Glacier Media Inc. (TSX: GVC) (“Glacier” or the “Company”) reported

revenue and earnings for the period ended June 30, 2024.

SUMMARY RESULTS

|

(thousands of dollars) |

|

Three months ended June 30, |

|

|

|

Six months ended June 30, |

|

|

except share and per share amounts |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

33,532 |

|

|

$ |

37,322 |

|

|

$ |

68,282 |

|

|

$ |

76,540 |

|

|

EBITDA |

$ |

907 |

|

|

$ |

(3,237 |

) |

|

$ |

585 |

|

|

$ |

(5,478 |

) |

|

EBITDA margin |

|

2.7% |

|

|

|

(8.7% |

) |

|

|

0.9% |

|

|

|

(7.2% |

) |

|

EBITDA per share |

$ |

0.01 |

|

|

$ |

(0.02 |

) |

|

$ |

0.00 |

|

|

$ |

(0.04 |

) |

|

Capital expenditures |

$ |

1,229 |

|

|

$ |

1,142 |

|

|

$ |

1,988 |

|

|

$ |

2,219 |

|

|

Net loss attributable to common shareholder |

$ |

(3,280 |

) |

|

$ |

(8,186 |

) |

|

$ |

(7,709 |

) |

|

$ |

(13,403 |

) |

|

Net loss attributable to common shareholder per share |

$ |

(0.03 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.10 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, net |

|

131,131,598 |

|

|

|

131,900,782 |

|

|

|

131,131,598 |

|

|

|

132,195,531 |

|

|

(1) |

EBITDA is considered a non-GAAP measure. Refer to “EBITDA

Reconciliation” below for a reconciliation of the Company’s net

(loss) income attributable to common shareholders as reported under

IFRS to EBITDA. |

Q2 2024 PERFORMANCE

Q2 2024 continued the transformation of the

business, with a renewed operating plan of how the Company views

its core businesses and how it will manage legacy operations going

forward. The Company objective is to focus on the long-term growth

of its business information and consumer digital businesses. The

Company is optimistic that its core operations can and will

continue to perform well in the long-term and will generate strong

cash flows and enhance shareholder value. The respective brands,

market positions, and value to customers remains strong.

Over the past 12 months, the Company has moved

aggressively to close or sell underperforming print community media

operations to focus on its core businesses. Certain remaining print

operations continue to perform well, generating cash flow and

providing value to customers and readers. The Company will operate

these businesses while continuing to closely monitor their

performance.

Consolidated revenue for the three months ended

June 30, 2024, was $33.5 million, down $3.8 million or 10.2% from

the same period in the prior year. Consolidated EBITDA for the

quarter was $0.9 million, an improvement of $4.1 million from an

EBITDA loss of $3.2 million in the comparative quarter. Capital

expenditures for the period were $1.2 million as compared to $1.1

million in the comparative quarter.

The substantial 10.2% quarter-over-quarter

revenue decline was primarily driven by the closure and sale of

underperforming print community media operations and the sale of

the mining media business over the course of the last few quarters.

Not including print community media (where the bulk of the

restructuring and sales of business occurred) overall revenues

increased by 1.8%. Lastly, the mix of revenues shifted between Q2

2023 and Q2 2024; the share of print community media revenues

declined from 26.4% of total revenues in 2023 to 16.6% of total

revenues in 2024.

EBITDA for the quarter was $0.9 million, a $4.1

million improvement over an EBITDA loss in Q2 2023 of $3.2 million.

Not including print community media, overall EBITDA was $0.5

million. The profitability improvement resulted from a combination

of restructuring legacy operations and improved profitability in

several core operating businesses.

Financial Position. As at June

30, 2024, the Company had a cash balance of $5.0 million and $7.0

million of non-recourse mortgages (which relate to land for the

farm shows in Saskatchewan and Ontario).

For further information please contact Mr. Orest

Smysnuik, Chief Financial Officer, at 604-708-3264.

ABOUT THE COMPANY

Glacier Media Inc. is a broad portfolio of

business information and consumer digital businesses. Serving a

diverse array of industries and users, the businesses are typically

leaders in their respective industry and/or geographic markets.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking

statements that relate to, among other things, the Company’s

objectives, goals, strategies, intentions, plans, beliefs,

expectations, and estimates. These forward-looking statements

include, among other things, statements relating to our

expectations as to the core operations performing well in the

long-term, and generation of future cash flows. These

forward-looking statements are based on certain assumptions,

including continued economic growth and recovery and the

realization of cost savings in a timely manner and in the expected

amounts, which are subject to risks, uncertainties and other

factors which may cause results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements, and undue reliance should not be placed

on such statements.

