- SaaS revenue grows 16%, adjusted EBITDA1 margin of 25%, annual

recurring revenue grows 14%

- Increases profitability outlook for third consecutive quarter

after 32% growth in Adjusted EBITDA

- Company adds Mark Morgan as president of commercial

operations

Kinaxis® (TSX:KXS), a leading provider of supply chain

orchestration solutions, reported results for its third quarter

ended September 30, 2024. All amounts are in U.S. dollars. All

figures are prepared in accordance with IFRS Accounting Standards

unless otherwise indicated.

“We delivered a solid third quarter with continued strength in

customer wins, win rates and financial results that allow us to

increase our full-year profitability guidance for the third

consecutive quarter,” said John Sicard, president and chief

executive officer at Kinaxis. “We recently hit several exciting

product milestones, including over 100 customers using our Maestro

AI chat agent, and our Enterprise Scheduling product going live at

a global consumer products company. I am also particularly proud

that Kinaxis was named a 2024 Gartner® Peer Insights™ Customers’

Choice for Supply Chain Planning Solutions, the only vendor to earn

that distinction in the report, which highlighted that 93% of

customers are willing to recommend Kinaxis. This kind of

achievement is only possible through outstanding strategy and

execution, company-wide.”

Q3 2024 Highlights

$ USD thousands, except as otherwise

indicated

Q3 2024

Q3 2023

Change

Total Revenue

121,528

108,079

12%

SaaS

78,621

67,940

16%

Subscription term

licenses

2,250

2,535

(11)%

Professional services

35,471

32,851

8%

Maintenance and

support

5,186

4,753

9%

Gross profit Margin

76,365 63%

65,336 60%

17%

Profit (loss) Per diluted share

6,751 $0.23

7,390 $0.25

(9)%

Adjusted EBITDA1 Margin

30,013 25%

22,801 21%

32%

Cash from operating activities

29,945

(1,460)

_

(1)

“Adjusted EBITDA” is a non-IFRS measure and is not a recognized,

defined or standardized measure under IFRS. This measure as well as

any other non-IFRS financial measures reported by Kinaxis are

defined in the “Non-IFRS Measures” section of this news

release.

“I’m pleased with ongoing progress towards our normalized,

mid-term 25% adjusted EBITDA margin target, as well as progress on

strategic initiatives to capture even more of the $16 billion

supply chain management software market,” said Bob Courteau,

executive chair at Kinaxis. “The Board and management have been

working very closely over the past six months to review our

strategic plan and to assess performance across our operations.

That work, with additional input from consultants, has confirmed

the strength of Kinaxis’ leading market position and strategy, and

highlighted some exciting opportunities ahead, which we’re already

acting on.

Courteau concluded: “I’m also thrilled we have added

proven industry leader, Mark Morgan, as our new president of

commercial operations to drive our go-to-market functions. Incoming

leadership, new initiatives, and Kinaxis’ stellar foundation, which

John Sicard was instrumental in building, are all key elements to

scaling the organization through our next phase of rapid,

profitable growth.”

Key Performance Indicators

The company’s Annual Recurring Revenue2 (ARR), which includes

subscription amounts related to both SaaS and on-premise contracts,

rose 14% to 347 million at the end of the quarter.

$USD millions

Q3 2024

Q3 2023

Change

Annual recurring revenue2

347

304

14%

(2)

Annual Recurring Revenue (ARR) is the total annualized value of

recurring subscription amounts (ultimately recognized as SaaS,

Subscription term licenses and Maintenance and support revenue) of

all subscription contracts at a point in time. Annualized

subscription amounts are determined solely by reference to the

underlying contracts, normalizing for the varying revenue

recognition treatments under IFRS 15 for cloud-based versus

on-premise subscription amounts. It excludes one-time fees, such as

for non-recurring professional services, and assumes that customers

will renew the contractual commitments on a periodic basis as those

commitments come up for renewal, unless such renewal is known to be

unlikely. We believe that this measure provides a more current

indication of our performance in the growth of our subscription

business than other metrics.

