Parex Resources Inc. (“Parex” or the “Company”) (TSX: PXT) and its

strategic partner Ecopetrol S.A. (“Ecopetrol”), are pleased to

announce that they have entered into definitive agreements to

consolidate their position along the Llanos Foothills trend in

alignment with current Colombian government objectives to secure

gas supply and support energy transition initiatives.

Parex and Ecopetrol are now strategically

positioned with eight blocks, along with the creation of a mutual

area of interest (“AMI”), to capitalize on the approximately

500-kilometer geological trend and explore for new sources of

domestic gas and liquids. This trend boasts world-class discoveries

at both ends, which cumulatively have produced over 1.4 million

barrels of oil(1), and roughly 4 trillion cubic feet of natural

gas(1), with the middle of the trend largely unexplored.

The agreements signify progress in Parex’s long-term gas

strategy to pursue underexplored liquids-rich plays, which are

within an area that has existing infrastructure that can be

leveraged to accelerate exploration and development following new

regulations that have been approved by the Colombian

government.

“After extensive joint efforts, Parex and Ecopetrol are proud to

announce the execution of definitive agreements to explore the

high-potential Foothills of Colombia and harmonize our respective

land positions. On behalf of Parex, I want to express my gratitude

to Ecopetrol for their trust in our company, while reaffirming our

commitment to the respectful treatment of community and stakeholder

rights. This collaboration not only supports Colombia’s energy

position and the current administration’s initiatives, but also

marks a transformative frontier for Parex as we advance our gas

strategy alongside our strategic partner,” commented Imad Mohsen,

President & Chief Executive Officer.

“Over the last three years, Parex has

strategically strengthened our asset portfolio, such as carrying

out the Arauca & LLA-38 farm-in and acquiring 18 new blocks in

the 2021 Colombia bid round. This further partnership with

Ecopetrol is a continuation of those efforts to expand and

high-grade our portfolio as we focus on executing near-field

exploration prospects – while concurrently drilling high-impact

targets with step-change potential.”

Key Highlights

- Assumed

operatorship in all exploration and future development activities

where Parex holds a newly acquired working interest

(“W.I.”)(2).

-

Harmonized the LLA-4-1, LLA-16-1, and LLA-121 blocks(2) to become

50-50 joint venture partners as well as the option to jointly

participate in two additional blocks within the trend is under

evaluation.

- Received

a 50% participation share in the form of exploratory rights within

the Sirirí Convenio(2), where the producing Gibraltar field is

located, in exchange for drilling the Gibraltar Profundo

exploration well and further capital investments of $11 million

(gross).

- The

Gibraltar field is currently producing from the Mirador

formation(3)(4), which is excluded from the definitive

agreements(2) and will remain 100% Ecopetrol W.I.

- Gibraltar

Profundo is a 3D-defined exploration prospect targeting gas and

condensate below the Mirador formation, and becomes one of the

highest-ranking prospects in Parex’s high-impact big ‘E’

exploration portfolio; with expected results in 2025, the prospect

is located within the existing facilities of the Gibraltar field

where a discovery could be fast-tracked to existing pipeline

infrastructure.

- Created

an AMI within the Foothills trend that includes the Niscota

exploration area, whereby if either party acquires the rights

within an area, each party has the right to acquire a 50% W.I. of

the acquired area(5)(6).

- The

Niscota area is on trend to the producing fields of Cusiana,

Cupiagua, Floreña, and Pauto Sur, which together produced over

23,000 bbl/d of oil(4) and roughly 1 bcf/d of natural gas(4) in

2023 from discoveries made in the 1980s and 1990s; peak average

production from the combined fields was approximately 450,000 bbl/d

of oil(1) and roughly 3 bcf/d of natural gas(1).

-

Continuing to work jointly to unlock transportation via recent

changes in regulations that allow for the conversion of existing

oil pipelines to multiphase pipelines, minimizing the need for new

independent treatment facilities for each block, and accelerating

commercial onstream time for successful gas production.

(1) Source: IHS – S&P Global.(2) See “Block & Working

Interest Summary” for additional information.(3) The Gibraltar

field currently produces approximately 37,000 mcf/d of natural gas

and roughly 700 barrels of light crude oil from the Mirador

formation (January 2024).(4) Source: National Hydrocarbons Agency

of the Republic of Colombia (“ANH”).(5) Excludes the extension of

the existing discoveries from the Piedemonte Convenio, where

Ecopetrol will keep 100% rights over such area.(6) Subject to

government approval.

