Goldmoney Inc. (TSX: XAU) (US: XAUMF) (“Goldmoney” or the

“Company”), is pleased to report that further to its press release

of June 13, 2023 announcing the Company’s real assets investment

strategy, the Company’s subsidiary Goldmoney Properties Ltd. has

completed the acquisition of its third property in the UK.

On December 22, 2023, Goldmoney Properties

completed the acquisition of St James Place I and II, in

Cirencester, Cotswold District, in the county of Gloucestershire,

United Kingdom. The asset is comprised of two buildings with a

total gross internal area (GIA) of 132,763 square feet. St James

Place I was built in 2007 and won the British Council for Offices

(BCO) award for Best Corporate Workplace in the South of England

& Wales region in 2008. St James Place II was built in 2016 and

won the BCO award for Best Corporate Workplace in the South of

England & Wales region in 2017. The two buildings were acquired

by ABRDN and a subsidiary of Phoenix Group Holdings for £47.4

million in 2019.

Goldmoney Properties has acquired the building

from ABRDN and a subsidiary of Phoenix Group Holdings in an

off-market transaction for consideration of £26.5 million

(approximately CAD $44.8 million). The acquisition was financed by

Barclays PLC at a loan-to-value (LTV) ratio of approximately 65%.

The financing rate is fixed for a period of five years at an

interest rate of approximately 5.25% and is non-recourse to

Goldmoney Properties. The two buildings serve as the global

headquarters for a FTSE 100 Company and are let to the company

under a full repairing and insurance lease producing £2.35 million

(approximately CAD $4 million) of net rental income per annum. The

remaining term on the two leases is 18 years through February 2042,

with annual rent increases of between 1% and 5% indexed to the

Retail Price Index (RPI).

Following this acquisition, Goldmoney Inc. has a

liquid working capital position of approximately CAD $20 million

consisting of cash and precious metals (unaudited).

Statement from Roy Sebag, Founder and CEO of

Goldmoney Inc.

“With the acquisition of St James Place I and II, Goldmoney

Properties now owns three long-life high quality real assets

totaling over 412,000 square feet. Our property portfolio is

expected to produce circa $11 million of inflation indexed net

rental income in 2024 with a blended remaining lease term on our

portfolio of 14.3 years. We believe that each one of our properties

provides an irreplaceable purpose and usefulness within the

built-up environment serving the local communities where we have

invested. Our last transaction is perhaps the most attractive of

all with 18 years of secure income allowing us to finance the

building with confidence. Should interest rates continue to rise,

we will aggressively amortise the financing from Goldmoney

Properties’ significant operating cash flows. At this juncture,

however, we see more evidence that short-term interest rates in the

UK have reached a cycle peak and, if anything, believe that a new

phase of monetary easing comes next, perhaps even sooner than we

had originally anticipated in the 2023 shareholder letter.

“We set out to build Goldmoney Properties into a second

diversified income stream for Goldmoney Inc. by deploying the

excess capital we had earned over the 2020-2023 period. Our goal

was to capitalise on the generational shift in interest rates, and

we felt that it was possible for this second income stream to reach

$10 million of long-term inflation indexed earnings power per

annum. Because our precious metals businesses have performed so

well in recent months, we have been provided with the opportunity

not only to reach this goal but to exceed it a whole year earlier

than expected. Moreover, we have established ourselves as a

reputable counterparty in the institutional property markets and

have built relationships with the most prestigious asset managers.

The conviction we have demonstrated in 2023 is providing further

access to off-market deal-flow and opportunities to deploy further

capital in the future.

“We now have a simplified operating structure and own three

prosperous businesses: the core Goldmoney.com precious metals

business, Goldmoney Properties, and a significant stake in our

luxury jewelry brand Menē. At the parent level, we retain

significant cash and precious metals liquidity and no debt.

Finally, we expect our two operating businesses to produce over $18

million of operating income in calendar 2024. This additional

capital will be reinvested to grow our long-run earnings power and

to repurchase shares in the open market.”

About Goldmoney Inc.

