Acceleware Ltd. Announces Closing of Non-Brokered Private Placement of Units

11 Novembre 2022 - 1:43AM

Acceleware Ltd. (TSXV:AXE)

(“

Acceleware” or the

“

Corporation”) announces that, on November 10,

2022, the Corporation closed the non-brokered private placement of

units (the “

Units”) that it previously announced

on October 20, 2022 (the “

Private Placement”).

Each Unit consists of one common share of the Corporation (a

“

Common Share”) and one common share purchase

warrant of the Corporation (a “

Warrant”). Each

Warrant entitles the holder of the Warrant to acquire one Common

Share, at an exercise price of $0.36, for a period ending on

November 10, 2024. In the event that the Common Shares trade at a

closing price at or greater than $0.81 per Common Share for a

period of thirty (30) consecutive trading days, Acceleware may

accelerate the expiry date of the Warrants by giving notice to the

holders thereof, and in such case, the Warrants will expire on the

30th day after the date on which such notice is given by

Acceleware. Pursuant to the Private Placement, the Corporation

distributed a total of 6,666,667 Units, at a price of $0.27 per

Unit, for total gross proceeds of $1,800,000. There were no

finders’ fees or commissions paid in connection with the Private

Placement.

The proceeds of the Private Placement will be

used to fund a portion of the workover for the commercial-scale RF

XL pilot project at Marwayne, Alberta and for general corporate

purposes. The Common Shares issued in connection with the Private

Placement and any Common Shares issued upon exercise of the

Warrants will be subject to a four-month hold period which will

expire on March 10, 2023 in accordance with applicable securities

legislation.

Insiders of the Corporation purchased a total of

154,249 Units under the Private Placement, which is considered a

related party transaction within the meaning of Multilateral

Instrument 61-101 Protection of Minority Security Holders in

Special Transactions (“MI 61-101”). The

Corporation relied on the exemptions from the valuation and

minority shareholder approval requirements of MI 61-101 contained

in Sections 5.5(a) and 5.7(a), respectively, of MI 61-101 in

respect of such insider participation. No new insiders and no

control persons were created in connection with the Private

Placement.

About Acceleware

Acceleware (www.acceleware.com) is an innovator

of clean-tech decarbonization technologies comprised of two

business units: Radio Frequency (RF) Heating Technology and Seismic

Imaging Software.

Acceleware is piloting RF XL, its patented

low-cost, low-carbon production technology for heavy oil and oil

sands that is materially different from any heavy oil recovery

technique used today. Acceleware's vision is that electrification

of heavy oil and oil sands production can be made possible through

RF XL, supporting a transition to much cleaner energy production

that can quickly bend the emissions curve downward. With clean

electricity, Acceleware’s RF XL technology could eliminate

greenhouse gas (GHG) emissions associated with heavy oil and oil

sands production. RF XL uses no water, requires no solvent, has a

small physical footprint, can be redeployed from site to site, and

can be applied to a multitude of reservoir types.

Acceleware and Saa Dene Group

(co-founded by Jim Boucher) have created

Acceleware | Kisâstwêw to raise the

profile, adoption, and value of Acceleware technologies. The

shared vision of the partnership is to improve the

environmental and economic performance of

the energy sector by supporting ideals that are

important to Indigenous peoples, including respect for land, water,

and clean air.

The Company’s seismic imaging software solutions

are state-of-the-art for high fidelity imaging, providing the most

accurate and advanced imaging available for oil exploration in

complex geologies. Acceleware is a public company listed on

Canada’s TSX Venture Exchange under the trading symbol

“AXE”.

Disclaimers

This press release contains “forward-looking

information” within the meaning of securities legislation.

Forward-looking information generally means information about an

issuer’s business, capital, or operations that is prospective in

nature, and includes disclosure about the issuer’s prospective

financial performance or financial position.

The forward-looking information in this press

release can be identified by the terms “expects”, “intends”, and

derivatives thereof, and includes information about the benefits of

RF XL, future operation of the Pilot, participation of insiders in

the Private Placement, the proposed use of proceeds of the Private

Placement and the intention of funding partners to support the

workover project with accelerated funding.

Actual results may vary from the forward-looking

information in this press release due to certain material risk

factors. These risk factors are described in detail in Acceleware’s

continuous disclosure documents, which are filed on SEDAR at

www.sedar.com.

Acceleware assumes no obligation to update or

revise the forward-looking information in this press release unless

it is required to do so under securities legislation.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information:Geoff Clark, CEOTel: +1

(403) 249-9099geoff.clark@acceleware.com

Acceleware Ltd.435 10th Avenue SECalgary, AB,

T2G 0W3 CanadaTel: +1 (403) 249-9099www.acceleware.com

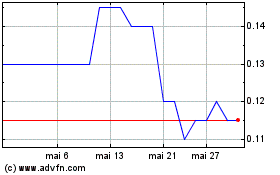

Acceleware (TSXV:AXE)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Acceleware (TSXV:AXE)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025