Lithium Americas Corp. (TSX: LAC) (NYSE: LAC)

(“

Lithium Americas”

or the

“

Company”) today announced that it has entered

into a purchase agreement (“

Purchase Agreement”)

with General Motors Co. (NYSE: GM) (“

GM”) pursuant

to which GM will make a $650 million equity investment in Lithium

Americas (the “

Transaction”). In connection with

the Transaction, the Company has provided an update on the

construction plan for the Thacker Pass lithium project in Humboldt

County, Nevada (“

Thacker Pass” or the

“

Project”), including the release of an

independent National Instrument 43-101 (“

NI

43-101”) feasibility study (“

Feasibility

Study”).

Further details on the Transaction are reported

in a joint release issued today by the Company and GM. All figures

presented are in U.S. Dollars.

TRANSACTION HIGHLIGHTS:

- The largest-ever

investment by an automaker to produce battery raw materials, with

GM to become Lithium Americas’ largest shareholder.

- Lithium Americas

to receive $650 million equity investment from GM consisting of:

- $320 million

first tranche investment for common shares representing 9.999% of

Lithium Americas before separation; and

- $330 million

second tranche investment, contemplated to be invested in the

Company’s U.S. business following the separation of its U.S. and

Argentine businesses (the “Separation”).

- After the first

tranche investment, GM will receive exclusive access to Phase 1

production through a binding supply agreement and a Right of First

Offer (“ROFO”) on Phase 2 production.

- Investment

supports the development of Thacker Pass, the largest known lithium

resource in the U.S.

- Project

estimated to supply lithium needed for up to one million electric

vehicles (“EVs”) per year.

- Investment also

supports the Company’s previously announced Separation by creating

the foundation for an independent U.S. business focused on Thacker

Pass and a North American lithium supply chain (“Lithium

Americas (NewCo)”).

PROJECT HIGHLIGHTS:

- Advancing

Thacker Pass construction plan targeting 80,000 tonnes per annum

(“tpa”) of battery-quality lithium carbonate

(“Li2CO3”)

production capacity in two phases of 40,000 tpa, respectively

(“Phase 1” and “Phase 2”).

- Phase 1

production expected to commence in the second half of 2026.

- Project life of 40 years

(“LOM”) utilizing less than 25% of the current

measured and indicated (“M&I”) mineral

resource estimate.

- Proven and probable mineral reserves

of 3.7 million tonnes (“Mt”) lithium carbonate

equivalent (“LCE”) at an average grade of 3,160

parts per million lithium (“ppm Li”).

- M&I mineral resource estimate of

16.1 Mt LCE at an average grade of 2,070 ppm Li.

- $5.7 billion net

present value (“NPV”) at 8% discount and 21.4%

internal rate of return (“IRR”), after-tax when

using a price assumption of $24,000 per tonne (“/

t”) of Li2CO3.

- Phase 1 and

Phase 2 capital cost estimates of $2.27 billion and $1.73 billion,

respectively, are based on cost estimates from Q3 2022 and include

a 13.1% contingency.

- Awarded the

Engineering, Procurement and Construction Management

(“EPCM”) contract for the construction of Thacker

Pass to Bechtel Corporation.

- Thacker Pass is

expected to create 1,000 jobs during construction and 500 jobs

during operations.

TRANSACTION DETAILS

STRATEGIC INVESTMENTGM has

agreed to make an aggregate investment of $650 million in two

tranches. In tranche 1, GM will acquire 15.0 million common shares

of Lithium Americas (each, a “LAC Share”) at a

price of $21.34 per share (the “Tranche 1 Subscription

Price”), for gross proceeds of $320 million

(“Tranche 1”). The funds from Tranche 1 will be

held in escrow until certain conditions are met, as discussed in

the Transaction Terms section below. If those conditions are met,

the funds will be released to the Company and GM will own a 9.999%

equity interest in Lithium Americas. Lithium Americas anticipates

that the escrow release will occur by mid-2023.

Following the Separation and the satisfaction of

certain conditions, GM has agreed to subscribe for shares of

Lithium Americas (NewCo) at the then market price on the date of

subscription, subject to a cap of 130% of the Tranche 1

Subscription Price (adjusted for the Separation) in an amount equal

to $330 million (“Tranche 2”).

Lithium Americas has agreed to use the proceeds

from the Transaction for the development of Thacker Pass.

