Steppe Gold Ltd. (TSX: STGO) (OTCQX:

STPGF) (FSE: 2J9) (“

Steppe Gold” or the

“

Company”) is pleased to announce its

financial results for the year ended December 31, 2022.

HIGHLIGHTS

Year Ended December 31, 2022

Highlights (all figures in US$000’s unless stated

otherwise and except for per unit amounts which are in US$)

- Revenue for the

year ended December 31, 2022, was $62,366 (December 31, 2021

$24,050) on sales of 33,681 gold ounces (December 31, 2021: 12,899

gold ounces) and 38,740 silver ounces (December 31, 2021: 28,622

silver ounces) with average realized prices per ounce of $1,818 and

$20 respectively (December 31, 2021: $1,837 and $24).

- Operating income

from mine operations, before depreciation and depletion was $35,028

(December 31, 2021: $12,435).

- Adjusted EBITDA

after stream payments was $11,927.

- Site

all-in-sustaining-Cost (“AISC”) was $796 per ounce sold for the

year ended December 31, 2022.

- As at December 31,

2022 cash amounted to $2,515 and total bank, other debt and

payables were $18,385 for net debt of $15,870.

- During the year

ended December 31, 2022, 958,289 tonnes of ore were mined and

922,051 tonnes of ore were stacked on the leach pad with an average

gold grade of 1.82 g/t and an average silver grade of 12.06

g/t.

- The Company

announced on February 21, 2023 the results of technical report of

the 100% owned ATO Project in Mongolia comprising a further 1.5

years at the fresh rock expansion (the “Phase 2 Expansion”), for a

12 year aggregate mine life.

- The results

reinforce the Company’s current Phase 2 Expansion plans with

construction already underway, and existing permitting and

infrastructure in place. The Phase 2 Expansion is scheduled to

start with first concentrates in Q1 2025. The life of mine plan

includes the ongoing oxide operations which have a further three

years to run, for a total of 14 years of mine life, from January 1,

2023.

- The Company repaid

$46,856 on the 2021 Gold 2 Loan from the cash deposit during 2022.

The maturity date of the remaining loan balance of $2,838 has been

extended to July 28, 2024.

- In January 2023,

the Company reached an agreement for an additional $5,000 for

allocation to working capital funded directly from the Trade and

Development Bank of Mongolia. The loan maturity date is within 12

months.

Fourth Quarter Highlights (all

figures in US$000’s unless stated otherwise and except for per unit

amounts which are in US$)

- Revenue for the

three months ended December 31, 2022, was $17,962 on sales of

10,172 gold ounces and 19,347 silver ounces with average realized

prices per ounce of $1,686 and $17 respectively.

- Operating income

from mine operations, before depreciation and depletion, was

$9,608.

- Adjusted EBITDA

after stream payments was $4,066.

- Site AISC was $804

per ounce sold for the quarter.

- During the three

months ended December 31, 2022, 119,808 tonnes of ore were mined

and 261,368 tonnes of ore were stacked on the leach pad with an

average gold grade of 1.79 g/t and an average silver grade of 10.02

g/t.

Outlook

2022 was an active year for mining and stacking

on the heap leach phase at the ATO gold mine. This has continued

largely uninterrupted, in spite of strong headwinds from COVID-19

and the related supply chain problems. With the recent relaxation

of the zero COVID restrictions in China, we have seen an

improvement in parts of the China/Mongolia supply chain.

With over 2,824,108 tonnes stacked on the leach

pad and a further 498,697 tonnes on the ROM pad at year end, we are

pleased to report continued strong gold and silver inventory

build-up.

The focus for 2023 will be to maximize oxide

production from the substantial inventories on hand and

aggressively move forward with the Phase 2 Expansion. Discussions

are advancing on financing for Phase 2 Expansion in parallel with

plans to pursue a dual listing of the Company’s common shares on

the Main Board of the Stock Exchange of Hong Kong Limited.

On March 6, 2023, the Company entered into a

binding letter of intent (the “Binding Agreement”) pursuant to

which the Company, either directly or through a wholly-owned

subsidiary, will acquire all of the issued and outstanding common

shares of Anacortes Mining Corp. (“Anacortes”) by way of a court

approved plan of arrangement under the Business Corporations Act

(British Columbia), in an all-share transaction (the

“Transaction”). Under the terms of the Binding Agreement, Anacortes

shareholders will receive 0.4532 of a Steppe Gold common share for

each Anacortes common share, which represents consideration of

approximately C$0.48 per Anacortes common share and a premium of

36% based on the closing prices of the Anacortes common shares on

the TSX-V and the Steppe Gold common shares on the TSX, each as of

the close of trading on March 3, 2023. The Transaction is subject

to, among other things, the execution of an arrangement agreement,

the receipt of all necessary regulatory, stock exchange and court

approvals, and obtaining shareholder approval of the Transaction at

a meeting of the Anacortes shareholders, which is expected to be

held in Q2 2023.

