AuEx Ventures, Inc. ("AuEx" or the "Company") (TSX: XAU) is pleased

to report an updated resource estimate for the Company's 49% owned

Long Canyon gold deposit located within the Pequop Gold District in

eastern Elko County, Nevada. The resource has grown significantly

and exploration results continue to demonstrate the attractiveness

and growth potential of the Long Canyon gold deposit.

The Classified Mineral Resource estimate is quoted at a cut-off

grade 0.2 grams per tonne ("g/t") and consists of;

-- A Measured and Indicated resource of 672,000 ounces of gold at an

average grade of 1.71 g/t gold (12,240,000 tonnes); and

-- An Inferred resource of 552,000 ounces of gold at an average grade of

1.65 g/t gold (10,394,000 tonnes)

Ronald L. Parratt, President & CEO of AuEx stated, "This new

resource estimate continues to demonstrate the robustness and

upside potential of Long Canyon and of the new Pequop Gold

District. Mineralization still has significant growth potential and

many exploration targets remain to be drill tested. Additional

surface evaluation may lead to the identification of additional

targets as well. Exploration activity is underway with five drill

rigs working and with significant engineering, metallurgy and

environmental work ongoing. We look forward to another exciting

year for Long Canyon."

----------------------------------------------------------------------------

2010 Resource

----------------------------------------------------------------------------

Cut-off Tonnes g/t Au oz Au

----------------------------------------------------------------------------

0.20 587,000 2.50 47,000

Measured 0.30 510,000 2.84 47,000

1.00 297,000 4.47 43,000

----------------------------------------------------------------------------

0.20 11,653,000 1.67 625,000

Indicated 0.30 9,839,000 1.93 611,000

1.00 4,432,000 3.61 515,000

----------------------------------------------------------------------------

0.20 12,240,000 1.71 672,000

Measured & Indicated 0.30 10,348,000 1.98 657,000

1.00 4,729,000 3.67 558,000

----------------------------------------------------------------------------

0.20 10,394,000 1.65 552,000

Inferred 0.30 8,292,000 2.01 536,000

1.00 3,571,000 3.97 456,000

----------------------------------------------------------------------------

The block-diluted resources are shown at additional cutoffs in

order to provide grade-distribution information. Using a 0.3 g/t

cut-off, as was used for the 2009 initial resource, the 2010

resource contains an increase over the 2009 estimate of 81% for

resources in the Measured & Indicated category and a 17%

increase for resources in the Inferred category. The focus in 2009

was on infill drilling with less step-out drilling. It is important

to note that at a higher 1.0 g/t cut-off, the total resource ounces

are only slightly reduced however the grade of mineralization more

than doubles demonstrating the robust, high-grade nature of the

deposit as shown below;

Measured and Indicated resource of 558,000 ounces at an average grade

of 3.67 g/t gold (4,729,000 tonnes) and,

Inferred resource of 456,000 ounces at an average grade of 3.97 g/t

gold (3,571,000 tonnes)

The 2010 exploration and development program for Long Canyon is

budgeted at $19,800,000 funded 49% by AuEx and will consist of

45,000 metres of additional infill drilling as well as significant

step-out drilling to help further define the limits of the deposit.

Further surface exploration consisting of soil and rock chip

sampling is also planned to define additional exploration targets

on the large property package. Further column leach metallurgical

testing, geotechnical evaluation and other engineering activities

are underway to move the project to the pre-feasibility stage.

