Athabasca Minerals Inc. Announces Year End 2013 Results

EDMONTON, ALBERTA--(Marketwired - Mar 31, 2014) - Athabasca

Minerals Inc. ("Athabasca" or the "Corporation") (TSX-VENTURE:ABM)

is pleased to announce its financial results for the fourth quarter

and year ended November 30, 2013. The Corporation's audited

financial statements and management's discussion and analysis

("MD&A") for the year ended November 30, 2013 are available on

SEDAR at www.sedar.com and on the Athabasca Minerals website at

www.athabascaminerals.com.

Q4 2013

Highlights

- During Q4 2013, Athabasca generated net aggregate sales of

$3,698,041 from corporate-owned aggregate operations versus

$989,513 during Q4 2012, an increase of $2,708,528 or 273.7%.

- The Corporation delivered 136,993 tonnes from corporate-owned

aggregate operations in Q4 2013 versus the delivery of 63,945

tonnes during Q4 2012, an increase of 73,048 tonnes or 114.2%.

- Total aggregate production at the Kearl aggregate operation was

significantly increased, with Q4 gravel production of 307,000

tonnes accounting for 62% of total gravel produced during fiscal

2013. An additional 123,000 tonnes of processed sand was also

produced during Q4.

- During Q4, substantial improvement in cost efficiency was

realized with Kearl pit aggregate processing, through the increase

in total production with a decrease in the cost per tonne of

aggregate produced.

Fiscal 2013 Year End

Highlights

- Athabasca generated record total revenue of $25,118,000 for the

fiscal year ended November 30, 2013, an increase of $10,395,325 or

70.6% over the prior year.

- During the fiscal year ended November 30, 2013, the Corporation

generated net aggregate sales of $14,698,719 from corporate-owned

aggregate operations versus $3,040,328 during fiscal 2012, an

increase of $11,658,391 or 383.5%.

- By fiscal 2013 year-end, Athabasca had successfully processed

and stockpiled finished goods inventory with a cost of nearly $7.5

million. This crushed gravel and sand inventory is available for

sale to meet regional aggregate demand.

- The Corporation continued to significantly benefit from cash

flow collected from its land use agreement for work camp purposes,

with more than $525,000 cash received during fiscal 2013.

- The Corporation was strengthened through the addition of

previously announced appointments to its board of directors, its

advisors, and senior management

- Communication with Alberta Environment and Sustainable

Resources Development resulting in notification during February

2014 that the department has completed its review of the Firebag

Project, enabling the Corporation to next provide a Conservation

and Reclamation Business Plan to the department for their review

before final approval.

President and CEO

Dom Kriangkum states; "We are pleased with the Corporation's

progress in supplying gravel, sand and industrial minerals in

Alberta. We continue to grow and improve our efficiency at

aggregate production, while identifying new sources of industrial

minerals, including aggregates, required for oil sands projects,

infrastructure and oil and gas exploration. In particular, we are

working hard to transition from aggregate pit management toward

further developing and increasing aggregate production from

Athabasca-owned pits where the opportunity for greater margins are

higher. With our growth from less than 20 employees to a current

staff of greater than 60 members, we look forward to continuing to

increase our productivity and to service regional product

requirements."

Operations

Update

Susan Lake aggregate

management operations are ongoing, while at a slower pace than

normal, as light aggregate demand within the region has been

experienced thus far in 2014. From discussions with its major

customers, and from other external sources, management anticipates

a near term ramp-up in aggregate demand, followed by strong demand

through the remainder of the fiscal year.

Activity at our

corporate-owned pits is ongoing with the planned temporary

suspension of crushing operations at Kearl pit, which began in

mid-December 2013, is expected to continue through approximately

May 2014, at which time spring conditions and dewatering at the pit

will be addressed. Thereafter, Athabasca intends to process

aggregate at its Kearl pit during the period June through mid-

December 2014.

Management intends

to have completed all crushing operations at the Cowpar pit, a pit

that was made available through a joint venture announced March 4,

2014, before removing its crushing spread during March 2014.