The nature of the company’s long-term contracts provides

visibility into future, contracted revenue. The following table

presents revenue expected to be recognized in the future related to

performance obligations that are unsatisfied (or partially

unsatisfied) at September 30, 2024.

$USD millions

Remainder of

2024

2025

2026 and later

Total

SaaS

79.3

253.2

350.3

682.8

Maintenance and support

5.2

15.7

17.2

38.1

Subscription term licenses

—

0.1

0.1

0.2

Total

84.5

269.0

367.6

721.1

Financial Guidance

Kinaxis is updating its fiscal 2024 guidance, as follows:

FY 2024 Guidance

Total revenue

$483-495 million

SaaS

15-17% growth

Subscription term

license

$11-12 million

(Increased)

Adjusted EBITDA1 margin

20-22%

(Increased)

Guidance in this press release is provided to enhance visibility

into Kinaxis’ expectations for financial targets for the periods

indicated. Please refer to the section regarding forward-looking

statements that forms an integral part of this release. This press

release along with the financial statements and MD&A for the

quarter ended September 30, 2024 are available on Kinaxis’ website

and on SEDAR at www.sedar.com.

Conference Call

Kinaxis will host a conference call tomorrow, October 31, 2024,

to discuss these results. John Sicard, chief executive officer, Bob

Courteau, executive chair, and Blaine Fitzgerald, chief financial

officer, will host the call starting at 8:30 a.m. Eastern Time. A

question and answer session will follow management's presentation.

Investors and participants must register for the call in

advance. See registration link below. Please call the

conference telephone number fifteen minutes prior to the start

time.

DATE:

Thursday, October 31, 2024

TIME:

8:30 a.m. Eastern Time

CALL REGISTRATION:

https://registrations.events/direct/Q4I91416395

WEBCAST

https://events.q4inc.com/attendee/409878969 (available for three

months)

About Kinaxis Inc.

Kinaxis is a global leader in modern supply chain orchestration.

We serve supply chains and the people who manage them in service of

humanity. Our software is trusted by renowned global brands to

provide the agility and predictability needed to navigate today’s

volatility and disruption. We combine our patented concurrency

technique with a human-centered approach to AI to empower

businesses of all sizes to orchestrate their end-to-end supply

chain network, from multi-year strategic planning through

down-to-the-second execution and last-mile delivery. For more news

and information, please visit kinaxis.com or follow us on

LinkedIn.

Non-IFRS Measures

This press release makes reference to Adjusted Profit and

Adjusted EBITDA, which are non-IFRS financial measures, as well as

Adjusted EBITDA margin which expresses Adjusted EBITDA as a

percentage of revenue. Adjusted Profit, Adjusted EBITDA and

Adjusted EBITDA margin are not recognized, defined or standardized

measures under IFRS. We use these measures to provide investors

with supplemental information on our operating performance and to

highlight trends in our core business that may not otherwise be

apparent when relying solely on IFRS financial measures. We believe

that securities analysts, investors and other interested parties

frequently use non-IFRS measures in the evaluation of issuers.

Providing these non-IFRS measures provides useful information

because they portray the financial results of the Company before

certain expenses that do not impact the ongoing operating decisions

taken by management. Management also uses non-IFRS measures in

order to facilitate operating performance comparisons from period

to period, prepare annual operating budgets and assess our ability

to meet our capital expenditure and working capital requirements,

and to determine components of employee compensation.

Adjusted Profit represents profit adjusted to exclude the

changes in the fair value of contingent consideration, our equity

compensation plans, special charges, and non-recurring items.

Adjusted EBITDA represents profit adjusted to exclude the change in

the fair value of contingent consideration, our equity compensation

plans, special charges, non-recurring items, income tax expense,

depreciation and amortization, foreign exchange loss (gain) and net

finance (income) expense. Adjusted EBITDA margin expresses Adjusted

EBITDA as a percentage of revenue. Our definitions of Adjusted

Profit, Adjusted EBITDA and Adjusted EBITDA margin will likely

differ from those used by other companies (including our peers) and

therefore comparability may be limited. Non-IFRS measures should

not be considered a substitute for or in isolation from measures

prepared in accordance with IFRS. Investors are encouraged to

review our financial statements and disclosures in their entirety

and are cautioned not to put undue reliance on non-IFRS measures

and view them in conjunction with the most comparable IFRS

financial measures. Kinaxis has reconciled Adjusted Profit and

Adjusted EBITDA to the most comparable IFRS financial measure as

follows:

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

(In thousands of USD)

(In thousands of USD)

Profit

6,751

7,390

16,372

6,039

Change in fair value of contingent

—

(705

)

—

1,951

Share-based compensation

12,929

8,745

29,353

26,119

Special charges1

3,174

—

3,174

—

Non-recurring item2

22

—

7,320

—

Adjusted profit

22,876

15,430

56,219

34,109

Income tax expense

3,337

3,584

8,028

4,885

Depreciation and amortization

6,209

6,456

18,882

19,860

Foreign exchange gain (loss)

411

(76

)

245

2,033

Net finance and other income

(2,820

)

(2,593

)

(8,751

)

(5,742

)

7,137

7,371

18,404

21,036

Adjusted EBITDA

30,013

22,801

74,623

55,145

Adjusted EBITDA Margin

25

%

21

%

21

%

18

%

Note:

(1) Costs associated with business

transformation activities, financial advice and shareholder

communications.

(2) Costs associated with the

restructuring initiative

Forward-Looking Statements

Certain statements in this release constitute forward-looking

statements within the meaning of applicable securities laws.

Forward-looking statements include statements as to our

expectations for:

- growth of annual total revenue, annual SaaS and Subscription

term licenses revenue, and our expectations for Adjusted EBITDA

margin achievement, in each case looking forward for our fiscal

year ending December 31, 2024;

- SaaS growth and increased profitability in years beyond 2024;

and

- contracted revenue in future periods, including 2024, 2025 and

2026 and later.

This release also includes forward-looking statements as to

Kinaxis’ growth opportunities and the potential benefits of, and

markets and demand for, Kinaxis’ products and services. These

statements are subject to certain assumptions, risks and

uncertainties, including our view of the relative position of

Kinaxis’ products and services compared to competitive offerings in

the industry.

In particular, our guidance for 2024 annual total revenue,

annual SaaS and Subscription term license revenue and annual

Adjusted EBITDA margin, as well as our comments on our expectations

for SaaS growth and increased profitability in years beyond 2024,

are subject to certain assumptions and associated risks

including:

- our ability to win business from new customers and expand

business from existing customers;

- the timing of new customer wins and expansion decisions by our

existing customers;

- maintaining our customer retention levels, and specifically,

that customers will renew contractual commitments on a periodic

basis as those commitments come up for renewal, at rates consistent

with our historic experience;

- fluctuations in the value of foreign currencies relative to the

U.S. Dollar; and

- with respect to Adjusted EBITDA and profitability, our ability

to contain expense levels while expanding our business.

Our guidance and commentary for achievement of contracted

revenue in future periods, including in 2024, 2025 and 2026 and

later, is based on assumptions and associated risks including:

- our ability to satisfy material unperformed obligations under

our long-term contracts; and

- the continued financial capacity and creditworthiness of our

customers under long-term contracts.

These and other assumptions, risks and uncertainties may cause

Kinaxis’ actual results, performance, achievements and developments

to differ materially from the results, performance, achievements or

developments expressed or implied by forward-looking statements.

Material risks and uncertainties relating to our business are

described under the headings “Forward-Looking Statements” and

“Risks and Uncertainties” in our annual MD&A dated February 28,

2024, under the heading “Risk Factors” in our Annual Information

Form dated March 25, 2024 and in our other public documents filed

with Canadian securities regulatory authorities, which are

available at www.sedarplus.ca. Forward-looking statements are

provided to help readers understand management’s expectations as at

the date of this release and may not be suitable for other

purposes. Readers are cautioned not to place undue reliance on

forward-looking statements. Kinaxis assumes no obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as expressly

required by law.

SOURCE: Kinaxis Inc.

