Green Shift

Commodities Ltd.

(

TSXV: GCOM and

OTCQB:

GRCMF), (“

Green Shift”,

“

GCOM” or the “

Company”) is

pleased to announce that it has entered into a definitive agreement

dated December 8, 2023 with Latam Battery Metals Inc.

(“

Latam”) whereby Latam will acquire 100% of the

issued and outstanding shares (the “

Target

Shares”) of two wholly-owned subsidiaries of GCOM, which

together hold 3 indirectly a 100% interest in the Berlin Project

(“

Berlin” or the “

Project”)

located in Caldas, Colombia (the

“Transaction”).

Latam is an arm’s length privately held company focused on the

uranium sector with strong operating experience in Colombia and

intends to pursue a listing on a recognized stock exchange in

Canada (the

“Listing”) in the coming months.

Transaction Highlights

- Unlocks value

for the Project today allowing GCOM to retain exposure to uranium,

while focusing on advancing its portfolio of Lithium projects

across the Americas.

- Puts the

Project in the hands of Latam, who encompasses in country,

technical and operating experience to advance the Project through

development.

- As

consideration for the Target Shares (see below for further

details), GCOM will receive a minimum of C$5 million in post

Listing common shares of Latam (the “Latam

Shares”), cash payments of up to C$6 million subject to

achievement of certain milestones and a 1% net smelter return

(“NSR”) royalty payable on all production from the

Project.

- Further

improves GCOM’s balance sheet as Latam is assuming all liabilities

and taxes associated with the Project.

Trumbull Fisher, CEO and Director of GCOM

commented, "This strategic sale marks a pivotal moment for GCOM as

we continue to evolve and refine our portfolio to focus on the

battery metals section of the clean energy landscape. Considering

our team's specialized knowledge in lithium, we believe the most

effective strategy to maximize shareholder value involves

transferring Berlin to a dedicated team focused on the Project and

that is familiar with the intricacies of the country, providing the

necessities to advance development. Simultaneously, we aim to

retain a substantial equity stake maintaining significant exposure

to capitalize on the continued positive momentum in the uranium

sector. In addition, this transaction provides a significant

increase to our working capital as Latam is assuming all the

liabilities associated with the Berlin project."

Luis Ducassi, CEO of Latam, added, “We are

enthusiastic about this transaction and the opportunities it

presents. The Berlin Project with its historical multi-commodity

resources and advanced metallurgy is a strategic choice for us, as

our in-house team in Colombia is ready to commence work on it

promptly. We extend our appreciation to the GCOM team for their

collaboration throughout this transaction, and we look forward to

maintaining open and constructive channels of communication as we

collectively navigate the future opportunities that this venture

presents.”

Transaction Details

As consideration for the acquisition of the

Target Shares, Latam has agreed to deliver to GCOM (collectively,

the “Consideration”):

|

(a) |

Upon closing of the Transaction:(i) CDN$20,000 in

cash;(ii) Such number of Latam Shares representing

20% of the then outstanding Latam Shares;

and(iii) A 1% NSR royalty payable on all

production from the Property. |

|

(b) |

On the earlier of (i) 90 days after the date on which the Project

has been brought into good standing, and (ii) five days following

completion of the Listing, CDN$1,000,000 in cash; |

|

(c) |

Upon completion of the Listing, either (i) assuming the Listing is

completed within 12 months following the Closing, the greater of

(1) such number of additional Latam Shares that would result in

GCOM owning 20% of the number of post-Listing Latam Shares; and (2)

such number of additional Latam Shares with a value of

CDN$5,000,000, in each case at a deemed price per share equal to

the Listing price; or (ii) assuming the Listing is not completed

within 12 months following Closing, the greater of (1) such number

of additional Latam Shares that would result in GCOM owning 25% of

the number of post-Listing Latam Shares; and (2) such number of

additional Latam Shares with a value of CDN$6,000,000, in each case

at a deemed price per share equal to the Listing price; |

|

(d) |

As soon as practicable, and in any event within 30 days, after the

date that Latam achieves commercial production of uranium ore from

the Property, CDN$5,000,000 in cash; and |

|

(e) |

Green Shift will also be entitled to nominate one director to the

Latam board of directors. |

|

|

|

From the date of closing the Transaction until

such time as all of the Consideration has been paid, Latam has

agreed not to transfer any interest in the Target Shares or the

Property without the prior written consent of GCOM, which consent

may be withheld, conditioned or delayed in the sole discretion of

GCOM.

Completion of the Transaction is conditional

upon the approval of the TSX Venture Exchange (the

“TSXV”) and the satisfaction of certain other

closing conditions customary in transactions of this nature.

