TransAlta to Acquire Heartland Generation from Energy Capital Partners at a Reduced Price of $542 Million

14 Novembre 2024 - 1:00PM

Highlights

- TransAlta and

ECP have agreed to an $80 million purchase price reduction to

reflect two required asset divestitures representing 97 MW (net

ownership)

- Transaction

revalued at approximately $542 million, inclusive of the assumption

of $232 million of low-cost debt, and subject to a further

favourable economic adjustment of approximately $80 million,

reflecting the economic benefit of the Heartland business arising

since the effective date of the transaction of October 31, 2023,

prior to working capital adjustments

- Heartland

portfolio valued at a net price of approximately $270 per kilowatt,

with an expected EBITDA multiple1 of approximately 5.4 times

- Highly accretive

to free cash flow, with an attractive cash yield upon closing

underpinned by approximately 60% of revenues contracted with a

weighted-average remaining life of 15 years

- Corporate

pre-tax synergies of approximately $20 million per annum

- Transaction to

add 1,747 MW (net interest) of complementary capacity, including

contracted cogeneration and peaking generation, legacy gas-fired

thermal generation, transmission capacity, and potential hydrogen

development opportunities, all of which will be critical to support

reliability in the Alberta electricity market

- Enhances and

further diversifies TransAlta’s competitive portfolio in the highly

dynamic and shifting electricity landscape in Alberta

TransAlta Corporation (TSX: TA; NYSE: TAC)

("TransAlta" or "Company") announced today that it has entered into

an amending agreement to the share purchase agreement (the

"Amending Agreement") with an affiliate of Energy Capital Partners

("ECP"), the parent of Heartland Generation Ltd. and Alberta Power

(2000) Ltd. (collectively, "Heartland"), relating to the previously

announced acquisition of Heartland and its business operations by

TransAlta (the "Transaction"). In order to meet the requirements of

the federal Competition Bureau ("Bureau"), TransAlta has also

entered into a consent agreement with the Commissioner of

Competition pursuant to which TransAlta has agreed to divest

Heartland's Poplar Hill and Rainbow Lake assets following closing

of the Transaction (the "Divestitures"). Closing of the Transaction

is expected to occur on or before December 4, 2024.

In consideration of the Divestitures, TransAlta

and ECP have agreed to a purchase price reduction of $80 million

for the Transaction. ECP will be entitled to receive the proceeds

from the sale of Poplar Hill and Rainbow Lake, net of certain

adjustments following completion of the Divestitures. The revised

transaction price of $542 million will be further reduced by

approximately $80 million following closing of the Transaction, to

reflect the economic benefit of the Heartland business arising

since October 31, 2023, which is payable to TransAlta, consistent

with the terms of the original share purchase agreement. The net

cash payment for the Transaction, before working capital

adjustments, is estimated at $230 million, and will be funded

through a combination of cash on hand and draws on its credit

facilities.

“We are pleased to be able to move forward with

the Heartland acquisition in the coming weeks, and to incorporate

Heartland's complementary assets within our Alberta portfolio.

Consistent with our original investment thesis, the Alberta market

will increasingly require low-cost, flexible and fast-responding

generation to support grid reliability over the coming years. The

transaction supports our competitive position in Alberta by

ensuring we maintain a robust and diversified portfolio, which

together with our energy marketing capabilities, complements and

supports Alberta's electricity grid. The Heartland portfolio will

contribute meaningful cash flows with significant value from our

corporate synergies, even with the planned asset divestitures,"

said John Kousinioris, President and Chief Executive Officer of

TransAlta.

Heartland owns and operates generation assets

consisting of 507 MW of cogeneration, 387 MW of contracted and

merchant peaking generation, 950 MW of natural gas-fired thermal

generation, transmission capacity and a development pipeline that

includes the 400 MW Battle River Carbon Hub.

Investment Highlights

The transaction is strategically attractive to

TransAlta and provides the following benefits:

- Expands

Flexible Generation Capabilities: Augments and diversifies

TransAlta’s portfolio in Alberta's current energy-only market by

expanding its flexible, fast-ramping capacity and marketing

capabilities to enhance our ability to respond to changing market

conditions stemming from the intermittency of increasing renewable

generation.

-

Maintains Attractive Transaction Metrics: The

acquisition is highly accretive to free cash flow with an

attractive multiple and strong cash yield. The Transaction, net of

economic adjustment, values the portfolio of assets at

approximately $270 per kilowatt, well below the replacement cost of

current and other forms of reliable generation, providing a

low-cost expansion of our ability to deliver reliable generation to

the market demands of Alberta.

- Delivers

Highly Contracted Cash Flow: Post-closing, the assets are

expected to add approximately $85 to $90 million of average annual

EBITDA2 after factoring synergies and the divestitures of Poplar

Hill and Rainbow Lake. Approximately 60 per cent of revenues are

under contract with high creditworthy counterparties which have a

weighted-average remaining contract life of 15 years.

-

Near-term Synergies: TransAlta will continue to

leverage corporate costs within our existing business which will

provide estimated corporate pre-tax synergies of approximately $20

million per annum. In addition, the combined portfolio will enable

the Company to further optimize operations and supply chains

through scale to achieve additional synergies.

- Builds

On Regional Expertise: The Company is well positioned to

deliver significant value through our deep technical and local

operational experience which, together with our 113-year history in

Alberta, will ensure continuing safe and reliable generation in a

dynamic and evolving landscape.

1 Expected EBITDA multiple is a metric

calculated by dividing expected capital expenditures by average

annual EBITDA. Readers are cautioned that our method for

calculating expected EBITDA multiple may differ from methods used

by other entities. Therefore, it may not be comparable to similar

measures presented by other entities.