Management then intends to haul its crushing spread to the Conklin

stockpile site for maintenance and storage before it is transported

to the Kearl pit for set-up in late May.

Activity from our

Logan pit is now complete for the winter season with hauling of

aggregate expected to resume in late fall 2014, at such time that

winter roads can be accessed and product is deliverable.

| Financial Highlights |

|

|

|

Q4 and Year Ended November 30 |

|

|

Q4 2013 |

|

Q4 2012 |

YE Nov 30, 2013 |

|

YE Nov 30, 2012 |

|

Aggregate management fees |

$ |

2,882,736 |

|

$ |

3,311,716 |

$ |

10,419,281 |

|

$ |

11,682,347 |

|

Net aggregate sales |

$ |

3,698,041 |

|

$ |

989,513 |

$ |

14,698,719 |

|

$ |

3,040,328 |

|

Total revenue |

$ |

6,580,777 |

|

$ |

4,301,229 |

$ |

25,118,000 |

|

$ |

14,722,675 |

|

Aggregate operating expenses |

$ |

3,774,204 |

|

$ |

1,429,184 |

$ |

16,606,177 |

|

|

4,915,191 |

|

Gross profit |

$ |

2,806,573 |

|

$ |

2,872,045 |

$ |

8,511,823 |

|

$ |

9,807,484 |

|

Total aggregate tonnes sold |

|

2,704,301 |

|

|

3,124,134 |

|

9,911,381 |

|

|

10,936,767 |

|

Net (loss) income from land use agreement |

$ |

(143,127 |

) |

$ |

467,119 |

$ |

(406,646 |

) |

$ |

1,018,019 |

|

Net income from aggregate operations |

$ |

532,442 |

|

$ |

693,482 |

$ |

2,328,286 |

|

$ |

3,692,390 |

|

Net income and comprehensive income |

$ |

389,315 |

|

$ |

1,160,601 |

$ |

1,921,640 |

|

$ |

4,710,409 |

|

Basic income per common share |

$ |

0.014 |

|

$ |

0.042 |

$ |

0.068 |

|

$ |

0.171 |

|

Basic cash flow per share |

$ |

0.064 |

|

$ |

0.070 |

$ |

0.216 |

|

$ |

0.231 |

Net income during

fiscal 2013 decreased to $1,921,640 from $4,710,409 in the prior

year, a reduction of $2,788,769. There were two primary

contributing factors: 1) a $1,263,066 reduction in aggregate

management fees resulting from a 1,263,031 (11.9%) reduction in

aggregate tonnes sold from Susan Lake; 2) a $1,424,665 reduction in

net income from the land use agreement compared to 2012, resulting

from both permanent and expected temporary lodge closures at the

Poplar Creek work camp. While net aggregate sales from

corporate-owned pits rose by $11,658,391 during fiscal 2013,

related aggregate operating expenses increased by approximately the

same amount. During fiscal 2013 both the Kearl and Logan

corporate-owned pits were brought into their first full year of

operation. Management has identified opportunities for improved

cost savings that are expected to be realized over the course of

their second full year of operations during fiscal 2014.

Outlook

The Corporation

determines demand for the year by discussing expected aggregate

requirements with its major customers. Regional demand for

aggregate slowed near the end of 2013, and sales have remained

lighter than usual thus far in fiscal 2014, due to light customer

demand being experienced within the region. Through discussions

with some major customers regarding their full year anticipated

aggregate requirements, despite light sales volume in the early

months of fiscal 2014, aggregate demand is expected to ramp up so

that full year results will normalize. A recent industry survey

conducted with its member companies, reports that the 2014 oilsands

capital budget is forecast to be $25 billion, a near all-time

high.

Athabasca's core

business relies on aggregate demand from Alberta's oil, natural gas

and mining industries in addition to municipal and road

construction projects. Historically Athabasca has stronger third

and fourth quarters following typically slower first and second

quarters due to seasonal considerations such as winter conditions

and spring break-up conditions.

