AuEx Ventures, Inc.: Long Canyon Project Proceeds Toward Feasibility

21 Décembre 2009 - 1:00PM

Marketwired

AuEx Ventures, Inc. (TSX: XAU) ("AuEx" or the "Company") is pleased

to announce continuing progress on several fronts advancing the

development of the Long Canyon gold deposit in eastern Elko County,

Nevada. These include the completion in 2009 of over 100,000 feet

of core and reverse circulation drilling, significant metallurgical

testwork to confirm the amenability of the deposit to conventional

recovery techniques, geotechnical investigations for safe pit

designs and the collection of data necessary for further

permitting. In addition, the results of a Preliminary Economic

Assessment were released on December 1 that demonstrate the

attractive economics of the project including a 64% pre-tax IRR and

a 1.3 year payback on capital at a gold price of $800/ounce. The

Company owns a 49% interest in the Long Canyon Venture along with

Fronteer Development Group, Inc. ("Fronteer") who owns 51% and is

operator.

Drilling conducted at Long Canyon in 2009 consisted of over 200

core and reverse circulation holes. Activity was initially focused

on metallurgical and infill holes to upgrade the existing resource

with work shifting during the latter part of the field season to

more exploration due to the lifting of permitting restrictions.

Highlights of new results from infill drilling conducted during

2009 include;

LC 341C containing 68.0 feet @ 0.251 ounces/ton gold

LC 343C containing 19.2 feet @ 0.222 ounces/ton gold

LC 351C containing 15.0 feet @ 0.102 ounces/ton gold

LC 353C containing 29.0 feet @ 0.203 ounces/ton gold

LC 356C containing 38.5 feet @ 0.068 ounces/ton gold

A drill hole map and a table containing the results from 22 new

infill holes is attached to this release. An updated table of all

released drill results from Long Canyon reported at a 0.30 g/t

cutoff grade is available at www.auex.com.

Over 40 core holes were drilled at Long Canyon during 2009 to

provide subsurface samples of gold mineralization for metallurgical

evaluation. Numerous column leach tests have been conducted from

surface samples recovered in late 2008 and more tests are planned

using this core to confirm the favorable metallurgical response

indicated from that work. Additional holes drilled at Long Canyon

during 2009 were completed for geotechnical data to assist in pit

wall slope stability design studies and for hydrology related

purposes.

The Preliminary Economic Assessment announced on December 1

(AuEx release NR09-30 dated December 1, 2009), confirms the earlier

held belief that Long Canyon possessed very favorable project

economics. This assessment was performed using a gold price of $800

per ounce, estimated initial capital costs of $66,000,000,

operating costs based on similar projects and metallurgical

recoveries based on the ongoing Long Canyon metallurgical program.

The results of the assessment indicate a 6 year mine life producing

an average of 93,000 ounces/year at a cash cost of $351/ounce. The

project generates a pre-tax IRR of 64%, a project payback of 1.3

years and a pre-tax NPV of $145,000,000. The resource used for this

assessment did not include any drill results from 2009.

Further information regarding these activities at Long Canyon

will be reported over the next few months as they become available.

This will include additional drill results including those from

exploration drilling conducted to the northeast of the known

resource, an updated 43-101 resource estimate for the Long Canyon

deposit using all drill data through the end of 2009, a detailed

metallurgical report incorporating testwork based on core samples,

and a forecast for the 2010 Long Canyon Venture budget.

As reported to AuEx by Fronteer, all drill samples were

collected following standard industry practice and were assayed by

ALS Chemex of Reno, Nevada. True widths of the mineralized

intervals are interpreted by Fronteer to be 70-100% of the reported

lengths. Gold results were determined using standard fire assay

techniques on a 30 gram sample with an atomic absorption finish.

Samples exceeding 5 grams per tonne gold were re-assayed using a

gravimetric finish and the values received were reported in the

averages. QA/QC included the insertion of numerous standards and

blanks into the sample stream. A table containing all drill results

to date reported to a 0.3 gram/tonne cutoff is posted on the

Company's website. All data, as reported to the Company by Fronteer

and disclosed in this press release including sampling, analytical

and test data, have been reviewed by the Company's qualified person

Mr. Eric M. Struhsacker, M.Sc., and Certified Professional

Geologist as recognized by the American Institute of Professional

Geologists. The PEA was prepared under the supervision of Dr.

