Green Shift Commodities Ltd. (

TSXV:

GCOM), (“

Green Shift” or the

“

Company”) is pleased to announce that it has

closed the first tranche of its previously announced non-brokered

private placement financing of units of the Company (the

“

Units”) at a price of C$0.05 per Unit (the

“

Issue Price”), for gross proceeds of C$1,167,500

(the “

Offering”).

The Company issued an aggregate of 23,350,000

Units pursuant to the Offering, with each Unit consisting of one

common share in the capital of the Company (each, a “Common

Share”) and one Common Share purchase warrant (each, a

“Warrant”). Each Warrant entitles the holder to

purchase one Common Share at an exercise price of C$0.075 per share

until June 7, 2027.

The net proceeds of the Offering will be used

for general working capital purposes and to advance the Company’s

property interests. The Company paid finder fees to Stephen Avenue

Securities Inc., Canaccord Genuity Corp. and Ventum Financial Corp.

in connection with the Offering in the aggregate amount of C$7,350

in cash and 84,000 non-transferable finder warrants. Each finder

warrant entitles the holder to purchase one Common Share at an

exercise price of C$0.075 until June 7, 2027.

All securities issued in connection with the

Offering are subject to a statutory hold period expiring October 8,

2024. The Offering, including payment of the finder fees, is

subject to the final approval of the TSX Venture Exchange (the

“TSXV”).

Sale of Berlin Royalty

GCOM is also pleased to announce, further to its

press release dated April 23, 2024, that it has entered into a

definitive agreement (the “Agreement”) dated June

7, 2024 with a third-party (“AcquireCo”) pursuant

to which AcquireCo has agreed to acquire (the

“Transaction”) all of the outstanding shares of

1000871349 Ontario Inc. (“Subco”), a wholly-owned

subsidiary of the Company which owns, among other things, a 1% NSR

royalty covering all production from the Berlin Project (the

“Royalty”). AcquireCo is an arm’s length,

privately-held royalty company designed to gain exposure to rising

uranium prices by making strategic royalty acquisitions to grow its

portfolio.

Pursuant to the Agreement, AcquireCo has agreed

to acquire all of the issued and outstanding shares of Subco in

exchange for 12,000,000 common shares of AcquireCo

(“AcquireCo Shares”) at a deemed issue price of

C$0.25 per AcquireCo Share, representing total deemed consideration

of C$3,000,000. GCOM shall also have the right to appoint one

member of the Board of Directors of AcquireCo and shall be granted

rights to participate in any equity financing of AcquireCo in order

to maintain its pro rata ownership interest.

Closing of the Transaction is conditional upon,

among other things, receipt of any regulatory approvals in

connection with the Transaction and no material adverse change

having occurred affecting either the Royalty or AcquireCo.

Trumbull Fisher, CEO and Director of Green Shift

commented, “We are very pleased to enter this

definitive agreement and look forward to closing the Transaction.

This Transaction is expected to add to our many holdings of shares

in other companies and specifically a holding in a royalty company.

We are thrilled to be able to capitalize on this royalty at this

time, while still maintaining exposure though the shares we will

own.”

Insider Participation

Insiders of the Company, including Peter Mullens

and Martin Tunney, Directors of the Company acquired an aggregate

of 600,000 Units on the same terms as other investors for gross

proceeds to the Company of C$30,000 (the “Insider

Participation”). The Insider Participation constitutes a

“related party transaction” pursuant to Multilateral Instrument

61-101 – Protection of Minority Security Holders in Special

Transactions (“MI 61-101”). The Company is exempt

from the requirement to obtain a formal valuation or minority

shareholder approval in connection with the Insider Participation

under MI 61-101 in reliance on Sections 5.5(a) and 5.7(1)(a) of MI

61-101 due to the fair market value of the Insider Participation

being below 25% of the Company’s market capitalization for purposes

of MI 61-101. The Company did not file a material change report 21

days prior to the expected closing date of the Offering as the

details of the Insider Participation had not been finalized at that

time. The Offering has been approved by the board of directors of

the Company, with each of Messrs. Mullens and

Tunney having disclosed his interest in the Offering and abstaining

from voting thereon. The Company has not received nor has it

requested a valuation of its securities or the subject matter of

the Insider Participation in the 24 months prior to the date

hereof.

