Melcor REIT (TSX: MR.UN) today announced results for the first

quarter ended March 31, 2023. Revenue was stable in the

quarter at $18.99 million and net operating income was down 3% at

$11.52 million. Occupancy currently sits at 88%, up 0.3% compared

to year-end and we have retained 95% of expiring leases

year-to-date.

Andrew Melton, CEO of Melcor REIT commented: "I'm

pleased to report another quarter of stable results for the REIT.

While our results remain stable, we have achieved some successes

that will lead to further improvement in results, including

occupancy improvement to 88%, retention of 95% of expiring leases

and weighted average base rent growth compared both over period and

sequentially.

These results demonstrate our ongoing commitment to

strategic leasing efforts to improve occupancy and deliver value

for our unitholders. We are also pleased to have closed on the sale

of Kelowna Business Centre, generating proceeds that allowed us to

pay down our credit line and achieve a favorable return on

investment. As we navigate ongoing market challenges, the REIT

remains focused on maintaining stable results."

HIGHLIGHTS:Our portfolio continued

to produce stable results in the first quarter despite rising costs

and inflationary pressures in all our markets. We continue to focus

efforts on leasing and completed 25,328 sf of new leasing and

196,449 sf in renewals and holdovers in the quarter for a 95.5%

retention rate. These leasing efforts have resulted in an overall

increase in occupancy to 88.4%, up 0.3% since year end and up 1.0%

since Q1-2022. Weighted average base rents (WABR) also improved 1%

since year end despite challenging market conditions.

On February 1, 2023 we sold Kelowna Business

Centre, an office building located in Kelowna, BC for gross

proceeds of $19.50 million. This asset has been owned by the REIT

since 2013 and was an opportunistic sale that enabled the REIT to

pay down our line of credit while also achieving a good return on

investment for unitholders.

Retail properties continue to anchor our portfolio,

and have seen improvements in both occupancy and WABR compared to

last year. Retail represents 44.4% of our total GLA and 60.1% of

net rental income in Q1-2023. Our office properties continue to

navigate downward pressure on rental rates and an increase in

supply in some of our key geographic areas, specifically our

Edmonton office properties which have seen an increase in new

development of office space in recent years. Despite these

pressures, occupancy has increased over Q1-2022 by 0.7% and by 0.4%

since year-end. In Q1-2023, we completed new leasing of 25,328 sf,

which includes 21,998 sf office space and 3,330 sf retail space,

all in our Northern Alberta region.

In the quarter, rental revenue and net rental

income remained steady and NOI decreased by 3% due in part to the

timing of operating expenses and increased utility costs including

gas/heat and power. Revenue stability is a result of improved

occupancy which directly increases recovery revenue, as more tenant

space is occupied. Base rents were down 1% due to the sale of

Kelowna Business Center. On a same-asset basis, both base rents and

total rental revenue were up 1%.

We adjusted our normalized capital expenditures

estimates at the end of 2022 to account for increases realized in

the past and projections for future spend required to property

manage our assets to attract and retain tenants. This increase in

estimate resulted in a reduction to both adjusted funds from

operations (down 25%) and adjusted cash from operations (down 35%).

These reductions had an inverse effect on our payout ratios, which

were both up significantly over Q1-2022.

On February 10, 2023 we entered in the fourth

amendment to our revolving credit agreement with our existing

lenders (the “Credit Facility Amendment”). The most significant

amendments were increasing our available credit from $35.00 million

to $50.00 million and adding an investment property with a carrying

value of $11.91 million as collateral.

FINANCIAL HIGHLIGHTSFinancial

highlights of our performance are summarized below.

- Revenue remained stable at $18.99

million (Q1-2022: $18.97 million)

- NOI was down 3% at $11.52 million

(Q1-2022: $11.86 million)

- FFO was down 8% to $6.01 million or

$0.21 per unit (Q1-2022: $6.53 million or $0.22 per unit)

- ACFO was down 35% at $3.78 million or

$0.13 per unit (Q1-2022: $5.77 million or $0.20 per unit). Our

quarterly payout ratio was 92% based on ACFO (Q1-2022: 61%)

As at March 31, 2023 we had $3.31 million in

cash and $25.57 million in undrawn liquidity under our revolving

credit facility. We renewed financing on one property for $2.00

million at a rate of 5.69% in Q1-2023.

