Orezone Gold Corporation (TSX:ORE) is pleased to provide an update

on the progress of the ongoing Feasibility Study, resource update

and the latest drilling results for its wholly owned Bombore Gold

Project in Burkina Faso, West Africa.

Highlights

-- Mining and processing costs for the oxide material have been reduced as

compared to those costs used in the August 2012 resource estimation. The

improvement in costs is based on the technical studies and current

design criterion for an oxide-only carbon-in-leach (CIL) plant. This

will have a positive impact on the next resource update and the

potential economics of the project.

-- Geotechnical work confirms that the pit slopes used in the previous

resource update were conservative and steeper slopes can be used and

should result in a positive impact on the next resource update and

feasibility study pit designs. No significant issues were discovered

with respect to ground water, infrastructure design, mine water

management or waste management.

-- Metallurgical studies indicate that previously estimated recoveries,

work indices and rapid leaching kinetics were reasonable. Further

optimization work including a gravity circuit, flotation and air

sparging with the addition of lead nitrate will be performed on the

sulphide material. Tests also indicate that approximately 67% of the

softer near surface saprolite oxide material (approx. 43% of the Aug.

2012 oxide resource) is amenable to using a scrubber as part of the

crushing/grinding circuit to send the already fine material directly to

the leaching circuit and thereby possibly reducing capital and operating

costs for an initial oxide-only CIL processing plant.

-- Drill results continue to indicate the potential to further expand the

oxide and sulphide resources.

Pit Slope Study

Golder Associates from Montreal, Quebec, delivered their final

pit slope recommendations in a Technical memorandum that was

received on March 14, 2013 and can be found on the Company website.

Except for instances where the saprolite slope height would exceed

60 m, the pit slopes recommended by Golder are steeper than those

used in the August 2012 resource estimation, i.e. between 36 and 55

degrees in saprolite (vs. 35 in 2012), 40 and 45 degrees in saprock

(vs. 40 in 2012) and 45 and 55 degrees in fresh (sulphide) rock

(vs. 45 in 2012). The final report is expected in Q2 2013.

Geotechnical Studies

Golder Associates from Montreal, Quebec, has essentially

completed the field investigations and the laboratory test work

that is required for the geotechnical design of the main

infrastructure, the mine waste and potential construction material

geochemical characterization and the water management plan. Golder

will now focus on the engineering design and a feasibility design

report that is expected in the following months.

Metallurgical Study

Orezone submitted a suite of 76 samples representative of

Bombore oxide, sulphide and mixed gold-bearing material to

McLelland Laboratories from Sparks, Nevada in October 2011 and

their final report can be found on Orezone's website. The testing

program was conducted under the technical direction of Mr. Jeffrey

Woods, consulting metallurgist with the objective to determine ore

variability and optimum conditions for cyanide leaching of the

Bombore gold-bearing material. Each of the samples was submitted

for detailed head analysis to characterize the samples by grade,

cyanide solubility, elemental make-up and carbon and sulphide

content. The majority of the samples were then combined into four

different composites that represented medium grade oxide, high

grade oxide, medium grade sulphide and high grade sulphide

material. Metallurgical testing of the composite samples included

gravity concentration, bulk sulphide flotation, direct agitated

(bottle-roll) cyanidation, combined gravity

concentration/cyanidation, bulk mechanically agitated CIL and

carbon-in-pulp (CIP) cyanidation tests. A petrographic study,

comminution tests and solid-liquid separation (SLS) tests were also

conducted at third party laboratories.

The main conclusions of the McLelland Metallurgical report

are:

- Gold recovery rates were generally rapid;

- Almost all variability samples were amenable to whole ore

milling cyanidation treatment at optimized conditions;

- Conventional SO2/air tailings slurry treatment was effective

in decreasing slurry CNWAD concentration to acceptable level;

- The optimum feed size for whole ore cyanidation of oxide

composites was in the range of 100% -212um to 100% -150um;

- The optimum cyanide concentration for cyanidation of oxide

composites was a maximum of 0.5 gNaCN/L (the lowest concentration

used for this optimization work and could leave room for

improvement);

- The optimum feed size for whole ore cyanidation of sulphide

composites was 80% -53um;

- The optimum cyanide concentration for cyanidation of sulphide

composites was 0.5 to 1.0 gNaCN/L;

- Gravity concentration prior to cyanidation may improve gold

recovery for sulphide composites; and

- The sulphide composites responded well to flotation treatment

for recovery of gold.