The securities to be issued pursuant to the

Offering have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and may not be

offered or sold in the United States or to, or for the account or

benefit of, U.S. persons absent registration or an applicable

exemption from the registration requirements. This news release

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

About Green Shift Commodities

Ltd.

Green Shift Commodities Ltd. is focused on the

exploration and development of commodities needed to help

decarbonize and meet net-zero goals. The Company is advancing a

portfolio of lithium prospects across the Americas. This includes

the Rio Negro Project, a district-scale project in an area known to

contain hard rock lithium pegmatite occurrences that were first

discovered in the 1960s, yet largely underexplored since and the

Santiago Luis Lithium Project, both located in Argentina. The

Company is also exploring the Armstrong Project, located in the

Seymour-Crescent-Falcon lithium belt in northern Ontario, known to

host spodumene-bearing lithium pegmatites and significant

discoveries.

For further information, please

contact:

Trumbull FisherDirector and

CEOEmail:

tfisher@greenshiftcommodities.comTel: (416)

917-5847

Website:

www.greenshiftcommodities.comTwitter:

@greenshiftcomLinkedIn:

https://www.linkedin.com/company/greenshiftcommodities/

Forward-Looking Statements

This news release includes certain “forward

looking statements”. Forward-looking statements consist of

statements that are not purely historical, including statements

regarding beliefs, plans, expectations or intensions for the

future, and include, but not limited to, statements with respect

to: the anticipated use of proceeds from the Offering; the approval

of the TSXV; the outcome of permitting activities, the completion

of future exploration work and the potential metallurgical

recoveries and results of such test work; the future direction of

the Company’s strategy; and other activities, events or

developments that are expected, anticipated or may occur in the

future. These statements are based on assumptions, including: (i)

receipt of final TSXV approval for the Offering; (ii) satisfaction

of the conditions to closing of the Transaction; (iii) the ability

to achieve positive outcomes from test work; (iv) actual results of

our exploration, resource goals, metallurgical testing, economic

studies and development activities will continue to be positive and

proceed as planned, (v) requisite regulatory and governmental

approvals will be received on a timely basis on terms acceptable to

Green Shift (vi) economic, political and industry market conditions

will be favourable, and (vii) financial markets and the market for

uranium, battery commodities and rare earth elements will continue

to strengthen. Such statements are subject to risks and

uncertainties that may cause actual results, performance or

developments to differ materially from those contained in such

statements, including, but not limited to: (1) failure to obtain

final TSXV approval for the Offering, (2) the failure to satisfy

the conditions to completion of the Transaction; (3) changes in

general economic and financial market conditions, (4) changes in

demand and prices for minerals, (5) the Company’s ability to source

commercially viable reactivation transactions and / or establish

appropriate joint venture partnerships, (6) litigation, regulatory,

and legislative developments, dependence on regulatory approvals,

and changes in environmental compliance requirements, community

support and the political and economic climate, (7) the inherent

uncertainties and speculative nature associated with exploration

results, resource estimates, potential resource growth, future

metallurgical test results, changes in project parameters as plans

evolve, (8) competitive developments, (9) availability of future

financing, (9) exploration risks, and other factors beyond the

control of Green Shift including those factors set out in the “Risk

Factors” in our Management Discussion and Analysis dated May 28,

2024 for the three months ended March 31, 2024 available on SEDAR+

at www.sedarplus.ca. Readers are cautioned that the assumptions

used in the preparation of such information, although considered

reasonable at the time of preparation, may prove to be imprecise

and, as such, undue reliance should not be placed on

forward-looking statements. Green Shift assumes no obligation to

update such information, except as may be required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

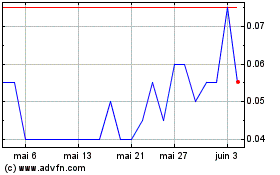

Green Shift Commodities (TSXV:GCOM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Green Shift Commodities (TSXV:GCOM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024