Lithium Americas Corp. (TSX: LAC) (NYSE: LAC) (“

Lithium

Americas” or the “

Company”) has reported

its financial and operating results for the fourth quarter and year

ended December 31, 2023 (“

Q4 2023”) and has filed

its audited consolidated financial statements

(“

Financials”) and management’s discussion and

analysis (“

MD&A”) for the year ended December

31, 2023. The Company is also providing an update on its Thacker

Pass lithium project in Humboldt Country, Nevada (“

Thacker

Pass”).

HIGHLIGHTS

Thacker Pass

- Site preparation

for major earthworks has been completed, including all site

clearing, commissioning a water supply system, site access

improvements and site infrastructure.

- The Company is

currently focused on advancing detailed engineering, procurement

and execution planning for the construction of Thacker Pass Phase

1. Detailed engineering is approximately 30% design complete to

date, and the Company plans to continue to increase the level of

detailed engineering in advance of issuing full notice to proceed

(“FNTP”), which is expected in the second half of

2024.

- On March 12, 2024,

the Company received a conditional commitment (“Conditional

Commitment”) from the U.S. Department of Energy

(“DOE”) for a $2.26 billion loan under the

Advanced Technology Vehicles Manufacturing

(“ATVM”) Loan Program (the

“Loan”) for financing the construction of the

processing facilities at Thacker Pass, targeting to produce an

initial 40,000 tonnes per year (“tpa”) of battery

grade lithium carbonate (“Phase 1”).

- The Company and its

engineering, procurement and construction management

(“EPCM”) contractor, Bechtel, entered into a

National Construction Agreement (Project Labor Agreement)

(“PLA”) with North America’s Building Trades

Unions (“NABTU”) for construction of Thacker

Pass.

- The Company leased

a parcel of land in the nearby City of Winnemucca for a

transloading terminal (“TLT”) to be used during

operations, providing direct access to the mainline railroad and an

interstate highway.

- Estimated total

capital cost (“CAPEX”) for Phase 1 construction

has been revised to $2.93 billion to reflect updated quantities and

execution planning tied to increased engineering progress, use of

union labor through a PLA for construction of Thacker Pass,

development of an all-inclusive housing facility for construction

workers, updated equipment pricing and a larger project

contingency.

- The DOE Loan plus

the strategic investment from General Motors Holdings LLC

(“GM”) are expected to provide the majority of the

capital necessary to fund Phase 1.

- During the year

ended December 31, 2023, $193.7 million was spent on Thacker Pass.

The Company expects capital expenditures to be significantly lower

in the first half of 2024 as the focus turns from early works to

advancing detailed engineering and project planning ahead of

FNTP.

- Mechanical

completion of Thacker Pass Phase 1 is targeted for 2027 following a

three-year construction period. Major construction is expected to

commence in the second half of 2024 following the anticipated

closing of the DOE Loan and issuance of FNTP.

- In December 2023,

the U.S. District Court, District of Nevada issued a final order

and judgment dismissing a lawsuit that was filed in February 2023

by three tribes asserting among other claims, inadequate

consultation by the Bureau of Land Management prior to the issuance

of the Record of Decision for Thacker Pass.

Corporate

- As of December 31,

2023, the Company had approximately $196 million in cash and cash

equivalents.

- In light of current

market conditions and to preserve strong liquidity, the Company has

reduced project capital expenditures to minimal levels until

closing of the DOE Loan and issuance of FNTP, which are expected in

the second half of the year. In addition, the Company has taken

actions to reduce its general and administrative and operating

expense budget for 2024 by more than 25%.

TECHNICAL INFORMATION

The scientific and technical information in this

news release has been reviewed and approved by Rene LeBlanc, PhD,

SME, Vice President, Growth and Product Strategy of the Company,

and a “qualified person” as defined under National Instrument

43-101 and Subpart 1300 of Regulation S-K under the United States

Securities Act of 1933.

FINANCIALS

Selected consolidated financial information is

presented as follows:

|

(in US$ million except per share information) |

Year ended December 31, |

|

|

2023 |

2022 |

|

|

$ |

$ |

|

Expenses |

27.6 |

60.9 |

|

Net loss |

3.9 |

67.8 |

|

Loss per share – basic |

0.02 |

0.42 |

|

(in US$ million) |

As at December 31, 2023 |

As at December 31, 2022 |

|

|

$ |

$ |

| Cash and cash equivalents |

195.5 |

0.6 |

| Total assets |

439.5 |

27.8 |

| Total long-term liabilities |

7.5 |

8.0 |

During the year ended December 31, 2023,

expenses and net loss decreased due to the commencement of

construction at Thacker Pass resulting in the commencement of

capitalization of a majority of project costs effective February 1,

2024. Also, at December 31, 2023, the Company recognized a $32.8

million gain on the change in fair value of the derivative

liability related to the number of shares to be issued pursuant to

the second tranche of the subscription agreement with GM.