GCOM has engaged Generic Capital Corp.

(“Generic”) as its financial advisor in connection

with the Transaction. Pursuant to such engagement, GCOM has agreed

to pay Generic an advisory fee comprised of 3,333,333 common shares

of GCOM (“GCOM Shares”), with a value of $200,000

at a deemed price per share of $0.06, being the closing price of

the GCOM Shares on TSXV on the date immediately prior to the

announcement of the Transaction. The GCOM Shares will be issuable

to Generic upon closing of the Transaction, subject to the approval

of the TSXV.

About Green

Shift Commodities

Ltd.

Green Shift Commodities Ltd. is focused on the

exploration and development of commodities needed to help

decarbonize and meet net-zero goals. The Company is advancing a

portfolio of lithium prospects which includes the recently acquired

Rio Negro Project in Argentina, a district-scale project in an area

known to contain hard rock lithium pegmatite occurrences that were

first discovered in the 1960s with little exploration since, and

the Armstrong Project, located in the Seymour-Crescent-Falcon

lithium belt in northern Ontario, known to host spodumene-bearing

lithium pegmatites and significant discoveries.

About Latam Battery Metals

Inc.

Latam is a privately held mining Company focused

on the uranium sector. The Company is led by Luis Ducassi, a

respected businessman who recently led mining efforts in Peru for

the Ministry of Energy and Mines. The Company’s technical team has

significant exploration, operating and business development

experience throughout the Americas including at companies such as

Hochschild Mining Plc, Compañia de Minas Buenaventura and O3 Mining

Inc. The Company intends to pursue a listing on a recognized stock

exchange in Canada as soon as practicable.

For further

information, please

contact:

Green Shift

Commodities Ltd.

Trumbull FisherDirector and CEOEmail:

tfisher@greenshiftcommodities.comTel: (416)

917-5847

Website: www.greenshiftcommodities.com

Twitter: @greenshiftcom LinkedIn:

https://www.linkedin.com/company/greenshiftcommodities/

Forward-Looking Statements

This news release includes certain “forward

looking statements”. Forward-looking statements consist of

statements that are not purely historical, including statements

regarding beliefs, plans, expectations or intensions for the

future, and include, but not limited to, statements with respect

to: closing of the Transaction; the approval of the TSXV; the

future direction of the Company’s strategy; and other activities,

events or developments that are expected, anticipated or may occur

in the future. These statements are based on assumptions, including

that: (i) expectations and assumptions concerning the Transaction,;

(ii) actual results of exploration, resource goals, metallurgical

testing, economic studies and development activities will continue

to be positive and proceed as planned, (iii) requisite regulatory

and governmental approvals will be received on a timely basis on

terms acceptable to Green Shift (iv) economic, political and

industry market conditions will be favourable, and (v) financial

markets and the market for uranium, battery commodities and rare

earth elements will continue to strengthen. Such statements are

subject to risks and uncertainties that may cause actual results,

performance or developments to differ materially from those

contained in such statements, including, but not limited to: (1)

the failure to satisfy the conditions to completion of the

arrangement, including the TSXV not providing approval of the

Transaction and all required matters related thereto; (2) changes

in general economic and financial market conditions, (3) changes in

demand and prices for minerals, (4) the Company’s ability to source

commercially viable reactivation transactions and/or establish

appropriate joint venture partnerships, (5) litigation, regulatory,

and legislative developments, dependence on regulatory approvals,

and changes in environmental compliance requirements, community

support and the political and economic climate, (6) the inherent

uncertainties and speculative nature associated with exploration

results, resource estimates, potential resource growth, future

metallurgical test results, changes in project parameters as plans

evolve, (7) competitive developments, (8) availability of future

financing, (9) the effects of COVID-19 on the business of the

Company, including, without limitation, effects of COVID-19 on

capital markets, commodity prices, labour regulations, supply chain

disruptions and domestic and international travel restrictions,

(10) exploration risks, and other factors beyond the control of

Green Shift including those factors set out in the “Risk Factors”

in our Management Discussion and Analysis dated August 23, 2023 for

the three and six months ended June 30, 2023 and other public

documents available on SEDAR+ at www.sedarplus.ca Readers are

cautioned that the assumptions used in the preparation of such

information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on forward-looking statements. Green Shift

assumes no obligation to update such information, except as may be

required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press

release.

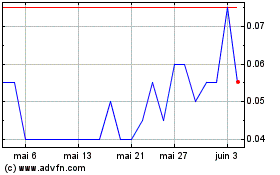

Green Shift Commodities (TSXV:GCOM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Green Shift Commodities (TSXV:GCOM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024