The Long Canyon mineral resource estimation was completed by

Mine Development Associates ("MDA") as of May 13, 2010. The

resources were modeled and estimated by evaluating the drill data

statistically and utilizing geologically interpreted cross-sections

provided by Fronteer to interpret mineral domains on cross-sections

spaced at 50-metre intervals throughout the extent of the Long

Canyon mineralization. The mineral domain interpretations were then

rectified on cross-sections spaced at 10-metre intervals. The

modeled mineralization was analyzed statistically to establish

estimation parameters, and gold grades were estimated by

inverse-distance methods into a block model with 5 metre (width) x

10 metre (length) x 3 metre (height) blocks that were coded to the

mineral domains by the 10-metre mineral domain polygons. All

modeling of the diluted resources was performed using Gemcom

Surpac® software. Quality-control data generated during the various

drill programs conducted at Long Canyon were independently reviewed

by MDA as part of the resource study. The person responsible for

the resource estimate on behalf of MDA is Michael Gustin, Ph.D., P.

Geo, a Qualified Person as defined by National Instrument 43-101.

Further details of the estimation procedure will be available in an

updated NI 43-101 report, which will be filed by the Company on

SEDAR (www.sedar.com), no later than 45 days from the date of this

release.

Ronald L. Parratt, Certified Professional Geologist, is the

Company's designated Qualified Person for this news release and has

reviewed the information contained in the release and confirmed

that it is consistent with that provided by Michael Gustin of MDA,

the independent QP responsible for the resource estimate.

The Long Canyon deposit is subject to a joint venture agreement

with Fronteer Gold, Inc. the 51% owner and operator.

AuEx Ventures, Inc. is a precious metals exploration company

that has a current portfolio of nineteen exploration projects in

Nevada, one project in Utah, four projects in Argentina and one

project in Spain. The Company controls about 167,000 acres of

unpatented claims and fee land in prospective areas of Nevada.

Fifteen of the projects are in exploration earn-in or formal joint

venture agreements with eight companies who provide exploration

funding. The Company applies the extensive exploration experience

and high-end technical skills of its founders to search for and

acquire new precious metal exploration projects that are then

offered for joint venture. AuEx is listed on the Toronto Stock

Exchange under the symbol XAU.

AuEx Ventures, Inc.

By: Ronald L. Parratt, President & CEO

This release includes certain statements that may be deemed to

be "forward-looking statements" within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995. All statements in

this release, other than statements of historical facts, that

address future production, reserve potential, exploration and

development activities and events or developments that the Company

expects, are forward-looking statements. Although the management of

AuEx believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, and actual results or

developments may differ materially from those in the

forward-looking statements. Factors that could cause actual results

to differ materially from those in forward-looking statements

include market prices, exploration and development successes,

continued availability of capital and financing, and general

economic, market or business conditions. Please see our public

filings at www.sedar.com for further information.

This press release uses the terms "indicated resources" and

"inferred resources", which are calculated in accordance with the

Canadian National Instrument 43-101 and the Canadian Institute of

Mining and Metallurgy Classification system. We advise investors

that while those terms are recognized and required by Canadian

regulations, the U.S. Securities and Exchange Commission does not

recognize them. U.S. investors are cautioned not to assume that any

part or all of mineral deposits in these categories will ever be

converted into reserves. In addition, "Inferred resources" have a

great amount of uncertainty as to their existence, and great

uncertainty as to their economic and legal feasibility. It cannot

be assumed that all or any part of an Inferred Mineral Resource

will ever be upgraded to a higher category. Under Canadian rules,

estimates of Inferred Mineral Resources may not form the basis of

feasibility or pre-feasibility studies, except in rare cases. U.S.

investors are cautioned not to assume that part or all of an

inferred resource exists, or is economically or legally

minable.

Contacts: AuEx Ventures, Inc. Ronald L. Parratt President &

CEO 775-337-1545 rparratt@auex.com www.auex.com

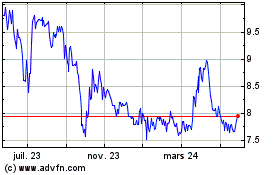

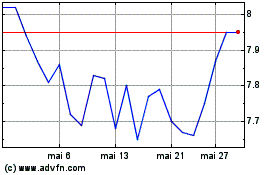

GoldMoney (TSX:XAU)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

GoldMoney (TSX:XAU)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024