OFFTAKE & INVESTOR RIGHTS

AGREEMENTLithium Americas has entered into an agreement to

supply GM with lithium carbonate production from Phase 1 of Thacker

Pass (the “Offtake Agreement”) in connection with

the escrow release of the Tranche 1 investment. The price within

the Offtake Agreement will be based on an agreed upon price formula

linked to prevailing market prices. The term of the Offtake

Agreement will be 10 years from the commencement of Phase 1

production, with the option for GM to extend by an additional five

years. GM will also have a ROFO on the offtake of Thacker Pass’

Phase 2 production.

As part of the Transaction, Lithium Americas and

GM will enter into an investor rights agreement (the

“Investor Rights Agreement”). GM will be required

to “lock-up” their securities until the later of (i) one year after

the Separation, or (ii) the earlier of (i) six months after the

closing of Tranche 2, or (ii) the date Tranche 2 is not completed

in accordance with its terms, provided that the foregoing lock-up

restriction will not apply if the Separation does not occur (such

date being the “Lock-up Outside Date”). The

Investor Rights Agreement also provides among other things, for GM

to be entitled to the following:

- If (i) following

the closing of Tranche 1 and prior to the completion or termination

of Tranche 2, GM owns any issued and outstanding LAC Shares, or

(ii) following the completion or termination of Tranche 2, GM owns

10% or more of the issued and outstanding LAC Shares – the right to

nominate an individual to serve on the Board of Directors of

Lithium Americas;

- If (i) following

the closing of Tranche 1 and prior to the completion or termination

of Tranche 2, GM owns any issued and outstanding LAC Shares, or

(ii) following the completion or termination of Tranche 2, GM owns

(i) 10% or more of the issued and outstanding LAC Shares or (ii)

own 5% or more of the issued and outstanding LAC Shares and is a

party to the Offtake Agreement (or a similar agreement with Lithium

Americas) and does not have a nominee on the board of directors of

Lithium Americas – the right to have a nonvoting observer attend

all Lithium Americas board meetings; and

- Until the later

of: (i) the Lock-up Outside Date, and (ii) the date on which GM

ceases to either (i) own 10% or more of the issued and outstanding

LAC Shares, or (ii) owns 5% or more of the issued and outstanding

LAC Shares and be a party to the Offtake Agreement (or a similar

agreement with Lithium Americas) – the right to participate in any

subsequent issuances of Lithium Americas securities to “top-up” its

pro rata ownership of Lithium Americas.

In addition, GM will be subject to a standstill

limitation whereby it will not be able to increase its holdings

beyond 20% of the issued and outstanding LAC Shares until a period

that is the earlier of (i) five years following the effective date

of the Investor Rights Agreement, and (ii) one year following the

date of the commencement of commercial production for Phase 1 (the

“Phase 1 Effective Date”) as outlined in the

Offtake Agreement.

U.S. DOE ATVM LOANAs previously

announced in April 2022, the Company submitted a formal application

to the U.S. Department of Energy (“DOE”) for the

funding of Thacker Pass through the DOE’s Advanced Technology

Vehicles Manufacturing Loan Program (“ATVM”)

designed to provide loans for facilities located in the U.S. for

the manufacturing of advanced technology vehicles and qualifying

components used in those vehicles. Lithium Americas believes that

the specific terms of this investment and Offtake Agreement both

demonstrate the Company’s commitment to supply lithium to U.S.

domestic EV production in alignment with the principles of the ATVM

and position the Company as a model candidate to receive the

maximum potential benefit of the ATVM program. The proceeds from

the DOE’s ATVM loan are expected to contribute a significant

portion of the initial capital costs for Thacker Pass Phase 1.

TRANSACTION TERMSTranche 1 of

the transaction will be structured through the initial issuance of

15,002,243 subscription receipts to GM, whereby each subscription

receipt will, upon satisfaction of escrow release conditions,

convert into one common share and 79.26% of a Tranche 2 Alternative

Exercise Warrant (“Tranche 2 AEW”), with a Tranche

2 AEW exercisable into a common share at a price of $27.74 for a

term of 36 months. The conversion of the subscription receipts will

result in the issuance of all shares issuable for the Tranche 1

Investment and, through the shares issuable upon exercise of the

Tranche 2 AEW, the allocation of all shares issuable under the

Tranche 2 subscription. The escrow release conditions for the

subscription receipts include delivery of a ruling under the

Thacker Pass Record of Decision (“ROD”) appeal

that does not result in vacatur of the ROD, and conditions related

to water rights transfer for Thacker Pass among other customary

closing conditions. Upon satisfaction of the escrow release

conditions and the issuance of the Tranche 1 shares, the parties

will execute and deliver the Offtake Agreement and the Investor

Rights Agreement.

