MiniLuxe Holding Corp. (TSXV: MNLX) today announced its financial

results for the 13 weeks ended April 2, 2023 (“Q1 2023”). The

fiscal year of MiniLuxe is a 52-week reporting cycle ending on the

Sunday closest to December 31, which periodically necessitates a

fiscal year of 53 weeks. FY2022 consisted of a 53-week period while

all other fiscal years referred to in this release consist of

52-week periods. All quarters referred to in this release consist

of 13-week periods. Unless otherwise specified, all amounts are

reported in U.S. dollars.

MiniLuxe is pleased to announce continued

double-digit growth in year-over-year (“YOY”) revenue and YOY gross

profit demonstrating resiliency despite a challenging

macro-economic backdrop. Q1 2023 revenue increased 18% versus Q1

2022 at $5.2M (all figures in US$ unless otherwise noted).

Same-studio revenue hit a record level in Q1 2023, while

demonstrating 21% growth on 2019 revenue (pre-COVID comparable) on

a like-for-like basis of MiniLuxe on-premises fleet studio units

open in 2019 vs those open in 2023. Overall growth of MiniLuxe’s

most loyal customer base (those returning at least 20 visits or

more per year) grew 37% versus the same period prior year.

Q1 2023 gross profit of $2.2M increased 16% vs.

Q1 2022 – the Company views gross profit dollar growth as a key

indicator of MiniLuxe’s positive trajectory towards long-term

profitability. The MiniLuxe fleet of core studios continued to lead

the business, accounting for 94% of revenue in the period, and the

Company remains keenly focused on continuing to drive the full

potential of the economics of these studios while expanding and

scaling its omni-channel offering for the self-care industry.

Key to MiniLuxe’s current and future success is

the continued growth, development and scaling of the MiniLuxe

Talent Ecosystem of licensed and certified nail designers and

waxing specialists. Beauty professionals who are part of MiniLuxe’s

Talent Ecosystem are empowered to choose a well-defined career path

tied to increasing economic earning power while also having

flexibility of where, when, and how they will work. Expanding and

growing the size and breadth of MiniLuxe’s Talent Ecosystem and

continuing to make investments in the technology platform to serve

as the infrastructure-as-a-service and marketplace for these

designers are key strategic imperatives for 2023.

MiniLuxe’s Board and Executive Team remain

focused on driving the business on its path toward profitability

and cash generative operations. The management team continues to

execute on the Company’s 2023 priorities and is regularly

reassessing capital and resource needs to ensure optimal investment

of capital. With receipt of the $3.2 million Employee Retention

Credit (related to employee costs paid in 2020 & 2021),

MiniLuxe’s Q1 2023 ending cash balance was $8.0 million. This

capital, plus the continued growth of the MiniLuxe Talent Ecosystem

and Product channels, is forecasted to lead to positive free

cashflow generation in 2024 and to position MiniLuxe well to

achieve its strategic goals and vision to be the leader in the

self-care industry. The Company looks forward to sharing further

updates throughout the remainder of the year.

“Against the backdrop of a challenged macro

environment with regional bank failures, inflationary pressures and

global slowdown of growth, we were fortunate to see continued

recessionary resilience of the market in which we serve and

demonstrate double-digit growth on topline revenue and gross profit

dollars,” said Tony Tjan, Executive Chairman and Co-founder of

MiniLuxe.

“MiniLuxe is pleased to report continued double

digit growth in Q1 2023 with the core fleet of studios continuing

to demonstrate highly predictable levels of contribution as we

actively invest in new growth channels to further accelerate the

growth of the MiniLuxe omni-channel platform,” said Zoe Krislock,

CEO of MiniLuxe

Q1

2023 Financial Highlights

($USD)

- Total revenue of $5.2M, a YoY

increase of 18%, 94% of revenue generated from core MiniLuxe

studios

- Gross profit of $2.2M, a 16%

increase from prior year

- Q1 2023 Fleet Adjusted EBITDA1 at

$119K up 80% from Q1 2022

- Full Company Adjusted EBITDA1 of

($2.6M) compared to ($2.3M) for Q1 2022; increased loss

attributable to investment in SG&A to fund planned growth

initiatives

Q1 2023 Business

Highlights

- DTC (direct-to-consumer) product

growth came from a focus on MiniLuxe “Hero” SKUs (e.g. Cuticle Oil,

Topcoat and Pure Strength), which resulted in a doubling of

year-over-year sales. Approximately two-thirds of DTC product sales

in Q1 2023 came from Hero SKU offerings including bundled offerings

which encouraged clients to buy SKUs in multiple quantities. Q1

2023 e-commerce orders grew 115% from Q1 2022 and new customer

counts increased 130% year-over-year.

- MiniLuxe continues its integration

and planned growth initiatives for its Paintbox brand, which was

acquired in Fall 2022. Based in New York City and founded in 2014,

Paintbox has been re-defining the nail-care industry through its

creativity and proprietary modern nail art designs. Along with

MiniLuxe’s initial focus on increasing staffing & improving

talent compensation in the Upper East Side studio, the Company is

excited about its initial growth initiatives, including:

- Launching of the first Paintbox

“store-in-store” with an outpost in MiniLuxe’s Boston South End

studio. The footprint of less than 200 square feet presents the

opportunity for a fast payback and, if the test proves successful,

an opportunity for scale across other MiniLuxe studios and new

partner channels. This format includes some of Paintbox’s most

iconic nail art looks and introduces a new and premium nail art

certification along with a premium in-studio service at >50%

pricing to current non-Paintbox offerings.

- Expanding the Paintbox brand

through the launch of a ready-to-wear Paintbox press-on product

that allows clients to experience nail art at home and on-the-go.

