Kolibri Global Energy Inc. Begins Completion Operations

03 Novembre 2022 - 11:45AM

Business Wire

Kolibri Global Energy Inc. (the “Company” or

“KEI”) (TSX: KEI, OTCQX: KGEIF) is pleased to announce that

it has finished drilling the Glenn 16-3H well and has started

completion operations on the Emery 17-2H well in the Company’s

Tishomingo field in Oklahoma.

The Glenn 16-3H well was drilled safely and without incident to

its intended target depth. The well had oil and gas shows that were

stronger than those encountered in the Brock 9-3H and Emery 17-2H

wells, which had oil and gas shows comparable to our average

previously drilled corridor wells in the field.

The completion operations for the Emery 17-2H are underway and

are progressing well. Once they are finished, the completion

operations for the Brock 9-3H and Glenn 16-3H will be started. The

completion operations for these two wells will be done

concurrently. Initial production rates from the wells will be

reported once they are available.

Wolf Regener, President, and CEO commented, “We are proud of our

team and pleased that the drilling of all three wells was completed

safely and without incident. We look forward to having these three

wells on production, which we anticipate will help us meet our

forecasted 2,700 BOEPD year-end exit rate.”

About Kolibri Global Energy Inc.

Kolibri Global Energy Inc. is a North American energy company

focused on finding and exploiting energy projects in oil, gas, and

clean and sustainable energy. Through various subsidiaries, the

Company owns and operates energy properties in the United States.

The Company continues to utilize its technical and operational

expertise to identify and acquire additional projects. The

Company's shares are traded on the Toronto Stock Exchange under the

stock symbol KEI and on the OTCQX under the stock symbol KGEIF.

Cautionary Statements

In this news release and the Company’s other public

disclosure:

- The Company's natural gas production is reported in thousands

of cubic feet ("Mcfs"). The Company also uses references to

barrels ("Bbls") and barrels of oil equivalent

("Boes") to reflect natural gas liquids and oil production

and sales. Boes may be misleading, particularly if used in

isolation. A Boe conversion ratio of 6 Mcf:1 Bbl is based on an

energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead. Given that the value ratio based on the current price of

crude oil as compared to natural gas is significantly different

from the energy equivalency of 6:1, utilizing a conversion on a 6:1

basis may be misleading as an indication of value.

- Discounted and undiscounted net present value of future net

revenues attributable to reserves do not represent fair market

value.

- Possible reserves are those additional reserves that are less

certain to be recovered than probable reserves. There is a 10%

probability that the quantities actually recovered will equal or

exceed the sum of proved plus probable plus possible reserves.

- The Company discloses peak and 30-day initial production rates

and other short-term production rates. Readers are cautioned that

such production rates are preliminary in nature and are not

necessarily indicative of long-term performance or of ultimate

recovery.

Caution Regarding Forward-Looking Information

Certain statements contained in this news release constitute

"forward-looking information" as such term is used in applicable

Canadian securities laws and “forward-looking statements” within

the meaning of United States securities laws (collectively,

“forward looking information”), including statements regarding the

expected timing and completion of the Company’s work and

operations, the Company safely and efficiently drilling and

completing the wells, and expected results from the well.

Forward-looking information is based on plans and estimates of

management and interpretations of data by the Company's technical

team at the date the data is provided and is subject to several

factors and assumptions of management, including $85 a barrel oil

price, $6 Henry Hub and NGL pricing of $34 bbl cost inflation of

over 20% for the three remaining wells planned for 2022, work and

operations in the Company’s 2022 drill program being completed on

schedule, future operating costs, forecast prices and costs,

estimated production, capital and other expenditures, plans for

expected results of drilling activity, that anticipated results and

estimated costs will be consistent with management’s expectations,

that required regulatory approvals will be available when required,

that no unforeseen delays, unexpected geological or other effects,

including flooding and extended interruptions due to inclement or

hazardous weather conditions, equipment failures, permitting delays

or labor or contract disputes are encountered, that the necessary

labor and equipment will be obtained, that the development plans of

the Company and its co-venturers will not change, that the offset

operator’s operations will proceed as expected by management, that

the demand for oil and gas will be sustained, that the price of oil

will be sustained or increase, that the Company will continue to be

able to access sufficient capital through cash flow, debt,

financings, farm-ins or other participation arrangements to

maintain its projects, and that global economic conditions will not

deteriorate in a manner that has an adverse impact on the Company's

business, its ability to advance its business strategy and the

industry as a whole.

Forward-looking information is subject to a variety of risks and

uncertainties and other factors that could cause plans, estimates

and actual results to vary materially from those projected in such

forward-looking information. Factors that could cause the

forward-looking information in this news release to change or to be

inaccurate include, but are not limited to, the risk that any of

the assumptions on which such forward looking information is based

vary or prove to be invalid, including that the Company or its

subsidiaries is not able for any reason to obtain and provide the

information necessary to secure required approvals or that required

regulatory approvals are otherwise not available when required,

that unexpected geological results are encountered, that equipment

failures, permitting delays, labor or contract disputes or

shortages of equipment or labor or materials are encountered, the

risks associated with the oil and gas industry (e.g. operational

risks in development, exploration and production; delays or changes

in plans with respect to exploration and development projects or

capital expenditures; the uncertainty of reserve and resource

estimates and projections relating to production, costs and

expenses, and health, safety and environmental risks, including

flooding and extended interruptions due to inclement or hazardous

weather conditions), the risk of commodity price and foreign

exchange rate fluctuations, that the offset operator’s operations

have unexpected adverse effects on the Company’s operations, that

completion techniques require further optimization, that production

rates do not match the Company’s assumptions, that very low or no

production rates are achieved, that the price of oil will decline,

that the Company is unable to access required capital, that

occurrences such as those that are assumed will not occur, do in

fact occur, and those conditions that are assumed will continue or

improve, do not continue or improve, and the other risks and

uncertainties applicable to exploration and development activities

and the Company's business as set forth in the Company's management

discussion and analysis and its annual information form, both of

which are available for viewing under the Company's profile at

www.sedar.com, any of which could result in delays, cessation in

planned work or loss of one or more concessions and have an adverse

effect on the Company and its financial condition. The Company

undertakes no obligation to update these forward-looking

statements, other than as required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221103005637/en/

Wolf E. Regener +1 (805) 484-3613 Email:

wregener@kolibrienergy.com Website: www.kolibrienergy.com

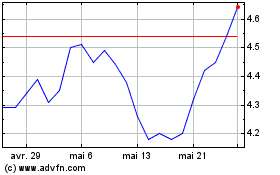

Kolibri Global Energy (TSX:KEI)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Kolibri Global Energy (TSX:KEI)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025