Editors Note: There is a photo associated with this release.

Augustine Gold and Copper Limited (TSX:SAU) ("St. Augustine" or

the "Company") and Nationwide Development Corporation ("Nadecor")

announced that they have reached a major milestone with the

handover by St. Augustine to Nadecor of the Benguet Settlement

Documents, which finalized the settlement with Benguet Mining

Corporation ("Benguet") for sale of its operating rights in the

King-king Copper-Gold Project in Pantukan, Compostela Valley

Province in the Philippines.

With the settlement completed and turned over by St. Augustine

to Nadecor, this gives the joint venture clear title to the

King-king Project. The clear title facilitates Nadecor's ability to

assign the King-king Project MPSA to the joint venture mining

company, and finalizes St. Augustine's equity as the joint venture

partner. It also provides a corporate structure within which the

project can operate as it moves forward in development.

"We are very pleased to have reached this watershed event in the

project and our partnership," said Andrew J. Russell, President of

St. Augustine. "With this turnover, we begin the joint venture

phase of development and cooperation between Nadecor and St.

Augustine, which will directly benefit thousands of Filipinos and

be a big boost to the Philippine economy."

For his part, Nadecor President Conrado T. Calalang praised St.

Augustine's role in the settlement and the future of the project.

"St. Augustine has been lock-step with us in the development of the

project and we are pleased, not just with the technical and

financial benefits they bring, but more importantly their

commitment to integrity and transparency in their dealings with

Nadecor and the community, which spells success for the

project."

St. Augustine reached the full and final settlement with Benguet

on August 30, 2011 for the King-king MPSA (Mineral Production

Sharing Agreement) with an amended Heads of Terms Agreement that

allowed all future payments to be settled with a single, final

payment of $10,250,000. Prior to this, St. Augustine had already

given a down payment of $8,000,000, for a total settlement package

of $18,250,000.

Under the original Heads of Terms Agreement signed in July 2010,

between Benguet and St. Augustine, through its subsidiary, St.

Augustine Mining Ltd. (SAML), Benguet agreed to a settlement with

Nadecor on outstanding issues on the King-king Project, including

the following:

-- Assign and transfer its interest in the Sagittarius Alpha Realty Corp.

claims surrounding the King-king Project to Nadecor;

-- Assign and transfer its interest in the Pantukan Mineral Corp. (PMC)

shares and operating rights in the PMC Claims surrounding the King-king

Project to Nadecor;

-- Terminate and complete the release of all of its rights, titles,

interests and claims in the Operating Agreement with Nadecor;

-- Assign or transfer all of its rights, titles, interests and claims in

the King-king MPSA to Nadecor;

-- All of Benguet's affiliates shall release, assign or transfer any other

rights, titles, interests or claims they have in respect of the King-

king Project; and

-- Complete turnover of all books, records, project information and project

samples.

Turnover of the settlement documents to Nadecor was delayed

until the issues created by dissident minority shareholder Jose

Ricafort were recently resolved by the Philippine Court of Appeals

and the Supreme Court, and the duly-elected Nadecor board led by

Mr. Calalang was clearly recognized and its authority

confirmed.

Mr. Calalang noted that the Court of Appeals decision dated 18

February, 2013 is legally binding and immediately effective, and

removes any doubt as to who is authorized to represent NADECOR as

its Board of Directors, and therefore the authority of the newly

elected Board and the Board immediately preceding it is clear. The

ruling stated:

"The Annual Stockholders' Meeting of NADECOR held on August 15,

2011 is hereby declared valid and the Board of Directors and

Officers elected thereat are declared lawfully elected. Any and all

acts of the Board of Directors elected during the August 15, 2011

NADECOR Annual Stockholders' Meeting are declared valid. ...

Likewise, the Writ of Preliminary Injunction dated June 13, 2012 is

made permanent (covering orders prohibiting the RICAFORT group from

scheduling and holding stockholders' meetings, the ratification of

rescission of agreements with St. Augustine Gold & Copper and

the election of a new board of directors)."

The challenge of dissident shareholder Jose Ricafort was thrown

out by the Court of Appeals, and the administrative complaint filed

against the Court of Appeals justices who rendered the same

decision, was dismissed by the Supreme Court by a vote of 15-0 on

February 19, 2013. We refer you to the official NADECOR website,

www.nadecor.com.ph, which features links to the full texts of the

above referenced decisions by the Philippines' highest Courts.

