset base;

- 2023 production

volumes associated with the Post Quarter US transaction.

By their nature, forward-looking statements are

subject to numerous risks and uncertainties, some of which are

beyond our control, including general economic conditions,

inflation and supply chain issues, industry conditions, volatility

of commodity prices, currency fluctuations, imprecision of reserve

estimates, royalties, environmental risks, taxation, regulation,

changes in tax or other legislation, competition from other

industry participants, the failure to complete acquisitions on the

timing and terms expected, the failure to satisfy conditions of

closing for any acquisitions, the lack of availability of qualified

personnel or management, the continued impacts of COVID-19 on

demand for commodities, stock market volatility, and our ability to

access sufficient capital from internal and external sources. Risks

are described in more detail in our Annual Information Form for the

year ended December 31, 2021 available at www.sedar.com.

With respect to forward-looking statements

contained in this news release, we have made assumptions regarding,

among other things, future commodity prices, future capital

expenditure levels, future production levels, future exchange

rates, future tax rates, future legislation, the cost of developing

and producing our assets, our ability and the ability of our

lessees to obtain equipment in a timely manner to carry out

development activities, our ability to market our oil and gas

successfully to current and new customers, our expectation for the

consumption of crude oil and natural gas, our expectation for

industry drilling levels, our ability to obtain financing on

acceptable terms, shut-in production, production additions from our

audit function and our ability to add production and reserves

through development and acquisition activities. Additional

operating assumptions with respect to the forward-looking

statements referred to above are detailed in the body of this news

release.

You are cautioned that the assumptions used in

the preparation of such information, although considered reasonable

at the time of preparation, may prove to be imprecise and, as such,

undue reliance should not be placed on forward-looking statements.

Our actual results, performance, or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements. We can give no assurance that any of

the events anticipated will transpire or occur, or if any of them

do, what benefits we will derive from them. The forward-looking

information contained in this document is expressly qualified by

this cautionary statement. To the extent any guidance or

forward-looking statements herein constitute a financial outlook,

they are included herein to provide readers with an understanding

of management's plans and assumptions for budgeting purposes and

readers are cautioned that the information may not be appropriate

for other purposes. Our policy for updating forward-looking

statements is to update our key operating assumptions quarterly

and, except as required by law, we do not undertake to update any

other forward-looking statements.

You are further cautioned that the preparation

of financial statements in accordance with International Financial

Reporting Standards (IFRS), which are the Canadian generally

accepted accounting principles (GAAP) for publicly accountable

enterprises, requires management to make certain judgments and

estimates that affect the reported amounts of assets, liabilities,

revenues, and expenses. These estimates may change, having either a

positive or negative effect on net income, as further information

becomes available and as the economic environment changes.

Conversion of Natural Gas to Barrels of

Oil Equivalent (BOE)

To provide a single unit of production for

analytical purposes, natural gas production and reserves volumes

are converted mathematically to equivalent barrels of oil (boe). We

use the industry-accepted standard conversion of six thousand cubic

feet of natural gas to one barrel of oil (6 Mcf = 1 bbl). The 6:1

boe ratio is based on an energy equivalency conversion method

primarily applicable at the burner tip. It does not represent a

value equivalency at the wellhead and is not based on either energy

content or current prices. While the boe ratio is useful for

comparative measures and observing trends, it does not accurately

reflect individual product values and might be misleading,

particularly if used in isolation. As well, given that the value

ratio, based on the current price of crude oil to natural gas, is

significantly different from the 6:1 energy equivalency ratio,

using a 6:1 conversion ratio may be misleading as an indication of

value.

Non-GAAP Financial Ratios and Other

Financial Measure

Within this news release, references are made to

terms commonly used as key performance indicators in the oil and

gas industry. We believe that the non-GAAP financial ratios,

cash costs and netback, and a

supplemental financial measure, payout ratio, are

useful for management and investors to analyze operating

performance and liquidity and we use these terms to facilitate the

understanding and comparability of our results of operations.

However, these terms do not have any standardized meanings

prescribed by GAAP and therefore may not be comparable with the

calculations of similar measures for other entities.

Cash costs, which is calculated

on a boe basis, is comprised by the recurring cash based costs,

excluding taxes, reported on the statements of operations. For

Freehold, cash costs are identified as operating expense, G&A

and cash-based interest, financing and share-based compensation pay

outs. Cash costs allow Freehold to benchmark how changes in its

manageable cash-based cost structure compare against prior

periods.

The netback, which is also

calculated on a boe basis, as average realized price less operating

expenses, general and administrative and cash interest charges,

represents the per boe cash flow amount which allows us to

benchmark how changes in commodity pricing and our cash-based cost

structure compare against prior periods.

The following table presents the computation of

Cash Costs and the Netback:

|

|

Three Months Ended March 31 |

|

$/boe |

|

2022 |

|

|

2021 |

|

Change |

|

Royalty and other revenue |

$ |

69.87 |

|

$ |

37.31 |

|

87 |

% |

|

Production and ad valorem taxes |

|

(1.30 |

) |

|

(0.27 |

) |

381 |

% |

|

Net revenue |

|

69.87 |

|

|

37.31 |

|

87 |

% |

|

Less |

|

|

|

|

General and administrative |

|

(2.92 |

) |

|

(3.27 |

) |

-11 |

% |

|

Operating expense |

|

(0.13 |

) |

|

(0.16 |

) |

-19 |

% |

|

Interest and financing cash expense |

|

(0.65 |

) |

|

(0.94 |

) |

-31 |

% |

|

Cash costs |

|

(3.70 |

) |

|

(4.37 |

) |

-15 |

% |

|

Netback |

$ |

66.17 |

|

$ |

32.94 |

|

101 |

% |

Payout ratios are often used

for dividend paying companies in the oil and gas industry to

identify dividend levels in relation to funds from operations that

are also used to finance debt repayments and/or acquisition

opportunities. Payout ratio is calculated as dividends paid as a

percentage of funds from operations.

|

|

Three Months Ended March 31 |

|

(000s) |

|

2022 |

|

|

2021 |

|

Change |

|

Dividends paid |

$ |

27,112 |

|

$ |

7,663 |

|

255 |

% |

|

Funds from operations |

$ |

71,893 |

|

$ |

32,421 |

|

122 |

% |

|

Payout ratio |

|

38 |

% |

|

24 |

% |

14 |

% |

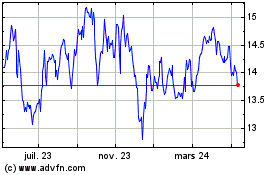

Freehold Royalties (TSX:FRU)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

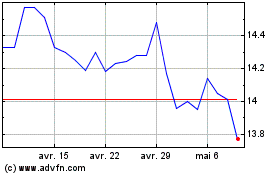

Freehold Royalties (TSX:FRU)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024