goeasy Ltd. Announces Enhancements to Securitization and Credit Facilities

31 Janvier 2022 - 3:07PM

goeasy Ltd. (TSX: GSY), (“

goeasy” or the

“

Company”), one of Canada’s leading non-prime

consumer lenders, announced today enhancements to its existing

revolving securitization warehouse facility (the

“

Securitization Facility”) and senior secured

revolving credit facility (the “

Credit Facility”).

The Company has announced an increase to its

Securitization Facility from $600 million to $900 million. The

Securitization Facility, which was originally established in

December 2020, will continue to be structured by National Bank

Financial Markets, with the addition of Bank of Montreal and Royal

Bank of Canada as new lenders to the syndicate. The facility will

continue to bear interest on advances payable at the rate of

1-month Canadian Dollar Offered Rate (“CDOR”) plus

185 bps. Based on the current 1-month CDOR rate of 0.52% as of

January 28, 2022, the interest rate would be 2.37%. The Company

will continue utilizing an interest rate swap agreement to generate

fixed rate payments on the amounts drawn and mitigate the impact of

increases to interest rates. Proceeds from the Securitization

Facility will be used for general corporate purposes, primarily

funding the growth of the Company’s consumer loan portfolio.

The Company also announced an amendment to its

Credit Facility, which will decrease from $310 million to $270

million, with the maturity extended to January 27, 2025 and a

reduction to the interest rate payable on advances. On lenders

prime rate (“Prime”) advances, the interest rate

payable has been reduced by 125 bps, from the previous rate of

Prime plus 200 bps to Prime plus 75 bps. On draws elected to be

taken utilizing the Canadian Bankers’ Acceptance rate

(“BA”), the interest rate payable has been reduced

by 75 bps, from the previous rate of BA plus 300 bps to BA plus 225

bps. Based on the current Prime rate of 2.45% and the current

90-day BA rate of 0.50% as of January 28, 2022, the interest rate

on the principal amount drawn would be 3.20% or 2.75%,

respectively, at the option of the Company. Additionally, the

amendment incorporates key modifications including improved advance

rates, less restrictive covenants, and a broader syndicate of

banks. The amended Credit Facility is underwritten by Bank of

Montreal, Royal Bank of Canada, Wells Fargo Bank, CIBC, National

Bank of Canada and Toronto-Dominion Bank, and the Company has the

ability to utilize an accordion feature to increase the size of the

facility by up to an additional $100 million.

“The enhancements to our funding facilities

represent another key milestone in developing a scalable and

diversified capital structure, while providing sufficient liquidity

to fund our organic growth through the end of 2024”, said Jason

Mullins, goeasy’s President and Chief Executive Officer, “With

participation from 5 of the 6 major banks in Canada, the amendments

lift the combined capacity close to $1.2 billion, while improving

flexibility, increasing our liquidity by $260 million and reducing

our fully drawn weighted average cost of borrowing to 4.2%. While

we expect interest rates to rise in the future, the material shift

in our funding to lower cost secured sources, combined with the

fixed rate nature of our unsecured notes and the hedging we

implement on each draw, conspires to provide a shelter against an

increase in rates. The strength and diversification of our balance

sheet continues to remain well capitalized to achieve our long-term

growth objectives.”

About goeasy

goeasy Ltd., a Canadian company, headquartered

in Mississauga, Ontario, provides non-prime leasing and lending

services through its easyhome, easyfinancial and LendCare brands.

Supported by more than 2,200 employees, the Company offers a wide

variety of financial products and services including unsecured and

secured instalment loans. Customers can transact seamlessly through

an omni-channel model that includes an online and mobile platform,

over 400 locations across Canada, and point-of-sale financing

offered in the retail, power sports, automotive, home improvement

and healthcare verticals, through more than 4,000 merchants across

Canada. Throughout the Company’s history, it has acquired and

organically served over 1 million Canadians and originated over

$7.2 billion in loans, with one in three easyfinancial customers

graduating to prime credit and 60% increasing their credit score

within 12 months of borrowing.

Accredited by the Better Business Bureau, goeasy

is the proud recipient of several awards including Waterstone

Canada’s Most Admired Corporate Cultures, Glassdoor Top CEO Award,

Achievers Top 50 Most Engaged Workplaces in North America, Greater

Toronto Top Employers Award, the Digital Finance Institute’s

Canada’s Top 50 FinTech Companies, ranking on the TSX30 and placing

on the Report on Business ranking of Canada’s Top Growing Companies

and has been certified as a Great Place to Work®. The company is

represented by a diverse group of team members from over 75

nationalities who believe strongly in giving back to the

communities in which it operates. To date, goeasy has raised and

donated over $3.8 million to support its long-standing partnerships

with BGC Canada, Habitat for Humanity and many other local

charities.

goeasy Ltd.’s. common shares are listed on the

TSX under the trading symbol “GSY”. goeasy is rated BB- with

a stable trend from S&P and Ba3 with a stable trend from

Moody’s. Visit www.goeasy.com.

For further information contact:Jason

MullinsPresident & Chief Executive Officer(905) 272-2788

Farhan Ali KhanSenior Vice President and Chief

Corporate Development Officer(905) 272-2788

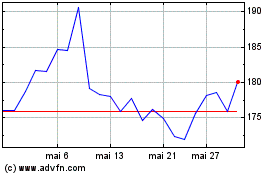

Goeasy (TSX:GSY)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Goeasy (TSX:GSY)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024