Goldmoney Receives Exemption from Canadian Securities Regulators for its Precious Metals Purchase and Storage Services in Canada

13 Septembre 2024 - 11:00PM

Goldmoney Inc. (TSX: XAU) (US: XAUMF) (“

Goldmoney”

or the “

Company”), today announced that it has

received exemptive relief (“

Exemptive Relief”)

from Canadian securities regulators allowing it and two of its

operating subsidiaries, (collectively the “exempted Goldmoney

entities”) to continue offering clients in Canada precious metals

purchase and storage services to facilitate their precious metals

transactions (“

Precious Metals Transactions”).

The exemption allows the exempted Goldmoney

entities to conduct this activity without the need to become

registered as a dealer or to deliver a prospectus, subject to

compliance with certain terms and conditions. The relief extends to

the directors, officers and representatives of the exempted

Goldmoney entities.

Clients with Canadian addresses who enter into

precious metals transactions and create on-line holdings

(“Holdings”) with Goldmoney will continue to

transact on the Company’s online proprietary internet-based

platform.

In Canada, the Company services its clients

primarily through its wholly owned subsidiary, Goldmoney Vault Inc

(“GVI”). Companies, institutions and

high-net-worth individuals also can establish a client relationship

with Goldmoney Vault UK Limited (United Kingdom)

(“GVUK”). GVI or GVUK arrange precious metals

storage as agents for clients with third party vault custodians

acceptable to Canadian securities regulators.

Roy Sebag, Chairman and Chief Executive Officer

of Goldmoney said: “Goldmoney welcomes the granting of this

exemptive relief. It eliminates regulatory uncertainty in our

Canadian precious metals business and could not have been achieved

without the cooperation of the Canadian regulators who took part.

We wish to acknowledge these regulators for taking the time to

learn about the unique nature of physical precious metal

custody.”

Unless extended, the Exemptive Relief expires

upon the fifth anniversary of the exemption which will occur on

September 11, 2029. The order granting Exemptive Relief can end

earlier by order of a court or securities regulator or if the law

applicable to the exempted Goldmoney entities changes to conflict

with or duplicate the content of the order.

The Exemptive Relief applicable to clients with

a Canadian address is subject to terms and conditions

including:

- requiring, on the earlier of (i)

logging into the client platform trading account after the date of

the Exemptive Relief and (ii) the first transaction occurring after

the date of the Exemptive Relief, the delivery of a risk disclosure

statement (“RDS”) to each client and prospective

client (‘prospect”) and that a written or

electronic acknowledgement be obtained from the client or prospect

confirming that the client or prospect has received, read and

understood the RDS. Such acknowledgment will be separate from and

prominent among other acknowledgements provided by the client as

part of the Holding-opening process.

- compliance with business conduct

obligations set out in the Exemptive Relief, including acting

fairly, honestly and in good faith with respect to clients,

handling client complaints appropriately, maintaining minimum

working capital requirements; establishing and following conflicts

of interests policies including referral arrangements and

procedures, compliance with gatekeeper and RDS-delivery

obligations, not lending or providing margin or credit to clients

or providing recommendations or advice relating to transactions in

precious metal or allowing clients to take short positions and not

offering bitcoin, ether, cryptocurrencies or other novel or

emerging asset classes, or options or other derivatives thereon, to

clients or prospects.

- dealing with client Holdings in a

specified manner, including by providing to each client, (i) prior

to such client’s first transaction, certain information that is

deemed important about the client’s relationship with exempted

Goldmoney entities and each individual acting on their behalf, (ii)

promptly after each transaction with clients who do not meet

statutory sophistication standards, providing written confirmation

of the transaction including a description of the transaction, the

notional amount, quantity or volume of precious metal transacted,

the price paid for such metal, the commission, sales charge,

service charge and any other amount charged in respect of the

transaction, the particular exempted Goldmoney entity that

transacted with the client and whether such entity acted as

principal or agent, and the date of the transaction, and (iii)

quarterly or more frequently if desired by the client, appropriate

Holding statements;

- establishment, maintenance and

application of specified policies, procedures, controls and

supervision relating to compliance and record-keeping, including

business continuity and disaster recovery and

- the Company remaining a reporting

issuer listed on the Toronto Stock Exchange.

