Middlefield Limited (the “Manager”), the manager of Middlefield

Global Real Asset Fund (“Real Asset”), is pleased to announce that

Real Asset intends to merge into Real Estate Split Corp., a split

share corporation founded on November 19, 2020, which invests in a

diversified, actively managed, high conviction portfolio of issuers

engaged in e-commerce and data infrastructure as well as the

multi-family, industrial, retail, seniors housing and healthcare

sectors (the “Merger”).

The investment objectives of Real Estate Split

Corp. are to provide:

Holders of Class A shares with:

(i) non-cumulative monthly cash distributions;

and

(ii) the opportunity for capital

appreciation through exposure to Real Estate Split Corp’s

portfolio; and

Holders of Preferred shares with:

(i) fixed cumulative preferential quarterly cash

distributions; and

(ii) a return of

the original issue price of $10.00 to holders upon maturity.

Real Estate Split Corp. is focused on

traditional property types like industrial, multi-family, senior

housing, and retail that Middlefield Capital Corporation, the

investment advisor of Real Asset and Real Estate Split Corp (the

“Advisor”), believes are well-positioned to benefit from growing

demand and constrained real estate supply, as well as emerging

property types like data centres, U.S. cell towers, and life

science labs that represent an increasing share of the real estate

market. Real Estate Split Corp. employs a tactical asset allocation

strategy in order to seek the best combination of capital

appreciation potential and income and will actively adjust the

Portfolio’s asset allocation across sectors/themes based upon the

Advisor’s outlook.

A special meeting of Real Asset unitholders will

be held on or about September 24, 2024, at which unitholders of

Real Asset will be asked to approve the Merger. Further details of

the meeting will be provided in an information circular to be

distributed to Real Asset unitholders in advance of the special

meeting. If approved, the Merger is expected to be completed on or

about December 6, 2024 (the “Effective Date”). All costs of the

Merger and the special meeting will be borne by the Manager.

The Manager believes that the proposed Merger

provides many benefits to Real Asset unitholders. Pursuant to the

Merger, Real Asset unitholders will receive Units of Real Estate

Split Corp. (each Unit comprised of one Preferred Share and one

Class A Share of Real Estate Split Corp.). The Real Estate Split

Corp. distribution yield based on June 24, 2024 net asset value is

16.2% per Class A Share and 5.2% per Preferred Share, resulting in

an expected overall distribution increase for Real Asset

unitholders of 58.5% after accounting for the exchange ratio. The

management fee of Real Estate Split Corp. is 0.85% per annum, a

reduction from the 1.10% per annum management fee of Real

Asset.

In addition, Class A Shares and Preferred Shares

of split share corporations have demonstrated the potential to

trade closer to, and in some cases above, their net asset value.

Therefore, the Manager believes that Real Asset’s current market

discount to NAV will likely narrow, if not be completely

eliminated. Split share corporations are unique investment vehicles

that provide opportunities for both conservative and more

aggressive investors. Further details regarding the operation of

split share corporations can be found at

https://middlefield.com/split-share-primer/.

Lastly, the Merger will not only allow Real

Asset unitholders to maintain exposure to institutional quality

assets like Blackstone Core+ Real Estate Investment Limited

Partnership (the “Blackstone LP”), but also deliver a more optimal

weighting of Blackstone LP in Real Estate Split Corp. portfolio

after the Merger. The Blackstone LP investment would amount to

approximately 5.7% of Real Estate Split Corp’s net assets if the

Merger had been completed on June 24, 2024, being the day prior to

this press release.

Considering the benefits referred to above, the

Manager is recommending Real Asset unitholders vote in favour of

merging with Real Estate Split Corp.

The Merger will not be effected on a

tax-deferred roll-over basis and, as such, will be considered a

taxable event for Real Asset unitholders that may result in capital

losses or gains becoming realized. The Merger will be completed at

an exchange ratio calculated as the net asset value per unit of

Real Asset determined as at the close of trading on the TSX on the

business day immediately prior to the Effective Date divided by the

net asset value per Unit of Real Estate Split Corp. determined as

at the close of trading on the TSX on the business day immediately

prior to the Effective Date. Pursuant to the Merger, Real Estate

Split Corp. will assume the liabilities of Real Asset and will

issue Units of Real Estate Split Corp., based on the exchange

ratio, in satisfaction of the purchase price for the assets of Real

Asset.