2 Average annual EBITDA is not defined and has

no standardized meaning under IFRS. It is a forward-looking

non-IFRS measure that is used to show the average annual adjusted

EBITDA that is expected to generate following completion of the

Transaction. It is unlikely to be comparable to similar measures

presented by other companies and should not be viewed in isolation

from, as an alternative to, or more meaningful than, our IFRS

results. Please refer to the “Additional IFRS Measures and Non-IFRS

Measures” section of our management’s discussion and analysis for

the three and nine months ended September 30, 2024 (“MD&A”) for

more information about the non-IFRS measures we use, including a

reconciliation of adjusted EBITDA to Earnings before income tax,

the most directly comparable IFRS measure, which section of the

MD&A is incorporated by reference herein. The MD&A can be

found on SEDAR+ (www.sedarplus.ca) under TransAlta’s profile.

About TransAlta

Corporation:

TransAlta owns, operates and develops a diverse

fleet of electrical power generation assets in Canada, the United

States and Australia with a focus on long-term shareholder value.

TransAlta provides municipalities, medium and large industries,

businesses and utility customers with affordable, energy efficient

and reliable power. Today, TransAlta is one of Canada’s largest

producers of wind power and Alberta’s largest producer of

hydroelectric power. For over 113 years, TransAlta has been a

responsible operator and a proud member of the communities where we

operate and where our employees work and live. TransAlta aligns its

corporate goals with the UN Sustainable Development Goals and the

Future-Fit Business Benchmark, which also define sustainable goals

for businesses. Our reporting on climate change management has been

guided by the International Financial Reporting Standards (IFRS) S2

Climate-related Disclosures Standard and the Task Force on

Climate-related Financial Disclosures (TCFD) recommendations.

TransAlta has achieved a 66 per cent reduction in GHG emissions or

21.3 million tonnes CO2e since 2015 and received an upgraded MSCI

ESG rating of AA.

For more information about TransAlta, visit our

web site at transalta.com.

Cautionary Statement Regarding

Forward-Looking Information

This news release contains "forward-looking

information", within the meaning of applicable Canadian securities

laws, and "forward-looking statements", within the meaning of

applicable United States securities laws, including the United

States Private Securities Litigation Reform Act of 1995

(collectively referred to herein as "forward-looking statements").

In some cases, forward-looking statements can be identified by

terminology such as "plans", "expects", "proposed", "will",

"would", "anticipates", "develop", "continue", "estimate", and

similar expressions suggesting future events or future performance.

In particular, this news release contains, without limitation,

statements pertaining to: TransAlta's acquisition of Heartland; the

anticipated benefits arising from such transaction, including that

the transaction will be accretive to free cash flow and cash yield,

that Heartland's assets will be supportive to grid reliability; the

amount of pre-tax synergies; the acquisition EBITDA multiple of 5.4

times; the expected addition of $85 to $90 million of average

annual EBITDA; the expected closing date and the 400 MW Battle

River Carbon Hub opportunity, including the project's continued

development. These forward-looking statements are not historical

facts but are based on TransAlta’s belief and assumptions based on

information available at the time the assumptions were made,

including, but not limited to the following material assumptions:

that there are no significant applicable laws and regulations

beyond those that have already been announced; that there are no

significant changes to the integrity and reliability of our assets;

that the timing, capital costs and material attributes of, and

annual EBITDA, free cash flow and cash yield generated from the

Heartland portfolio are consistent with current expectations; the

political and regulatory environments; the price of power in

Alberta; and the condition of the financial markets not changing

significantly. These statements are subject to a number of risks

and uncertainties that may cause actual results to differ

materially from those contemplated by the forward-looking

statements. Some of the factors that could cause such differences

include: operational risks involving Heartland's facilities;

changes in market power and gas prices in Alberta; supply chain

disruptions impacting major maintenance and growth projects;

failure to obtain necessary regulatory approvals in a timely

fashion, or at all; inability to economically or technologically

advance the Battle River Carbon Hub Project to final investment

decision or commercial operation; any loss of value in the

Heartland portfolio during the interim period prior to closing;

cybersecurity breaches; negative impacts to our credit ratings;

legislative or regulatory developments and their impacts;

increasingly stringent environmental requirements and their

impacts; increased competition; global capital markets activity

(including our ability to access financing at a reasonable cost or

at all); changes in prevailing interest rates, currency exchange

rates and inflation levels; armed hostilities; general economic

conditions in the geographic areas in which TransAlta operates; and

other risks and uncertainties discussed in the Company's materials

filed with the securities regulatory authorities from time to time

and as also set forth in the Company's MD&A and Annual

Information Form for the year ended December 31, 2023. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which reflect TransAlta’s expectations only as of the

date of this news release. The purpose of the financial outlooks

contained in this news release are to give the reader information

about management's current expectations and plans and readers are

cautioned that such information may not be appropriate for other

purposes and is given as of the date of this news release.

TransAlta disclaims any intention or obligation to update or revise

these forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

law.

Note: All financial figures are in Canadian

dollars unless otherwise indicated.

For more information:

|

Investor Inquiries: |

Media Inquiries: |

| Phone: 1-800-387-3598 in

Canada and U.S. |

Phone: 1-855-255-9184 |

| Email:

investor_relations@transalta.com |

Email:

ta_media_relations@transalta.com |

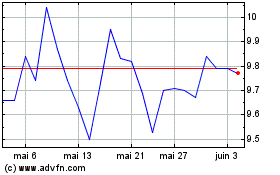

TransAlta (TSX:TA)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

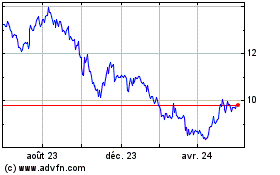

TransAlta (TSX:TA)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024