Lithium Americas Corp. (TSX: LAC) (NYSE: LAC) (“Lithium

Americas” or the “Company”) has reported financial and

operating results for the second quarter ended June 30, 2022.

HIGHLIGHTS

Argentina

Caucharí-Olaroz

- Construction continues to progress towards production with key

areas of the processing plant preparing to commence commissioning

shortly.

- 33kv power line,

gas pipeline and the water systems were completed and

commissioned.

- Over 1,650

workers on site with team beginning to transition from construction

to operations.

- With construction over 90% complete, focus has shifted to

prioritize production over completion of all purification circuits.

As a result, a portion of the purification process designed to

achieve battery-quality is being deferred until early 2023.

- In late May

2022, the site achieved a milestone of 6,000,000 total person hours

without a lost time injury.

- As of June 30,

2022, 88%, or $653 million, of the $741 million capital budget has

been spent. The Company continues to monitor the high inflationary

environment in Argentina but does not expect any impact on the

Company’s funding requirements for the project to reach production.

- The development analysis on the second stage expansion of at

least 20,000 tonnes per annum of lithium carbonate equivalent

continues to advance with development of the wellfield

underway.

Pastos Grandes

- In June 2022, the Company approved a development plan and a

budget of approximately $30 million to advance Pastos Grandes

towards a construction decision.

United States

Thacker Pass

- On June

28, 2022, the State Environmental Commission unanimously rejected

an appeal of the February 2022 issuance of a Water Pollution

Control Permit for Thacker Pass by the Nevada Department of

Environmental Protection.

- On July

20, 2022, the Company’s Lithium Technical Development Center

(“LiTDC”) was officially opened in a ceremony attended by the

Company’s leadership team, Nevada Governor and University of

Nevada, Reno President.

- LiTDC

replicates Thacker Pass’ flowsheet from raw ore to final product in

an integrated process.

-

Battery-quality lithium carbonate samples are being produced for

potential customers and partners.

- An

appeal on the Record of Decision is moving forward with briefings

scheduled to be complete August 11, 2022, and a final decision

expected shortly thereafter. The Company has all permits to

commence construction.

-

Early-works construction is on track to commence in 2022. Cultural

assessment work was successfully completed in mid-July.

- The

Company has issued a request for proposal from engineering,

procurement and construction management firms to perform detailed

engineering, execution planning and construction management

services for Thacker Pass.

- Analysis

is being completed with a leading international environmental

engineering consulting firm to determine expected carbon intensity

and water utilization, based on current feasibility study planning

work.

- The

Company continues to progress the U.S. Department of Energy

Advanced Technology Vehicles Manufacturing loan program

application, which is expected to fund the majority of Thacker

Pass’ capital costs.

Corporate

- As at June 30,

2022, the Company had $441 million in cash and cash equivalents

with an additional $75 million in available credit.

- On April 28,

2022, the Company entered into an agreement to acquire a 5% stake

in Green Technology Metals Limited (ASX: GT1), a North American

focused lithium exploration and development company with hard rock

spodumene assets in north-western Ontario, Canada.

- On July 19,

2022, the Company published a 2021 Environment, Social, Governance

and Safety (ESG-S) Report themed Enabling Transition, highlighting

the Company’s ESG-S practices and overall progress made over the

past two years (reporting period of January 1, 2020 to December 31,

2021).

- The Company

continues to explore a separation of its US and Argentina

operations. While no final decision has been made, the Company is

exploring structuring alternatives to effect the separation.

TECHNICAL INFORMATION

The Technical Information in this news release

has been reviewed and approved by Rene LeBlanc, PhD, SME, Chief

Technical Officer of Lithium Americas, and a Qualified Person as

defined by National Instrument 43-101.

