Time to Bet on 4 High-Carat

Hot-Shots

The wait is over. Everything is now in place to hit the

jackpot – by discovering billions of dollars worth of diamonds in

one of the world‘s most attractive diamond exploration regions:

Finland. Today, Arctic Star Exploration Corp.(TSX.V: ADD; US: ASDZF; Frankfurt: 82A1) announced the start of an eagerly-awaited

exploration program at its 100% owned Timantti Project in

Finland.

Last week, the company closed its agreement to acquire an 100%

interest in this promising project. It took the company more than

one year to do so. Following last week‘s announcement, the

company‘s stock jumped +41% on 3.7 million shares – never before

did the company trade so many shares on a single day. Obviously,

investors have high hopes for this European project, but waited for

the official closing.

This is not only an early-stage exploration play, but also a

well-advanced development project with 2 diamond-bearing kimberlite

pipes (called the Black Wolf and White Wolf) already discovered on

the district-scale property. More diamondiferous pipes are highly

probable on Arctic´s property and are just waiting to get

discovered.

With exploration – especially geophysics and drilling – to start

now (according to today‘s news), investors could very well fall in

love with this sexy diamond play today as it‘s widely known that

it´s all about drilling. Betting on a drill success is what

provides the rare opportunity to the extreme high rewards that the

diamond exploration space is known for. No other commodity sector

creates riches as fast as the diamond sector. Discovering diamonds

with the drill bit is like hitting the jackpot on a slot machine,

however the good news is that it‘s already confirmed that there are

diamonds on this property. This is what makes this project so

attractive. And a major "discovery" worth billions of dollars could

just be around the corner.

In Good Company: 4 High-Carat

Personalities Are Also Betting On A Success

Scott Eldridge Scott Eldridge

Most recently on Tuesday, Arctic announced major management

changes. Scott Eldridge has become President & CEO. He was a

Co-Founder of Euroscandic International Group Inc., a private

investment banking and consulting company with a tag line that says

it all: “Natural Resource Finance“. Eldridge served as President

and CEO between 2008-2016, during which time he has been

responsible for raising in excess of $500 million CAD in combined

equity and debt financing for mining projects around the globe,

varying from exploration to mine construction financing. He was

involved in transactions with the following companies:

First Majestic Silver Corp. ($1.4 billion

market cap.), Silvercrest Mines Inc. ($154 million

takeover by First Majestic), Integra Gold

Corp. ($590 million takeover by Eldorado

Gold), Probe Mines Ltd.($440 million takeover

by Goldcorp), Endeavour Silver Corp. ($340

million market cap.), Excelsior Mining Corp.

($191 million market cap.), Newstrike Capital

Inc. ($140 million takeover by Timmins

Gold), Pediment Gold Corp. ($137 million

takeover by Argonaut Gold), Esperanza Resources

Corp. ($69 million takeover by Alamos Gold).

What better President & CEO for Arctic can you wish for when

considering that Eldridge had this stunning success in the past? As

most of the above transactions led to takeovers and mergers with

major mining companies, one can certainly say that he has an

instinct for exploration projects to eventually become mines.

However he also deserves much respect for picking so many winners

not in gold´s last bull market but during the last bear market: All

of the above transactions happened after 2010. Rockstone asked

Eldridge for a statement on why he believes the Timantti Project is

so attractive. His answer cuts right to the chase and gives me

confidence of being a shareholder:

“I am thrilled to be a part of Arctic‘s executive

team as we are on the brink of our initial exploration program on

our 100% owned Timantti Diamond Project in Finland that will

include drilling. Timantti represents a feverish opportunity for

shareholders to gain exposure to one of the last known

district-scale diamond fields, that coincidentally lies within

proximity to excellent infrastructure and has year-round access.

These operational benefits of the district will enhance Timantti‘s

economics should Arctic discover an ore-body. Finland consistently

ranks high on the Fraser Institute‘s international rating survey.