In 2023, total assets

increased primarily due to the distribution to the Company pursuant

to the Arrangement, of the unspent remaining proceeds of the first

tranche of the GM investment and $75 million to establish

sufficient working capital, as well as the commencement of

capitalization of a majority of Thacker Pass costs effective

February 1, 2024.

This news release

should be read in conjunction with the Company’s Financial

Statements and MD&A for the year ended December 31, 2023, which

are available on the Company’s issuer profile on SEDAR+ at

www.sedarplus.ca and on EDGAR at www.sec.gov.

ABOUT LITHIUM AMERICAS

Lithium Americas is committed to responsibly

developing the 100%-owned Thacker Pass project located in Humboldt

County in northern Nevada, which hosts the largest known Measured

and Indicated lithium resource in North America. The Company is

focused on advancing Thacker Pass Phase 1 toward production;

targeting nameplate capacity of 40,000 tpa of battery-quality

lithium carbonate. The Company and its EPCM contractor, Bechtel,

entered into a PLA with NABTU for construction of Thacker Pass. The

three-year construction build is expected to create approximately

1,800 direct jobs. Lithium Americas’ shares are listed on the

Toronto Stock Exchange and New York Stock Exchange under the symbol

LAC. To learn more, visit www.lithiumamericas.com or follow

@LithiumAmericas on social media.

INVESTOR

CONTACT

Virginia Morgan, VP, IR and

ESG+1-778-726-4070ir@lithiumamericas.comwww.lithiumamericas.com

FORWARD-LOOKING INFORMATION

This news release contains certain

“forward-looking information” within the meaning of applicable

Canadian securities legislation, and “forward-looking statements”

within the meaning of applicable United States securities

legislation (collectively referred to as “forward-looking

information” (“FLI”)). All statements, other than

statements of historical fact, are FLI and can be identified by the

use of statements that include, but are not limited to, words, such

as “anticipate,” “plan,” “continues,” “estimate,” “expect,” “may,”

“will,” “projects,” “predict,” “proposes,” “potential,” “target,”

“implement,” “scheduled,” “forecast,” “intend,” “would,” “could,”

“might,” “should,” “believe” and similar terminology, or statements

that certain actions, events or results “may,” “could,” “would,”

“might” or “will” be taken, occur or be achieved. FLI in this news

release includes, but is not limited to, the expected operations,

financial results and condition of the Company; the Company’s

future objectives and strategies to achieve those objectives,

including the future prospects of the Company; the estimated cash

flow, capitalization and adequacy thereof for the Company; timing

of the issuance of the FNTP; development of Thacker Pass, including

timing, progress, approach, continuity or change in plans,

construction, commissioning, milestones, anticipated production and

results thereof and expansion plans; expectations regarding

accessing funding from the ATVM Loan Program and the strategic

investment from GM, including the sufficiency of such funding and

investment for the majority of the Company’s capital requirements

for Phase 1; the Company’s ability to raise capital; expected

expenditures to be made by the Company on Thacker Pass; ability to

produce high purity battery grade lithium products; the expected

reduction of the Company’s general and administrative and operating

expense budget for 2024; the timing, cost, quantity, capacity and

production at Thacker Pass; successful development of Thacker Pass,

the expected capital expenditures for the construction of Thacker

Pass, including the CAPEX for Phase 1 construction; as well as

other statements with respect to management’s beliefs, plans,

estimates and intentions, and similar statements concerning

anticipated future events, results, circumstances, performance or

expectations that are not historical facts.

FLI involves known and unknown risks,

assumptions and other factors that may cause actual results or

performance to differ materially. FLI reflects the Company’s

current views about future events, and while considered reasonable

by the Company as of the date of this news release, are inherently

subject to significant uncertainties and contingencies.