FINANCIAL RESULTS

Selected consolidated financial information is

presented as follows:

|

(in US$ million except per share information) |

Quarter ended June 30, |

|

|

|

2022 |

|

|

2021 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

Expenses |

|

(90.3) |

|

|

|

(13.0) |

|

|

|

Net loss |

|

(16.6) |

|

|

|

(19.3) |

|

|

|

Loss per share – basic |

|

(0.12) |

|

|

|

(0.16) |

|

|

|

(in US$ million) |

As at June 30, 2022 |

|

|

As at December 31, 2021 |

|

|

|

|

|

$ |

|

|

|

$ |

|

|

|

Cash and cash equivalents |

|

440.8 |

|

|

|

510.6 |

|

|

|

Total assets |

|

1,043.5 |

|

|

|

817.3 |

|

|

|

Total long-term liabilities |

|

(221.4) |

|

|

|

(272.8) |

|

|

During the six months ended June 30, 2022, total

assets increased primarily due to the acquisition of Millennial

Lithium. Total long-term liabilities decreased due to $31.2 million

decrease in fair value of convertible senior notes derivative

liability and repayment of $24.7 million limited recourse loan

facility balance and accumulated interest.

The lower net loss in Q2 2022 compared to Q2

2021 is primarily attributable to $81.6 million gain on change in

fair value of convertible notes derivative driven by a decrease in

market value of the Company’s shares, partially offset with $71.5

million share of loss of Cauchari-Olaroz Project as a result of

foreign exchange loss on the project’s loans.

This news release

should be read in conjunction with Lithium Americas’ condensed

consolidated interim financial statements and management's

discussion and analysis for the six months ended June 30, 2022,

which are available on the Company’s website and SEDAR. All amounts

are in U.S. dollars unless otherwise indicated.

ABOUT LITHIUM AMERICAS

Lithium Americas is focused on advancing lithium

projects in Argentina and the United States to production. In

Argentina, Caucharí-Olaroz is advancing towards first production

and Pastos Grandes represents regional growth. In the United

States, Thacker Pass has received its Record of Decision and is

advancing towards construction. The Company trades on both the

Toronto Stock Exchange and on the New York Stock Exchange, under

the ticker symbol “LAC”.

For further information contact:Investor

RelationsTelephone: 778-656-5820Email:

ir@lithiumamericas.comWebsite: www.lithiumamericas.com

FORWARD-LOOKING

STATEMENTS

This news release contains “forward-looking

information” and “forward-looking statements” (which we refer to

collectively as forward-looking information) under the provisions

of applicable securities legislation. All statements, other than

statements of historical fact, are forward-looking information.

Examples of forward-looking information in this news release

include, among other things, statements related to: successful

development of the Caucharí-Olaroz project, the Thacker Pass

project and the Pastos Grandes project, including timing, progress,

construction, milestones, scale, anticipated production and results

thereof; timing for commissioning of the Caucharí-Olaroz project,

plans to prioritize commissioning and the expected timing to

complete deferred construction items as a result of such

prioritization; the Company’s ability to fund its development

programs through debt or equity financing, including through

government loan programs, and the expected outcome of debt or other

financing strategies the Company is pursuing, including the

Advanced Technology Vehicles Manufacturing loan program

application; expectations concerning completion of a feasibility

study for the Thacker Pass project and that testing of the Thacker

Pass flowsheet at the Lithium Technical Center to support the

feasibility study will be successful; expected timing and outcome

of litigation or regulatory processes concerning the Thacker Pass

project; expected outcome and timing of environmental surveys and

analysis, permit applications and other environmental matters;

expected expenditures to be made by the Company on its properties,

inflationary impacts on such expenditures and the Company’s ability

to remain fully funded for its share of such expenditures; the

potential for partnership and financing scenarios for the Thacker

Pass project; and the proposed separation of the Company’s

business, its structure and completion thereof.

Forward-looking information is based upon a

number of factors and assumptions that, if untrue, could cause the

actual results, performances or achievements of the Company to be

materially different from future results, performances or

achievements expressed or implied by such information. Such

information reflects the Company’s current views with respect to

future events and is necessarily based upon a number of assumptions

that, while considered reasonable by the Company today, are

inherently subject to significant uncertainties and contingencies.