Having been involved with mining projects in Northern Europe in the

past, to me Finland is the Nevada or Quebec of Europe as a premier

mining jurisdiction with significant local support programs. Our

world-class exploration team has discovered multiple diamond mines

in the past. The stars appear to be aligning in

Finland.“

Roy Spencer Roy Spencer

In July 2017, when Arctic announced its plans to acquire the

Timantti Project in Finland, Roy Spencer joined the company as a

Director. He was largely responsible for discovering the Black Wolf

and White Wolf diamond pipes, which now belong to Artic. Spencer

was also largely responsible for discovering the

multi-billion-dollar Grib diamond pipes in Russia, some 450 km east

from the Wolf pipes in Finland. Both the Wolf and Grib diamond

pipes are “connected“ to eachother as both occur on the same

Karelian Craton (very old areas of the earth´s crust which are the

world´s dominant source of diamonds). In July, Roy Spencer

commented:

”Kimberlites are likely to occur in fields – also

known as clusters – which typically contain 30 or more separate

kimberlites. The Wolf kimberlites are just the first discoveries in

a more extensive cluster. There is good evidence for the existence

of this field in the public domain. This data shows regional

distribution of kimberlitic indicator minerals and diamonds in

surficial tills. The Exploration Reservation will allow Arctic Star

to explore the entire region.“

Spencer is certain that more diamond pipes can and will be found

on Arctic´s Timantti Property in Finland.

Buddy Doyle Buddy Doyle

Buddy Doyle is also a legendary diamond mine discoverer. He was

largely responsible for discovering the multi-billion-dollar Diavik

diamond pipe in Canada. The 2 diamond gurus, Roy and Buddy, have

collaborated previously on bringing into production the Liqhobong

Diamond Mine in Lesotho, South Africa. As arguably 2 of the most

accomplished diamond explorers in the world are now uniting to work

on another diamond project together, this certainly grabs our

attention and you should follow closely what they are up to now.

This could turn out big. Arctic´s Executive Chairman, Pat Power,

said the following in an interview in late July 2017:

”It was about 2006 when Buddy Doyle looked at this

project we just took into the company. We made an offer for a

percentage of it. But they wanted 12.5 million Euros for 25% of it,

which we didn´t have the ability to do back then. Then 2008 came

and everything became really difficult for all resource companies,

specifically for diamond companies. It became very, very difficult.

Roy Spencer, who you could call the father of the Timantti Project,

found the “Grib” pipe, 450 km east in Russia as the president of

Archangel Diamond Corp. in 1996. That turned out to be a mine,

which started producing about 2 years ago. But as usual in Russia,

he got kicked out before it became productive. He traced chemistry

trails to the Finnish border and all those trails originated in

Finland somewhere.“

Jared Lazerson Jared Lazerson

On Tuesday, Arctic also announced the appointment of Jared

Lazerson as a Director. Pat Power had the following to say:

”We are excited with the addition of Jared Lazerson

to Arctic’s Board of Directors, his market, technology and

industrial mineral mining experience are a welcome addition to the

Board. The momentum he has created with the recent development of

MGX Minerals is particularly relevant as we advance Arctic’s newest

diamond exploration property.”

Lazerson is also the CEO of MGX Minerals Inc., a company he grew

from $2 million to a current market capitalization of around $100

million, and a 2017 high in excess of $200 million. In February

2017, Lazerson also joined the Advisory Board of Far Resources

Ltd., whereafter the company appreciated strongly from about $0.10

to currently $0.50. Shareholders of Arctic now hope for a similar

performance.

Another Grib Diamond Mine in Finland?

Full version / After Lukoil reported

nearly $340 million USD in revenue from sales of around 4.5 million

carats of rough diamonds from its Grib

Mine in Russia in 2016, the mine was sold for $1.45

billion USD to Russia‘s largest privately-owned financial company.

(Photo source) Full version / After Lukoil reported

nearly $340 million USD in revenue from sales of around 4.5 million

carats of rough diamonds from its Grib

Mine in Russia in 2016, the mine was sold for $1.45

billion USD to Russia‘s largest privately-owned financial company.

(Photo source)

Read the full report with more details on the Timantti

Project in Finland and the Grib Diamond Mine in Russia here.

Is Arctic Star zeroing-in on diamond riches in

Finland?

By Marc Davis

There are tantalizing clues as to the possible whereabouts of

billions of dollars worth of buried diamonds in the rough.

Since their discovery a few years ago, these geological clues have

become known as the Black Wolf and the White Wolf.

Located in northern Finland, they consist of twin diamond-embedded

rock formations — scientifically referred to as kimberlite pipes.

And they have kept their secret for many millions of years.

Now the wait is finally over. For the first time ever, their

geological DNA is being closely scrutinized in the hopes that it

will point the way to a considerably more richly endowed nearby

diamond deposit.