Accordingly, there can be no certainty that they will accurately

reflect actual results. Risks and assumptions upon which such FLI

is based include, without limitation: the general business and

economic uncertainties and adverse market conditions; uncertainties

inherent to feasibility studies and mineral resource and mineral

reserve estimates; the ability of the Company to secure sufficient

additional financing, advance and develop Thacker Pass, and to

produce battery grade lithium; the respective benefits and impacts

of Thacker Pass when production operations commence; settlement of

agreements related to the operation and sale of mineral production

as well as contracts in respect of operations and inputs required

in the course of production; the Company’s ability to operate in a

safe and effective manner, and without material adverse impact from

the effects of climate change or severe weather conditions;

uncertainties relating to receiving and maintaining mining,

exploration, environmental and other permits or approvals in

Nevada; demand for lithium, including that such demand is supported

by growth in the electric vehicle market; current technological

trends; the impact of increasing competition in the lithium

business, and the Company’s competitive position in the industry;

continuing support of local communities and the Fort McDermitt

Paiute Shoshone Tribe for Thacker Pass; continuing constructive

engagement with these and other stakeholders, and any expected

benefits of such engagement; the stable and supportive legislative,

regulatory and community environment in the jurisdictions where the

Company operates; impacts of inflation, currency exchanges rates,

interest rates and other general economic and stock market

conditions; the impact of unknown financial contingencies,

including litigation costs, environmental compliance costs and

costs associated with the impacts of climate change, on the

Company’s operations; increased attention to environmental, social

and governance (“ESG”) and sustainability-related

matters, risks related to the Company’s public statements with

respect to such matters that may be subject to heightened scrutiny

from public and governmental authorities related to the risk of

potential “greenwashing,” (i.e., misleading information or false

claims overstating potential sustainability related benefits);

risks that the Company may face regarding potentially conflicting

anti-ESG initiatives from certain U.S. state or other governments;

estimates of and unpredictable changes to the market prices for

lithium products; development and construction costs for Thacker

Pass, and costs for any additional exploration work at the project;

estimates of mineral resources and mineral reserves, including

whether mineral resources not included in mineral reserves will be

further developed into mineral reserves; reliability of technical

data; anticipated timing and results of exploration, development

and construction activities, including the impact of ongoing supply

chain disruptions and availability of equipment and supplies on

such timing; timely responses from governmental agencies

responsible for reviewing and considering the Company’s permitting

activities at Thacker Pass; availability of technology, including

low carbon energy sources and water rights, on acceptable terms to

advance Thacker Pass; the Company’s ability to obtain additional

financing on satisfactory terms or at all, including the outcome of

the ATVM Loan Program application; government regulation of mining

operations and mergers and acquisitions activity, and treatment

under governmental, regulatory and taxation regimes; ability to

realize expected benefits from investments in or partnerships with

third parties; accuracy of development budgets and construction

estimates; changes to the Company’s current and future business

plans and the strategic alternatives available to the Company; that

the Company will meet its future objectives and priorities; that

the Company will have access to adequate capital to fund its future

projects and plans; that such future projects and plans will

proceed as anticipated; as well as assumptions concerning general

economic and industry growth rates, commodity prices, currency

exchange and interest rates and competitive conditions. Although

the Company believes that the assumptions and expectations

reflected in such FLI are reasonable, the Company can give no

assurance that these assumptions and expectations will prove to be

correct.

There can be no assurance that FLI will prove to

be accurate, as actual results and future events could differ

materially from those anticipated in such information. As such,

readers are cautioned not to place undue reliance on this

information, and that this information may not be appropriate for

any other purpose, including investment purposes. The Company’s

actual results could differ materially from those anticipated in

any FLI as a result of the risk factors set out herein and in the

financial statements and MD&A for the year ended December 31,

2023, available on the Company’s issuer profile on SEDAR+ at

www.sedarplus.ca and EDGAR at www.sec.gov. All FLI contained in

this news release is expressly qualified by the risk factors set

out in the aforementioned documents. Readers are further cautioned

to review the full description of risks, uncertainties and

management’s assumptions in the aforementioned documents and other

disclosure documents available on SEDAR+ and on EDGAR.

The Company expressly disclaims any obligation

to update FLI as a result of new information, future events or

otherwise, except as and to the extent required by applicable

securities laws. Forward-looking financial information also

constitutes FLI within the context of applicable securities laws

and as such, is subject to the same risks, uncertainties and

assumptions as are set out in the cautionary note above.

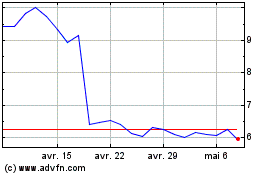

Lithium Americas (TSX:LAC)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Lithium Americas (TSX:LAC)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024