Michael Gustin, P.G., Mr. Thomas Dyer, P.E., and Mr. Gary Simmons,

each of whom are "qualified persons" as such term is defined in

National Instrument 43-101, and have each read and confirmed that

the PEA-related content in this news release fairly and accurately

reflects the contents of the PEA report. Further details concerning

the Long Canyon property are described in the Company's National

Instrument 43-101 report filed on Sedar and are on the Company's

website.

AuEx Ventures, Inc. is a TSX listed precious metals exploration

company that has a current portfolio of twenty one exploration

projects in Nevada, one in Utah, one project in Spain and two

projects in Argentina. The Company controls over 167,000 acres of

unpatented mining claims and fee land in Nevada. Twelve of the

projects are in joint venture or exploration earn-in agreements

with eight companies who provide exploration funding. The Company

applies the extensive Nevada exploration experience and high-end

technical skills of its founders to search for and acquire new

precious metal exploration projects that are then offered for joint

venture.

AuEx Ventures, Inc.

By: Ronald L. Parratt, President & CEO

This release includes certain statements that may be deemed to

be "forward-looking statements" within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995. All statements in

this release, other than statements of historical facts, that

address future production, reserve potential, exploration and

development activities and events or developments that the Company

expects, are forward-looking statements. Although the management of

AuEx believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, and actual results or

developments may differ materially from those in the

forward-looking statements. Factors that could cause actual results

to differ materially from those in forward-looking statements

include market prices, exploration and development successes,

continued availability of capital and financing, and general

economic, market or business conditions. Please see our public

filings at www.sedar.com for further information.

To view the Long Canyon Drill Highlights map accompanying this

press release, please click on the following link:

http://media3.marketwire.com/docs/xau1221.pdf

---------------------------------------------------------

Intercept Intercept

From To Length Au Length Au

Hole ID (feet) (feet) (feet) oz/T (meters) (gpt)

---------------------------------------------------------

LC326C 195 248.5 53.5 0.026 16.3 0.89

---------------------------------------------------------

LC341C 119.5 167 47.5 0.119 14.5 4.07

---------------------------------------------------------

including 155 163.4 8.4 0.438 2.6 15.01

---------------------------------------------------------

192 260 68 0.251 20.7 8.59

---------------------------------------------------------

including 208.7 241.5 32.8 0.496 10.0 16.99

---------------------------------------------------------

LC343C 327 346.2 19.2 0.222 5.9 7.60

---------------------------------------------------------

LC346C 417.5 424 6.5 0.123 2.0 4.20

---------------------------------------------------------

LC349C 262.5 272 9.5 0.102 2.9 3.51

---------------------------------------------------------

LC350C 43 61 18 0.041 5.5 1.41

---------------------------------------------------------

LC351C 0 58 58 0.02 17.7 0.70

---------------------------------------------------------

356 371 15 0.102 4.6 3.49

---------------------------------------------------------

LC352C 230.5 272.8 42.3 0.072 12.9 2.45

---------------------------------------------------------

LC353C 37 66 29 0.203 8.8 6.94

---------------------------------------------------------

LC354C 76.5 139.5 63 0.045 19.2 1.54

---------------------------------------------------------

LC356C 354 392.5 38.5 0.068 11.7 2.33

---------------------------------------------------------

LC357C 119 135 16 0.044 4.9 1.51

---------------------------------------------------------

LC361C 343 358 15 0.058 4.6 1.99

---------------------------------------------------------

LC362C 329 364.6 35.6 0.052 10.9 1.77

---------------------------------------------------------

LC365C 370 417 47 0.05 14.3 1.73

---------------------------------------------------------

LC366C 756 768 12 0.035 3.7 1.20

---------------------------------------------------------

LC380C 271 314 43 0.055 13.1 1.89

---------------------------------------------------------

Note: Holes LC347C, LC355CB, LC369C, LC370C and LC376C do

not contain reportable values for this table.

Contacts: AuEx Ventures, Inc. Ronald L. Parratt 775-337-1545

rparratt@auex.com

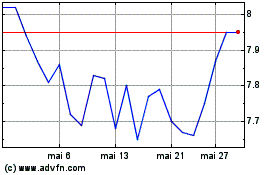

GoldMoney (TSX:XAU)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

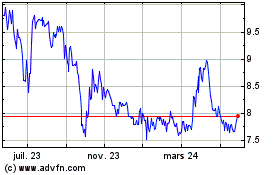

GoldMoney (TSX:XAU)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024