MiniLuxe’s client experience derived from over a decade of

performing services together with Paintbox’s extensive history of

collaborations with high fashion and luxury brands provides the

Company the foundation to create what it believes will be the

industry’s most curated, best looking, and highest performing

press-on nails. Paintbox press-on nails will launch through the

brand’s e-commerce platform with collaborations and partnerships

during New York Fashion Week in the later part of the year.

- Subsequent to end of Q1 2023, the Company completed

construction and commenced operations in a new studio location in

West Central Florida, at the Water Street Development in Downtown

Tampa Bay, FL. The grand opening of the studio occurred on May 11,

2023 as MiniLuxe celebrated its 21st studio location opening, the

first since the

pandemic.

Q1

2023 Results

Selected Financial Measures

MiniLuxe notes a change in accounting policy to

more accurately reflect revenue generated from talent and product

revenue streams to more align with how management analyzes the

Company. The change has been retrospectively applied and does not

have any effect on revenue recognition principles utilized or total

overall revenue recognized.

Results of Operations

The following table outlines the consolidated

statements of loss and comprehensive loss for the fiscal quarters

ended April 2, 2023, and March 27, 2022:

Cash Flows

The following table presents cash and cash

equivalents as at April 2, 2023 and March 27, 2022:

Non-IFRS Measures and Reconciliation of

Non-IFRS Measures

This press release references certain non-IFRS

measures used by management. These measures are not recognized

under International Financial Reporting Standards (“IFRS”), do not

have a standardized meaning prescribed by IFRS, and are therefore

unlikely to be comparable to similar measures presented by other

companies. Rather, these measures are provided as additional

information to complement those IFRS measures by providing further

understanding of the Company’s results of operations from

management’s perspective. Accordingly, these measures should not be

considered in isolation nor as a substitute for analysis of the

Company’s financial information reported under IFRS. The non-IFRS

measures referred to in this press release are “Adjusted EBITDA”

and “Fleet Adjusted EBITDA”.

Adjusted EBITDA

Adjusted EBITDA is used by management as a

supplemental measure to review and assess operating performance.

Management believes Adjusted EBITDA most accurately reflects the

commercial reality of the Company's operations on an ongoing basis

by adding back non-cash expenses. Additionally, the rent-related

adjustments ensure that studio-related expenses align with revenue

generated over the corresponding time periods.

Adjusted EBITDA is calculated by adding back

fixed asset depreciation, right-of-use asset depreciation under

IFRS 16, asset disposal, and share-based compensation expense to

IFRS operating income, then deducting straight-line rent expenses2

net of lease abatements. IFRS operating income is revenue less cost

of sales (gross profit), additionally adjusted for general and

administrative expenses, and depreciation and amortization

expense.

The Company also uses Fleet Adjusted EBITDA to

evaluate its fleet performance. This metric is calculated in a

similar manner, starting with Talent revenue and adjusting for

non-fleet Talent revenue and cost of sales, further adjusted by

fleet SG&A and finally subtracting the same straight line rent

expense used in the full company Adjusted EBITDA (as the fleet

holds all real estate leases). The Company believes that this

metric most closely mirrors how management views the fleet portion

of the business.

The following table reconciles Adjusted EBITDA

to net loss for the periods indicated:

The following table reconciles Fleet Adjusted

EBITDA to net loss for the periods indicated:

About MiniLuxe

MiniLuxe, a Delaware corporation based in

Boston, Massachusetts is a digital-first, socially responsible

lifestyle brand and talent empowerment platform and marketplace

[let’s consider] for the nail and waxing industry. For over a

decade, MiniLuxe has been setting industry standards for health,

hygiene, high quality services, and fair labor practices in its

efforts to transform the nail care and waxing industry. Underlying

MiniLuxe’s mission and purpose is to become one of the largest

inclusionary educators and employers of diverse self-care

professionals across our omni-channel ecosystem and talent

empowerment platform.

Today, MiniLuxe derives its revenue streams from

nail care and waxing services across an omni-channel ecosystem of

on premises with company-owned studios and partnerships and

off-premises on-demand services. The company also develops and

sells a proprietary retail and e-commerce line of clean nail care

and waxing products that are also used in MiniLuxe services.

MiniLuxe is driven by a fully integrated digital platform that

manages all client bookings, preferences, and payments and provides

designers with the ability to manage scheduling and client

preferences, track their performance and compensation, and access

training content. Since its inception, MiniLuxe has performed

nearly 3 million services. www.miniluxe.com

For further information

Anthony TjanExecutive Chairman, MiniLuxe Holding

Corp.atjan@miniluxe.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

1Please refer to “Non-IFRS Measures and Reconciliation of

Non-IFRS Measures” sections of this press release.2Straight-line

rent expense for a given payment period is calculated by dividing

the sum of all payments over the life of the lease (the figure used

in the present value calculation of the right-of-use asset) by the

number of payment periods (typically months). This number is then

annualized by adding the rent expenses calculated for the payment

periods that comprise each fiscal year. For leases signed mid-year,

the total straight-line rent expense calculation applies the new

lease terms only to the payment periods after the signing of the

new lease.

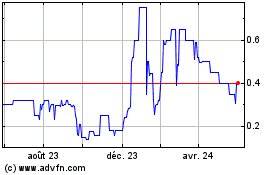

Miniluxe (TSXV:MNLX)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

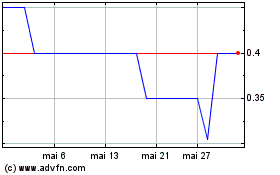

Miniluxe (TSXV:MNLX)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025