Initially discovered in 2005 by a small mineral exploration

start-up called European Diamonds plc, the White Wolf and Black

Wolf pipes are the first to emerge in a region that no doubt hosts

more diamond-laced discoveries.

More on this in a moment.

A decade ago, the economic potential of these twin pipes was probed

by way of some small-scale drilling. But the distribution of the

micro diamonds among the rock samples taken proved to be too

inconsistent to justify additional drill testing. So the project

was abandoned and has since languished — until now.

Veteran diamond exploration company Arctic Star Exploration

Corp. (TSX.V: ADD) has come to Finland to test a

scintillating theory: the two Wolf kimberlites can point the

way to a glittering treasure trove at the heart of one of the

world’s last under-explored diamond fields.

To this end, the company has acquired the White Wolf and Black Wolf

diamond pipes and the geologically-prospective exploration grounds

that surround them. This sizeable property can be found in the

under-explored region of Kuusamo.

Known as the Foriet Property [now called Timantti

Project], Arctic Star’s exploration permits will now be

the hunting grounds for a whole cluster of kimberlite pipes — any

one of which could be the mother lode.

By studying all the geological characteristics of the initial White

Wolf and Black Wolf discoveries, Arctic Star’s geologists believe

they can zero-in on a swarm of proximal pipes. After all, this is

the methodology that has proven phenomenally successful in Canada’s

Northwest Territories (NWT).

It’s an exploration approach that also helped unearth several

large, prolifically-mineralized Russian diamond mines that are

located less than 500 kilometres to the east of the Foriet

Property. Interestingly, these mines were only found relatively

recently.

Can History Repeat Itself?

When another small diamond exploration company called Dia Met

Minerals discovered the Point Lake diamond pipe in the NWT in 1991,

there was considerable fanfare.

The stock rallied from mere pennies to over $67 the following year.

By then, a small handful of far richer diamond pipes had been

located nearby. They later became the multi-billion-dollar Ekati

diamond mine — the first of its kind in Canada.

In fact, it turned out that Point Lake was worthless because it

contains too few diamonds to be mined. But that didn’t

matter.

What did matter is that the Point Lake discovery was a technical

success that led geologists to eight proximal kimberlite pipes —

all of which proved to be rich with diamonds.

Since the commercialization of Canada’s inaugural diamond mine,

another nearby mine called Diavik has also come into existence.

Together, they have yielded over $25 billion worth of diamonds so

far.

Fortunately for Arctic Star, its Vice President of Exploration is

Buddy Doyle, who was integral to turning Diavik into a world-class

mine in the 90s. This is when he was exploration manager for

Kennecott Canada Exploration Inc. — a subsidiary of the world’s

biggest mining company, Rio Tinto plc.

Now he hopes to do it again. Only this time around, he also has the

benefit of vastly improved diamond-hunting technology and a wealth

of geological savoir faire. In recent years, he has traversed much

of the frigid vastness of the NWT looking to replicate his earlier

success at Diavik.

His search has now brought him and Arctic Star to Finland where he

is applying the same diamond sleuthing expertise to one of the

world’s last diamond-hunting frontiers.

Why the Wolf Pipes are Key to Revealing New Diamond

Fields

Fortunately, there’s plenty of scientific encouragement for

Arctic Star’s quest. For instance, the Foriet Property is close to

the Russian border and is part of the same tectonic plate that

already hosts several Russian diamond mines.

Known as the Karelian Craton, this crustal feature is geologically

comparable to the Slave Craton in Canada’s Arctic, which is home to

the Ekati and Diavik diamond mines. In other words, it’s proven to

be geologically fertile for economic diamond discoveries.

Here’s how kimberlite pipes are found in both the Karelian and the

Slave cratons: They are tracked down by following trails of

indicator minerals. Many millennia ago, these tiny, colourful

stones were eroded from kimberlites by glaciers and then deposited

down ice.

The thicker the dispersion train, the closer the indicator minerals

are to their diamondiferous bedrock source. In other words, finding

diamondiferous pipes this way is analogous to following a trail of

crumbs to a loaf of bread.

The Black Wolf and White Wolf pipes were discovered by this very

same process.

Again, it’s worth mentioning that this is how the kimberlite

pipes that constitute the Ekati and Diavik diamond mines were

found.

Indicator mineral trails that are comparable to the one that leads

to the White Wolf and Black Wolf pipes can also be found elsewhere

on Arctic Star’s property. This supports the theory that other

proximal kimberlite pipes are still waiting to be discovered.

