March 13, 2025 - Sylogist Ltd. (TSX: SYZ) ("Sylogist" or the

"Company"), a leading public sector SaaS company, today announced

its results for the fourth quarter and the full year ended December

31, 2024.

"Our Q4 performance reaffirms the success of our transition to a

SaaS-driven enterprise," said Bill Wood, President & CEO

of Sylogist. "We are pleased with our go-to-market execution

and the momentum we’ve built. While transitioning project service

revenue—such as new implementations and customer upgrades—to

partners may temporarily impact top-line growth, it is a strategic

move designed to enhance long-term operating leverage and

scalability. We are confident that replacing this handed-off

revenue with high-margin SaaS revenue will drive even greater value

for our shareholders.

We’re also proud to report a 20% year-over-year increase in our

Net Promoter Score or NPS — from an already strong 51 in 2023 to 62

this year. This significant improvement reflects the trust we’ve

built with our customers and validates our commitment to delivering

solutions that drive real value, reinforcing our competitive

differentiation in the market."

1 Growth comparisons for Q4 2024 compared to Q4 2023 have been

adjusted to reflect the divestiture of the Managed IT Services

division.

Conference Call Details

The Company will host a conference call at 8:30

AM Eastern Time on March 13, 2025. A replay of the call will

be archived in the investor section of the Company’s website.

Date: Thursday, March 13, 2025Time: 8:30

a.m. EDTParticipant Toll-Free Dial-In Number: +

1-844-752-3805Webcast link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=sXr9662vPlease

dial-in before the start of the conference to secure a line and

avoid delays.

About SylogistSylogist provides

mission-critical SaaS solutions to over 2,000 public sector

customers globally across the government, non-profit, and education

market segments. The Company's stock is traded on the Toronto Stock

Exchange under the symbol SYZ. Information about Sylogist,

inclusive of full financial statements together with Management’s

Discussion and Analysis, can be found at www.sedarplus.ca or at

www.sylogist.com.

Forward-looking Statements

This news release contains “forward-looking

information” within the meaning of applicable securities

legislation. Although the forward-looking information is based on

what the Company believes are reasonable assumptions, current

expectations, and estimates, investors are cautioned from placing

undue reliance on this information since actual results may vary

from the forward-looking information. Forward-looking information

may be identified by the use of forward-looking terminology such as

“believe”, “assume”, “intend”, “may”, “will”, “expect”, “estimate”,

“anticipate”, “continue”, “could”, “should”, “can”, “outlook” or

similar terms, variations of those terms or the negative of those

terms, and the use of the conditional tense as well as similar

expressions.

Such forward-looking information that is not

historical fact, including statements based on management’s beliefs

and assumptions, cannot be considered as guarantees of future

performance. They are subject to a number of risks and

uncertainties, including but not limited to future economic

conditions, the markets that the Company serves, the actions of

competitors, major new technological trends, and other factors,

many of which are beyond the Company’s control, that could cause

actual results to differ materially from those that are disclosed

in or implied by such forward-looking information. The

forward-looking information contained in this news release is

expressly qualified by this cautionary statement. The Company

undertakes no obligation to update publicly any forward-looking

information whether because of new information, future events or

otherwise other than as required by applicable legislation.

Important risk factors that may affect these expectations include,

but are not limited to, the factors described under the section

“Risks and Uncertainties” found in the Company’s Annual Information

Form for the fiscal period ended December 31, 2023, and in the

Management’s Discussion and Analysis for the quarters ended

March 31, 2024, June 30, 2024, and September 30,

2024, and for the year ended December 31, 2024 and other

documents available on the Company’s profile at www.sedarplus.ca.

Readers are cautioned that the foregoing list of factors is not

exhaustive.