For further information please contact the

Company’s Chief Financial Officer:

Sean Ty Chief Financial Officer

Goldmoney Inc. +1 647 250 7098

About Goldmoney Inc.

Goldmoney Inc. (TSX:XAU) specializes in the

investment and custody of enduring real assets. Through its

subsidiaries, the Company offers precious metals trading services

to clients, including secure custody and storage solutions.

Goldmoney also maintains diversified interests in property

investment and jewelry manufacturing. For more information about

Goldmoney, visit goldmoney.com.

No stock exchange, securities commission or

other regulatory authority has approved or disapproved the

information contained herein.

Forward-Looking Statements

This news release contains or refers to certain

forward-looking information. Forward-looking information can often

be identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “plan”, “intend”, “estimate”, “may”,

“potential” and “will” or similar words suggesting future outcomes,

or other expectations, beliefs, plans, objectives, assumptions,

intentions or statements about future events or performance. All

information other than information regarding historical fact, which

addresses activities, events or developments that Goldmoney Inc.

believes, expects or anticipates will or may occur in the future,

is forward-looking information. Forward-looking information does

not constitute historical fact but reflects the current

expectations of the Company regarding future results or events

based on information that is currently available. By their nature,

forward-looking statements involve numerous assumptions, known and

unknown risks and uncertainties, both general and specific, that

contribute to the possibility that the predictions, forecasts,

projections and other forward-looking information will not occur.

Such forward-looking information in this release speak only as of

the date hereof.

Forward-looking information in this release

includes, but is not limited to, the receipt of Exemptive Relief

and the ability of the Company to comply with the prescribed terms

and conditions and otherwise continue to operate its business on a

compliant and economic basis. This forward-looking information is

based on reasonable assumptions and estimates of management of the

Company at the time it was made, and involves known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

information. Such factors include, among others: the Company’s

operating history; the ability to establish suitable and robust

compliance procedures and controls with appropriate supporting

systems; future capital needs and uncertainty of additional

financing; fluctuations in the market price of the Company’s common

shares; the effect of government regulation and compliance on the

Company and the industry; legal and regulatory change and

uncertainty; jurisdictional factors associated with international

operations; foreign restrictions on the Company’s operations;

product development and rapid technological change; dependence on

technical infrastructure; protection of intellectual property; use

and storage of personal information and compliance with privacy

laws; network security risks; risk of system failure or inadequacy;

the Company’s ability to manage rapid growth; competition; the

ability to identify opportunities for growth internally and through

acquisitions and strategic relationships on terms which are

economic or at all; the ability to identify and complete the

acquisition of suitable real estate investment opportunities on

terms which are economic or at all; the ability to successfully

operate and manage real estate holdings; the ability to service

bank indebtedness and renew such indebtedness on commercially

acceptable terms or at all; effectiveness of the Company’s risk

management and internal controls; use of the Company’s services for

improper or illegal purposes; uninsured and underinsured losses;

theft & risk of physical harm to personnel; precious metal

trading risks; and volatility of precious metals prices &

public interest in precious metals investment; and those risks set

out in the Company’s most recently filed annual information form,

available on SEDAR+. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially, there may be other factors that cause results

not to be as anticipated, estimated or intended. There can be no

assurance that such statements will prove to be accurate as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information. The Company

undertakes no obligation to update or revise any forward-looking

information, except as required by law.

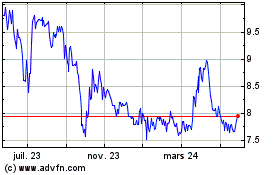

GoldMoney (TSX:XAU)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

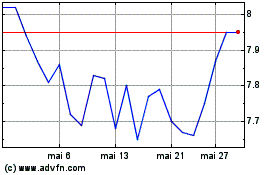

GoldMoney (TSX:XAU)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025