Kelso Technologies Inc. (“Kelso” or the “Company”), (TSX: KLS),

(NYSE American: KIQ) reports that it has released its unaudited

consolidated interim financial statements and Management Discussion

and Analysis for the three months ended March 31, 2023.

The unaudited consolidated interim financial

statements were prepared in accordance with International Financial

Reporting Standards (“IFRS”) as issued by the International

Accounting Standards Board (“IASB”). All amounts herein are

expressed in United States dollars (the Company’s functional

currency) unless otherwise indicated.

The Company’s unaudited consolidated financial

statements and MD&A for the three months ended March 31, 2023

were approved by the Board of Directors on May 10, 2023.

SUMMARY OF FINANCIAL

PERFORMANCE

|

Three months ended March 31 |

|

|

2023 |

|

|

2022 |

|

|

Revenues |

|

$ |

2,459,958 |

|

$ |

2,963,851 |

|

|

Gross profit |

|

$ |

1,086,568 |

|

$ |

1,428,394 |

|

|

Gross profit margin |

|

|

44% |

|

|

48% |

|

|

Adjusted EBITDA (loss) |

|

$ |

(531,618 |

) |

$ |

207,880 |

|

|

Non-cash expenses |

|

$ |

255,059 |

|

$ |

262,016 |

|

|

Termination settlement |

|

$ |

(465,360 |

) |

$ |

- |

|

|

Net income (loss) |

|

$ |

(786,677 |

) |

$ |

(54,136 |

) |

|

Basic earnings (loss) per share |

|

$ |

(0.01 |

) |

$ |

0.00 |

|

LIQUIDITY AND CAPITAL

RESOURCES

As at March 31, 2023 the Company had cash on

deposit in the amount of $2,613,852, accounts receivable of

$1,018,212, prepaid expenses of $170,799 and inventory of

$4,084,472 compared to cash on deposit in the amount of $2,712,446,

accounts receivable of $1,381,979, prepaid expenses of $92,768 and

inventory of $4,144,196 compared as at December 31, 2022.

The Company had income tax payable of $43,126 at

March 31, 2023 compared to $30,626 at December 31, 2022.

The working capital position of the Company as

at March 31, 2023 was $6,365,196 compared to $7,000,568 as at

December 31, 2022. Capital resources and operations are to be

expected to protect the Company’s ability to conduct ongoing

business as planned for the foreseeable future.

Net assets of the Company were $9,994,995 as at

March 31, 2023 compared to $10,781,672 as at December 31, 2022. The

Company had no interest-bearing long-term liabilities or debt as at

March 31, 2023 or December 31, 2022.

OUTLOOK

During the first quarter of 2023 the owners and

shippers that utilize rail tank cars continue to cautiously commit

to investment in new tank car equipment and/or the re-qualification

of their existing rail tank car fleets. Industry experts anticipate

that new car production will track replacement demand for the

438,000 tank car fleet and be in the range of 7,000 – 10,000 cars

per year. Rail tank car re-qualifications will be in the range of

40,000 – 50,000 cars per year for the next several years.

Rail tank car activity requiring Kelso

components has remained mostly unchanged based on general economic

recoveries and manufacturing supply chain disruptions that may

require an increase in rail tank car transportation solutions.

Traditional foreign supply chains in the rail tank car industry

have become unreliable. The Company’s “100% American-Made”

reputation and its proven ability to service customer orders even

during the most challenging of times have improved Kelso’s

reputation and brand recognition.

Industry projections indicate that the rail tank

car market is entering a period of modest fleet growth coupled with

growth in rail tank car utilization. Industry analysts predict new

tank car demand at approximately 9,200 tank cars in 2023. The

addition of new customers and the anticipated build of new tank

cars and re-qualification activities are expected to provide modest

financial growth from rail operations.

Management believes that there are significant

opportunities to grow from the introduction of new innovative

products in both the rail and automotive industries that are

emerging from our R&D activities. The Company continues to

research, develop and engineer promising new transportation related

equipment. In the heavily regulated transportation industries, the

Company’s R&D projects are complex, time consuming and

expensive. The primary purpose of our R&D investments is to

advance and elevate the probability of future financial successes

from a larger and more diverse product line.