Management believes FFO best reflects our true

operating performance and ACFO best reflects our cash flow and

therefore our ability to pay distributions. Net income in the

current and comparative period is significantly impacted by the

non-cash fair value adjustments described above and thus not a

meaningful metric to assess financial performance.

OPERATING HIGHLIGHTSWe are pleased

with the volume of new leasing activity across our portfolio.

Leasing in the quarter includes 221,777 sf of new and renewed

leases (including holdovers) and we have retained 95% of expiring

leases. Future leasing is promising, with commitments on an

additional 47,116 sf in new deals which would bring committed

occupancy up to 90%. Leasing efforts yielded a WABR increase of 1%

across the portfolio in Q1-2023, which will help offset rising

costs.

DISTRIBUTIONSOur monthly

distributions remained at $0.04 per unit, stable over year-end. The

quarterly payout ratio was 92% based on ACFO and 58% based on FFO

(Q1-2022: ACFO: 61% and FFO: 53%).

SUBSEQUENT EVENTOn April 14, 2023

we declared the following distributions:

|

Month |

Declaration Date |

Record Date |

Distribution Amount |

|

April 2023 |

April 28, 2023 |

May 15, 2023 |

$0.04 per unit |

|

May 2023 |

May 31, 2023 |

June 15, 2023 |

$0.04 per unit |

|

June 2023 |

June 30, 2023 |

July 14, 2023 |

$0.04 per unit |

Non-standard KPI's:

|

|

Three months ended March 31 |

|

|

($000's) |

|

2023 |

|

|

2022 |

|

Δ% |

|

NOI1 |

|

11,522 |

|

|

11,855 |

|

(3) |

|

Same-asset NOI1 |

|

11,492 |

|

|

11,687 |

|

(2) |

|

FFO1 |

|

6,008 |

|

|

6,530 |

|

(8) |

|

AFFO1 |

|

3,659 |

|

|

4,911 |

|

(25) |

|

ACFO1 |

|

3,776 |

|

|

5,767 |

|

(35) |

|

Rental revenue |

|

18,990 |

|

|

18,965 |

|

— |

|

Income before fair value adjustments1 |

|

3,015 |

|

|

3,694 |

|

(18) |

|

Fair value adjustment on investment properties2 |

|

(1,586 |

) |

|

(3,662 |

) |

nm |

|

Cash flows from operations |

|

1,882 |

|

|

4,293 |

|

(56) |

|

Distributions paid to unitholders |

|

1,556 |

|

|

1,556 |

|

— |

|

Distributions paid3 |

$0.12 |

|

$0.12 |

|

— |

- Non-GAAP financial

measure. Refer to the Non-GAAP and Non-Standard Measures section

for further information.

- The abbreviation nm is shorthand for

not meaningful and is used through this MD&A where

appropriate.

- Distributions have

been paid out at $0.04 per unit per month since August 2021.

Operational Highlights:

|

|

March 31,2023 |

December 31,2022 |

Δ% |

|

Number of properties |

|

38 |

|

|

39 |

|

(3 |

) |

|

GLA (sf) |

|

3,146,006 |

|

|

3,216,141 |

|

(2 |

) |

|

Occupancy (weighted by GLA) |

|

88.4 |

% |

|

88.1 |

% |

— |

|

|

Retention (weighted by GLA) |

|

95.5 |

% |

|

86.1 |

% |

11 |

|

|

Weighted average remaining lease term (years) |

|

3.79 |

|

|

4.25 |

|

(11 |

) |

|

Weighted average base rent (per sf) |

$16.64 |

|

$16.55 |

|

1 |

|

Per Unit Metrics:

|

|

Three months ended March 31 |

|

|

|

|

|

2023 |

|

|

2022 |

|

Δ% |

|

Per Unit Metrics |

|

|

|

|

|

Net income (loss) |

|

|

|

|

|

Basic |

$0.28 |

|

($0.50 |

) |

|

|

|

Diluted |

$0.09 |

|

($0.50 |

) |

|

|

|

Weighted average number of units for net income (loss)