The Company’s consolidated financial results for

the year ended December 31, 2022 have been filed on SEDAR. The full

version of the condensed interim consolidated financial statements

and associated management's discussion & analysis can be viewed

on the Company's website at www.steppegold.com or under the

Company's profile on SEDAR at www.sedar.com.

Steppe Gold Ltd.

Steppe Gold is Mongolia’s premier precious

metals company.

For Further information, please

contact:Bataa Tumur-Ochir, CEO and President

Jeremy South, Senior Vice President and Chief

Financial Officer

Shangri-La office, Suite 1201, Olympic Street19A, Sukhbaatar

District 1,Ulaanbaatar 14241, MongoliaTel: +976 7732 1914

Non-IFRS Performance

Measures

EBITDA is defined as earnings before interest,

taxes, depreciation and amortization. Adjusted EBITDA is defined as

adjusted earnings before interest, taxes, depreciation and

amortization. Further details of Non-IFRS Performance Measures

noted above can be found in the Company’s management's discussion

& analysis.

Cautionary Note Regarding

Forward-Looking Statements

This news release contains certain statements or

disclosures relating to the Company that are based on the

expectations of its management as well as assumptions made by and

information currently available to the Company which may constitute

forward-looking statements or information (“forward-looking

statements”) under applicable securities laws. All such statements

and disclosures, other than those of historical fact, which address

activities, events, outcomes, results, or developments that the

Company anticipates or expects may, or will occur in the future (in

whole or in part) should be considered forward-looking statements.

In some cases, forward-looking statements can be identified by the

use of the words “continued”, “focus”, “scheduled”, “will” and

similar expressions. In particular, but without limiting the

foregoing, this news release contains forward-looking statements

pertaining to the following: trading of the Company's common shares

and business, listing of common shares on the Hong Kong Stock

Exchange, economic, and political conditions in Hong Kong and

Mongolia, consummation and timing of the Transaction, the

satisfaction of the conditions precedent to the Transaction, the

strengths, characteristics and potential of the resulting company

and discussion of future plans, projections, objectives, estimates

and forecasts and the timing related thereto, including with

respect to the ATO gold mine.

The forward-looking statements contained in this

news release reflect several material factors and expectations and

assumptions of the Company including, without limitation: required

shareholder and regulatory approvals, exercise of any termination

rights under the Binding Agreement, meeting other conditions in the

Binding Agreement, material adverse effects on the business,

properties and assets of the Company, changes in business plans and

strategies, market and capital finance conditions, risks inherent

to any capital financing transactions, risks inherent to a possible

Steppe Gold dual primary listing, changes in world commodity

markets, currency fluctuations, costs and supply of materials

relevant to the mining industry, change in government and changes

to regulations affecting the mining industry.

The Company believes the material factors,

expectations, and assumptions reflected in the forward-looking

statements are reasonable at this time, but no assurance can be

given that these factors, expectations, and assumptions will prove

to be correct. The forward-looking statements included in this news

release are not guarantees of future performance and should not be

unduly relied upon. Such forward-looking statements involve known

and unknown risks, uncertainties, and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements including, without

limitation: changes in world commodity markets, equity markets,

costs and supply of materials relevant to the mining industry,

change in government and changes to regulations affecting the

mining industry, and certain other risks detailed from time to time

in the Company’s public disclosure documents including, without

limitation, those risks identified in this news release and in the

Company’s annual information form dated March 31, 2023, copies of

which are available on the Company’s SEDAR profile at

www.sedar.com. Readers are cautioned that the foregoing list of

factors is not exhaustive and are cautioned not to place undue

reliance on these forward-looking statements.

The forward-looking statements contained in this

news release are made as of the date hereof and the Company

undertakes no obligations to update publicly or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise, unless so required by applicable

securities laws.

The Toronto Stock Exchange has not reviewed and

does not accept responsibility for the adequacy or accuracy of the

content of this news release.

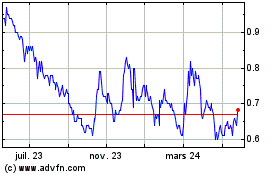

Steppe Gold (TSX:STGO)

Graphique Historique de l'Action

De Mar 2025 à Avr 2025

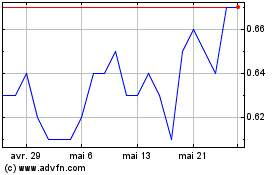

Steppe Gold (TSX:STGO)

Graphique Historique de l'Action

De Avr 2024 à Avr 2025