Several new rail products currently in AAR

service field trials continue to progress well during the first

quarter of 2023. The Company anticipates regulatory progress in

2023 that can lead to new revenue sources when full approval and

early AAR vetted conditional sales to qualified customers are

permitted.

The KXI HD prototype vehicle has been

completed and initial testing activities are above expectations.

All mechanical and hydraulic components are proven technologies

that are sourced from well-established OEM suppliers and

stakeholders. Component designs have been scaled from existing uses

in military and commercial applications to fit the specifications

of KXI HD. The prototype vehicle has been commissioned with

the Company’s proprietary encryption protected Road-To-No-Road™

wilderness driver assistance software which encompasses our

trademarks PreciseRide™ and AdaptiveGrip™. The commissioned

prototype vehicle is currently going through extensive software and

engineering commissioning and integrity testing in preparation for

Canadian Motor Vehicle Safety Standards compliance testing.

Once KXI HD has its commercial design

specifications completed the final design will have to attain full

compliance with the Canadian Motor Vehicle Safety Standards

(CMVSS). Successful completion of the CMVSS requirements should

allow the Company to meet the Federal Motor Vehicle Safety

Standards (FMVSS) in the United States including the majority of

compliance requirements for each Canadian province and each

American state. This is expected to provide the Company with a

National Safety Mark awarded as a final stage manufacturer which is

a key prerequisite for enabling full scale marketing initiatives

and initial commercial sales in late 2023 and 2024.

Timing of regulatory approvals on new rail and

automotive products and corresponding revenue streams remains

unpredictable and cannot be guaranteed to be successful. Management

continues to assess the Company’s research and development

discoveries, new product viability, budget restrictions and market

potential of all R&D programs. Management adjusts R&D plans

based on testing results as part of the Company’s R&D risk

management program. Despite the many challenges imposed by the

COVID-19 recession, historic inflation rates and compromised supply

chain issues, Management remains bullish on the potential of the

Company’s new product developments.

The Company deploys capital resources sensibly

to maintain financial health and liquidity. The Company’s working

capital was $6,365,196 as at March 31, 2023. Current working

capital and anticipated sales activity for 2023 is expected to

protect the Company’s ability to conduct ongoing business

operations and R&D initiatives for the foreseeable future. With

no interest-bearing long-term debt to service and improved sales

prospects from a larger product portfolio, Kelso can continue to

focus on longer term financial performance on behalf of the

shareholders of Kelso.

About Kelso Technologies

Kelso is a diverse product development company

that specializes in the design, engineering, production and

distribution of proprietary service equipment used in

transportation applications. The Company’s reputation has been

earned as a designer and reliable supplier of unique high-quality

rail tank car valve equipment that provides for the safe handling

and containment of hazardous and non-hazardous commodities during

transport. All Kelso products are specifically designed to provide

economic and operational advantages to customers while reducing the

potential effects of human error and environmental harm.

For a more complete business and financial

profile of the Company, please view the Company's website at

www.kelsotech.com and public documents posted under the Company’s

profile on www.sedar.com in Canada and on EDGAR at www.sec.gov in

the United States.

On behalf of the Board of

Directors,

James R. Bond, CEO and President

Notice to Reader: References to

Adjusted EBITDA refer to net earnings from continuing operations

before interest, taxes, amortization, unrealized foreign exchange

and non cash share-based expenses (Black Scholes option pricing

model) and write off of assets. Adjusted EBITDA is not an earnings

measure recognized by IFRS and does not have a standardized meaning

prescribed by IFRS. Management believes that Adjusted EBITDA is an

alternative measure in evaluating the Company's business

performance. Readers are cautioned that Adjusted EBITDA should not

be construed as an alternative to net income as determined under

IFRS; nor as an indicator of financial performance as determined by

IFRS; nor a calculation of cash flow from operating activities as

determined under IFRS; nor as a measure of liquidity and cash flow

under IFRS. The Company's method of calculating Adjusted EBITDA may

differ from methods used by other issuers and, accordingly, the

Company's Adjusted EBITDA may not be comparable to similar measures

used by any other issuer.

