Liberty Gold Announces Closing of Royalty Transactions and US$5.7 Million Private Placement and Welcomes Wheaton Precious Metals as a Strategic Shareholder

18 Septembre 2023 - 12:00PM

Liberty Gold Corp. (TSX:LGD; OTCQX:LGDTF) (“Liberty Gold” or the

“Company”) is pleased to announce the successful completion of the

previously announced (see press release dated September 11, 2023)

purchase and resale of a 0.5% Net Smelter Royalty (“NSR”) on the

Company’s Black Pine Oxide Gold Project (“Black Pine”) in

southeastern Idaho transactions (the “Royalty Transactions”) as

well as the closing of the non-brokered private placement raising

proceeds of US$5.7 million (the “Offering”).

ROYALTY TRANSACTIONS

The Company has acquired the existing 0.5% NSR

from a private company on certain claims at Black Pine by

delivering US$3.5 million in cash consideration and 200,000 common

shares of the Company. Concurrently, the Company has granted an

affiliate of Wheaton Precious Metals Corp. (“Wheaton”) a new 0.5%

NSR (the “Royalty”) covering all claims comprising Black Pine for

which the Company has received cash consideration of US$3.6

million. The Company has been granted an option to repurchase 50%

of the Royalty for US$3.6 million at any point in time up to the

earlier of commercial production at Black Pine or January 1, 2030.

An affiliate of Wheaton has also been granted a Right of First

Refusal on any royalties, streams or pre-pays that include precious

metals pertaining to Black Pine.

PRIVATE PLACEMENT FINANCING

Under the Offering, the Company sold 22.9

million shares at C$0.34 per share for proceeds to the Company of

US$5.7 million. Wheaton subscribed to US$5 million of the Offering

and existing shareholders, management and directors of the Company

subscribed to US$0.7 million of the Offering.

The Company intends to use the proceeds of the

Offering for exploration, development, economic studies and

permitting programs for the Company's projects in the Great Basin

and for general working capital.

Certain directors, management and insiders of

the Company (collectively, the “Interested Persons”) purchased or

acquired direction and control over an aggregate of 558,820 common

shares under the Offering. The Interested Persons are each

considered a “related party” of Liberty Gold and the sale of common

shares under the Offering to the Interested Persons constitutes a

“related party transaction” within the meaning of MI 61-101 –

Protection of Minority Security Holders in Special

Transactions.

The securities offered have not been, and will

not be, registered under the United States Securities Act of 1933,

as amended (the “U.S. Securities Act”) or any U.S. state securities

laws, and may not be offered or sold in the United States or to, or

for the account or benefit of, United States persons absent

registration or any applicable exemption from the registration

requirements of the U.S. Securities Act and applicable U.S. state

securities laws. This press release shall not constitute an offer

to sell or the solicitation of an offer to buy securities in the

United States, nor will there be any sale of these securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful.

ABOUT LIBERTY GOLD

Liberty Gold is focused on exploring for and

developing open pit oxide deposits in the Great Basin of the United

States, home to large-scale gold projects that are ideal for

open-pit mining. This region is one of the most prolific

gold-producing regions in the world and stretches across Nevada and

into Idaho and Utah. We know the Great Basin and are driven to

discover and advance big gold deposits that can be mined profitably

in open-pit scenarios.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations Phone:

604-632-4677 or Toll Free 1-877-632-4677 info@libertygold.ca

All statements in this press release, other than

statements of historical fact, are "forward-looking information"

with respect to Liberty Gold within the meaning of applicable

securities laws, including statements that address potential

quantity and/or grade of minerals. Forward-looking information is

often, but not always, identified by the use of words such as

"seek", "anticipate", "plan", "continue", "planned", "expect",

"project", "predict", "potential", "targeting", "intends",

"believe", "potential", and similar expressions, or describes a

"goal", or variation of such words and phrases or state that

certain actions, events or results "may", "should", "could",

"would", "might" or "will" be taken, occur or be achieved.

Forward-looking information is not a guarantee of future

performance and is based upon a number of estimates and assumptions

of management at the date the statements are made including, among

others, assumptions about future prices of gold, and other metal

prices, currency exchange rates and interest rates, favourable

operating conditions, political stability, obtaining governmental

approvals and financing on time, obtaining renewals for existing

licenses and permits and obtaining required licenses and permits,

labour stability, stability in market conditions, the timing and

success of future plans and objectives in the areas of sustainable

development, health, safety, environment, community development;

successful resolution of disputes and anticipated costs and

expenditures. Many assumptions are based on factors and events that

are not within the control of Liberty Gold and there is no

assurance they will prove to be correct.

Such forward-looking information, involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to

the interpretation of results and/or the reliance on technical

information provided by third parties as related to the Company’s

mineral property interests; changes in project parameters as plans

continue to be refined; current economic conditions; future prices

of commodities; possible variations in grade or recovery rates; the

costs and timing of the development of new deposits; failure of

equipment or processes to operate as anticipated; the failure of

contracted parties to perform; the timing and success of

exploration activities generally; delays in permitting; possible

claims against the Company; labour disputes and other risks of the

mining industry; delays in obtaining governmental approvals, the

completion of exploration as well as those factors discussed in the

Annual Information Form of the Company dated March 28, 2023 in the

section entitled "Risk Factors", under Liberty Gold’s SEDAR profile

at www.sedar.com.

Although Liberty Gold has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements.

Liberty Gold disclaims any intention or obligation to update or

revise any forward-looking information, whether as a result of new

information, future events or otherwise.

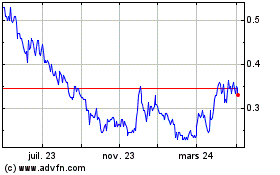

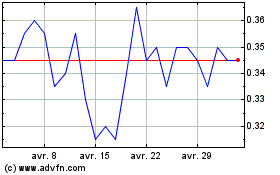

Liberty Gold (TSX:LGD)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Liberty Gold (TSX:LGD)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024