Brompton Lifeco Split Corp. Announces Class A Share Split

28 Novembre 2024 - 11:12PM

(TSX: LCS, LCS.PR.A) Brompton Lifeco Split Corp.

(the “Fund”) is pleased to announce its intention to complete a

stock split of its class A shares (the “Share Split”) due to the

Fund’s strong performance. Class A shareholders of record at the

close of business on December 17, 2024 will receive 14 additional

class A shares for every 100 class A shares held, pursuant to the

Share Split. The Share Split is subject to the approval of the

Toronto Stock Exchange (the “TSX”).

Following the Share Split, class A shareholders

will continue to receive regular monthly cash distributions

targeted to be $0.075 per class A share. As a result, the Share

Split will increase the total dollar amount of distributions to be

paid to class A shareholders by approximately 14%. The Fund

provides a distribution reinvestment plan, on a commission-free

basis for class A shareholders that wish to reinvest distributions

and realize the benefits of compound growth.

Over the last 10 years, the class A shares have

delivered a 14.9% per annum total return based on net asset value,

outperforming the S&P/TSX Capped Financials Total Return Index

by 4.6% per annum and the S&P/TSX Composite Total Return Index

by 6.5% per annum.(1) Since inception, class A shareholders have

received cash distributions of $9.03 per share.

Following the completion of the Share Split, the

preferred shares of the Fund are expected to have downside

protection from a decline in the value of the Fund’s portfolio of

approximately 49%.(2) The preferred shares have delivered a 6.2%

per annum total return over the last 10 years, outperforming the

S&P/TSX Preferred Share Total Return Index by 3.6% per annum

with lower volatility.(1)

The class A shares are expected to commence

trading on an ex-split basis at the opening of trading on December

17, 2024. No fractional class A shares will be issued and the

number of class A shares each holder shall receive will be rounded

down to the nearest whole number.

The Fund invests in a portfolio on an

approximately equal weighted basis, of common shares consisting of

the four Canadian life insurance companies: Great-West Lifeco Inc.,

iA Financial Corporation Inc., Manulife Financial Corporation and

Sun Life Financial Inc.

About Brompton Funds

Founded in 2000, Brompton is an experienced

investment fund manager with income and growth focused investment

solutions including exchange-traded funds (ETFs) and other TSX

traded investment funds. For further information, please contact

your investment advisor, call Brompton’s investor relations line at

416-642-6000 (toll-free at 1-866-642-6001), email

info@bromptongroup.com or visit our website at

www.bromptongroup.com.

(1) See Standard Performance Data

table below.(2) Based on the NAV of the Class A

shares used to determine the Share Split ratio.

|

Brompton Lifeco Split Corp.Compound Annual NAV

returns to October 31, 2024 |

1 Yr |

3 Yr |

5 Yr |

10 Yr |

|

Class A Shares (TSX:LCS) |

110.7% |

26.5% |

20.3% |

14.9% |

|

S&P/TSX Capped Financials Total Return Index |

45.7% |

9.7% |

12.1% |

10.3% |

|

S&P/TSX Composite Total Return Index |

32.0% |

8.1% |

11.4% |

8.4% |

|

|

|

|

|

|

|

Preferred Shares (TSX:LCS.PR.A) |

6.8% |

6.5% |

6.5% |

6.2% |

|

S&P/TSX Preferred Share Total Return Index |

31.1% |

1.0% |

6.2% |

2.6% |

Returns are for the periods ended October 31,

2024 and are unaudited. The table shows the Fund’s compound return

on a class A share and preferred share for each period indicated,

compared with the S&P/TSX Capped Financials Total Return Index

(“Financials Index”), the S&P/TSX Composite Total Return Index

(“Composite Index”), and the S&P/TSX Preferred Share Total

Return Index (“Preferred Index”) (together the “Indices”). The

Financials Index is derived from the Composite Index based on the

financials sector of the Global Industry Classification Standard.

The Composite Index tracks the performance, on a market weight

basis and total return basis, of a broad index of

large-capitalization issuers listed on the TSX. The Preferred Index

tracks the performance, on a market weight basis and total return

basis, of preferred shares listed on the TSX that meet criteria

relating to size, liquidity, and issuer rating. The Fund is

passively managed and consists of four Canadian life insurance

companies on an approximately equal-weighted basis; therefore, its

performance is not expected to mirror that of the Indices which

have more diversified portfolios and include a substantially larger

number of companies. Furthermore, the Indices’ performance is

calculated without the deduction of management fees, fund expenses

and trading commissions, whereas the performance of the Fund is

calculated after deducting such fees and expenses. Additionally,

the performance of the Fund’s class A shares is impacted by the

leverage provided by the Fund’s preferred shares. The performance

information shown is based on net asset value per class A share or

the redemption price per preferred share and assumes that cash

distributions made by the Fund during the periods shown were

reinvested at net asset value per class A share or the redemption

price per preferred share in additional class A shares or preferred

shares of the Fund. Past performance does not necessarily indicate

how the Fund will perform in the future.

You will usually pay brokerage fees to your

dealer if you purchase or sell shares of the investment funds on

the TSX or other alternative Canadian trading system (an

“exchange”). If shares are purchased or sold on an exchange,

investors may pay more than the current net asset value when buying

shares of the investment fund and may receive less than the current

net asset value when selling them.

There are ongoing fees and expenses associated

with owning shares of an investment fund. An investment fund must

prepare disclosure documents that contain key information about the

fund. You can find more detailed information about the fund in the

public filings available at www.sedarplus.ca. The indicated rates

of return are the historical annual compounded total returns

including changes in share value and reinvestment of all

distributions and do not take into account certain fees such as

redemption costs or income taxes payable by any securityholder that

would have reduced returns. Investment funds are not guaranteed,

their values change frequently and past performance may not be

repeated.

Certain statements contained in this document

constitute forward-looking information within the meaning of

Canadian securities laws. Forward-looking information may relate to

matters disclosed in this document and to other matters identified

in public filings relating to the Fund, to the future outlook of

the Fund and anticipated events or results and may include

statements regarding the future financial performance of the Fund.

In some cases, forward-looking information can be identified by

terms such as “may”, “will”, “should”, “expect”, “plan”,

“anticipate”, “believe”, “intend”, “estimate”, “predict”,

“potential”, “continue” or other similar expressions concerning

matters that are not historical facts. Actual results may vary from

such forward-looking information. Investors should not place undue

reliance on forward-looking statements. These forward-looking

statements are made as of the date hereof and we assume no

obligation to update or revise them to reflect new events or

circumstances.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or any

applicable exemption from the registration requirements. This news

release does not constitute an offer to sell or the solicitation of

an offer to buy securities nor will there be any sale of such

securities in any state in which such offer, solicitation or sale

would be unlawful.

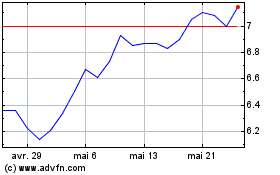

Brompton Lifeco Split (TSX:LCS)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Brompton Lifeco Split (TSX:LCS)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024