The main recommendations of the McLelland Metallurgical report

are:

- Further optimization of the cyanide concentration for the

oxide composites as gold recovery was not decreased at the lowest

cyanide concentration tested (0.5 gNaCN/L);

- Further optimization of flotation conditions for the sulphide

composites since they showed high gold recoveries by flotation;

- Further optimization of gold recovery for sulphide composites

during agitated cyanidation testing should include air sparging and

lead nitrate addition; and

- Mineralogical analysis of the tailings from outlier

variability results may determine the causes for the few below

trend recoveries.

Since December 2012, Orezone initiated the following

complementary metallurgical studies

- Hazen Research Inc. from Golden, Colorado, has completed

semiautogenous grinding (SAG) Mill Comminution (SMC) testing on

three saprolite and saprock granodiorite PQ core samples. Their

report was received on February 26, 2013 and is posted on the

Orezone website.

- Orezone submitted a suite of 26 sulphide samples to SGS

Laboratories from Lakefield, Ontario for additional comminution

work including JK tech Drop Weight, Crusher Work Index and Bond

Ball Mill Work Index test work. Their report is expected in Q2

2013. Preliminary results confirm the findings of previous similar

studies by AMMTEC from Perth, Australia and McLelland on Bombore

samples, indicating a Bond Ball Mill Work Index of 15 kWh/t for

typical sulphide samples.

- Orezone submitted a suite of pyrrhotite-bearing sulphide

samples to COREM from Quebec City, Quebec, for lead nitrate

optimization tests, with the possible benefits of improving

cyanidation recoveries and reducing cyanide consumption for this

type of material. Their report is expected in Q2 2013.

- Orezone, with the supervision of G Mining from Montreal,

Quebec, completed preliminary scrubbing tests on site which

confirmed the potential use of scrubbers in a lower CAPEXOPEX

comminution circuit. Orezone then submitted a suite of eight oxide

composite PQ drill samples to Met-Solve Laboratories Inc., from

Langley, British Colombia, for scrubber test work and design

parameters. The Met-Solve preliminary results are positive and

indicate a scrubber is viable to process the upper and mid portions

of the saprolite (softer portions). The final report of results and

any suggested design parameters is expected in Q2 2013. Orezone

plans to visit in April another gold operation in West Africa that

uses a scrubber, with similar grades and resources to Bombore.

- Orezone has contracted Roche Ltd. from Montreal, Quebec, as

the process engineers to deliver the preliminary mill design.

Resource Update

The Company has recently commissioned with SRK from Toronto,

Ontario and G Mining an interim resource update using 68,400 m (843

holes) of the current program that will bring the total database to

over 405,000 m (5,106 holes), including 72 recent P16 holes

totalling 4,867 m. The update is expected to be completed in April

2013 and will be the basis for the reserves and the mine plan of

the full Feasibility Study ("FS") to be released in 2H 2013.

Table 1 2013 Resource Update Optimization parameters

----------------------------------------------------------------------------

Optimization Parameter Unit 2013 CIL 2012 CIL 2011 CIL

----------------------------------------------------------------------------

Gold Price $/oz 1,400.00 1,400.00 1,000.00

----------------------------------------------------------------------------

Govt. Royalty $/oz 70.00 70.00 40.00

----------------------------------------------------------------------------

Selling Costs $/oz 2.5 2.5 2.5

----------------------------------------------------------------------------

Dilution % 5 5 5

----------------------------------------------------------------------------

Mining Loss % 5 5 5

----------------------------------------------------------------------------

Overall Pit Slopes

Oxide Degrees 36(1) 35 35

Transition Degrees 44(2) 40 40

Fresh Degrees 51(3) 45 45

----------------------------------------------------------------------------

Process recovery

Oxide % 92.0(4) 94.0 93.0

Transition % 89.0(5) 92.0 92.0

Fresh % 81.7(6) 82.0 81.0

----------------------------------------------------------------------------

Mining Costs - Ore

Oxide $/tonne 1.74 1.90 1.40

Transition $/tonne 2.32 2.35 1.74

Fresh $/tonne 2.44 2.44 1.89

----------------------------------------------------------------------------

Mining Costs - Waste

Oxide $/tonne 1.63 1.90 1.40

Transition $/tonne 2.18 2.35 1.74

Fresh $/tonne 2.28 2.44 1.89

----------------------------------------------------------------------------

Incr. Bench Cost

per 10 m Bench $/tonne 0.03 0.04 0.03

----------------------------------------------------------------------------

Processing Costs (7)

Oxide $/tonne 6.60 7.21 6.67

Transition $/tonne 7.83 9.76 8.52

Fresh $/tonne 15.02 12.66 12.43

----------------------------------------------------------------------------

G&A Costs (8)

Oxide $/tonne 3.72 3.84 2.69

Transition $/tonne 3.72 3.84 2.69

Fresh $/tonne 3.72 3.84 2.69

----------------------------------------------------------------------------

Notes:

(1),(2),(3) Average slopes were used for the 2013 Whittle optimization but

Golder's detailed recommendations will be used for the pit design; between

36 and 55 degrees for saprolite (where the height of the saprolite wall is

less than 80 meters), between 40 and 45 degrees for transition, and between

45 and 55 degrees for sulphide/fresh.