In fact, diamond fields usually involve 10-30 kimberlites but can

in some cases include as many as 100 or more. A cluster of pipes

usually resembles a shotgun blast spread out over an area in

diameter of up to 100 kilometres in diameter.

To this point, Finnish federal government geological data shows the

presence of an 80-kilometre-wide “cloud” of indicator minerals

dispersed across a wide area that is roughly centred on the Wolf

pipes. This suggests that Arctic Star property encompasses a whole

new cluster of kimberlites.

Additionally, the company’s till sampling program utilizes the same

sampling and mineral ranking techniques that were used to find the

Ekati and Diavik mines. This means that Arctic Star can predict the

potential of certain kimberlite targets to host diamonds with a

high degree of confidence.

Along with till sampling, Arctic Star’s accomplished

diamond-finding geologists also intend to use aerial geophysical

surveys and follow-up ground-based geophysics to identify new

kimberlite prospects on its new property.

In the near term, Arctic Star is revisiting the economic potential

of the Wolf pipes.

To this end, the company is beginning by sampling 14 core holes

with a total length of 530 metres of kimberlite at Black Wolf that

was drilled over a decade ago and was never assayed for

diamonds.

Truth be told, the size potential of the Wolf kimberlites has still

to be determined. A ground-based geophysics program will go a long

way to solving this mystery. And more drilling still needs to be

done to better understand the overall grade of the deposit.

This re-evaluation of the Wolf pipes is made easier due to the fact

that these deposits are located near paved roads and in relative

close proximity to a power grid, as well as logistical

supplies.

Also, there is a skilled labour force nearby in the

economically-underdeveloped town of Kuusamo. This pro-mining

community also benefits from its own airport and is only an

eight-hour drive from Helsinki.

It would therefore be far less expensive to commercialize one or

more diamond mines in this region than in a remote, inhospitable

location like the NWT.

Arctic Star’s President Patrick Power comments, “We plan to

evaluate the economic potential of the Wolf pipes as an immediate

priority.

“However, the greatest potential for success at the Foriet Property

is the likelihood of finding more diamondiferous kimberlites, any

one of which could be richly endowed enough to be economic, and to

eventually become a mine.”

In terms of geopolitical risk, the Fraser Institute recently ranked

Finland as the most attractive jurisdiction for mining investment

anywhere in the world. So this too represents a major de-risking

project booster.

Investment Summary

The company is also still active in the NWT, where it is

involved in a joint venture to explore and develop the T Rex

Project for diamondiferous kimberlite pipes.

So the company’s overall risk profile is mitigated by the fact that

it has two separate exploration projects underway in two different

jurisdictions.

On a technical note, Arctic Star has only about 54.7 million shares

outstanding, representing a relatively tight share structure.

In the eventuality of positive news flow, such a situation

typically acts as a potent catalyst to higher share price

valuations.

All told, Arctic Star is gearing-up for a busy exploration season

that could yet take investors on the ride of a lifetime.

About the Author: Marc Davis has

a deep background in the capital markets spanning 25 years. He is

also a longstanding financial journalist, having worked for leading

digital financial news agencies in North America and in London’s

financial centre. He is also a former business reporter for CBC

Television. Over the years, his articles have also

appeared in dozens of digital publications worldwide. They include

USA Today, CBS Money Watch, Investors’ Business Daily, the

Financial Post, Reuters, National Post, Google News, Barron’s,

China Daily, Huffington Post and AOL. Disclaimer: This online

publication is intended for information purposes only. No statement

or expression of opinion directly or indirectly, is an offer,

solicitation or recommendation to buy or sell any of the securities

mentioned. The cost of Marc Davis’ research costs are defrayed by a

nominal payment from Arctic Star Exploration Corp. Additionally

Marc Davis has been issued stock options by Arctic Star Exploration

Corp.

Management & Directors

SCOTT

ELDRIDGE

President &

CEO

Mr. Eldridge has over 10 years of experience in finance and

general management in the mining sector. He has a B.B.A. from

Capilano University, and an M.B.A. from Central European

University. He co-founded Euroscandic International Group Inc., a

private company offering investment banking and advisory services

to natural resource companies where he served as President and CEO

from 2008 to 2016. During his time in the industry he has been

responsible for raising in excess of $500 million CAD in combined

equity and debt financing for mining projects varying from

exploration to construction financing around the globe. He has held

several directorships and executive roles with both private and

public companies.