Kinaxis Inc. Condensed Consolidated

Interim Statements of Financial Position (Expressed in

thousands of USD) (Unaudited)

September 30, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

183,228

$

174,844

Short-term investments

111,402

118,118

Trade and other receivables

137,485

156,609

Prepaid expenses

19,355

14,810

451,470

464,381

Non-current assets:

Unbilled receivables

1,121

3,155

Other receivables

925

972

Prepaid expenses

2,128

1,130

Investment tax credits recoverable

11,271

8,362

Deferred tax assets

35,092

1,184

Contract acquisition costs

30,186

27,438

Property and equipment

33,342

40,300

Right-of-use assets

46,055

47,109

Intangible assets

19,535

23,394

Goodwill

74,997

74,556

254,652

227,600

$

706,122

$

691,981

Liabilities and Shareholders’

Equity

Current liabilities:

Trade payables and accrued liabilities

107,149

39,700

Provisions

605

—

Deferred revenue

126,382

137,598

Lease obligations

5,305

5,805

239,441

183,103

Non-current liabilities:

Lease obligations

45,016

45,985

Deferred tax liabilities

6,362

8,065

51,378

54,050

Shareholders’ equity:

Share capital

283,605

307,327

Contributed surplus

11,322

44,339

Accumulated other comprehensive income

(loss)

2,202

1,360

Retained earnings

118,174

101,802

415,303

454,828

$

706,122

$

691,981

Kinaxis Inc.

Condensed Consolidated Interim

Statements of Comprehensive Income (Expressed in thousands of

USD, except share and per share data) (Unaudited)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Revenue

$

121,528

$

108,079

$

359,176

$

314,981

Cost of revenue

45,163

42,743

139,695

124,974

Gross profit

76,365

65,336

219,481

190,007

Operating expenses:

Selling and marketing

22,639

23,532

74,907

76,113

Research and development

21,137

20,111

66,343

61,042

General and administrative

24,977

14,098

62,489

43,666

68,753

57,741

203,739

180,821

7,612

7,595

15,742

9,186

Other income:

Foreign exchange gain (loss)

(411

)

76

(245

)

(2,033

)

Net finance and other income

2,887

2,598

8,903

5,722

Change in fair value of contingent

consideration

—

705

—

(1,951

)

2,476

3,379

8,658

1,738

Profit before income taxes

10,088

10,974

24,400

10,924

Income tax expense

3,337

3,584

8,028

4,885

Profit

6,751

7,390

16,372

6,039

Other comprehensive income:

Items that are or may be reclassified

subsequently to profit (loss):

Foreign currency translation differences -

foreign operations

3,053

(1,757

)

1,097

(1,468

)

Change in valuation of cash flow

hedges

463

(594

)

(255

)

(364

)

3,516

(2,351

)

842

(1,832

)

Total comprehensive income

$

10,267

$

5,039

$

17,214

$

4,207

Basic earnings per share

$

0.24

$

0.26

$

0.58

$

0.21

Weighted average number of basic Common

Shares

28,226,878

28,428,856

28,286,208

28,250,462

Diluted earnings per share

$

0.23

$

0.25

$

0.57

$

0.21

Weighted average number of diluted Common

Shares

28,812,999

29,240,154

28,946,558

29,119,827

Condensed Consolidated Interim

Statements of Changes in Shareholders’ Equity (Expressed in

thousands of USD) (Unaudited)

Accumulated other comprehensive

income (loss)

Share

capital

Contributed

surplus

Cash flow hedges

Currency translation

adjustments

Total

Retained

earnings

Total equity

Balance, December 31, 2022

$

244,713

$

65,129

$

—

$

(156

)

$

(156

)

$

91,742

$

401,428

Profit

—

—

—

—

—

10,060

10,060

Other comprehensive income

—

—

441

1,075

1,516

—

1,516

Total comprehensive income

—

—

441

1,075

1,516

10,060

11,576

Share options exercised

41,545

(9,991

)

—

—

—

—

31,554

Restricted share units vested

10,676

(10,676

)

—

—

—

—

—

Performance share units vested

2,628

(2,628

)