The parties will implement Tranche 2 either

through the exercise of the Tranche 2 AEW or a purchase of shares

under a second tranche subscription agreement (which would result

in the automatic termination of the Tranche 2 AEW) that provides

for the purchase $329,852,134.38 of shares of the Company at

prevailing market price, to a maximum of $$27.74 per share

(adjusted for the separation, if applicable). To the extent that GM

completes an investment under one subscription alternative (either

the Tranche 2 subscription agreement or the Tranche 2 AEW), the

Common Shares will cease to be issuable under the other agreement.

In addition to other closing conditions, Tranche 2 will be subject

to a condition that the Company secure sufficient funding to

complete the development of Phase 1 of the Thacker Pass Project as

set out in the Feasibility Study.

Completion of the Transaction remains subject to

customary regulatory approvals, including approval of the TSX and

NYSE, and other customary closing conditions.

A copy of the Purchase Agreement, the Offtake

Agreement and the Investor Rights Agreement will be available on

the Company’s page on SEDAR at www.sedar.com and on EDGAR at

www.edgar.com.

ADVISORS AND COUNSELBMO Capital

Markets served as financial advisor, and Cassels Brock &

Blackwell LLP, Dorsey & Whitney LLP and McCarthy Tétrault LLP

served as legal counsel to Lithium Americas.

Morgan Stanley & Co. LLC served as financial

advisor to GM. Mayer Brown LLP and Osler, Hoskin & Harcourt LLP

served as legal counsel to GM.

SEPARATION UPDATE

On November 3, 2022, the Company announced that

it intended to advance a reorganization that will result in the

separation of its U.S. and Argentine business units into two

independent public companies. The Company continues to advance the

execution plan for the Separation, targeting completion in Q3

2023.

For more details about the Separation, please

refer to Lithium Americas’ press release on November 3, 2022.

PROJECT UPDATE

Thacker Pass Feasibility Study results reflect

operational and process improvements, including increased

extraction rates from an optimized mine plan through new ore

control strategy, an increase in sulfuric acid utilization by

targeting illite clay with greater potential for increasing lithium

extraction per tonne of sulfuric acid and increased crystallization

steps to further remove magnesium impurities.

Other process and design improvements were made

to further minimize the Project’s environmental impact, including,

increased capacity to 80,000 tpa within approximately the same

mining footprint as the permitted pit boundary and without

increasing the size of the sulfuric acid plant, additional

beneficiation and neutralization circuits to increase the

neutrality of filter pressed tailings and implementing a tail gas

scrubber utilizing a neutralization solution in the sulfuric acid

plant to minimize emissions and reduce impacts to ambient air

quality.

FEASIBILITY

STUDY SUMMARY1

|

Scenarios |

Year 1-25 |

40 Years LOM |

|

Design production capacity |

80,000 tpa Li2CO3 (Phase 1 - 40,000 tpa) |

|

Mining method |

Continuous open-pit mining |

|

Processing method |

Sulfuric acid leaching |

|

Mineral reserves |

3.7 Mt LCE at a grade of 3,160 ppm Li |

|

Period |

25 years |

40 years |

|

Lithium carbonate price2 |

$24,000 / t Li2CO3 |

|

Initial capital costs – Phase 1 |

$2,268 million |

|

Initial capital costs – Phase 2 |

$1,728 million |

|

Sustaining capital costs |

$628 million |

$1,510 million |

|

Operating Costs (average) |

$6,743 / t |

$7,198 / t |

|

Average Annual EBITDA (per year) |

$1,176 million |

$1,094 million |

|

After-tax NPV @ 8% Discount Rate |

$4,950 million |

$5,727 million |

|

After-tax IRR |

21.2 |

% |

21.4 |

% |

CONSTRUCTION TIMELINEPhase 1

will consist of a single sulfuric acid plant with a nominal

production rate of 3,000 tonnes per day (“tpd”)

sulfuric acid. Phase 2 construction will begin upon completion of

Phase 1, with the addition of a second sulfuric acid plant with an

additional nominal production rate of 3,000 tpd.