Legal Notice Regarding Forward-Looking

Statements: This news release contains “forward-looking

statements” within the meaning of applicable securities

legislation. Forward-looking statements are indicated expectations

or intentions. Forward-looking statements in this news release

include that owners and shippers that use rail tank cars continue

to cautiously commit to investment in new rail tank car equipment;

that industry experts anticipate that new car production will track

replacement demand for the 438,000 tank car fleet and be in the

range of 7,000 – 10,000 cars per year; that rail tank car

re-qualifications will be in the range of 40,000 – 50,000 cars per

year for the next several years; that the Company’s reliable “100%

American-Made” reputation and proven reliable service record for

customer orders even during the most challenging of times has

improved Kelso’s reputation; that market share is approximately

half of the rail tank car market volume; that the anticipated

upswing in new build and retrofit activity for rail tank cars

combined with a growing number of certified Kelso products are

expected to provide longer-term financial growth opportunities from

rail operations; that Management remains bullish on the potential

of all new product developments in both the rail and automotive

industries that are emerging from the Company’s R&D activities;

the KXI Heavy-Duty suspension prototype has been completed

including featuring the Company’s proprietary encryption protected

Road-To-No-Road™ wilderness driver assistance software, the KXI HD

prototype is going through extensive engineering integrity testing

for Canadian Motor Vehicle Safety Standards compliance – a

prerequisite for a full scale market introduction in 2023; and that

current working capital and anticipated sales activity for the rest

of 2023 are expected to protect the Company’s ability to conduct

ongoing business operations for the foreseeable future. Although

Kelso believes the Company’s anticipated future results,

performance or achievements expressed or implied by the

forward-looking statements and information are based upon

reasonable assumptions and expectations, they can give no assurance

that such expectations will prove to be correct. The reader should

not place undue reliance on forward-looking statements and

information as such statements and information involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of Kelso to differ

materially from anticipated future results, performance or

achievement expressed or implied by such forward-looking statements

and information, including without limitation that the risk that

the longer-term effects of COVID-19 including inflation and short

supply chain issues may last much longer than expected delaying

R&D schedules and business orders from OEM customers; that our

development of new products may proceed slower than expected, cost

more or may not result in a salable product; that tank car

producers may produce or retrofit fewer than cars than expected and

even if they meet expectations, they may not purchase the Company’s

products for their tank cars; capital resources may not be adequate

enough to fund future operations as intended; that regulatory

compliance including Canadian Motor Vehicle Safety Standards may be

delayed or cancelled; that the Company’s products may not provide

the intended economic or operational advantages to end users; that

market introduction of KXI in 2023 may not grow and sustain

anticipated revenue streams; that the Company’s new rail and

automotive products may not receive regulatory certification; that

customer orders may not develop or be cancelled; that competitors

may enter the market with new product offerings which could capture

some of the Company’s market share; that a new product idea under

research and development may be dropped if ongoing product testing

and market research reveal engineering and economic issues that

render a new product concept infeasible; and that the Company’s new

equipment offerings may not capture market share as well as

expected. Except as required by law, the Company does not intend to

update the forward-looking information and forward-looking

statements contained in this news release.

For further information, please

contact:

|

James R. Bond, CEO and President |

Richard Lee, Chief Financial Officer |

Corporate Address: |

|

Email: bond@kelsotech.com |

Email: lee@kelsotech.com |

13966 - 18B Avenue South Surrey, BC V4A 8J1 www.kelsotech.com |

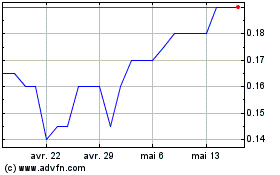

Kelso Technologies (TSX:KLS)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Kelso Technologies (TSX:KLS)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025