Vanguard Announces Final 2013 Annual Capital Gains Distributions for the Vanguard ETFs

24 Décembre 2013 - 11:22PM

Business Wire

Vanguard Investments Canada Inc. today announced final annual capital gains distributions for the

Vanguard ETFsTM listed below for the 2013 tax year.

These amounts are for the year-end capital gains distributions

only, which will be re-invested and the resulting units immediately

consolidated, so that the number of units held by each investor

will not change. Investors holding their units outside registered

plans will have taxable amounts to report and an increase in the

adjusted cost base of their investment. The annual capital gains

distributions do not include the ongoing monthly or quarterly

distribution amounts, which are reported in a separate press

release.

The ex-dividend date for the 2013 annual distributions will be

December 27, 2013. The record date for the 2013 annual

distributions will be December 31, 2013, payable on January 6,

2014. The tax characteristics for all distributions declared in

2013 will be reported in early 2014.

Vanguard ETF TSX Net asset

Annual Annual Ticker value

(NAV) capital capital Symbol per unit

as gain per gain per at Dec 23, unit

($) unit as % 2013 ($) of NAV at Dec

23,

2013 Vanguard FTSE Canada Index ETF VCE

28.2303 0.1323 0.4686% Vanguard FTSE Canada All Cap

Index ETF VCN 26.9203 0.0078 0.0290%

Vanguard FTSE Canadian High Dividend Yield Index ETF VDY

29.8407 0.0469 0.1572% Vanguard FTSE Canadian

Capped REIT Index ETF VRE 24.2757 0.0399

0.1644% Vanguard FTSE Emerging Markets Index ETF VEE

25.7958 0.0040 0.0155%

Vanguard’s eleven other TSX-listed ETFs will not make capital

gains distributions in 2013.

To learn more about the TSX-listed Vanguard ETFs, please visit

www.vanguardcanada.ca

About Vanguard

Vanguard Investments Canada Inc. is a wholly owned indirect

subsidiary of The Vanguard Group, Inc. and manages more than $1

billion (CAD) in assets. The Vanguard Group, Inc. is one of the

world’s largest investment management companies and a leading

provider of company-sponsored retirement plan services. Vanguard

manages more than $2.8 trillion (USD) in global assets, including

$300 billion (USD) in global ETF assets. Vanguard has offices in

the United States, Canada, Europe, Australia and Asia. The firm

offers more than 160 funds to U.S. investors and more than 100

additional funds, including ETFs, to clients in the other markets

in which the firm operates.

Vanguard operates under a unique operating structure. Unlike

firms that are publicly held or owned by a small group of

individuals, The Vanguard Group is owned by Vanguard’s US-domiciled

funds and ETFs. Those funds, in turn, are owned by Vanguard

clients. This unique mutual structure aligns Vanguard interests

with those of its investors and drives the culture, philosophy, and

policies throughout the Vanguard organization worldwide. As a

result, Canadian investors benefit from Vanguard’s stability and

experience, low-cost investing, and client focus. For more

information, please visit vanguardcanada.ca.

All asset figures are as of November 30, 2013, unless otherwise

noted.

Commissions, management fees and expenses all may be

associated with the Vanguard ETFs™. This offering is only made by

prospectus. The prospectus contains important detailed information

about the securities being offered. Copies are available from

Vanguard Investments Canada Inc. at

www.vanguardcanada.ca. Please read the prospectus before

investing. ETFs are not guaranteed, their values change frequently,

and past performance may not be repeated.

“S&P 500®” is a registered trademark of Standard &

Poor’s Financial Services LLC (“S&P”) and has been licensed for

use by S&P Dow Jones Indices LLC and its affiliates and

sublicensed for certain purposes by Vanguard. “FTSE®” is a

trademark of London Stock Exchange Group companies and is used by

FTSE under licence. These trademarks have been licenced for use by

Vanguard. None of the Vanguard ETFs are sponsored, endorsed, sold

or promoted by any of the aforementioned trademark owners and the

related index providers and their respective affiliates or their

third party licensors and these entities bear no liability and make

no claim, prediction, representation, warranty or condition

regarding the advisability of buying, selling or holding units in

the Vanguard ETFs.

For more information, contact Vanguard Public Relations at

610-669-5002

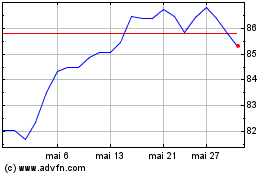

Vanguard S&P 500 Index E... (TSX:VSP)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Vanguard S&P 500 Index E... (TSX:VSP)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024