Melcor Real Estate Investment Trust Completes $83 Million Initial Public Offering

01 Mai 2013 - 2:04PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED

STATES.

Melcor Developments Ltd. (TSX:MRD) and Melcor Real Estate Investment Trust (the

"REIT") (TSX:MR.UN) announced today that the REIT has completed its initial

public offering of 8,300,000 trust units at a price of $10.00 per trust unit.

The offering raised gross proceeds of approximately $83,000,000 and was

underwritten by a syndicate of underwriters co-led by RBC Capital Markets and

CIBC, and including BMO Nesbitt Burns Inc., TD Securities Inc., Desjardins

Securities Inc., National Bank Financial Inc., Scotia Capital Inc., Canaccord

Genuity Corp. and Laurentian Bank Securities Inc. RBC Capital Markets and CIBC

were the bookrunners on the transaction.

Melcor Developments Ltd. and the REIT have granted the underwriters an

over-allotment option, exercisable for a period of 30 days following the

closing, to purchase up to an additional 830,000 trust units at a price of

$10.00 per trust unit which, if exercised in full, will increase the total gross

proceeds of the offering to Melcor and the REIT to approximately $91,300,000.

"We are very pleased to conclude this process and launch Melcor REIT to grow our

income-producing assets portfolio for the benefit of Melcor and new trust

unitholders," commented Ralph B. Young, CEO of the REIT's promoter and manager,

Melcor Developments Ltd. and a trustee of the REIT. "With a strong relationship

with Melcor Developments and access to its significant development pipeline, we

are confident that both companies will continue to grow our already proven and

established western Canadian real estate presence."

"We were very pleased with investor interest in Melcor REIT and are excited to

get to work growing our portfolio and building value for our investors," added

Darin Rayburn, CEO of the REIT.

The trust units will commence trading today on the Toronto Stock Exchange under

the symbol "MR.UN".

The REIT initially intends to make monthly cash distributions to its unitholders

at a rate of $0.05625 per trust unit, which are initially expected to provide an

annual yield of 6.75%. The first cash distribution, which will be for the period

from the date of closing of the offering to May 31, 2013, is expected to be paid

on or about June 14, 2013 to unitholders of record on May 31, 2013, in an amount

estimated to be $0.05625 per unit.

Melcor Developments Ltd. (collectively, with its affiliates, "Melcor") has

retained an approximate 55.5% effective interest in the REIT (or an approximate

51.1% effective interest if the over-allotment option is exercised in full).

The trust units have not been, nor will they be, registered under the United

States Securities Act of 1993, as amended, and may not be offered, sold or

delivered, directly or indirectly, in the United States or to, or for the

account or benefit of, "U.S. persons" (as defined in Regulation S under the

United States Securities Act of 1933, as amended). This press release does not

constitute an offer to sell or a solicitation of an offer to buy any of the

trust units in the United States or to, or for the account or benefit of, U.S.

Persons.

About Melcor Real Estate Investment Trust

Melcor Real Estate Investment Trust is an unincorporated, open-ended real estate

investment trust established pursuant to a declaration of trust under the laws

of the Province of Alberta. The REIT has been created for the purpose of

acquiring and owning income producing properties located in Western Canada,

comprised primarily of retail, office and industrial properties. Concurrent with

the completion of the initial public offering of trust units, the REIT

indirectly acquired, through a limited partnership, interests in a portfolio of

27 income producing properties located in the Edmonton, Alberta region; the

Calgary, Alberta region; Lethbridge, Alberta; Regina, Saskatchewan; and Kelowna,

British Columbia, with approximately 1.57 million owned square feet of gross

leasable area.

About Melcor Developments Ltd.

Melcor is a diversified real estate development and management company with a

rich heritage of integrity and innovation in real estate since 1923.

Through four integrated operating divisions, Melcor develops and manages

mixed-use residential communities, business and industrial parks, office

buildings, retail commercial centres and golf courses.

Melcor's headquarters are located in Edmonton, Alberta, with regional offices

throughout Alberta and British Columbia. Company developments span Western

Canada and the US. Melcor has been a public company since 1968 and trades on the

Toronto Stock Exchange (TSX:MRD).

Forward-Looking Statements

This press release may contain forward-looking information within the meaning of

applicable securities legislation, which reflects Melcor's and the REIT's

current expectations regarding future events. Forward- looking information is

based on a number of assumptions and is subject to a number of risks and

uncertainties, many of which are beyond Melcor's or the REIT's control, that

could cause actual results and events to differ materially from those that are

disclosed in or implied by such forward-looking information. Such risks and

uncertainties include, but are not limited to, the factors discussed under "Risk

Factors" in the final prospectus of the REIT dated April 19th, 2013. Neither

Melcor nor the REIT undertake any obligation to update such forward-looking

information, whether as a result of new information, future events or otherwise,

except as expressly required by applicable law.

For more information, visit the REIT's website at www.melcorREIT.ca and the

REIT's and Melcor's respective issuer profiles at www.sedar.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Melcor Developments Ltd.- President & COO

Melcor Real Estate Investment Trust- Trustee

Brian Baker

780-423-6931

Melcor Developments Ltd.- CFO

Melcor Real Estate Investment Trust- CFO

Jonathan Chia, CA

780-423-6931

Melcor Developments Ltd.- Executive Vice-President

Melcor Real Estate Investment Trust- CEO

Darin Rayburn

780-423-6931

www.melcorREIT.ca

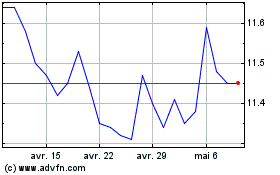

Melcor Developments (TSX:MRD)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Melcor Developments (TSX:MRD)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024