(000s):1 |

|

|

|

|

|

Basic |

|

12,963 |

|

|

12,987 |

|

— |

|

|

Diluted |

|

29,088 |

|

|

12,987 |

|

124 |

|

|

FFO |

|

|

|

|

|

Basic2 |

$0.21 |

|

$0.22 |

|

|

|

|

Diluted2 |

$0.20 |

|

$0.21 |

|

|

|

|

Payout ratio2 |

|

58 |

% |

|

53 |

% |

|

|

|

AFFO |

|

|

|

|

|

Basic 2 |

$0.13 |

|

$0.17 |

|

|

|

|

Payout ratio2 |

|

95 |

% |

|

71 |

% |

|

|

|

ACFO |

|

|

|

|

|

Basic2 |

$0.13 |

|

$0.20 |

|

|

|

|

Payout ratio2 |

|

92 |

% |

|

61 |

% |

|

|

|

Weighted average number of units for FFO, AFFO and ACFO

(000s):3 |

|

|

|

|

|

Basic |

|

29,088 |

|

|

29,090 |

|

— |

|

|

Diluted |

|

34,257 |

|

|

36,256 |

|

(6 |

) |

- For the purposes of

calculating per unit net income the basic weighted average number

of units includes Trust Units and the diluted weighted average

number of units includes Class B LP Units and convertible

debentures, to the extent that their impact is dilutive.

- Non-GAAP ratio. Refer to the Non-GAAP

and Non-Standard Measures section for further information.

- For the purposes of calculating per

unit FFO, AFFO and ACFO the basic weighted average number of units

includes Trust Units and Class B LP Units.

Balance Sheet Highlights:

|

|

March 31,2023 |

December 31,2022 |

Δ% |

|

Total assets ($000s) |

709,578 |

|

730,769 |

|

(3 |

) |

|

Equity at historical cost ($000s)1 |

288,196 |

|

288,196 |

|

— |

|

|

Indebtedness ($000s)2 |

421,537 |

|

440,688 |

|

(4 |

) |

|

Weighted average interest rate on debt |

3.99 |

% |

4.01 |

% |

— |

|

|

Debt to GBV, excluding convertible debentures (maximum threshold -

60%)3 |

50 |

% |

51 |

% |

(2 |

) |

|

Debt to GBV (maximum threshold - 65%)3 |

56 |

% |

57 |

% |

(2 |

) |

|

Finance costs coverage ratio4 |

2.22 |

|

2.32 |

|

(4 |

) |

|

Debt service coverage ratio5 |

1.90 |

|

1.88 |

|

1 |

|

- Calculated as the sum of trust units

and Class B LP Units at their historical cost value. In accordance

with IFRS the Class B LP Units are presented as a financial

liability in the consolidated financial statements. Please refer to

page 11 for calculation of Equity at historical cost.

- Calculated as the sum of total amount

drawn on revolving credit facility, mortgages payable, Class C LP

Units and convertible debentures, excluding unamortized discount

and transaction costs. Please refer to page 11 for calculation of

Indebtedness.

- Debt to GBV is a Non-GAAP ratio. Refer

to the Non-GAAP and Non-Standard Measures section for further

information.

- Non-GAAP financial ratio. Calculated

as the sum of FFO and finance costs; divided by finance costs,

excluding distributions on Class B LP Units and fair value

adjustment on derivative instruments. This metric is not calculated

for purposes of covenant compliance on any of our debt facilities.

Please refer to Non-GAAP and Non-Standard Measures section for

further information.

- Non-GAAP financial ratio. Calculated

as FFO; divided by sum of contractual principal repayments on

mortgages payable and distributions of Class C LP Units, excluding

amortization of fair value adjustment on Class C LP Units. This

metric is not calculated for purposes of covenant compliance on any

of our debt facilities. Please refer to Non-GAAP and Non-Standard

Measures section for further information.

MD&A and Financial

StatementsInformation included in this press release is a

summary of results. This press release should be read in

conjunction with the REIT's Q1-2023 quarterly report to

unitholders. The REIT’s consolidated financial statements and

management’s discussion and analysis for the three-months ended

March 31, 2023 can be found on the REIT’s website at

www.MelcorREIT.ca or on SEDAR (www.sedar.com).

Conference Call &

WebcastUnitholders and interested parties are invited to

join management on a conference call to be held May 3, 2023 at

11:00 AM ET (9:00 AM MT). Call 416-915-3239 in the Toronto area;

1-800-319-4610 toll free.

The call will also be webcast (listen only) at

https://www.gowebcasting.com/12425. A replay of the call will be

available at the same URL shortly after the call is concluded.