Total designed capacity of 80,000 tpa Li2CO3

production upon completion of both Phase 1 and Phase 2. Actual

production varies by year with anticipated average production of

approximately 70,000 tpa Li2CO3 in the first 25 years and

approximately 67,000 tpa over LOM, including ramp up of Phase 1 and

Phase 2.

The Company continues to prepare for

construction while we await a ruling for the appeal of the issuance

of the ROD following a hearing held by the US District Court,

District of Nevada (“Federal Court”) on January 5,

2023. During the hearing, plaintiffs and the Company addressed

final questions, the Federal Court reaffirmed no additional

hearings or briefings are required and they expect to issue a

decision in the next couple months.

CAPITAL COST ESTIMATEThe

initial capital cost estimate covers early-works, mine development,

mining, the process plant, the off-site transload facility,

commissioning and all associated infrastructure.

The capital cost estimates include a 13.1%

contingency. The Phase 2 estimate is derived from the Phase 1

estimate and the lower Phase 2 estimated capital costs are a result

of mine development, infrastructure and transload facility

synergies.

|

Initial Capital Costs ($ millions) |

Phase 1 Costs |

Phase 2 Costs |

|

Mine |

$ |

58 |

$ |

30 |

|

Process Plant and Infrastructure |

$ |

1,963 |

$ |

1,582 |

|

Offsite – Transload Facility |

$ |

78 |

$ |

31 |

|

Owner's Costs |

$ |

169 |

$ |

86 |

|

Total Initial Capital Costs |

$ |

2,268 |

$ |

1,729 |

In addition to the initial capital costs, $50

million in mining equipment cost will be repaid to the mining

contractor over the first five years of production.

Sustaining capital costs include replacement

costs for mining equipment, process plant equipment, and expansions

of storage facilities and infrastructure.

OPERATING COST ESTIMATE

Operating costs in each area include labor, maintenance materials

and supplies, raw materials, and outside services, among others.

Reagents account for approximately 63% of LOM total operating costs

for the process plant and the sulfuric acid plant. Primary reagents

include liquid sulfur, limestone, soda ash, flocculant and

quicklime.

|

|

Year 1-25 |

40 Years LOM |

|

$ per tonne

Li2CO3 |

% of Total |

$ per tonne

Li2CO3 |

% of Total |

|

Mine |

$ |

1,026 |

15 |

% |

$ |

1,144 |

16 |

% |

|

Lithium Process Plant |

$ |

3,088 |

46 |

% |

$ |

3,213 |

45 |

% |

|

Liquid Sulfuric Acid Plant |

$ |

2,424 |

36 |

% |

$ |

2,627 |

36 |

% |

|

General & Administrative |

$ |

205 |

3 |

% |

$ |

215 |

3 |

% |

|

Total Operating Costs |

$ |

6,743 |

100 |

% |

$ |

7,198 |

100 |

% |

MINERAL RESOURCE ESTIMATE

Thacker Pass

Mineral Resource Estimate as of November 2, 2022

|

Category |

Tonnage(Mt) |

Average Li(ppm) |

Lithium Carbonate Equivalent (Mt) |

|

Measured |

534.7 |

2,450 |

7.0 |

|

Indicated |

922.5 |

1,850 |

9.1 |

|

Total Measured & Indicated |

1,457.2 |

2,070 |

16.1 |

|

Inferred |

297.2 |

1,870 |

3.0 |

Notes for the November

2, 2022 Mineral Resource:

- The Qualified Person who supervised

the preparation of and approved disclosure for the estimate is

Benson Chow, P.G., SME-RM.

- Mineral Resources that are not

Mineral Reserves do not have demonstrated economic

viability. Mineral Resources are inclusive of 217.3 million

metric tonnes (Mt) of Mineral Reserves.

- Mineral Resources are reported

using an economic break-even formula: “Operating Cost per Resource

Tonne”/“Price per Recovered Tonne Lithium” * 10^6 = ppm Li Cutoff.

“Operating Cost per Resource Tonne” = US$88.50, “Price per

Recovered Tonne Lithium” is estimated: (“Lithium Carbonate

Equivalent (LCE) Price” * 5.323 *(1 – “Royalties”) * “Recovery”.

