Atlas Salt (the “Company” or “Atlas” -

TSXV: SALT; OTCQB: REMRF), 100% owner of

North America’s premier undeveloped high-grade salt project,

announces a non-brokered private placement for up to five million

units at a price of $2.00 per unit for aggregate gross proceeds of

up to $10,000,000 (the “Offering”) targeting strategic

institutional investors.

Each unit will consist of one common share of

the Company and one-half of one common share purchase warrant. Each

full warrant will entitle the holder thereof to purchase one common

share at a price of $2.40 per share at any time two years from the

closing of the Offering.

The Offering is scheduled to close on or about

January 16, 2023 (the “Closing Date”), or such

later date as the Company may determine, and is subject to certain

conditions including, but not limited to, receipt of TSX Venture

Exchange conditional acceptance.

The Company may pay certain eligible finders a

finder’s fee comprising a cash commission of up to 7% of the gross

proceeds of the Offering and non-transferable finder’s warrants of

up to 7% of the number of Common Shares. Such finder’s warrants

shall entitle the holder to acquire one common share of the Company

at a price of $2.40 for a period of 24 months from the Closing

Date.

There is an offering document related to this

Offering that can be accessed under the issuer’s profile at

www.sedar.com. Prospective investors should read this offering

document before making an investment decision.

Subject to compliance with applicable regulatory

requirements and in accordance with National Instrument 45-106

Prospectus Exemptions (“NI 45-106”), the Offering is being made to

purchasers resident in all provinces of Canada, except Quebec,

pursuant to the listed issuer financing exemption under Part 5A of

NI 45-106 (the “Listed Issuer Financing Exemption”). The common

shares offered under the Listed Issuer Financing Exemption will not

be subject to a hold period pursuant to applicable Canadian

securities laws.

It is anticipated that the net proceeds of the

Offering will be used for general working capital purposes and the

advancement and initiation of the pre-production development of the

Great Atlantic Salt Project on the west coast of Newfoundland.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy nor shall there be any

sale of any securities in any jurisdiction in which such offer,

solicitation, or sale would be unlawful including any of the

securities in the United States of America. The securities have not

been and will not be registered under the United States Securities

Act of 1933, as amended (the “1933 Act”), or any state securities

laws and may not be offered or sold within the United States or to,

or for account or benefit of, U.S. Persons (as defined in

Regulation S under the 1933 Act) unless registered under the 1933

Act and applicable state securities laws, or an exemption from such

registration requirements is available.

Atlas Salt Corporate Video

Click on the following link to view the

Company’s latest corporate video:

https://youtu.be/RlH5--Q2Vu0

Project Map

About Atlas Salt

Bringing the Power of SALT to

Investors: Atlas Salt owns 100% of the Great Atlantic salt

deposit strategically located in western Newfoundland in the middle

of the robust eastern North America road salt market. The project

features a large homogeneous high-grade resource located

immediately next to a deep water port. Atlas is also the largest

shareholder in Triple Point Resources as it pursues development of

the Fischell’s Brook Salt Dome in the heart of an emerging Clean

Energy Hub on the west coast of Newfoundland.

We seek Safe Harbor.

For information, please contact:

Patrick J. Laracy, CEO(709)

754-3186Email: laracy@atlassalt.com

MarketSmart Communications Inc.Adrian

SydenhamToll-free: 1-877-261-4466Email: info@marketsmart.ca

Forward-Looking Statements

This press release includes certain

"forward-looking information" and "forward-looking statements"

(collectively "forward-looking statements") within the meaning of

applicable Canadian securities legislation. All statements, other

than statements of historical fact, included herein, without

limitation, statements relating to the future operating or

financial performance of the Company, are forward-looking

statements. Forward-looking statements are frequently, but not

always, identified by words such as "expects", "anticipates",

"believes", "intends", "estimates", "potential", "possible", and

similar expressions, or statements that events, conditions, or

results "will", "may", "could", or "should" occur or be achieved.

Forward-looking statements in this press release relate to, among

other things: statements relating to the successful closing of the

Offering and anticipated timing thereof and the intended use of

proceeds. Actual future results may differ materially. There can be

no assurance that such statements will prove to be accurate, and

actual results and future events could differ materially from

those anticipated in such statements. Forward looking statements

reflect the beliefs, opinions and projections on the date the

statements are made and are based upon a number of assumptions and

estimates that, while considered reasonable by the respective

parties, are inherently subject to significant business,

technical, economic, and competitive uncertainties and

contingencies. Many factors, both known and unknown, could cause

actual results, performance or achievements to be materially

different from the results, performance or achievements that are

or may be expressed or implied by such forward-looking statements

and the parties have made assumptions and estimates based on or

related to many of these factors. Such factors include, without

limitation: the timing, completion and delivery of the referenced

assessments and analysis. Readers should not place undue reliance

on the forward-looking statements and information contained in

this news release concerning these times. Except as required by

law, the Company does not assume any obligation to update the

forward-looking statements of beliefs, opinions, projections, or

other factors, should they change, except as required by law.

TSX Venture Exchange

Disclaimer

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/7edbecd6-3e78-4772-a38e-c9bd1ac71712

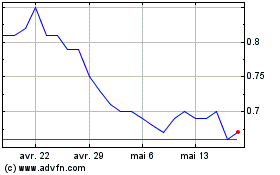

Atlas Salt (TSXV:SALT)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Atlas Salt (TSXV:SALT)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025