—

—

—

—

—

Share-based payments

—

35,788

—

—

—

—

35,788

Shares issued for contingent

consideration

11,097

—

—

—

—

—

11,097

Shares repurchased

(3,332

)

(33,283

)

—

—

—

—

(36,615

)

Total shareholder transactions

62,614

(20,790

)

—

—

—

—

41,824

Balance, December 31, 2023

$

307,327

$

44,339

$

441

$

919

$

1,360

$

101,802

$

454,828

Profit

—

—

—

—

—

16,372

16,372

Other comprehensive loss

—

—

(255

)

1,097

842

—

842

Total comprehensive income (loss)

—

—

(255

)

1,097

842

16,372

17,214

Share options exercised

17,777

(4,193

)

—

—

—

—

13,584

Restricted share units vested

11,841

(11,841

)

—

—

—

—

—

Deferred share units vested

1,396

(1,396

)

—

—

—

—

—

Performance share units vested

5,533

(5,533

)

—

—

—

—

—

Share-based payments

—

29,739

—

—

—

—

29,739

Shares repurchased

(38,489

)

(39,793

)

—

—

—

—

(78,282

)

Obligation related to share

repurchases

(21,780

)

—

—

—

—

—

(21,780

)

Total shareholder transactions

(23,722

)

(33,017

)

—

—

—

—

(56,739

)

Balance, September 30, 2024

$

283,605

$

11,322

$

186

$

2,016

$

2,202

$

118,174

$

415,303

Condensed Consolidated Interim

Statements of Cash Flows (Expressed in thousands of USD)

(Unaudited)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Cash flows from operating activities:

Profit

$

6,751

$

7,390

$

16,372

$

6,039

Items not affecting cash:

Depreciation of property and equipment and

right-of-use assets

4,870

5,126

14,888

15,787

Amortization of intangible assets

1,339

1,330

3,994

4,073

Share-based payments

12,929

8,745

29,353

26,119

Net finance income

(2,820

)

(2,593

)

(8,751

)

(5,742

)

Change in fair value of contingent

consideration

—

(705

)

—

1,951

Income tax expense

3,337

3,584

8,028

4,885

Investment tax credits recoverable

(900

)

(825

)

(2,909

)

(2,234

)

Change in operating assets and

liabilities

3,511

(23,810

)

9,714

736

Interest received

2,199

2,150

10,387

5,345

Interest paid

(436

)

(399

)

(1,277

)

(1,247

)

Income taxes paid

(835

)

(1,453

)

(4,703

)

(4,324

)

29,945

(1,460

)

75,096

51,388

Cash flows from (used in) investing

activities:

Purchase of property and equipment and

intangible assets

(163

)

(378

)

(2,247

)

(2,010

)

Purchase of short-term investments

(21,891

)

(72,053

)

(238,760

)

(172,724

)

Redemption of short-term investments

46,722

35,005

245,117

95,165

24,668

(37,426

)

4,110

(79,569

)

Cash flows from (used in) financing

activities:

Payment of lease obligations

(1,834

)

(1,689

)

(5,360

)

(5,245

)

Repurchase of shares

(20,875

)

—

(78,282

)

—

Proceeds from exercise of stock

options

2,276

1,071

13,584

20,715

(20,433

)

(618

)

(70,058

)

15,470

Increase (decrease) in cash and cash

equivalents

34,180

(39,504

)

9,148

(12,711

)

Cash and cash equivalents, beginning of

period

147,155

201,608

174,844

175,347

Effects of exchange rates on cash and cash

equivalents

$

1,893

$

(1,801

)

(764

)

(2,333

)

Cash and cash equivalents, end of

period

183,228

160,303

$

183,228

$

160,303

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030951042/en/

Investor Relations Rick Wadsworth | Kinaxis

rwadsworth@kinaxis.com 613-907-7613 Media Relations Jaime

Cook | Kinaxis jcook@kinaxis.com 289-552-4640

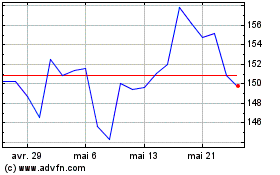

Kinaxis (TSX:KXS)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Kinaxis (TSX:KXS)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024