AGGREGATE

OPERATIONS:

• Corporate-Owned Pits

Currently, processed

and stockpiled inventory includes approximately 600,000 tonnes of

gravel and 400,000 tonnes of sand located across Athabasca's

corporate pits and stockpile sites. In conjunction with its

transition to corporate-owned aggregate operations, by fiscal 2013

year-end, Athabasca had successfully processed and stockpiled

nearly $7.5 million of crushed gravel and sand inventory. These

aggregate finished products are available for sale without further

production cost to be incurred. It will be a management priority to

turn over its existing inventory during fiscal 2014, along with the

efficient production of further processed aggregates from its

corporate-owned pits. In order to assist our sales efforts we are

initiating a new sales division over the summer with further

announcements to follow.

Near the end of Q4

2013, Athabasca announced the resumption of gravel delivery from

its Logan pit to a regional customer. Gravel hauling continued for

a period of time until the customer suspended the operation when

they put their project on hold. The undelivered quantity is fully

processed and is available to be hauled pending contract resumption

from the customer. Meanwhile, this processed gravel is also being

marketed for sale to other regional customers. A portion of the

gravel has been hauled from the Logan pit to Athabasca's Conklin

stockpile site in preparation for year round sales and

delivery. Management

is focused on marketing this undelivered inventory to serve

regional demand. Since the haul road from the Logan pit is

accessible only during the winter months, the Corporation is

considering improving the existing road to be an all season road,

should demand justify the activity.

Through a joint

venture agreement with a First Nation's company, Athabasca opened

up its new "Cowpar" gravel pit during Q1 2014. Sales to regional

customers were billed during Q1 and Q2 and the Corporation is

currently hauling the remaining processed aggregate to a stockpile

site near a major highway north of Conklin, Alberta for year round

sales. The Cowpar pit has been depleted of gravel, and pit

reclamation is in progress at this time. Under the same joint

venture agreement, the Corporation is awaiting approval from the

Alberta Government to open a second new pit later this year.

Significant

quantities of processed sand and gravel inventory are stockpiled at

the Kearl pit. The Corporation anticipates sales and delivery of

sand and gravel from these stockpiles to a major customer beginning

in Q2 2014 and throughout the remainder of the year. The

Corporation's crushing spread is to be mobilized to the Kearl pit,

with scheduled production at that location to begin in Q3 2014, for

additional sand and gravel processing for regional customers.

During fiscal 2014

Athabasca seeks to improve its corporate pit cost efficiencies,

through its improved Kearl pit dewatering method, which should

improve the overall rate of aggregate processing. Other primary

targeted cost reductions are with equipment repair and maintenance

costs, work crew accommodation costs, and reduced hauling rates for

aggregates delivery.

• Susan Lake Public Pit

Q1 2014 was subject

to frozen conditions and periods of extreme cold and snow resulting

in very little construction activity requiring sand and gravel.

Despite the soft first quarter in 2014, the Corporation anticipates

that the activities in the Susan Lake gravel pit will ramp up

during Q2 and become increasingly active during the third and

fourth quarters. The Corporation has recently received sand and

gravel orders from existing users for significant quantities to be

fulfilled during fiscal 2014. Management also received substantial

gravel requests from new customers who are bidding on works for a

new oil sands project at the north end of the Susan Lake pit.

INDUSTRIAL METALLIC MINERALS

PROJECTS:

• Firebag Project (Silica

Sand)

The Firebag silica

sand was tested and found to be suitable as frac sand for the oil

and gas industry. In February 2014 the Corporation received

notification from Alberta Environment and Sustainable Resources

Development ("ESRD") that the department has completed its review

of Athabasca's silica sand surface material lease application at

the Firebag Project. The notice confirms that ESRD has, in

principle, completed its review of the lease boundary that is

approximately 80 acres in size, and forms a part of the larger

Firebag Project. Athabasca previously submitted a technical memo

documenting development and reclamation and will now provide a

Conservation and Reclamation Business Plan ("CRBP") to ESRD for

their review before receiving final approval. The CRBP is a normal

course requirement of the approval process.