(4),(5),(6) For the 2013 Whittle optimization, this table shows the

metallurgical recovery expected around the average in-situ grade, and is

including fine carbon and solution losses of 0.017 gpt.

(7) 2013 Whittle optimization costs include $0.10/t in re-handling costs.

(8) 2013 Whittle optimization costs include $0.60/t of rehabilitation and

sustaining capital provisions. Ore haulage costs will be refined for each

pit in the feasibility study.

Exploration and definition drilling

The recent drilling has further expanded the southern P16 and

the P17N deposits and with open ended mineralization, more

expansion drilling is warranted. Scout drilling on the new P13

target on 400 m line spacing has intersected narrow mineralized

zones on all fences in the northern portion of the target area;

follow up reverse circulation (RC) and core (DD) drilling is

required to confirm the geometry and the continuity of the

mineralized zones intercepted during the scout drilling program.

Results for this release include 7,734 m of RC drilling (151 holes)

and 145 m of DD drilling (1 hole) and are essentially from the

southern area of the property. The drilling in this location was

designed to upgrade and expand the P16, P17N and Siga South

deposits, as well as test new targets with limited to no prior

drilling. Grades from P16, P17N and P13 remain higher than the

average Bombore grade.

Drilling stopped at the end of February (drill rig moved to

Orezone's Bondi project) and is expected to resume in April with

one core rig and one RC rig until the end of June when the rainy

season and two month break is planned.

An additional 92,000 m of results have now been released since

the August 2012 resource estimation. The ongoing drill program

continues to demonstrate the potential to upgrade and expand the

resources, especially the softer near surface oxide resources. The

current resource is constrained within optimized open pit shells

that span 11 km and includes 4.13 Moz of measured and indicated

(125 Mt @ 1.03 g/t) and 1.03 Moz of inferred resources (35 Mt @

1.00 g/t) with an average depth of drilling to only 120 meters. The

oxide portion of the resource occurs in the top 50 m and includes

1.76 Moz M&I and 0.26 Moz Inferred resources.

Table 2 Cumulative Results Excluded from the August 2012

Resource Reported to Date

----------------------------------------------------------------------------

Total Drilling to Date Grade g/t

----------------------------------------------------------------------------

Zone # of Holes Total m Uncut Cut(9)

----------------------------------------------------------------------------

KT - RC 23 1,169 1.31 1.22

----------------------------------------------------------------------------

CFU - RC 17 1,455 0.82 0.82

CFU - DD 16 2,517 2.72 1.08

----------------------------------------------------------------------------

Maga - RC 268 17,885 1.09 0.96

Maga - DD 60 12,874 1.29 1.09

----------------------------------------------------------------------------

P8P9 - RC 30 1,665 0.91 0.90

P8P9 - DD 44 8,416 1.04 0.99

----------------------------------------------------------------------------

P11 - RC 22 1,100 1.29 1.11

P11- DD 4 641 1.66 1.14

----------------------------------------------------------------------------

Siga E - RC 57 3,036 1.14 0.94

Siga E - DD 16 2,047 1.38 1.03

----------------------------------------------------------------------------

Siga W - RC 35 1,750 0.89 0.89

Siga W - DD 17 2,127 0.93 0.88

----------------------------------------------------------------------------

Siga S - RC 240 12,017 0.96 0.88

Siga S - DD 36 5,423 0.94 0.90

----------------------------------------------------------------------------

P16 - RC 53 2,664 1.04 1.04

P16 - DD 10 2,032 1.41 1.28

----------------------------------------------------------------------------

P17 - RC 4 175 2.43 2.25

P17 - DD 1 175 3.60 2.48

----------------------------------------------------------------------------

P17 N - RC 51 2,598 1.09 1.04

P17 N - DD 1 175 0.72 0.72

----------------------------------------------------------------------------

P17 S - DD 15 1,694 2.94 2.46

----------------------------------------------------------------------------

P13 102 5,375 1.13 1.11

----------------------------------------------------------------------------

North - RC 338 22,174 1.08 0.96

North - DD 120 23,807 1.29 1.04

----------------------------------------------------------------------------

South - RC 354 17,903 0.99 0.90

South- DD 73 10,238 1.01 0.92

----------------------------------------------------------------------------

SE - RC 57 2,839 1.14 1.13

SE - DD 11 2,207 1.53 1.34

----------------------------------------------------------------------------

New targets - RC 153 7,973 1.11 1.07

New targets - DD 16 1,869 2.86 2.39

----------------------------------------------------------------------------

All - RC 902 50,889 1.05 0.96

----------------------------------------------------------------------------

All - DD 220 38,120 1.25 1.05

----------------------------------------------------------------------------

Notes:

(9) Weighted average grade of individual assays, cut to 5 g/t.