Variables are “LCE Price” = US$22,000/tonne Li2CO3, “Royalties” =

1.75% and “Recovery” = 73.5%.

- Presented at a cutoff grade of

1,047 ppm Li.

- A resource constraining pit shell

has been derived from performing a pit optimization estimation

using Vulcan software.

- The conversion factor for lithium

to LCE is 5.323.

- Applied density for the

mineralization is 1.79 t/m3.

- Measured Mineral Resources are in

blocks estimated using at least six drill holes and eighteen

samples within a 262 m search radius in the horizontal plane and 5

m in the vertical direction; Indicated Mineral Resources are in

blocks estimated using at least two drill holes and six to eighteen

samples within a 483 m search radius in the horizontal plane and 5

m in the vertical direction; and Inferred Mineral Resources are

blocks estimated with at least two drill holes and three to six

samples within a search radius of 722 m in the horizontal plane and

5 m in the vertical plane.

- Tonnages and grades have been

rounded to accuracy levels deemed appropriate by the QP. Summation

errors due to rounding may exist.

MINERAL RESERVE ESTIMATE

Thacker Pass

Mineral Reserve Estimate as of November 2, 2022

|

Category |

Tonnage(Mt) |

Average Li(ppm) |

Lithium Carbonate Equivalent (Mt) |

|

Proven |

192.9 |

3,180 |

3.3 |

|

Probable |

24.4 |

3,010 |

0.4 |

|

Total Proven and Probable |

217.3 |

3,160 |

3.7 |

Notes for the November

2, 2022 Mineral Reserve:

- The Qualified

Person who supervised the preparation of and approved disclosure

for the estimate is Kevin Bahe, P.E., SME-RM.

- Mineral Reserves

have been converted from measured and indicated Mineral Resources

within the feasibility study and have demonstrated economic

viability.

- Reserves

presented at an 85% maximum ash content and 1.533 kilogram of

lithium recovered per run of mine feed cutoff grade. A sales price

of $5,400 US$/t of Li2CO3 was utilized in the pit optimization

resulting in the generation of the reserve pit shell in 2019.

Overall slope of 27 degrees was applied. For bedrock material pit

slope was set at 47 degrees. Mining and processing cost of $57.80

per tonne of ROM feed, a processing recovery factor of 84%, and

royalty cost of 1.75% were additional inputs into the pit

optimization.

- A LOM plan was

developed based on equipment selection, equipment rates, labor

rates, and plant feed and reagent parameters. All Mineral Reserves

are within the LOM plan. The LOM plan is the basis for the economic

assessment within the NI 43-101 technical report titled

“Feasibility Study, National Instrument 43-101 Technical Report for

the Thacker Pass Project Humboldt County, Nevada, USA” with an

effective date of November 2, 2022 (the “Technical

Report”), which is used to show economic viability of the

Mineral Reserves.

- Applied density

for the ore is 1.79 t/m3.

- Lithium

Carbonate Equivalent is based on in-situ LCE tonnes with 95%

recovery factor.

- Tonnages and grades have been

rounded to accuracy levels deemed appropriate by the QP. Summation

errors due to rounding may exist.

- The reference point at which the Mineral Reserves are defined

is at the point where the ore is delivered to the run-of-mine

feeder.

Please refer to the

Technical Report for full details on the geology, mining,

processing and infrastructure of Thacker Pass.

MINERAL RESERVE ESTIMATE

METHODOLOGY

The Mineral Reserves

estimate in the Technical Report is based on current knowledge,

engineering constraints and permit status. A qualified person, as

defined under NI 43-101 (“QP”), has reviewed and

verified the Mineral Reserve estimate (the “Mineral

Reserves QP”), and is of the opinion that the methodology

for estimation of Mineral Reserves in the Technical Report is in

general accordance with the 2019 CIM Estimation of Mineral

Resources and Mineral Reserves Best Practice Guidelines, and using

the definitions in 2014 CIM Definition Standards for the

classification of Mineral Reserves. Large changes in the market

pricing, commodity price assumptions, material density factor

assumptions, future geotechnical evaluations, cost estimates or

metallurgical recovery could affect the pit optimization parameters

and therefore the cutoff grades and estimates of Mineral

Reserves.