About Melcor REITMelcor REIT is an

unincorporated, open-ended real estate investment trust. Melcor

REIT owns, acquires, manages and leases quality retail, office and

industrial income-generating properties in western Canadian

markets. Its portfolio is currently made up of interests in 38

properties representing approximately 3.15 million square feet of

gross leasable area located across Alberta and in Regina,

Saskatchewan; and Kelowna, British Columbia. For more information,

please visit www.MelcorREIT.ca.

Non-GAAP and Non-standard

MeasuresNOI, FFO, AFFO and ACFO are key measures of

performance used by real estate operating companies; however, they

are not defined by International Financial Reporting Standards

(IFRS), do not have standard meanings and may not be comparable

with other industries or income trusts. These non-IFRS measures are

defined and discussed in the REIT’s MD&A for the quarter ended

March 31, 2023, which is available on SEDAR at

www.sedar.com.

Finance costs coverage ratio:

Finance costs coverage ratio is a non-GAAP ratio and is calculated

as FFO plus finance costs for the period divided by finance costs

expensed during the period excluding distributions on Class B LP

Units and fair value adjustment on derivative instruments.

Debt service coverage ratio: Debt service coverage

ratio is a non-GAAP ratio and is calculated as FFO for the period

divided by principal repayments on mortgages payable and Class C LP

Units made during the period.

Debt to Gross Book Value: Debt to

GBV is a non-GAAP ratio and is calculated as the sum of total

amount drawn on revolving credit facility, mortgages payable, Class

C LP Units, excluding unamortized fair value adjustment on Class C

LP Units, liability held for sale (as applicable) and convertible

debenture, excluding unamortized discount and transaction costs

divided by GBV. GBV is calculated as the total assets acquired in

the Initial Properties, subsequent asset purchases and development

costs less dispositions.

Income before fair value adjustment and

taxes: Income before fair value adjustment and income

taxes is a non-GAAP financial measure and is calculated as net

income excluding fair value adjustments for Class B LP Units,

investment properties and derivative instruments.

|

|

Three months ended March 31 |

|

|

($000s) |

2022 |

|

2021 |

|

Δ% |

|

Net income (loss) for the period |

3,656 |

|

(6,538 |

) |

|

|

Fair value adjustment on Class B LP Units |

(2,903 |

) |

7,095 |

|

|

|

Fair value adjustment on investment properties |

1,586 |

|

3,662 |

|

|

|

Fair value adjustment on derivative instruments |

676 |

|

(525 |

) |

|

|

Income before fair value adjustment and taxes |

3,015 |

|

3,694 |

|

(18 |

) |

Fair value of investment

properties: Fair value of investment properties in the

Property Profile and Regional Analysis sections of the MD&A is

a supplementary financial measure and is calculated as the sum of

the balance sheet balances for investment properties and other

assets (TIs and SLR).

NOI Reconciliation:

|

|

Three months ended March 31 |

|

|

($000s) |

2022 |

|

2021 |

|

Δ% |

|

Net income (loss) for the period |

3,656 |

|

(6,538 |

) |

|

|

Net finance costs |

7,520 |

|

5,949 |

|

|

|

Fair value adjustment on Class B LP Units |

(2,903 |

) |

7,095 |

|

|

|

Fair value adjustment on investment properties |

1,586 |

|

3,662 |

|

|

|

General and administrative expenses |

779 |

|

788 |

|

|

|

Amortization of operating lease incentives |

1,058 |

|

901 |

|

|

|

Straight-line rent adjustment |

(174 |

) |

(2 |

) |

|

|

NOI |

11,522 |

|

11,855 |

|

(3 |

) |

Same-asset Reconciliation:

|

|

Three months ended March 31 |

|

|

($000s) |

2023 |

|

2022 |

|

Δ% |

|

Same-asset NOI |

11,492 |

|

11,687 |

|

(2 |

) |

|

Disposals |

30 |

|

168 |

|

|

|

NOI1 |

11,522 |

|

11,855 |

|

(3 |

) |

|

Amortization of tenant incentives |

(1,058 |

) |

(901 |

) |

|

|

SLR adjustment |

174 |

|

2 |

|

|

|

Net rental income |

10,638 |

|

10,956 |

|

(3 |

) |

FFO & AFFO Reconciliation:

|

|

Three months ended March 31 |

|

|

($000s, except per unit amounts) |

|

2023 |

|

|

2022 |

|

Δ% |

|

Net income (loss) for the period |

|

3,656 |

|

|

(6,538 |

) |

|

|

Add / (deduct) |

|

|

|

|

Fair value adjustment on investment properties |

|

1,586 |

|

|

3,662 |

|

|

|

Fair value adjustment on Class B LP Units |

|

(2,903 |

) |

|

7,095 |

|

|

|

Amortization of tenant incentives |

|

1,058 |

|

|

901 |

|

|

|

Distributions on Class B LP Units |

|

1,935 |

|

|

1,935 |

|

|

|

Fair value adjustment on derivative instruments |

|

676 |

|

|

(525 |

) |

|

|

FFO1 |

|

6,008 |

|

|

6,530 |

|

(8 |

) |

|

Deduct |

|

|

|

|

Straight-line rent adjustments |

|

(174 |

) |

|

(2 |

) |

|

|

Normalized capital expenditures |

|

(750 |

) |

|

(588 |

) |

|

|

Normalized tenant incentives and leasing commissions |

|

(1,425 |

) |

|

(1,029 |

) |

|

|

AFFO |

|

3,659 |

|

|

4,911 |

|

(25 |

) |

|

FFO/Unit |

$ |

0.21 |

|

$ |

0.22 |

|

|

|

AFFO/Unit |

$ |

0.13 |

|

$ |

0.17 |

|

|

|

Weighted average number of units (000s):1 |

|

29,088 |

|

|

29,090 |

|

— |

|

- For the purposes of

calculating per unit FFO and AFFO, the basic weighted average

number of units includes Trust Units and Class B LP Units.

ACFO Reconciliation:

|

|

Three months ended March 31 |

|

|

($000s, except per unit amounts) |

|

2023 |

|

|

2022 |

|

Δ% |

|

Cash flows from operations |

|

1,882 |

|

|

4,293 |

|

(56 |

) |

|

Distributions on Class B LP Units |

|

1,935 |

|

|

1,935 |

|

|

|

Actual payment of tenant incentives and direct leasing costs |

|

1,955 |

|

|

1,733 |

|

|

|

Changes in operating assets and liabilities |

|

532 |

|

|

(928 |

) |

|

|

Amortization of deferred financing fees |

|

(353 |

) |

|

351 |

|

|

|

Normalized capital expenditures |

|

(750 |

) |

|

(588 |

) |

|

|

Normalized tenant incentives and leasing commissions |

|

(1,425 |

) |

|

(1,029 |

) |

|

|

ACFO |

|

3,776 |

|

|

5,767 |

|

(35 |

) |

|

|

|

|

|

|

ACFO/Unit |

$ |

0.13 |

|

$ |

0.20 |

|

|

|

|

|

|

|

|

Weighted average number of units (000s)1 |

|

29,088 |

|

|

29,090 |

|

— |

|

- The

diluted weighted average number of units includes Trust Units,

Class B LP Units and convertible debentures.

Forward-looking Statements:This

press release may contain forward-looking information within the

meaning of applicable securities legislation, which reflects the

REIT's current expectations regarding future events.

Forward-looking information is based on a number of assumptions and

is subject to a number of risks and uncertainties, many of which

are beyond the REIT's control, that could cause actual results and

events to differ materially from those that are disclosed in or

implied by such forward-looking information. Such risks and

uncertainties include, but are not limited to, general and local

economic and business conditions; the financial condition of

tenants; the REIT’s ability to refinance maturing debt; leasing

risks, including those associated with the ability to lease vacant

space; and interest rate fluctuations. The REIT’s objectives and

forward-looking statements are based on certain assumptions,

including that the general economy remains stable, interest rates

remain stable, conditions within the real estate market remain

consistent, competition for acquisitions remains consistent with

the current climate and that the capital markets continue to

provide ready access to equity and/or debt. All forward-looking

information in this press release speaks as of the date of this

press release. The REIT does not undertake to update any such

forward-looking information whether as a result of new information,

future events or otherwise. Additional information about these

assumptions and risks and uncertainties is contained in the REIT’s

filings with securities regulators.

Contact Information:Tel:

1.855.673.6931 Em: ir@melcorREIT.ca

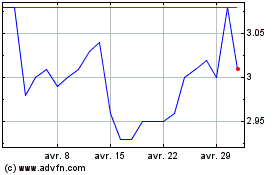

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024