The unitholders of Real Asset who do not wish to

participate in the Merger can sell their units in the market or

tender them for a redemption prior to the Merger by delivering a

redemption notice on or prior to 5pm EST. on September 25, 2024.

Real Asset unitholders should be aware that by tendering units for

redemption they will be exposed to pricing risk for the period

between the deadline to tender units and the effective date of the

redemption, being November 28, 2024, and that redemption proceeds

equal to the net asset value per unit of Real Asset as of such

redemption, less any costs associated with the redemption, will be

paid in December 2024.

The Merger remains subject to the satisfaction

of all regulatory requirements and customary closing

conditions.

About Middlefield

Founded in 1979, Middlefield is a specialist

equity income asset manager with offices in Toronto, Canada and

London, England. Our investment team utilizes active management to

select high-quality, global companies across a variety of sectors

and themes. Our product offerings include proven dividend-focused

strategies that span real estate, healthcare, innovation,

infrastructure, energy, diversified income and more. We offer these

solutions in a variety of product types including ETFs, Mutual

Funds, Split-Share Funds, Closed-End Funds and Flow-through

LPs.

For further information, please visit our

website at www.middlefield.com or contact Nancy

Tham in our Sales and Marketing Department at 1.888.890.1868.

Commissions, trailing commissions, management

fees and expenses all may be associated with owning units of an

investment fund or ETF investments. Please read the prospectus and

publicly filed documents before investing. You will usually pay

brokerage fees to your dealer if you purchase or sell units of an

investment fund on the Toronto Stock Exchange or alternative

Canadian trading platform (an “exchange”). If the units are

purchased or sold on an exchange, investors may pay more than the

current net asset value when buying units of an investment fund and

may receive less than the current net asset value when selling

them. There are ongoing fees and expenses associated with owning

units of an investment fund. An investment fund must prepare

disclosure documents that contain key information about RA. You can

find more detailed information about Real Asset in the public

filings available at www.sedar.com. The indicated rates of return

are the historical annual compounded total returns including

changes in unit value and reinvestment of all distributions and do

not take into account: certain fees such as sales fees, redemption

fees, distributions or optional charges or income taxes payable by

any securityholder that would have reduced returns. Investment

funds and ETFs are not guaranteed, their values change frequently

and past performance may not be repeated.

Certain statements in this press release may be

viewed as forward-looking statements. Any statements that express

or involve discussions with respect to predictions, expectations,

beliefs, plans, intentions, projections, objectives, assumptions or

future events or performance (often, but not always, using words or

phrases such as "expects", "is expected", "anticipates", "plans",

"estimates" or "intends" (or negative or grammatical variations

thereof), or stating that certain actions, events or results "may",

"could", "would", "might" or "will" be taken, occur or be achieved)

are not statements of historical fact and may be forward-looking

statements. Statements which may constitute forward-looking

statements relate to: the proposed timing of the Merger and

completion thereof; the benefits of the Merger; the holding of the

Real Asset meeting; and the reduction in management fees.

Forward-looking statements are subject to a variety of risks and

uncertainties which could cause actual events or results to differ

from those reflected in the forward-looking statements including as

a result of changes in the general economic and political

environment, changes in applicable legislation, and the performance

of each fund. There are no assurances the Manager, the Advisor,

Real Asset or Real Estate Split Corp. can fulfill such

forward-looking statements and undertake no obligation to update

such statements. Such forward-looking statements are only

predictions; actual events or results may differ materially as a

result of risks facing one or more of the Manager, the Advisor,

Real Asset or Real Estate Split Corp., many of which are beyond the

control of the Manager, the Advisor, Real Asset or Real Estate

Split Corp.

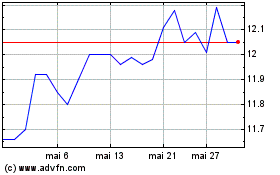

Real Estate Split (TSX:RS)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Real Estate Split (TSX:RS)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025