MINERAL RESOURCE ESTIMATE

METHODOLOGY

A QP has reviewed and

verified the Mineral Resources estimate (the “Mineral

Resources QP”) and is of the opinion that the Mineral

Resource estimation methodology is in general accordance with the

2019 CIM Estimation of Mineral Resources and Mineral Reserves Best

Practice Guidelines and uses the definitions in 2014 CIM Definition

Standards for Mineral Resources and Mineral Reserves for the

classification of Mineral Resources. Potential risk factors that

could affect the Mineral Resource estimates include but are not

limited to large changes in the market pricing, commodity price

assumptions, material density factor assumptions, future

geotechnical evaluations, metallurgical recovery assumptions,

mining and processing cost assumptions, and other cost estimates

could affect the pit optimization parameters and therefore the

cutoff grades and Mineral Resource estimates.

QUALITY ASSURANCE AND QUALITY

CONTROL

MINERAL

RESOURCES Sample names, certificate identifications, and

run identifications were cross referenced with the laboratory

certificates and sample assay datasheet for spot checking and

verification of data. No data anomalies were discovered during this

check.

Quality Assurance / Quality Control (QA/QC)

methodology utilized by Lithium Americas and results of these

checks were discussed between Lithium Americas’ geologists and the

Mineral Resources QP.

Geologic logs, Access databases, and Excel

spreadsheets were provided to the Mineral Resources QP for cross

validation with the Excel lithological description file. Spot

checks between Excel lithological description sheets were performed

against the source data with no inconsistencies found with the

geologic unit descriptions.

Verification of the block model was performed by

the creation of a geostatistical model and the review of its

various outputs. Histograms, HERCO grade tonnage curves, and swath

plots were created and analyzed to validate the accuracy of the

block model.

Based on the various reviews, validation

exercises and remedies outlined above, the Mineral Resources QP

concluded that the data is adequate for use for Mineral Resource

estimation.

MINERAL RESERVES The Mineral

Reserves QP reviewed the following as part of the mine planning,

cost model and Mineral Reserves data verification.

- Geotechnical:

slope stability study completed by BARR Engineering in 2019 was

reviewed.

- Mining Method:

open-pit mining with limited blasting has been reviewed and

assessed with geotechnical reports.

- Pit

Optimization: the pit limits were established based on the

Environmental Impact Statement pit extents and physical features.

The final pit shell was verified to provide a positive economic

value.

- Mine Design:

ramp, bench and face angle parameters were validated by

geotechnical reports.

- Production

Schedule: the production schedule was validated based on

reasonability.

- Labor and

Equipment: estimations for equipment sizes, capacity, availability

and utilization were reviewed for reasonability.

- Economic Model: model was reviewed

and demonstrated economic viability for the project.

- Facilities and Materials: facilities and materials located

within the reserve pit boundary will be re-located when access to

those areas are required during mining.

QUALIFIED PERSON

The scientific and technical information

contained in this news release has been derived from the Technical

Report and has been reviewed and approved by Rene LeBlanc, RM-SME,

Chief Technical Officer of the Company, a QP as defined under NI

43-101.Further information about Thacker Pass, including a

description of the key assumptions, parameters, sampling methods,

data verification and QA/QC programs, methods relating to Mineral

Resources and Mineral Reserves and factors that may affect those

estimates are contained in the Technical Report which will be made

available under the Company’s profile on SEDAR and on the Company’s

website.

Other than as described in the Company’s

continuous disclosure documents, there are no known legal,

political, environmental or other risks that could materially

affect the potential development of the Mineral Reserves and

Mineral Resources at this point in time.

NATIONAL INSTRUMENT 43-101

DISCLOSURE

A NI 43-101 Technical

Report will be prepared on the results of the updated Feasibility

Study by the Qualified Persons and will be filed on SEDAR within 45

days of this news release.

Readers are cautioned

that the conclusions, projections and estimates set out in this

news release are subject to important qualifications, assumptions

and exclusions, all of which will be detailed in the Technical

Report. To fully understand the summary information set out above,

the Technical Report that will be filed on SEDAR at www.sedar.com

should be read in its entirety.

CONFERENCE CALL

Lithium Americas will

host a conference call for analysts and investors on Tuesday,

January 31, 2023 at 10:00 am ET, followed by a question-and-answer

session.

To register for the

webcast, link here:

https://events.q4inc.com/attendee/888987622.

To register for the

dial-in numbers, link here:

https://conferencingportals.com/event/PTZkmgFQ.