Founded in 2001, Goldmoney (TSX:XAU) is a TSX

listed company invested in the real economy. The leading custodians

and traders of precious metals, Goldmoney Inc. also owns and

operates businesses in jewelry manufacturing and property

investment. For more information about Goldmoney,

visit goldmoney.com.

Media and Investor Relations inquiries:

Mark OlsonChief Financial

OfficerGoldmoney Inc.+1 647 250 7098

Forward-Looking Statements

This news release contains or refers to certain

forward-looking information. Forward-looking information can often

be identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “plan”, “intend”, “estimate”, “may”,

“potential” and “will” or similar words suggesting future outcomes,

or other expectations, beliefs, plans, objectives, assumptions,

intentions or statements about future events or performance. All

information other than information regarding historical fact, which

addresses activities, events or developments that the Goldmoney

Inc. believes, expects or anticipates will or may occur in the

future, is forward-looking information. Forward-looking information

does not constitute historical fact but reflects the current

expectations the Company regarding future results or events based

on information that is currently available. By their nature,

forward-looking statements involve numerous assumptions, known and

unknown risks and uncertainties, both general and specific, that

contribute to the possibility that the predictions, forecasts,

projections and other forward-looking information will not occur.

Such forward-looking information in this release speak only as of

the date hereof.

Forward-looking information in this release

includes, but is not limited to, statements with respect to: the

expected value and return on investment in the Company’s real

estate acquisitions, and the properties described herein (the

“Properties”) in particular, the ability of the current tenants on

the Properties to meet their rental obligations, the future state

of the Properties and the environment surrounding it, the ability

of the Company to maintain and service the indebtedness incurred to

acquire the properties, including any future refinancings, and the

ability of the Company to return value from the Properties to

shareholders. This forward-looking information is based on

reasonable assumptions and estimates of management of the Company

at the time it was made, and involves known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking information. Such

factors include, among others: the global inflationary environment

and its effect on real estate prices, interest rates, and the

Properties in particular; the ability of the Company to integrate

the Properties into its current operations; the anticipated value

and income growth in connection with the Properties; the ability to

maintain current and procure future commercial tenants for the

Properties; the surrounding environment and infrastructure of the

Properties remaining suitable; the anticipated variable interest

rate for the loan used to finance the acquisition of the

Properties, and the effect on this interest rate from the SONIA as

set by the Bank of England; the Company’s operating history;

history of operating losses; future capital needs and uncertainty

of additional financing; fluctuations in the market price of the

Company’s common shares; the effect of government regulation and

compliance on the Company and the industry; legal and regulatory

change and uncertainty; jurisdictional factors associated with

international operations; foreign restrictions on the Company’s

operations; product development and rapid technological change;

dependence on technical infrastructure; protection of intellectual

property; use and storage of personal information and compliance

with privacy laws; network security risks; risk of system failure

or inadequacy; the Company’s ability to manage rapid growth;

competition; the ability to identify opportunities for growth

internally and through acquisitions and strategic relationships on

terms which are economic or at all; effectiveness of the Company’s

risk management and internal controls; use of the Company’s

services for improper or illegal purposes; uninsured, uninsurable,

and underinsured losses; theft & risk of physical harm to

personnel; precious metal trading risks; and volatility of precious

metals prices & public interest in precious metals investment;

and those risks set out in the Company’s most recently filed annual

information form, available on SEDAR+ at www.sedarplus.ca.

Although the Company has attempted to identify important factors

that could cause actual results to differ materially, there may be

other factors that cause results not to be as anticipated,

estimated or intended. There can be no assurance that such

statements will prove to be accurate as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking information. The Company undertakes no obligation

to update or revise any forward-looking information, except as

required by law.

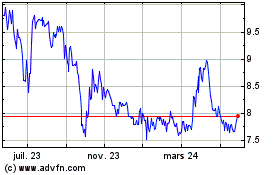

GoldMoney (TSX:XAU)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

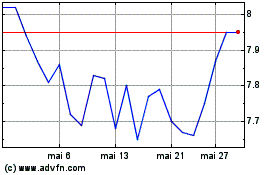

GoldMoney (TSX:XAU)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025