Table 3 Breakdown of Drilling Meterage for this Release

----------------------------------------------------------------------------

Zone Core Drilling RC Drilling

------------------------------------------------------------

# of holes Total m # of holes Total m

----------------------------------------------------------------------------

P11 1 145 0 0

Siga South 0 0 63 3,140

P16 0 0 20 1,005

P17N 0 0 13 683

P13 0 0 51 2,705

Sterilization 0 0 4 201

----------------------------------------------------------------------------

TOTAL 1 145 151 7,734

----------------------------------------------------------------------------

Table 4 Highlights of Reverse Circulation Drilling Results for

this Release

----------------------------------------------------------------------------

Uncut Cut

From To Length Grade Grade Total

Zone Section Hole (m) (m) (m) (g/t)(10) (g/t)(11) Assay(12)

----------------------------------------------------------------------------

P13 3400 TYC0038 25.00 32.00 7.00 1.57 1.57

----------------------------------------------------------------------------

P13 2200 TYC0013 18.00 33.00 15.00 1.42 1.38

----------------------------------------------------------------------------

P16 44225 BBC4008 29.00 43.00 14.00 1.05 1.05

----------------------------------------------------------------------------

P16 43925 BBC4004 30.00 37.00 7.00 1.64 1.64

----------------------------------------------------------------------------

P17 N 45975 BBC3989 36.00 57.00 21.00 0.83 0.83

----------------------------------------------------------------------------

P17 N 45950 BBC3950 25.00 38.00 13.00 0.86 0.86

----------------------------------------------------------------------------

P17 N 45950 BBC3951 12.00 19.00 7.00 1.60 1.60

----------------------------------------------------------------------------

P17 N 45875 BBC3992 6.00 15.00 9.00 1.58 1.58

----------------------------------------------------------------------------

Siga S 10650 BBC4072 30.00 42.00 12.00 4.08 2.40 Pending

----------------------------------------------------------------------------

Siga S 9950 BBC4043 19.00 40.00 21.00 0.81 0.81 Pending

----------------------------------------------------------------------------

Siga S 9900 BBC4036 10.00 32.00 22.00 0.69 0.69 Pending

----------------------------------------------------------------------------

Siga S 9900 BBC4037 25.00 36.00 11.00 1.01 1.01 Pending

----------------------------------------------------------------------------

Siga S 9750 BBC4025 39.00 50.00 11.00 1.25 1.25

----------------------------------------------------------------------------

Siga S 9750 BBC4026 15.00 26.00 11.00 1.54 1.54

----------------------------------------------------------------------------

Notes:

(10) Weighted average grade of uncut individual assays

(11) Weighted average grade of individual assays cut to 5 g/t

(12) Composite width and grade are preliminary where leach residue fire

assay results are pending

The mineralized intervals are based on a lower cut-off grade of

0.5 g/t, a minimal width of 3 m and up to a maximum of two

consecutive meters of dilution being included. The true width of

the mineralization is approximately 85% of the drill length

intervals in KT, CFU, Maga, P16, P17 and P8P9 areas, and 95% of the

drill length intervals in the Siga area. The true width is not

known yet on P17N, P17S and P13.The half-core samples were

collected by Orezone employees using a diamond saw. The core

samples were prepared by SGS Burkina Faso s.a.r.l. at the Bombore

site facility and then split by Orezone to 1 kg using Rotary Sample

Dividers (RSDs). A 1 kg aliquot was analyzed for leachable gold at

BIGS Global Burkina s.a.r.l in Ouagadougou, by bottle-roll

cyanidation using a LeachWell(TM) catalyst.

The RC drilling samples were divided by Orezone employees using

RSDs. A 2 kg split was prepared by SGS Burkina Faso s.a.r.l. at the

Bombore site facility and then split by Orezone to 1 kg using RSDs.