A replay of the webcast

will be available until January 30, 2024 at the link above and a

transcript will also be available at www.lithiumamericas.com.

ABOUT LITHIUM AMERICAS

Lithium Americas is focused on advancing lithium

projects in Argentina and the United States to production. In

Argentina, Caucharí-Olaroz is advancing towards first production

and Pastos Grandes represents regional growth. In the U.S., Thacker

Pass has received its ROD and is advancing towards construction.

The Company trades on both the Toronto Stock Exchange and on the

New York Stock Exchange, under the ticker symbol “LAC”.For further

information contact:Investor RelationsTelephone: 778-656-5820Email:

ir@lithiumamericas.comWebsite: www.lithiumamericas.com

FORWARD-LOOKING INFORMATION

This news release contains certain

forward-looking information, including information with respect to

the anticipated use of proceeds from the Transaction, the rights to

be provided to GM and the restrictions imposed on GM pursuant to

the Investor Rights Agreement and the Offtake Agreement, the

ability to obtain regulatory approval for the Transaction including

a favorable ROD and the ability of GM and Lithium Americas to meet

the other closing conditions of the Transaction. Statements that

are not historical fact are “forward-looking information” as that

term is defined in National Instrument 51-102 (“NI 51-102”) of the

Canadian Securities Administrators (collectively, “forward-looking

information”). Forward-looking information is frequently, but not

always, identified by words such as “plans”, “expects”,

“anticipates”, “believes”, “intends”, “estimates”, “potential”,

“possible” and similar expressions, or statements that events,

conditions or results “will”, “may”, “could” or “should” occur or

be achieved. In stating the forward-looking information herein,

Lithium Americas has applied certain material assumptions

including, but not limited to, the assumption that general business

conditions will not change in a materially adverse manner.

Forward-looking information involves information

about the future and is inherently uncertain, and actual results,

performance or achievements of Lithium Americas and its

subsidiaries may differ materially from any future results,

performance or achievements expressed or implied by the

forward-looking information due to a variety of risks,

uncertainties and other factors. Such risks and other factors

include, among others, risks involved in fluctuations in lithium

and other commodity prices and currency exchange rates;

uncertainties related to raising sufficient financing in a timely

manner and on acceptable terms; and other risks and uncertainties

disclosed in information released by Lithium Americas and filed

with the applicable regulatory agencies.

Lithium Americas’ forward-looking information is

based on the beliefs, expectations and opinions of management on

the date such information is posted, and Lithium Americas does not

assume, and expressly disclaims, any intention or obligation to

update or revise any forward-looking information whether as a

result of new information, future events or otherwise, except as

otherwise required by applicable securities legislation. For the

reasons set forth above, investors should not place undue reliance

on forward-looking information.

This news release also contains forward-looking

information related to the mineral resource and mineral reserve

estimates for the Thacker Pass Deposit and the information in this

news release should be qualified in its entirety based on the

information in the Technical Report. The material factors that

could cause actual results to differ from the conclusions,

estimates, designs, forecasts or projections include geological

modeling, grade interpolations, lithium price estimates, mining

cost estimates, mine design parameters, and final pit shell limits

such as more detailed exploration drilling or final pit slope

angle.

NON-GAAP FINANCIAL MEASURES

This news release includes disclosure of certain

non-GAAP financial measures, including expected average annual

EBITDA with respect to the results of the Feasibility Study for

Thacker Pass presented in this news release. Such measures have no

standardized meaning under IFRS and may not be comparable to

similar measures used by other issuers. The Company believes that

these measures provide investors with an improved ability to

evaluate the prospects of the Company and, in particular, Thacker

Pass. As Thacker Pass is not in production, the prospective

non-GAAP financial measures presented may not be reconciled to the

nearest comparable measure under IFRS and the equivalent historical

non-GAAP financial measure for the prospective non-GAAP financial

measure discussed herein is nil$.

__________________________1 The economic analysis is based on Q3

2022 pricing for capital and operating costs.2 Based on Q3 2022

long-term lithium carbonate price outlook from a leading industry

market consultant.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/14b7003d-427a-4b0b-932b-c2e9208c1c6c

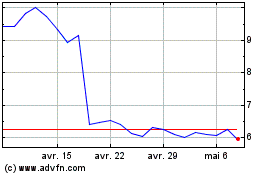

Lithium Americas (TSX:LAC)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Lithium Americas (TSX:LAC)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025