Next steps include

the completion and submission of the Firebag CRBP in the second

quarter of 2014 and progress towards the completion of a National

Instrument 43-101 resource report in respect of the Firebag

Project.

The Corporation has

also been in discussion with a major railway company for developing

a future frac sand trans-loading facility in Fort McMurray, within

a 27 acre strategically situated miscellaneous lease that Athabasca

has applied for. Management is currently preparing preliminary cost

estimates and examining alternatives for processing and

trans-loading of products.

• Richardson Project (Granite and

Dolomite)

To locate a suitable

long term aggregates source for the oil sands industry, the

Corporation has identified an area 70 kms north of the Susan Lake

Gravel pit that contains suitable bedrock for a quarry operation.

In March 2014 the Corporation announced the completion of its

Richardson Project winter drilling program. A total of eight

vertical core holes were drilled for a total of 843 metres over a

20 square km area. All holes successfully cored the dolomite and

all but one intersected the granite basement rocks. All holes were

drilled to a maximum depth of 144 metres. The dolomite and granite

were penetrated at similar depth levels attesting to the uniformity

of the units across the Richardson property area that was tested by

drilling. The location is strategically located to serve continuing

oil sands and infrastructure development within the Fort McMurray

region once the Susan Lake pit becomes depleted. We are working

toward getting the resource developed so that an alternative source

of aggregate will be available to supply regional needs at that

time.

Next steps include

the detailed core logging and sampling which will commence shortly

at Athabasca's Edmonton facility, to be followed up by independent

analytical test work. These 2014 drill holes coupled with

additional drilling from the same area in 2013 will provide the

information necessary to complete a National Instrument 43-101

resource estimate for the Richardson granite and dolomite in fiscal

2014. Following completion of the 43-101 the Corporation intends to

apply for a mineral lease on a portion of the Richardson Project

currently held by Athabasca under mineral permits; and

subsequently, the submission of a development application to

operate a hard rock quarry.

The complete

financial statements for Athabasca for the year-ended November 30,

2013 and Management's Discussion & Analysis for the same period

are available for viewing on the Corporation's website at

www.athabascaminerals.com and on SEDAR at www.sedar.com.

About Athabasca

Minerals

The Corporation is a

resource company involved in the management, exploration and

development of aggregate projects. These activities include

contracts works, aggregate pit management, aggregate production and

sales from corporate-owned pits, new aggregate development and

acquisitions of sand and gravel operations. The Corporation also

has industrial mineral land holdings for the purpose of locating

and developing sources of industrial minerals and aggregates

essential to high growth economic development.

Neither the TSX

Venture nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture) accepts responsibility

for the adequacy or accuracy of this release.

This news

release contains forward-looking statements that involve risks and

uncertainties. Forward- looking statements or information are based

on current expectations, estimates and projections that involve a

number of risks and uncertainties which could cause actual results

to differ materially from those anticipated by the Corporation. The

forward-looking statements or information contained in this news

release are made as of the date hereof and the Corporation does not

undertake any obligation to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws.

The securities

of Athabasca have not been, nor will be, registered under the

United States Securities Act of 1933, as amended, and may not be

offered or sold within the United States or to, or for the account

or benefit of, U.S. persons absent U.S. registration or an

applicable exemption from U.S. registration requirements. This

release does not constitute an offer for sale of securities in the

United States.

Dean Stuart403- 517-2270dean@boardmarker.net

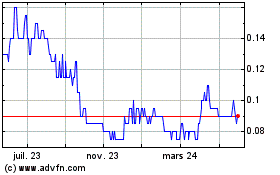

Aben Minerals (TSXV:ABM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

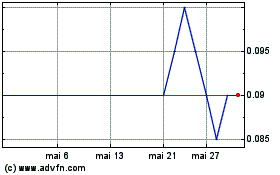

Aben Minerals (TSXV:ABM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025