Important factors that could cause actual

results to differ materially from these expectations include

failure to implement or achieve the intended results from our

strategic initiatives, and the other risk factors listed in our

Annual Information Form under the heading “Risk Factors” and in our

MD&A under the heading “Business Environment and Risks”, many

of which are out of our control. These other risk factors include,

but are not limited to that future cash flow from operations and

the availability under existing banking arrangements are believed

to be adequate to support financial liabilities, the ability of the

Company to sell advertising and subscriptions related to its

publications, foreign exchange rate fluctuations, the seasonal and

cyclical nature of the agricultural and energy sectors,

discontinuation of government grants, general market conditions in

both Canada and the United States, changes in the prices of

purchased supplies including newsprint, the effects of competition

in the Company’s markets, dependence on key personnel, integration

of newly acquired businesses, technological changes, tax risk,

financing risk, debt service risk and cybersecurity risk.

The forward-looking statements made in this news

release relate only to events or information as of the date on

which the statements are made. Except as required by law, the

Company undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements

are made or to reflect the occurrence of unanticipated events.

NON-IFRS FINANCIAL MEASURES

Earnings before interest, taxes, depreciation

and amortization (“EBITDA”), EBITDA margin and EBITDA per share,

are not generally accepted measures of financial performance under

IFRS. Management utilizes EBITDA as a financial performance measure

to assess profitability and return on equity in its decision

making. In addition, the Company, its lenders and its investors use

EBITDA to measure performance and value for various purposes.

Investors are cautioned; however, that EBITDA should not be

construed as an alternative to net income (loss) attributable to

common shareholders determined in accordance with IFRS as an

indicator of the Company’s performance.

The Company’s method of calculating these

financial performance measures may differ from other companies and,

accordingly, they may not be comparable to measures used by other

companies. A quantitative reconciliation of these non-IFRS measures

is included in the section entitled EBITDA Reconciliation.

EBITDA RECONCILIATION

|

(thousands of dollars) |

|

Three months ended June 30, |

|

|

Six months ended June 30, |

|

|

except share and per share amounts |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common shareholders |

$ |

(3,280 |

) |

|

$ |

(8,186 |

) |

|

$ |

(7,709 |

) |

|

$ |

(13,403 |

) |

|

Add (deduct): |

|

|

|

|

|

|

|

|

Non-controlling interests |

$ |

331 |

|

|

$ |

363 |

|

|

$ |

258 |

|

|

$ |

(3,274 |

) |

|

Interest expense, net |

$ |

1,584 |

|

|

$ |

380 |

|

|

$ |

3,032 |

|

|

$ |

675 |

|

|

Depreciation and amortization |

$ |

2,874 |

|

|

$ |

2,857 |

|

|

$ |

5,844 |

|

|

$ |

5,829 |

|

|

(Gain) loss on disposal, net |

$ |

323 |

|

|

$ |

- |

|

|

$ |

113 |

|

|

$ |

6,169 |

|

|

Other income |

$ |

(519 |

) |

|

$ |

- |

|

|

$ |

(1,140 |

) |

|

$ |

- |

|

|

Restructuring and other expenses (net) |

$ |

754 |

|

|

$ |

2,455 |

|

|

$ |

2,362 |

|

|

$ |

2,760 |

|

|

Share of loss (earnings) |

|

|

|

|

|

|

|

|

from joint ventures and associates |

$ |

42 |

|

|

$ |

631 |

|

|

$ |

(280 |

) |

|

$ |

533 |

|

|

Income tax recovery |

$ |

(1,202 |

) |

|

$ |

(1,924 |

) |

|

$ |

(1,895 |

) |

|

$ |

(4,767 |

) |

|

EBITDA (1) |

$ |

907 |

|

|

$ |

(3,424 |

) |

|

$ |

585 |

|

|

$ |

(5,478 |

) |

|

Notes: |

|

|

|

|

|

|

|

|

(1) Refer to "Non-IFRS Measures" section of MD&A for discussion

of non-IFRS measures used in this table. |

|

|

|

|

|

|

|

|

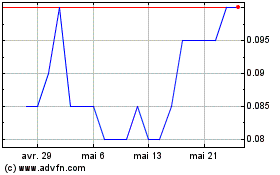

Glacier Media (TSX:GVC)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Glacier Media (TSX:GVC)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025