PATRICK

POWER

Executive

Chairman

Patrick Power is a seasoned venture capitalist and financier

with over 20 years of experience as a stock market professional and

as director of public companies. He has been President and CEO of

Arctic Star since its inception in 2002. Additionally, Mr. Power

serves as a director of other mineral exploration companies. Arctic

Star benefits from Mr. Power’s wealth of experience as a savvy

dealmaker, an adept financier and as a tireless, results-driven

leader of dynamic public companies. The company enjoys Mr. Power’s

large network of contacts within the industry, his enthusiasm and

his efforts as a member of the audit and remuneration panels.

BUDDY

DOYLE

VP of Exploration,

Director

Buddy Doyle has 25 years experience in mineral exploration. He

worked for Rio Tinto PLC for over 23 years, most recently he was

Exploration Manager/Vice President of Kennecott Canada Exploration

Inc. (owned by Rio Tinto), in charge of diamond exploration in

North America. He was a key member of the Kennecott Exploration

Australia team that discovered the multi-million ounce Minifie gold

deposits at Lihir in 1987-1988 and led the team which discovered

the Diavik diamond deposits in 1994-1995. Few geologists have seen

2 projects from discovery through to decision to mine. Mr. Doyle is

recognized by his peers in the exploration industry as an authority

on diamond exploration and kimberlite geology, and has

authored/co-authored numerous papers on these subjects. He was

awarded the 2007 Hugo Dummitt Award for excellence in Diamond

exploration. Since leaving Rio Tinto Mr. Doyle remains active in

the diamond sector through consultancy and non-executive

directorships. Mr. Doyle brings to the company a disciplined

scientific approach to mineral exploration and managerial skills

that have a proven track record. He holds a BSc in Applied Geology

from the Queensland University of Technology.

ROY

SPENCER

Director

Roy is a GSSA Member and a Fellow of the AusIMM. Roy joined De

Beers in 1966 and has been involved with exploration and deposit

evaluation for gemstones and other commodities throughout his

career. Roy’s tertiary education was at the University of Natal and

Rhodes University in South Africa, and is a member of the

Geological Society of South Africa and a Fellow of the Aus.I.M.M.

As technical director of Peregrine Diamonds, he discovered the

first kimberlites on the Pilbara craton in Western Australia in

1989, and as Leader of the Owners Team for Archangel Diamond

Corporation he was largely responsible for the discovery of the

world class Grib kimberlite in far northern Russia (February,

1996). In 1998, Roy created and raised the seed finance for Ilmari

Exploration Oy to explore for gold, base metals and diamonds on the

Karelian Craton in Finland. Ilmari went public in 2000, and

discovered the Lentiira kimberlite cluster in central Finland in

2003.

In 2006, as CEO of London-based diamond explorer European

Diamonds, Roy led the Owners Team which brought the Liqhobong

kimberlite (Lesotho) into commercial production on time and under

budget. In mid-2007, Roy left European, a company which had evolved

into a successful mid-tier diamond producer and marketer after

having raised £23 million over a 6-year period. Since that time Roy

has continued in gemstone exploration and deposit evaluation in

Africa, Finland and western Russia for a variety of junior and

senior mining companies.

BINNY JASSAL, CPA, CGA,

FCCA

Chief Financial

Officer

Binny Jassal brings over 20 years of accounting and management

experience to the Company. Mr. Jassal is a member of Certified

General Accountants in Canada, fellow member of Association of

Chartered Certified Accountants in London, England and holds

Certificate in Accounting and Finance from Ryerson University

Toronto. Previously, Mr. Jassal has worked in various accounting

positions (including public companies) within the manufacturing, IT

and telecommunication sectors. Mr. Jassal joined the Company in May

2006 and has been an important member of the team working on the

financial and corporate side of the operations.

Jared

Lazerson

Director

Mr. Lazerson is CEO and Director of lithium and magnesium miner

MGX Minerals (CSE:XMG). For the past 5 years, Mr. Lazerson, has

seen the market capitalization grow from $2 million CAD to a

current value of $100 million CAD and a 2017 high of over $200

million CAD. Mr. Lazerson has been responsible for all aspects of

growth of MGX including acquisitions, financing, operations and

technology development. MGX Minerals has developed some of the most

advanced and low-cost technology in the world for

lithium extraction from brine by eliminating the solar evaporation

step, thus reducing processing time from 2 years to 1 day. Mr.