Llanos Foothills Block & Working Interest

Summary

|

Block |

Parex |

Ecopetrol |

|

Updated |

|

Sirirí Convenio |

50% W.I. in Future Exploration(1)(4) |

100% W.I. in Current Producing Area(3)50% W.I. in Future

Exploration |

|

LLA-4-1 |

50% W.I.(2)(4) |

50% W.I. |

|

LLA-16-1 |

50% W.I.(2)(4) |

50% W.I. |

|

LLA-121 |

50% W.I.(1)(4) |

50% W.I. |

|

Existing Partnerships |

|

Capachos |

50% W.I.(2) |

50% W.I. |

|

Arauca |

Parex 50% Participating Share(2)(5) |

50% W.I. |

|

LLA-38 |

50% W.I.(2) |

50% W.I. |

|

LLA-122 |

50% W.I.(2) |

50% W.I. |

(1) New Parex operatorship.(2) Pre-existing Parex

operatorship.(3) Parex receives 50% participating share in future

exploration; Ecopetrol retains 100% W.I. and operatorship of

current production, with 50% participating share in future

exploration.(4) Subject to government approval.(5) Business

Collaboration Agreement with Ecopetrol (Parex 50% Participating

Share); Ecopetrol currently holds 100% of the W.I. in the Convenio

Arauca while the assignment procedure is pending.

About Parex Resources Inc.

Parex is the largest independent oil and gas

company in Colombia, focusing on sustainable, conventional

production. The Company’s corporate headquarters are in Calgary,

Canada, with an operating office in Bogotá, Colombia. Parex shares

trade on the Toronto Stock Exchange under the symbol PXT.

For more information, please contact:

Mike KruchtenSenior Vice President, Capital

Markets & Corporate PlanningParex Resources Inc.

403-517-1733investor.relations@parexresources.com

Steven EirichInvestor Relations &

Communications AdvisorParex Resources

Inc.587-293-3286investor.relations@parexresources.com

Advisory on Forward-Looking

Statements

Certain information regarding Parex set forth in

this press release contains forward-looking statements that involve

substantial known and unknown risks and uncertainties. The use of

any of the words "plan", "expect", “prospective”, "project",

"intend", "believe", "should", "anticipate", "estimate",

“forecast”, "guidance", “budget” or other similar words, or

statements that certain events or conditions "may" or "will" occur

are intended to identify forward-looking statements. Such

statements represent Parex's internal projections, estimates or

beliefs concerning, among other things, future growth, results of

operations, production, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, plans for and results of drilling activity,

environmental matters, business prospects and opportunities. These

statements are only predictions and actual events or results may

differ materially. Although the Company’s management believes that

the expectations reflected in the forward-looking statements are

reasonable, it cannot guarantee future results, levels of activity,

performance or achievement since such expectations are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could

cause Parex's actual results to differ materially from those

expressed or implied in any forward-looking statements made by, or

on behalf of, Parex.

In particular, forward-looking statements

contained in this press release include, but are not limited to,

statements with respect to the Company's focus, plans, priorities

and strategies and the benefits to be derived from such plans,

priorities and strategies; the expected benefits of the definitive

agreements, including that Parex and Ecopetrol are now

strategically positioned to capitalize on the approximately

500-kilometer trend and explore for new sources of domestic gas and

liquids; that Parex is to assume operatorship in all exploration

and future development activities on the jointly held eight blocks

where Parex holds a newly acquired W.I.; expected benefits from

recent changes in regulations that allow for converting existing

oil pipelines to multiphase pipelines; and the timing of results

expected from the Gibraltar Profundo exploration well and that a

discovery could be fast-tracked to existing pipeline

infrastructure. These statements are only predictions and actual

events or results may differ materially. Although the Company’s

management believes that the expectations reflected in the

forward-looking statements are reasonable, it cannot guarantee

future results, levels of activity, performance or achievement

since such expectations are inherently subject to significant

business, economic, competitive, political and social uncertainties

and contingencies. Many factors could cause Parex's actual results

to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Parex.

These forward-looking statements are subject to

numerous risks and uncertainties, including but not limited to, the

impact of general economic conditions in Canada and Colombia;

prolonged volatility in commodity prices; industry conditions

including changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are

interpreted and enforced in Canada and Colombia; determinations by

the Organization of Petroleum Exporting Countries (OPEC) and other

countries as to production levels; competition; lack of

availability of qualified personnel; the results of exploration and

development drilling and related activities; obtaining required

approvals of regulatory authorities in Canada and Colombia; the

risks associated with negotiating with foreign governments as well

as country risk associated with conducting international

activities; volatility in market prices for oil; fluctuations in

foreign exchange or interest rates; environmental risks; changes in

income tax laws or changes in tax laws and incentive programs

relating to the oil industry; changes to pipeline capacity; ability

to access sufficient capital from internal and external sources;