These assumptions include, among others, the following: current

technological trends; the Company’s ability to fund, advance and

develop its projects, including results therefrom and timing

thereof; capital costs, operating costs, and sustaining capital

requirements of the Caucharí-Olaroz project and the Thacker Pass

project, significant increases to such estimates and ability to

finance any such increases; a cordial business relationship between

the Company and its strategic partners, including Ganfeng Lithium

for the Caucharí-Olaroz project; ability of the Company to fund,

advance and develop its projects and raise additional capital as

needed; the Company’s ability to operate in a safe and effective

manner; uncertainties relating to receiving and maintaining mining,

exploration, environmental and other permits or approvals in Nevada

and Argentina, and resolving any complaints or litigation

concerning such environmental permitting processes; realizing on

the expected benefits from previous transactions with existing or

new partners, or for debt or equity financing; demand for lithium,

including that such demand is supported by growth in the electric

vehicle market; the Company’s ability to produce high purity

battery grade lithium products; the impact of increasing

competition in the lithium business, and the Company’s competitive

position in the industry; ability to attract and retain skilled

talent in a competitive hiring environment; currency exchange and

interest rates; general economic conditions, including inflationary

conditions and their impact on the Company, its contractors and

suppliers; the feasibility and costs of proposed project designs

and plans; availability of technology, including low carbon energy

sources and water rights, on acceptable terms to advance the

Thacker Pass project; stable and supportive legislative, regulatory

and community environments in the jurisdictions where the Company

operates; stability and inflation of the Argentinian peso,

including any foreign exchange or capital controls which may be

enacted in respect thereof, and the effect of current or any

additional regulations on the Company’s operations; the impact of

unknown financial contingencies, including costs of litigation and

regulatory processes, on the Company’s operations; gains or losses,

in each case, if any, from short-term investments in Argentine

bonds and equities; estimates of and unpredictable changes to the

market prices for lithium products; exploration, development and

construction costs for the Caucharí-Olaroz project and the Thacker

Pass project; the timing, cost, quantity, capacity and product

quality of production at the Thacker Pass project, and any

expansion scenario; technological advancements and changes;

estimates of mineral resources and mineral reserves, including

whether mineral resources will ever be developed into mineral

reserves; reliability of technical data; anticipated timing and

results of exploration, development and construction activities,

including the impact of COVID-19 on such timing; timely responses

from governmental agencies responsible for reviewing and

considering the Company’s permitting activities at the Thacker Pass

project; the impact of COVID-19 on the Company’s operations,

timelines and budgets; that pending patent applications are

approved; government regulation of mining operations and treatment

under governmental and taxation regimes; accuracy of development

budget and construction estimates; successful integration of

acquired businesses and projects; expected benefits from

investments made in third parties; changes to the Company’s current

and future business plans and the strategic alternatives available

to the Company; and stock market conditions generally.

Forward-looking information also involves known

and unknown risks that may cause actual results to differ

materially. These risks include, among others, inherent risks in

the development of capital intensive mineral projects (including as

co-owners), variations in mineral resources and mineral reserves,

changes in budget estimation, global demand for lithium, recovery

rates and lithium pricing, risks associated with successfully

securing adequate financing, including the outcome of the Company’s

loan application with the U.S. Department of Energy, changes in

project parameters and funding thereof, risks related to growth of

lithium markets and pricing for products thereof, changes in

legislation, governmental or community policy, changes in public

perception concerning mining projects generally and opposition

thereto, political risk associated with foreign operations,

permitting risk, including receipt of new permits and maintenance

of existing permits, outcomes of litigation and regulatory

processes concerning the Company’s projects, title and access risk,

cost overruns, unpredictable weather and maintenance of natural

resources, risks associated with climate change and its impact on

the Company’s projects and operations, unanticipated delays,

intellectual property risks, currency and interest rate

fluctuations, operational risks, health and safety risks,

cybersecurity risks, economic conditions, and general market and

industry conditions. Additional risks, assumptions and other

factors are set out in the Company’s most recent annual management

discussion analysis and annual information form, copies of which

are available under the Company’s profile on SEDAR at www.sedar.com

and on the SEC website at www.sec.gov.

Although the Company has attempted to identify

important risks and assumptions, given the inherent uncertainties

in such forward-looking information, there may be other factors

that cause results to differ materially. Forward-looking

information is made as of the date hereof and the Company does not

intend, and expressly disclaims any obligation to, update or revise

the forward-looking information contained in this news release,

except as required by law. Accordingly, readers are cautioned not

to place undue reliance on such forward-looking information.

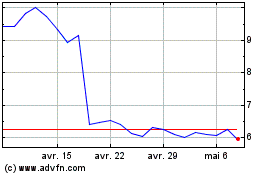

Lithium Americas (TSX:LAC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Lithium Americas (TSX:LAC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025