A 1 kg aliquot was analyzed for leachable gold at BIGS Global

Burkina s.a.r.l in Ouagadougou, by bottle-roll cyanidation using a

LeachWell(TM) catalyst. The leach residues from all samples with a

leach grade in excess of 0.2 g/t were prepared by BIGS Global

Burkina s.a.r.l. and then split by Orezone to 50 g using RSDs. A 50

g aliquot was analyzed by fire assay at SGS Burkina Faso s.a.r.l..

Orezone employs a rigorous Quality Control Program (QCP) including

a minimum of 10% standards, blanks and duplicates.

Qualified Persons

The drilling program was executed under the supervision of

Pascal Marquis, SVP Exploration for Orezone; the report titled

"Report on Metallurgical Testing - Bombore Drill Core Samples, MLI

Job No. 3625" was prepared by J. Davis, Metallurgist and Project

Manager at McLelland Laboratories; the technical memorandum titled

"Pit Slope Design for Bombore Project" was prepared by P.

Frechette, Project Manager at Golder Associates and; the Whittle

optimization parameters have been established by R. Gourde, Study

Manager at G Mining Services Inc. All are Qualified Persons under

National Instrument 43-101 and approved their respective technical

information in this release.

About Orezone Gold Corporation

Orezone is a Canadian company with a gold discovery track record

of +12 Moz and recent mine development experience in Burkina Faso,

West Africa. The company owns a 100% interest in Bombore which is

situated 85 km east of the capital city, adjacent to an

international highway. Mineral resources are constrained within

optimized open pit shells that span 11 km, and include 4.13 Moz of

measured and indicated (125 Mt @ 1.03 g/t) and 1.03 Moz of inferred

resources (35 Mt @ 1.00 g/t) with an average depth of drilling to

only 120 meters. The Company is working to further expand the

resources at Bombore while it completes a FS for a phase one

oxide-only CIL plant in 2H 2013 and becomes a mid-tier gold

producer by 2015.

FORWARD-LOOKING STATEMENTS AND FORWARD-LOOKING INFORMATION: This

news release contains certain "forward-looking statements" within

the meaning of applicable Canadian securities laws. Forward-looking

statements and forward-looking information are frequently

characterized by words such as "plan", "expect", "project",

"intend", "believe", "anticipate", "estimate", "potential",

"possible" and other similar words, or statements that certain

events or conditions "may", "will", "could", or "should" occur.

Forward-looking statements in this release include statements

regarding, among others; ground water; infrastructure design; mine

water management or waste management; scrubber and grinding circuit

design; improvements in the project economics; optimization and

trade-off studies; capital and operating cost estimates; gold

production for the project; completion of technical reports in Q2

2013; completion of a resource update in April 2013; completion of

a FS in 2H 2013; commencement of production at the Bombore Project

in 2015.

FORWARD-LOOKING STATEMENTS are based on certain assumptions, the

opinions and estimates of management at the date the statements are

made, and are subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those projected in the forward-looking statements.

These factors include the inherent risks involved in the

exploration and development of mineral properties, the

uncertainties involved in interpreting drilling results and other

geological and geotechnical data, fluctuating metal prices, the

possibility of project cost overruns or unanticipated costs and

expenses, the ability of contracted parties (including laboratories

and drill companies to provide services as contracted);

uncertainties relating to the availability and costs of financing

needed in the future and other factors. The Company undertakes no

obligation to update forward-looking statements if circumstances or

management's estimates or opinions should change. The reader is

cautioned not to place undue reliance on forward-looking

statements. Comparisons between any resource model or estimates

with the subsequent drill results are preliminary in nature and

should not be relied upon as potential qualified changes to any

future resource updates or estimates.

Readers are advised that National Instrument 43-101 of the

Canadian Securities Administrators requires that each category of

mineral reserves and mineral resources be reported separately.

Readers should refer to the annual information form of Orezone for

the year ended December 31, 2011 and other continuous disclosure

documents filed by Orezone since January 1, 2012 available at

www.sedar.com, for this detailed information, which is subject to

the qualifications and notes set forth therein.

Contacts: Orezone Ron Little CEO (613) 241-3699 or Toll Free:

(888) 673-0663rlittle@orezone.com Orezone Pascal Marquis SVP

Exploration (613) 241-3699 or Toll Free: (888)

673-0663pmarquis@orezone.com

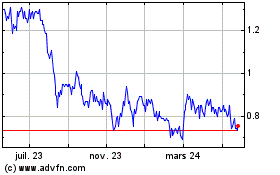

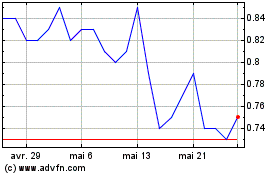

Orezone Gold (TSX:ORE)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Orezone Gold (TSX:ORE)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025