Lazerson holds a B.A. in International Relations from the

University of Pennsylvania.

THOMAS

YINGLING

Director

Thomas Yingling is a successful seasoned venture capitalist who

benefits from over 19 years of experience running resource based

public companies. He has been a Director of Arctic Star since its

inception in 2002. Mr. Yingling has served for almost two decades

as President of Brahma Communications Corp., an investment

consulting firm that specializes in corporate finance, investor

relations and strategic corporate planning for publicly traded

companies. He has served as President and CEO and/or a director of

other resource based public companies.

SEAN

CHARLAND

Director

Sean Charland is a seasoned communications professional with

experience in raising capital and marketing resource exploration

companies. He has helped raise over C$ 150 million for a variety of

venture listed and private companies in mineral exploration and

mining, technological and health sectors with the majority of the

focus on mineral exploration and mining. His network of contacts

within the financial community extends across North America and

Europe.

BILL

FERREIRA

Director

Mr. Ferreira is an exploration geologist with over 30 years

experience in gold, base-metal and diamond exploration in Canada.

Mr. Ferreira holds a Master of Science degree from the University

of Manitoba and a Bachelor of Science degree from the University of

Minnesota, Duluth. Mr. Ferreira’s employment experience includes

work for Noranda Exploration Canada, Esso Minerals Canada, Getty

Mines, Falconbridge Ltd., Granges Exploration, Canmine Resources

Corp. and San Gold Corp. Mr. Ferreira is past president of the

Manitoba Prospectors and Developers Association. Mr. Ferreira is

currently a member of the Association of Professional Engineers and

Geoscientists of the Province of Manitoba.

Company Details

Arctic Star Exploration Corp.

1111 West Georgia Street

Vancouver, B.C. V6E 4M3, Kanada

Phone: +1 604 689 1799

Email: info@arcticstar.ca

www.arcticstar.ca

Shares Issued & Outstanding: 73,862,522

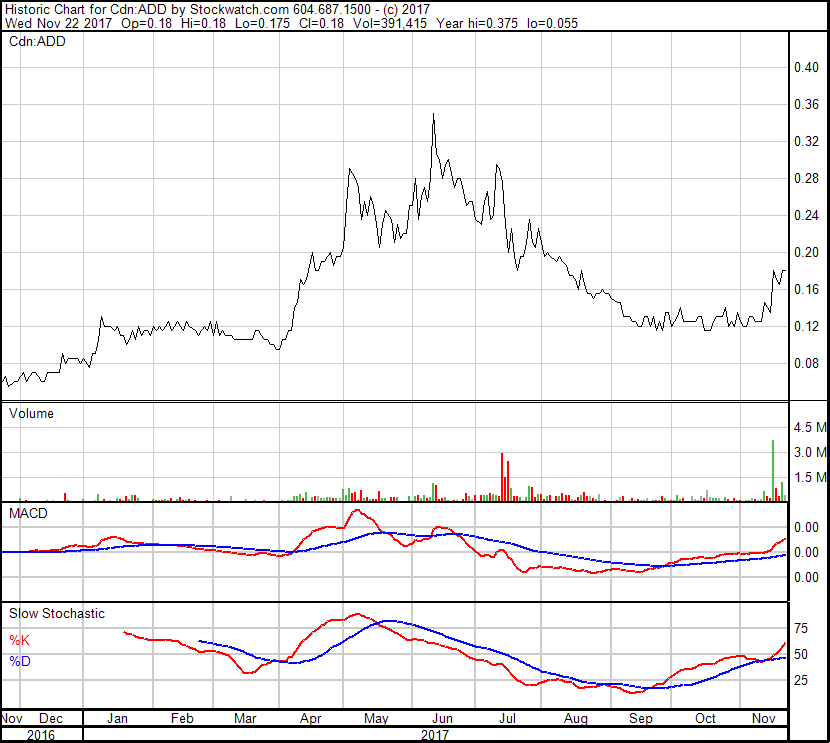

Chart

Canadian Symbol (TSX.V): ADD

Current Price: $0.18 CAD (11/22/2017)

Market Capitalization: $13 Million CAD

Chart

German Symbol / WKN(Frankfurt): 82A1 / A2DFY5

Current Price: €0.111 EUR (11/22/2017)

Market Capitalization: €8 Million EUR

Disclaimer: Please read the full disclaimer within the full

research report as a PDF (here), as fundamental risks and conflicts of

interest exist.

|