StorageVault to Acquire Three Locations for $21.8 Million

29 Mars 2023 - 1:00PM

STORAGEVAULT CANADA INC.

(“

StorageVault”) (

SVI-TSX) has

agreed to acquire three locations from three vendor groups

(collectively, the “

Vendors”) for an aggregate

purchase price of $21,825,000, subject to customary adjustments

(the “

Acquisitions”). Two of the Acquisitions are

arm’s length and one for $13,000,000 is a related party acquisition

(the “

Related Party Acquisition”) with Access Self

Storage Inc. (“

Access”) as the Vendor for that

Acquisition. It is anticipated that the Acquisitions will close in

Q1 and Q2 2023.

Two of the assets are located in Nova Scotia and

the other in Alberta.

Purchase Price and PaymentThe

aggregate purchase price is $21,825,000, subject to adjustments,

and is payable by the issuance of an aggregate of up to

approximately $4,500,000 of StorageVault common shares to certain

of the Vendors based on an agreed upon minimum price or VWAP ending

three days prior to closing, with the remainder of the aggregate

purchase price being paid with promissory notes, funds on hand or

consisting of debt of one of the stores being acquired.

Conditions Precedent to the

AcquisitionsThe obligations of StorageVault to complete

the Acquisitions are subject to conditions including, but not

limited to: completion of an agreement of purchase and sale,

mortgage assumption approval, satisfactory due diligence and

satisfactory environmental site assessment reports. The obligations

of both StorageVault and the Vendors to complete the closing of the

Acquisitions are subject to the satisfaction of other customary

closing conditions and include acceptance of the TSX

(“TSX”) for certain of the Acquisitions. None of

the three Vendor group Acquisitions are conditional or contingent

on the completion of the other Acquisitions.

Exemption from MI 61-101As

Access is a non-arm’s length party to StorageVault, the Related

Party Acquisition is considered a “related party transaction” under

MI 61-101 - “Protection of Minority Security Holders in Special

Transactions” (“MI 61-101”). StorageVault will

rely on exemptions from the formal valuation and minority approval

requirements of MI 61-101, in respect of the Related Party

Acquisition, pursuant to Section 5.5(a) and Section 5.7(a) (Fair

Market Value Not More Than 25% of Market Capitalization) of MI

61-101.

Other InformationThere can be

no assurance that the Acquisitions will be completed as proposed or

at all. No new insiders will be created, nor will any change of

control occur, as a result of the Acquisitions.

About StorageVault Canada

Inc.StorageVault owns and operates 238 storage locations

across Canada. StorageVault owns 206 of these locations plus over

4,500 portable storage units representing over 11.4 million

rentable square feet on over 665 acres of land. StorageVault also

provides last mile storage and logistics solutions and professional

records management services, such as document and media storage,

imaging and shredding services.

For further information, contact Mr. Steven

Scott or Mr. Iqbal Khan:

Tel: 1-877-622-0205

ir@storagevaultcanada.com

Forward-Looking Information: This news release

contains “forward-looking information” within the meaning of

applicable Canadian securities legislation. All statements, other

than statements of historical fact, included herein are

forward-looking information. In particular, this news release

contains forward-looking information in relation to: the proposed

Acquisitions; the timing for completion of the proposed

Acquisitions; the satisfaction of the conditions for completion of

the proposed Acquisitions; and the issuance of StorageVault common

shares to satisfy a portion of the purchase price for certain of

the Acquisitions. This forward-looking information reflects

StorageVault’s current beliefs and is based on information

currently available to StorageVault and on assumptions StorageVault

believes are reasonable. These assumptions include, but are not

limited to: the completion of satisfactory due diligence by

StorageVault in relation to the proposed Acquisitions; execution

of purchase agreements for certain of the proposed Acquisitions;

the satisfactory fulfilment of all of the conditions precedent to

the proposed Acquisitions including satisfactory due diligence,

mortgage assumption approvals, obtaining first mortgage

commitments, and satisfactory environmental site assessment

reports; the receipt of all required approvals for the proposed

Acquisitions, including TSX acceptance and any board approvals or

third party consents (including for mortgage commitments and

assumptions); the issuance of StorageVault common shares as

disclosed above as part of the purchase price for certain of the

Acquisitions; market acceptance of the proposed Acquisitions; the

receipt of, and accuracy of the value of, appraisals received for

certain of the proposed Acquisitions; acceptable financing to

complete the proposed Acquisitions; the level of activity in the

storage business and the economy generally; consumer interest in

StorageVault’s services and products; competition and

StorageVault’s competitive advantages; and StorageVault’s continued

response and ability to navigate the COVID-19 pandemic being

consistent with, or better than, its ability and response to

date. Forward-looking information is subject to known and unknown

risks, uncertainties and other factors that may cause the actual

results, level of activity, performance or achievements of

StorageVault to be materially different from those expressed or

implied by such forward-looking information. Such risks and other

factors may include, but are not limited to: general business,

economic, competitive, political and social uncertainties; general

capital market conditions and market prices for securities; delay

or failure to receive board of directors, third party or regulatory

approvals; the actual results of StorageVault’s future operations;

competition; changes in legislation, including environmental

legislation, affecting StorageVault; the timing and availability of

external financing on acceptable terms; conclusions of economic

evaluations and appraisals; lack of qualified, skilled labour or

loss of key individuals; risks related to the COVID-19 pandemic

including various recommendations, orders and measures of

governmental authorities to try to limit the pandemic, including

travel restrictions, border closures, non-essential business

closures, service disruptions, quarantines, self-isolations,

shelters-in-place and social distancing, mandatory vaccination

policies, disruptions to markets, economic activity, financing,

supply chains and sales channels, and a deterioration of general

economic conditions including a possible national or global

recession; and the impact that the COVID-19 pandemic may have on

StorageVault which may include: a short-term delay in payments from

customers, an increase in accounts receivable and an increase of

losses on accounts receivable; decreased demand for the services

that StorageVault offers; and a deterioration of financial markets

that could limit StorageVault’s ability to obtain external

financing. A description of additional risk factors that may cause

actual results to differ materially from forward-looking

information can be found in StorageVault’s disclosure documents on

the SEDAR website at www.sedar.com. Although StorageVault has

attempted to identify important risks and factors that could cause

actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. Readers

are cautioned that the foregoing list of factors is not exhaustive.

Readers are further cautioned not to place undue reliance on

forward-looking information as there can be no assurance that the

plans, intentions or expectations upon which they are placed will

occur. Forward-looking information contained in this news release

is expressly qualified by this cautionary statement. The

forward-looking information contained in this news release

represents the expectations of StorageVault as of the date of this

news release and, accordingly, is subject to change after such

date. However, StorageVault expressly disclaims any intention or

obligation to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except as expressly required by applicable securities law.

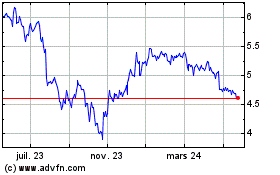

StorageVault Canada (TSX:SVI)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

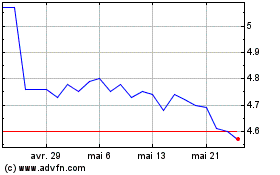

StorageVault Canada (TSX:SVI)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024