St. Augustine is listed on the main board of the Toronto Stock

Exchange and is run by industry leaders who have a proven record of

discovering, exploring and developing valuable mining assets around

the world. One of the largest shareholders in St. Augustine is

Queensberry Mining and Development Corporation ("Queensberry"), the

resource investment arm of the family of former Philippine Senator

Manny Villar. Following its investment of $11 million in May 2013,

Queensberry now holds 18% of St. Augustine and has the option to

increase its holding up to 32%.

King-king is one of the largest undeveloped copper-gold deposits

in the world and the second largest mining project in the

Philippines. The NI 43-101 compliant updated mineral resource

reported in a press release August 15, 2011 contains Measured

mineral resources of 120.3 million tonnes at 0.315% total copper,

0.112 soluble copper and 0.462 grams per tonne (g/t) gold, and

Indicated mineral resources of 841.9 million tonnes at 0.245% total

copper, 0.054% soluble copper, and 0.316 grams per tonne (g/t)

gold. The Inferred mineral resources are an additional 188.8

million tonnes at 0.215% total copper, 0.048% soluble copper, and

0.265 g/t gold. The Measured and Indicated mineral resource

consists of 5.4 billion pounds of contained copper and 10.3 million

troy ounces of contained gold. (The original resource Technical

Report for King-king was published in October 2010.)

NATIONAL INSTRUMENT 43-101 COMPLIANCE

Mr. James J. Moore, P.E., St. Augustine Gold and Copper Limited,

a qualified person under National Instrument 43-101 ("NI 43-101"),

has reviewed and approved the scientific and technical information

contained in this news release.

A NI 43-101 compliant technical report entitled "King-king

Copper-Gold Project Mindanao, Philippines" dated October 12, 2010,

and prepared by Michael G. Hester, FAusIMM of Independent Mining

Consultants, Inc., Donald F. Earnest, P.G., of Resource Evaluation,

Inc. and John G. Aronson of AATA International, Inc. has been filed

by the Company on www.sedar.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This announcement includes certain "forward-looking statements"

within the meaning of Canadian securities legislation. All

statements, other than statements of historical fact included

herein are forward-looking statements. Forward-looking statements

involve various risks and uncertainties and are based on certain

factors and assumptions. There can be no assurance that such

statements will prove to be accurate, and actual results and future

events could differ materially from those anticipated in such

statements. Important factors that could cause actual results to

differ materially from the Company's expectations include

uncertainties related to fluctuations in gold, copper and other

commodity prices and currency exchange rates; uncertainties

relating to interpretation of drill results and the geology,

continuity and grade of mineral deposits; uncertainties relating to

the completion of a bankable feasibility study; uncertainty of

estimates of capital and operating costs, recovery rates production

estimates and estimated economic return; the need for cooperation

of the Company's joint venture partner and government agencies in

the development of the Company's mineral projects; the need to

obtain additional financing to develop the Company's mineral

projects; the possibility of delay in development programs or in

construction projects and uncertainty of meeting anticipated

program milestones for the Company's mineral projects; and other

risks and uncertainties disclosed under the heading "Risk Factors"

in the Annual Information Form dated March 22, 2013, and filed with

Canadian securities regulatory authorities on the SEDAR website at

www.sedar.com.

To view the photo associated with this release, please visit the

following link:

http://www.marketwire.com/library/20130903-sau903i.jpg

Contacts: St. Augustine Gold and Copper Ltd. Kristi Harvie

Manager Investor and Corporate Affairs

509-343-3193kharvie@sagcmining.com www.sagcmining.com TMX Equicom

Marina Proskurovsky Account Manager 416-815-0700 ext.

288mproskurovsky@tmxequicom.com Nationwide Development Corporation

Atty. Leocadio S. Nitorreda Chief Operating Officer / General

Counsel +63-917-521-4178lnitorreda@kingkingproject.com

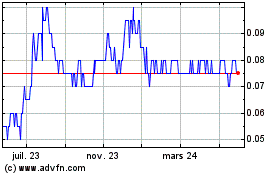

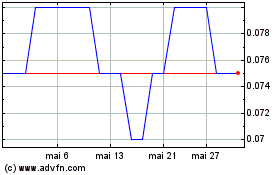

St Augustine Gold and Co... (TSX:SAU)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

St Augustine Gold and Co... (TSX:SAU)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024