failure of counterparties to perform under contracts; the risk that

Brent oil prices may be lower than anticipated; the risk that

Parex's evaluation of its existing portfolio of development and

exploration opportunities may not be consistent with its

expectations; the risk that Parex may not realize the expected

benefits from the definitive agreements; the risk that closing of

the definitive agreements may be delayed or may not occur at all;

the risk that necessary governmental and/or other approvals, as

required, may not be granted in connection with the definitive

agreements; risks associated with Parex's assumption of

operatorship in all exploration and future development activities

on the jointly held eight block where Parex holds a newly acquired

W.I.; the risk that recent changes in regulations may not result in

expected benefits; and risk that the timing of results from the

Gibraltar Profundo exploration well may be delayed and risk that a

discovery may not be fast-tracked to existing pipeline

infrastructure. Readers are cautioned that the foregoing list of

factors is not exhaustive. Additional information on these and

other factors that could affect Parex's operations and financial

results are included in reports on file with Canadian securities

regulatory authorities and may be accessed through the SEDAR+

website (www.sedarplus.ca).

Although the forward-looking statements

contained in this document are based upon assumptions which

Management believes to be reasonable, the Company cannot assure

investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking

statements contained in this document, Parex has made assumptions

regarding, among other things: current and anticipated commodity

prices and royalty regimes; availability of skilled labour; timing

and amount of capital expenditures; future exchange rates; the

price of oil, including the anticipated Brent oil price; the impact

of increasing competition; conditions in general economic and

financial markets; availability of drilling and related equipment;

effects of regulation by governmental agencies; receipt of partner,

regulatory and community approvals; royalty rates; future operating

costs; uninterrupted access to areas of Parex's operations and

infrastructure; recoverability of reserves and future production

rates; the status of litigation; timing of drilling and completion

of wells; on-stream timing of production from successful

exploration wells; operational performance of non-operated

producing fields; pipeline capacity; that Parex will have

sufficient cash flow, debt or equity sources or other financial

resources required to fund its capital and operating expenditures

and requirements as needed; that Parex's conduct and results of

operations will be consistent with its expectations; that Parex

will have the ability to develop its oil and gas properties in the

manner currently contemplated; that Parex's evaluation of its

existing portfolio of development and exploration opportunities is

consistent with its expectations; current or, where applicable,

proposed industry conditions, laws and regulations will continue in

effect or as anticipated as described herein; that the estimates of

Parex's production and reserves volumes and the assumptions related

thereto (including commodity prices and development costs) are

accurate in all material respects; that Parex will be able to

obtain contract extensions or fulfill the contractual obligations

required to retain its rights to explore, develop and exploit any

of its undeveloped properties; that Parex's internal security

protocols and engagements with its stakeholders and the Colombian

national government will be successful; that closing of the

definitive agreement will close; the anticipated benefits from the

definitive agreements; receipt of all required regulatory approvals

in respect of the definitive agreements; and other matters.

Management has included the above summary of

assumptions and risks related to forward-looking statements

provided in this document in order to provide shareholders with a

more complete perspective on Parex's current and future operations

and such information may not be appropriate for other purposes.

Parex's actual results, performance or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are

made as of the date of this document and Parex disclaims any intent

or obligation to update publicly any forward-looking statements,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

Analogous Information

Certain information in this press release may

constitute "analogous information" as defined in National

Instrument 51-101. Such information includes production estimates

and other information retrieved from publicly available sources.

Management of Parex believes the information is relevant as it may

help to define the reservoir characteristics and production profile

of lands in which Parex may hold an interest. Parex is unable to

confirm that the analogous information was prepared by a qualified

reserves evaluator or auditor and is unable to confirm that the

analogous information was prepared in accordance with the COGE

Handbook or with National Instrument 51-101. Such information is

not an estimate of the production, reserves or resources

attributable to lands held or to be held by Parex and there is no

certainty that the production, reserves or resources data and

economic information for the lands held or to be held by Parex will

be similar to the information presented herein. The reader is

cautioned that the data relied upon by Parex may be in error and/or

may not be analogous to such lands held or to be held by Parex.

Abbreviations

The following abbreviations used in this press

release have the meanings set forth below:

bbl/d barrels

per

daybcf/d billion

cubic feet per day

PDF

available: http://ml.globenewswire.com/Resource/Download/b61c452f-1435-4a7e-b970-f3bd3c6513d5

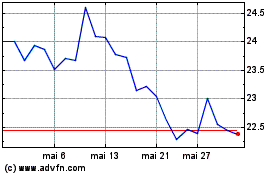

Parex Resources (TSX:PXT)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Parex Resources (TSX:PXT)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025