Actual results and developments may differ, in

some cases materially, from those expressed or implied by the

forward-looking statements contained in this news release. Such

statements are based on a number of assumptions which may prove to

be incorrect, including, but not limited to, assumptions about: (i)

competitive environment; (ii) operating risks; (iii) the Company’s

management and employees; (iv) capital investment by the Company’s

customers; (v) customer project implementations; (vi) liquidity;

(vii) current global financial and geopolitical conditions; (viii)

implementation of the Company’s commercial strategic plan; (ix)

access to credit sources and the terms of such financing; (x)

potential product liabilities and other lawsuits to which the

Company may be subject; (xi) additional financing and dilution;

(xii) market liquidity of the Company’s common shares; (xiii)

development of new products; (xiv) intellectual property and other

proprietary rights; (xv) acquisition and expansion; (xvi) foreign

currency; (xvii) interest rates; (xviii) technology and regulatory

changes; (xix) internal information technology infrastructure and

applications and (xx) cyber security. Certain information set out

herein may be considered as “financial outlook” within the meaning

of applicable securities laws. The purpose of this financial

outlook is to provide readers with disclosure regarding Sylogist’s

reasonable expectations as to the anticipated results of its

proposed business activities for the periods indicated. Readers are

cautioned that the financial outlook may not be appropriate for

other purposes.

Non-IFRS Financial Measures

This news release refers to certain non-IFRS

measures, namely Bookings, Adjusted EBITDA, Adjusted EBITDA Margin,

Annualized Recurring Revenue (“ARR”), Software as a Service

(“SaaS”) ARR, Net Promoter Score (“NPS”), and SaaS Net Revenue

Retention (“SaaS NRR”). These non-IFRS measures do not have any

standardized meaning prescribed by IFRS and may not be comparable

to similarly titled measures reported or calculated by other

companies. These measures are provided as additional information to

complement measures under IFRS by providing further understanding

of the Company’s expected results of operations from management’s

perspective. Accordingly, such measures should not be considered in

isolation nor as a substitute for analysis of the Company’s

financial information reported under IFRS.

- Bookings refer to the total value

of customer accepted contracts during the reporting period. This

includes SaaS bookings (the value of SaaS contracts for the entire

contracted term) and the project services bookings (the full value

of contracted project services).

- Adjusted EBITDA is calculated as

earnings before interest expense, interest income, income taxes,

depreciation and amortization, stock-based compensation, foreign

exchange gains/losses and the impact of acquisition and

restructuring.

- Adjusted EBITDA Margin refers to

Adjusted EBITDA as a percentage of revenue.

- ARR is defined as the annualized

value of contractually committed SaaS and maintenance and support

services. This quantification assumes that customers will renew the

contractual commitment on a periodic basis as they come up for

renewal unless the customer has notified the Company of its

intention to cancel.

- SaaS ARR refers to ARR attributable

to SaaS customer contracts.

- SaaS NRR refers to the percentage

of beginning of period ARR retained over a given 12-month period

inclusive of the impact of contractions, losses and the impact of

any additional expansion revenues from customer upgrades within the

existing customer base. The Company’s calculation of SaaS NRR

includes the impact of customers converting from its maintenance

and support offerings to its SaaS offerings.

- NPS is a

customer “experience” metric that measures the willingness of

customers to recommend a company’s products or services to

others.

Bookings, Adjusted EBITDA, Adjusted EBITDA

Margin, ARR, SaaS ARR, and SaaS NRR are provided to investors as

alternative methods for assessing the Company’s operating results

in a manner that is focused on the Company’s ongoing operations and

to provide a more consistent basis for comparison between periods.

These measures should not be construed as alternatives to profit or

cash flow from operating activities, determined in accordance with

IFRS as an indicator of the Company’s performance.

For further information regarding non-IFRS

measures used by the Company, please refer to a copy of the

Company’s Annual Financial Statements and Management’s Discussion

and Analysis for the year ended December 31, 2024, copies of which

are available on Sylogist's SEDAR profile

at www.sedarplus.ca.

Currency and RoundingAll

amounts in this Press Release are expressed in millions of Canadian

dollars unless otherwise stated. All percentage variations

expressed herein have been calculated based on variations resulting

from numbers expressed in millions. Any potential differences from

similarly calculated percentages in the Company’s Financial

Statements and Management’s Discussion and Analysis are due to

rounding and are nonmaterial.

For further information

contact:Sujeet Kini, Chief Financial OfficerSylogist

Ltd.

ir@sylogist.com(416) 491-8004

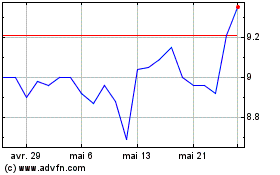

Sylogist (TSX:SYZ)

Graphique Historique de l'Action

De Mar 2025 à Avr 2025

Sylogist (TSX:SYZ)

Graphique Historique de l'Action

De Avr 2024 à Avr 2025